investments

Crypto portfolios: How much of a stablecoin allocation is too much?

Cryptocurrencies are well-known for being volatile assets, which means that experienced traders have plenty of opportunities in the space. Investors can expect to be taken on a wild ride if they plan on holding for a long time. Stablecoins, a class of cryptocurrencies that offers investors price stability pegged to the value of fiat currencies, offer investors a safe haven when market turbulence hits but may represent missed opportunities over time. Speaking to Cointelegraph, several experts have stated that retail investors should approach cryptocurrencies with a “pay yourself first” attitude and that an allocation of up to 5% in crypto should be relatively “safe” while allowing for “marginal return.” Stablecoins are entirely different: No “marginal return” can be expected from simply hol...

Museums in the metaverse: How Web3 technology can help historical sites

Metaverse events at ancient and historical sites could soon shape up to be an alternate future for tourism. Owners of physical castles and villas who have drafted up augmented reality blueprints of their properties think their ambitious plans to attract visitors in the metaverse will work, as virtual events can help them pay the hefty maintenance bills for their aging properties and also offer a chance to change historical narratives. The metaverse tourism model was expedited by downturns in tourism brought about by COVID-19, but the industry may have already been heading that way. Currently, major metaverse platforms are clunky, difficult to use and waiting for more “real estate” development, but firms are concentrating on what could be. Brands seem to be entering the metaverse en m...

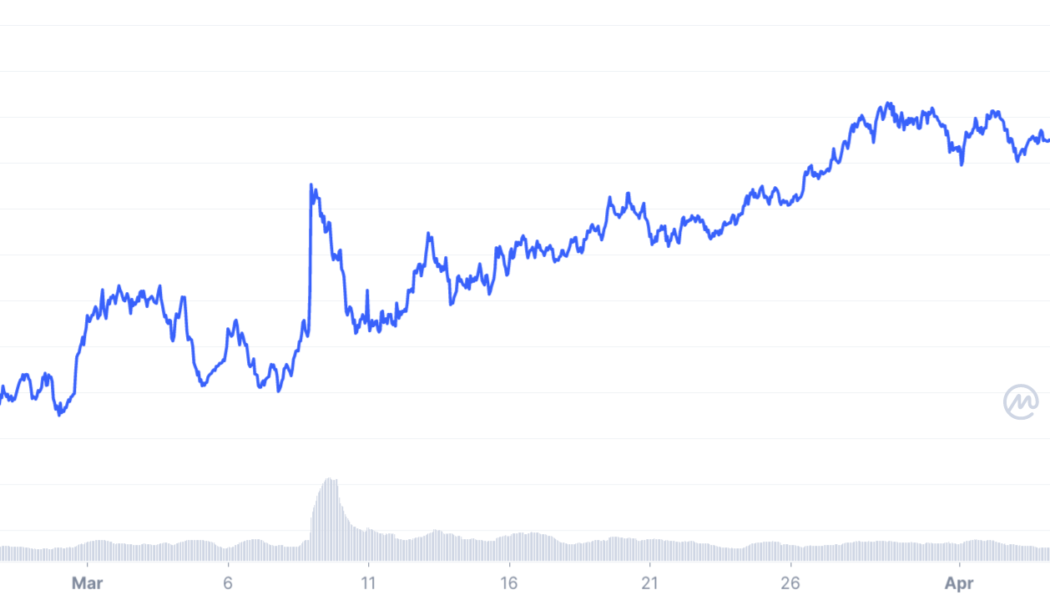

Monero defies crypto market slump with 10% XMR price rally — what’s next?

Privacy-focused cryptocurrency Monero (XMR) rallied by nearly 9.5% in the past week compared with the crypto market’s decline of 8.5% in the same period. What’s more, the XMR/USD pair has broken above a strong, multi-month resistance trendline, hinting at more upside ahead. XMR price action XMR’s price was down by a modest 0.87% on April 10 from its two-month-high of $245 established a day before. However, the cryptocurrency still outperformed its top rivals, including Bitcoin (BTC) and Ether (ETH), on a weekly timeframe. Speculations about entities using Monero to bypass sanctions could have boosted its appeal among investors. Meanwhile, The American research group Brookings warned last month that Monero, the first in the line of privacy coins, could...

‘People should invest in all of the major layer-1s,’ says a veteran trader

Scott Melker, veteran trader and pocaster, is convinced that major layer-1 protocols should be part of everyone’s investment portfolio. Instead of picking individual crypto projects, such as NFTs or blockchain games, Melker thinks it makes more sense to bet on the blockchain infrastructure on which these projects are built. “Any of these small projects could absolutely go nuts. But you’re going to have trouble choosing what they are. You should just own the layer-1 and the infrastructure that they’re all built on,” he said in an exclusive interview with Cointelegraph. “You may not own a Bored Ape, but Ethereum holders have certainly benefited from the success of Bored Apes!” he pointed out. Talking about his portfolio construction, Melker revealed that about 6...

