investments

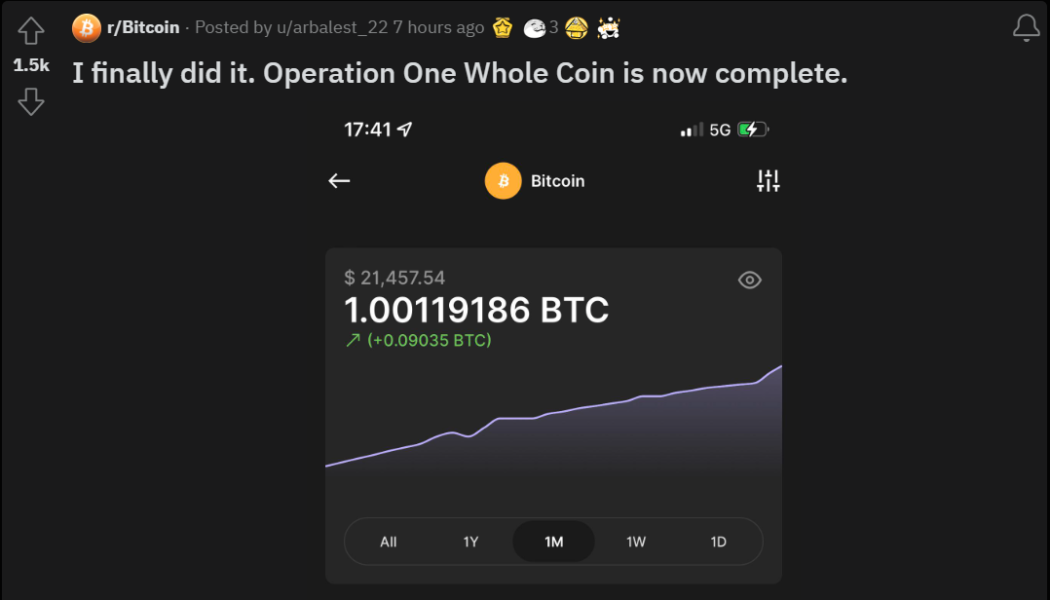

Small-time investors achieve the 1 BTC dream as Bitcoin holds $20k range

Ever since early Bitcoin (BTC) investors woke up millionaires as the ecosystem gained tremendous popularity alongside the mainstreaming of the internet, investors across the globe have been in the rush to accumulate as many of the 21 million BTC — one Satoshi at a time. With BTC recently trading at the $20,000 range for the first time since 2020, small-time investors found a small window of opportunity to achieve their dream of owning at least 1 BTC. On June 20, Cointelegraph reported that the number of Bitcoin wallet addresses containing one BTC or more increased by 13,091 in just 7 days. While the total number of addresses holding 1 BTC saw an immediate reduction in days to come, the crypto community on Reddit continues to welcome new crypto investors that hodled their way into becoming ...

FTX may be planning to purchase a stake in BlockFi: Report

Crypto exchange FTX is reportedly in talks to acquire a stake in BlockFi after the company issued a $250 million credit to the lending firm. According to a Friday report from the Wall Street Journal, FTX is currently in discussions with BlockFi regarding the crypto exchange purchasing a stake in the firm, but no equity agreement has been reached. The reported ongoing talks followed BlockFi signing a term sheet with FTX to secure a $250 million revolving credit facility on Tuesday. “BlockFi does not comment on market rumors,” a BlockFi spokesperson told Cointelegraph. “We are still negotiating the terms of the deal and cannot share more information at this time. We anticipate sharing more on the terms of the deal with the public at a later date. FTX founder and CEO Sam Ban...

Deloitte and NYDIG set up alliance to help businesses adopt Bitcoin

Professional services giant Deloitte is getting increasingly serious about Bitcoin (BTC) amid the ongoing market downturn, setting up a major initiative to promote BTC adoption. Deloitte has partnered with the Bitcoin-focused financial services firm, New York Digital Investment Group (NYDIG), to help companies of all sizes implement digital assets. According to a joint announcement on Monday, NYDIG and Deloitte are launching a strategic alliance to create a centralized approach for clients seeking advice to adopt Bitcoin products and services. The companies will work together to enable blockchain and digital asset-based services across multiple areas involving Bitcoin-related products, including banking, loyalty and rewards programs, employee benefits and others. According to the announcem...

El Salvador president addresses bear market concerns with Bitcoin hopium

El Salvador introduced BTC as legal tender on September 7, 2021, when its market price was around $50,000. Ever since, Bukele’s government made significant returns on their initial BTC investments as Bitcoin rallied to its all-time high of $69,000, which was redirected to the country’s various infrastructure development initiatives. However, as tensions rise amid falling BTC prices, Bukele decided to share advice for fellow Bitcoin investors that may be concerned about the prolonged bear market. Nayib Bukele, the president who helped Bitcoin (BTC) gain legal tender status in El Salvador, addressed the rising concerns of investors as BTC began trading for under $20,000 for the first time in 18 months. I see that some people are worried or anxious about the #Bitcoin market price. My advice: ...

