investments

MicroStrategy may explore ‘future yield generation opportunities’ on 95,643 BTC holdings

Business intelligence firm MicroStrategy said it will consider opportunities for yield generation on 95,643 “unencumbered” Bitcoin (BTC) held by its subsidiary MacroStrategy. In MicroStrategy’s report for the first quarter of 2022 released on Tuesday, the firm said it “may conservatively explore future yield generation opportunities on unencumbered MacroStrategy bitcoins” as a consideration following a $205 million BTC-collateralized loan issued by Silvergate Bank in March. As of March 31, MicroStrategy held a total of 129,218 BTC, which the firm reported had a carrying value of roughly $2.9 billion, reflecting cumulative impairment losses of more than $1 billion and an aggregate cost of $4 billion. “The original cost basis and market value of MicroStrategy’s bitcoin were $3.967 billion an...

MicroStrategy may explore ‘future yield generation opportunities’ on 95,643 BTC holdings

Business intelligence firm MicroStrategy said it will consider opportunities for yield generation on 95,643 “unencumbered” Bitcoin (BTC) held by its subsidiary MacroStrategy. In MicroStrategy’s report for the first quarter of 2022 released on Tuesday, the firm said it “may conservatively explore future yield generation opportunities on unencumbered MacroStrategy bitcoins” as a consideration following a $205 million BTC-collateralized loan issued by Silvergate Bank in March. As of March 31, MicroStrategy held a total of 129,218 BTC, which the firm reported had a carrying value of roughly $2.9 billion, reflecting cumulative impairment losses of more than $1 billion and an aggregate cost of $4 billion. “The original cost basis and market value of MicroStrategy’s bitcoin were $3.967 billion an...

Crypto Bahamas: Regulations enter critical stage as gov’t shows interest

The crypto community and Wall Street converged last week in Nassau, Bahamas, to discuss the future of digital assets during SALT’s Crypto Bahamas conference. The SkyBridge Alternatives Conference (SALT) was also co-hosted this year by FTX, Sam Bankman-Fried’s cryptocurrency exchange. Anthony Scaramucci, founder of the hedge fund SkyBridge Capital, kicked off Crypto Bahamas with a press conference explaining that the goal behind the event was to merge the traditional financial world with the crypto community: “Crypto Bahamas combines the crypto native FTX audience with the SkyBridge asset management firm audience. We are bringing these two worlds together to create a more equitable financial system.” Traditional finance eyes crypto as regulations take shape The combination of traditional ...

Robinhood makes significant strides in crypto business in Q1 despite falling revenue

On April 28, discount-brokerage platform Robinhood published its financial results for the first quarter of 2022. Year-over-year, the firm’s net revenue declined by 43% to $299 million. Specifically, revenue from cryptocurrency trading fell by 39% to $54 million during the same period. This was partly due to a decrease in the interest in meme stocks as well as an ongoing cryptocurrency bear market that dominated much of the first three months of the year. However, despite a decrease in sales, the company’s net cumulative funded accounts rose by 27% year-over-year to 22.8 million. At the same time, total assets under custody increased 15% to $93.1 billion. Robinhood took several important steps in enhancing its crypto business. First, the firm rolled out crypto wallets to the ap...

Home sweet hodl: How a Bitcoiner used BTC to buy his mom a house

There’s a special bond between mothers and their sons. For pseudonymous Alan, a 28-year-old engineer, a Bitcoin (BTC) loan helped his mom to buy a house. Alan told Cointelegraph that he took out a Bitcoin-backed loan in 2021 — serendipitously on his sister’s birthday — to gift his mom the tax-free money. She then used the funds to buy a house in North Yorkshire, England, while Alan kept his Bitcoin. Yorkshire, England, known as “God’s own country.” Source: North Yorkshire City Council Alan first used Bitcoin in 2012, learning it was a useful currency to buy things on the internet. He used the peer-to-peer (P2P) service localbitcoins.com, whose team are regular Cointelegraph contributors, to buy Bitcoin. Alan described the process of buying Bitcoin from real people as a “bizarre experience....