ProShares files with SEC for Short Bitcoin Strategy ETF

Exchange-traded funds (ETFs) issuer ProShares has filed a registration statement with the United States Securities and Exchange Commission to list shares of a Short Bitcoin Strategy ETF. In a Tuesday filing, ProShares applied with the SEC for an investment vehicle that would allow users to bet against Bitcoin (BTC) futures using an exchange-traded fund. According to the registration statement, the Short Bitcoin Strategy ETF will be based on daily investment results corresponding to the inverse of the return of the Chicago Mercantile Exchange Bitcoin Futures Contracts Index for a day. ProShares just filed for a Short Bitcoin Futures ETF. Even tho SEC rejected similar filing last year, this has shot IMO given ProShares’ perfect read on SEC w/ $BITO and the lack of issues w/ futures ETF...

SEC chair: retail crypto investors should be protected

Gary Gensler, chair of the United States Securities and Exchange Commission, said the agency’s protections that apply to investors of traditional assets should extend to those in the crypto market. In prepared remarks released Monday for the Penn Law Capital Markets Association Annual Conference, Gensler said he had requested SEC staff to explore getting crypto platforms registered, having them subject to the same regulatory framework as exchanges. In addition, the SEC chair said the agency’s staff could be working towards addressing regulatory clarity in the crypto space by considering how to register platforms “where the trading of securities and non-securities is intertwined” and whether retail crypto investors should be afforded the same protections as those in traditional markets. “Cr...

Celebrity tokens: Signs of rising crypto adoption in Indonesia

Cryptocurrency investments in Indonesia have seen considerable growth between 2020-2022, with 4% of the country’s population having invested in crypto. In 2021, crypto transaction volumes surpassed $34 billion, according to Indonesia’s Commodity Futures Trading Regulatory Agency. This growth has formed a new mindset toward crypto investment, especially in the mainstream media. One example of cryptocurrencies’ growing appeal in the mainstream is the participation of Indonesian celebrities and influencers. Crypto adoption among celebrities Celebrities and influencers in Indonesia seem to have become much more involved in Indonesia’s crypto investment industry since 2021. Many have become brand ambassadors for exchanges and crypto projects to help promote them and essentially raise the tradin...

Indonesia’s cryptocurrency community in 2022: An overview

Crypto is the next big thing in Indonesia. According to the Ministry of Trade, transactions for currencies like Bitcoin (BTC) grew over 14 times from a total of 60 trillion rupiahs ($4.1 billion) in 2020 to a total of 859 trillion rupiahs ($59.83 billion) in 2021. It’s getting to the point where crypto is becoming more popular than traditional stock. Vice Minister of Trade Jerry Sambuaga stated that more than 11 million Indonesians bought or sold crypto in 2021. In comparison, according to the Indonesian Central Securities Depository, the total number of portfolio investors — indicated by the number of single investor identities — reached 7.35 million in 2021. Even so, 11 million crypto investors is still only about 4% of Indonesia’s total population, meaning there’s still plenty of room t...

SEC rejects ARK 21Shares spot Bitcoin ETF application

The United States Securities and Exchange Commission, or SEC, has officially disapproved the application for the ARK 21Shares Bitcoin exchange-traded fund (ETF). In a Thursday filing, the SEC rejected a proposed rule change from the Chicago Board Options Exchange, or Cboe, BZX Exchange to list and trade shares of the ARK 21Shares Bitcoin (BTC) ETF. The SEC said the proposed rule change, originally published for comment in the Federal Register in August 2021, would not be “‘designed to prevent fraudulent and manipulative acts and practices” nor “protect investors and the public interest.” The SEC said that the Cboe BZX Exchange had not met the requirements of listing a financial product under its rules of practice as well as those of the Exchange Act. Under these restrictions, exchanges see...

Seven common mistakes crypto investors and traders make

Investing in cryptocurrencies and digital assets is now easier than ever before. Online brokers, centralized exchanges and even decentralized exchanges give investors the flexibility to buy and sell tokens without going through a traditional financial institution and the hefty fees and commissions that come along with them. Cryptocurrencies were designed to operate in a decentralized manner. This means that while they’re an innovative avenue for global peer-to-peer value transfers, there are no trusted authorities involved that can guarantee the security of your assets. Your losses are your responsibility once you take your digital assets into custody. Here we’ll explore some of the more common mistakes that cryptocurrency investors and traders make and how you can protect yourself from un...

Is China’s apprehension to ban NFTs a hopeful sign for investors?

It’s no secret that China has a clear disdain for all things crypto, as was highlighted last year when the country decided to ban its digital asset industry in its entirety. That said, one niche related to the crypto industry that has continued to thrive in the region despite the ban is its nonfungible token (NFT) market. However, with certain negative developments coming to the forefront recently, this may not be the case much longer. In this regard, many local social media platforms and internet firms have continued to update their policies so as to restrict and, in some cases, remove NFT platforms altogether from their networks, claiming a lack of regulatory clarity but, more importantly, fearing a government clampdown on their day-to-day operations. For example, WeChat, a Chinese insta...