How a DAO for a bank or financial institution will look like

DAOs can provide several services for banks, including asset management, compliance and lending. Banks today are already using blockchain technology for things like payment, clearing and settlement, trade finance, identity and syndicated loans, according to The Financial Times. However, there are still many unexplored areas in banking where a DAO-based model might be useful: Fundraising In the crypto world, initial coin offerings (ICOs) are breaking down the barrier between access to capital and traditional services like capital-raising firms. Likewise, banks can use DAOs to raise capital from a wider pool of investors via ICOs. Loans and Credit Using decentralized technology in banking can eliminate the need for gatekeepers in the lending industry. DAOs provide more secure ways for people...

Elusive Bitcoin ETF: Hester Perice criticizes lack of legal clarity for crypto

The crypto sector may be maturing, but regulatory clarity around the treatment of digital assets continues to remain cumbersome. This was recently highlighted by Commissioner Hester Peirce — also known as the United States Securities and Exchange Commission’s (SEC) “crypto mom” — in remarks she made at “The Regulatory Transparency Project Conference on Regulating the New Crypto Ecosystem: Necessary Regulation or Crippling Future Innovation?” Peirce began her speech by emphasizing the importance of “regulating the new crypto ecosystem.” While this may be, Peirce also noted that the crypto industry is still in search of an actual regulator. She said: “A bipartisan bill announced last week attempts to answer that question. Some people in the crypto industry are celebrating the all...

True Global Ventures doubles down on Web3 with $146M ‘follow-on’ fund

Venture capital firm True Global Ventures 4 Plus (TGV4 Plus) has announced the closure of a $146 million funding round earmarked for a wide range of Web3 projects — highlighting investors’ continued interest in crypto despite an ongoing bear market. The latest closure, dubbed the TGV4 Plus Follow On Fund, was led by a group of 15 general partners who committed over $4 million on average (over 40%, or $62 million) into the fund. The majority of the funding will be primarily injected into Web3 companies within TGV’s portfolio, while the remaining will be used to invest in late-stage Web3 opportunities. TGV previously invested in numerous Web3 initiatives using a base fund dedicated to the late-stage Series A, B and C across three business verticals: entertainment and gaming, financial servic...

How to survive in a bear market? Tips for beginners

Usually, bear markets bring about a feeling of uncertainty in any investor. Even more so for a newcomer, for whom it can feel like the end of the world. It may even be common knowledge that during bull cycles, investors are sure of making gains. Whereas in bear markets such as this, an unimaginable amount of pessimism sets in. The co-founder and strategic lead at the Kylin Network, Dylan Dewdney, told Cointelegraph that the two major mistakes that investors make while feeling anxious are “One, over-investing and two, not investing with conviction.” “You need to find the sweetspot where you have enough conviction in your investments while managing the resources devoted to them such that you are 100% comfortable with being patient for a long time. Lastly, bear markets are where the magic rea...

Crypto privacy is in greater jeopardy than ever before — here’s why

Despite the latest technology, the world has yet to crack the code for privacy and security online. But that isn’t the only big problem we need to worry about. Hackers and robbers are tricking innocent users into giving up their private information as society becomes increasingly digital — and virtual currencies have a role in all of this. Cryptocurrencies smashed records in 2022, with the market topping $2 trillion for the first time ever. And while this has been greeted with excitement by current investors, it’s made others more wary. Why? Because as the asset class grows, it becomes more appealing to malicious actors. And for evidence of this, you only need to look at the growing number of users being targets of cryptocurrency robberies. The big question is this: if these cr...

Central African Republic to tokenize the nation’s natural resources

The Central African Republic (CAR) has announced plans to proceed with its ambitious Sango Project by tokenizing access to the country’s abundant natural resources. President Faustin-Archange Touadéra posted a photograph of a statement on his official Twitter account Thursday detailing the next steps in the project. The statement, signed by Minister of State and cabinet chief of staff Obed Namsio, read, in part: “We are giving everyone access to the riches of our land. In other words, we are transforming them into equally valuable and important digital assets through an unprecedented new administrative and economic movement.” It went on to say that Touadéra has asked the parliament to prepare a new strategy to create investment opportunities in the country’s economy. The next s...

Fed governor explains who needs crypto regulation and why demand for it is growing

Regulation is needed to open the crypto ecosystem to a larger public, United States Federal Reserve Board Governor Christopher Waller told an audience at the SNB-CIF Conference on Cryptoassets and Financial Innovation in Zurich, Switzerland. Financial intermediaries can help manage risk for new crypto users, but cannot eliminate it, Waller said, and new and fast-growing financial products need public confidence to survive. The banking official used historical examples to show the relationship between technical innovation, regulation and the amassing of fortunes. “New technology — and a lack of clear rules — meant some new fortunes were made, even as others were lost,” Waller said. Experienced investors know how to operate in unregulated marketplaces and may not need or want regulation, Wal...

401(k) provider ForUsAll sues US Labor Dept over anti-crypto compliance release

ForUsAll, a 401(k) retirement provider, filed suit against the United States Department of Labor (DOL) and Martin Walsh as Labor secretary in U.S. District Court in Washington, D.C. on Thursday. The company is seeking the withdrawal of a DOL compliance assistance release issued in March, citing the Administrative Procedure Act, which safeguards against arbitrary official encroachment on private rights. The DOL release warned that the department’s Employee Benefits Security Administration is expected to “conduct an investigative program” aimed at 401(k) plans that contain cryptocurrency. ForUsAll CEO Jeff Schulte told Cointelegraph: “The government is suddenly trying to restrict the type of investments Americans can choose to make because they’ve decided today that they don’t like a certain...