21Shares launches hybrid Bitcoin and gold ETP to enable inflation hedge

21Shares, a major issuer of cryptocurrency exchange-traded products (ETP), is launching a new ETP tracking a mix of Bitcoin (BTC) and gold. The Switzerland-based firm on Wednesday announced the launch of the 21Shares ByteTree BOLD ETP (BOLD), a new product aiming to provide inflation protection by tracking an index providing risk-adjusted exposure to both BTC and gold. Listed on the SIX Swiss Exchange, the new hybrid ETP is subject to monthly rebalances according to the inverse historic volatility of each asset. At launch, BOLD comprises 18.5% of BTC and 81.5% of gold. The new ETP was developed in collaboration with the United Kingdom-based alternative investment provider, ByteTree Asset Management. The product is positioned as the world’s first combined BTC and gold ETP. “Gold has hi...

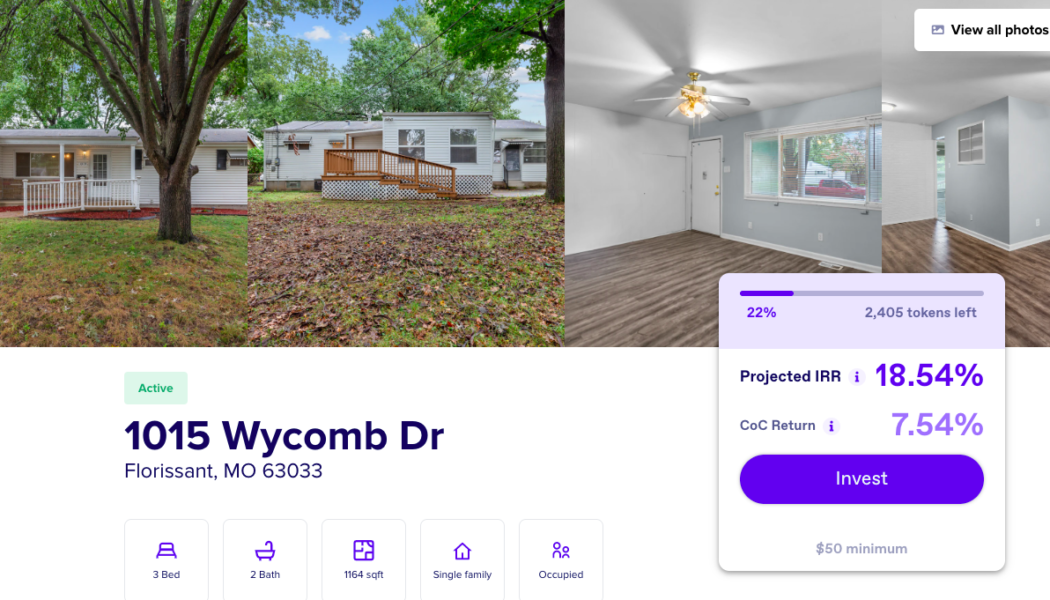

Web3 solutions aim to make America’s real estate market more accessible

America’s housing market may soon be facing its next bubble as home prices across the country continue to be fueled by demand, speculation and lavish spending that could result in a collapse. Moreover, many homeowners are opting to stay put due to climbing mortgage rates, creating a housing shortage. Data from the Federal National Mortgage Association, commonly known as Fannie Mae, found that 92% of homeowners think their current home is affordable. Yet, findings further show that 69% of the general population, consisting of both homeowners and renters, believe it’s becoming too difficult to find affordable housing. Web3 and the real-estate market While the fate of the United States housing market remains unclear, the rise of Web3 business models based around nonfungible tokens (NFTs...

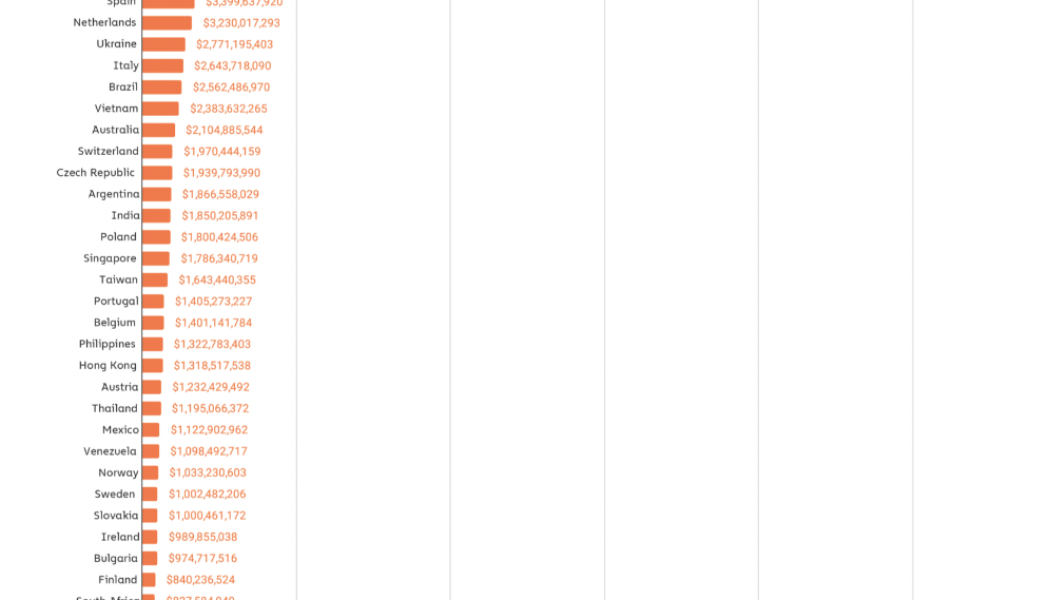

US investors realized 6X more crypto gains in 2021 than next country

Crypto investors from the United States realized crypto gains nearly six times higher in total than the UK, the second highest country in terms of realized gains. According to a report by Chainalysis, crypto investors in the US accrued a record $46.9 billion in realized gains throughout 2021, leading the rest of the world by a wide margin. The US is followed at quite some distance by the UK at $8.1 billion and Germany on $5.8 billion. Total realized cryptocurrency gains 2021: Chainalysis. The report comes as global cryptocurrency adoption continues to gain widespread traction. The US witnessed a massive increase in adoption and realized gains, with the total estimated gains for 2021 up 476% from $8.1 billion the year before. Special mentions were given to countries that outperformed ...

Simplify files with SEC for Bitcoin Strategy Risk-Managed Income ETF

Asset manager Simplify has filed a registration statement with the United States Securities and Exchange Commission to list shares of an exchange-traded fund linked to Bitcoin futures, Treasury securities, and options. In a Wednesday filing, Simplify applied with the SEC for an investment vehicle based on a Bitcoin (BTC) futures strategy, an income strategy, and an option overlay strategy. The Bitcoin Strategy Risk-Managed Income ETF, to be listed under the ticker MAXI on Nasdaq, is a series of exchange-traded funds from the asset management company. The fund will indirectly invest in BTC using crypto futures and, as part of its income strategy, hold short-term U.S. Treasury securities and ETFs that invest in Treasury securities. For its option overlay strategy, Simplify said it would purc...

The many layers of crypto staking in the DeFi ecosystem

Staking has been used fluently to describe several actions within the world of crypto, from locking your tokens on a decentralized finance (DeFi) application or centralized exchange (CEX) to using tokens to run a validator node infrastructure on a proof-of-stake (PoS) network. PoS is one of the most popular mechanisms that allows blockchains to validate transactions and it has become a credible consensus mechanism alternative to the original proof-of-work (PoW) used by Bitcoin. Miners require a lot of computational power to carry out the energy-intensive PoW, while PoS requires staking coins as collateral to validate blocks and verify transactions, which is significantly more energy-efficient and presents less centralization risk. These are some of the reasons why companies like Mozilla ch...

Cointelegraph’s experts reveal their crypto portfolios | Watch now on The Market Report

On this week’s show, Cointelegraph’s resident experts reveal exactly what percentages of their portfolios are allocated to what coins and why. But first, market expert Marcel Pechman carefully examines the Bitcoin (BTC) and Ether (ETH) markets. Are the current market conditions bullish or bearish? What is the outlook for the next few months? Pechman is here to break it down. Next up: the main event. Join Cointelegraph analysts Benton Yaun, Jordan Finneseth and Sam Bourgi as they reveal their crypto portfolios. We kick things off with Bourgi, whose top holdings are BTC with 67%, ETH with 20%. No surprise there but what about the rest? It’s an interesting mix, to say the least so make sure you stick around to find out. Next, we have Yuan, whose top three holdings are 35% BTC, 28% Terra...