investments

Bitcoin price rally provides much needed relief for BTC miners

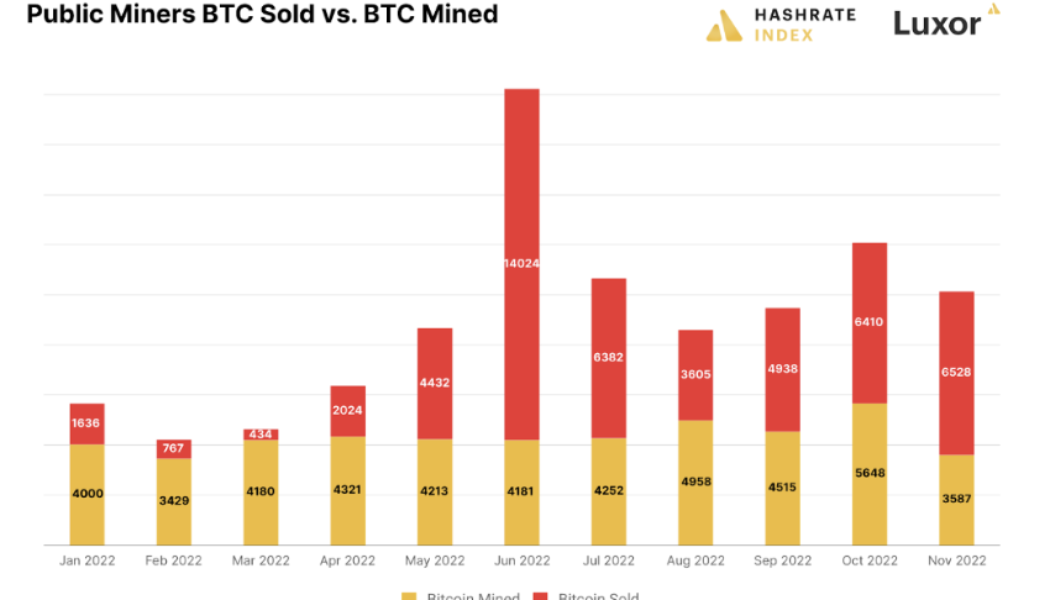

Bitcoin mining powers network transactions and BTC price. During the 2021 bull run, some mining operations raised funds against their Bitcoin ASICs and BTC reserves. Miners also preordered ASICs at a hefty premium and some raised funds by conducting IPOs. As the crypto market turned bearish and liquidity seized within the sector, miners found themselves in a bad situation and those who were unable to meet their debt obligations were forced to sell the BTC reserves near the market bottom or declare bankruptcy Notable Bitcoin mining bankruptcies in 2022 came from Core Scientific, filing for bankruptcy, but BTC’s early 2023 performance is beginning to suggest that the largest portion of capitulation has passed. Despite the strength of the current bear market, a few miners were able to i...

CoinFLEX attempts to hose down backlash over proposed new 3AC project

Amid mounting criticism on social media, crypto investment firm CoinFLEX has attempted to clarify its plans to build a new crypto exchange with Three Arrows Capital (3AC). A leaked pitch deck on Jan. 16 revealed it was collaborating with the now-bankrupt hedge fund to build a proposed crypto exchange called “GTX” — which would focus on the trading of claims against bankrupt firms. In a blog post published shortly after, CoinFLEX went on to “clarify misconceptions about the leaked materials concerning the proposed ‘GTX’ Exchange.” Firstly, CoinFLEX said it won’t actually be using the “GTX” name as detailed in the pitch deck, noting that it only serves as a placeholder name for now. Some members of the community had ...

Binance to let institutions store crypto with cold custody

Amid the centralized cryptocurrency exchanges (CEX) crisis, crypto exchange Binance is moving to improve its institutional trading services with cold-custody opportunities. On Jan. 16, Binance announced the official launch of Binance Mirror, an off-exchange settlement solution that enables institutional investors to invest and trade using cold custody. The newly launched Mirror service is based on Binance Custody, a regulated institutional digital asset custodian, and involves mirroring cold-storage assets through 1:1 collateral held on a Binance account. Binance emphasized that the new solution enables more security, allowing traders to access the exchange ecosystem without having to post collateral directly on the platform, stating: “Their assets remain secure in their seg...

Crypto asset manager Osprey Funds lays off most of its staff: Report

Digital asset manager Osprey Funds has reportedly laid off most of its staff since the summer, underscoring the ongoing operational challenges posed by crypto’s enduring bear market. Yahoo Finance reported on Jan. 9 that Osprey Funds is currently operating with fewer than ten employees after laying off 15 staff members since the summer. CEO Greg Kling told the publication that the layoffs were consistent with the market downturn and that Osprey was not at risk of closing operations. Osprey offers accredited investors access to crypto-focused investment products, including an over-the-counter Bitcoin (BTC) trust that can be purchased inside brokerage accounts. Crypto layoffs are in fashion. The community doesn’t stay quiet. https://t.co/XJrxRXqvR9 — Cointelegraph (@Cointelegraph...

Huobi net outflows crossed over 60M within the past 24 hours: Report

Cryptocurrency exchange Huobi has seen over $94.2 million dollars in net outflows within the past week. Within the past 24 hours alone, approximately $60 million has flowed out of the exchange, according to crypto analytics company Nansen. In the past 24 hours, Huobi has seen a significant increase in net outflows $60.9M* of the $94.2M* net outflow in the past week occurred in the past day alone *Contains Ethereum, Avalanche, BNB Chain, Fantom, & Polygon flows pic.twitter.com/JV1Tg13QMY — Nansen (@nansen_ai) January 6, 2023 Nansen also reported that a significant portion of withdrawals were in Tether (USDT), USD Coin (USDC), and Ether (ETH), from wallets with high balances. The significant increase in outflows from the exchange was allegedly triggered by rumors circulating on Twi...

El Salvador’s Bitcoin strategy evolved with the bear market in 2022

Cryptocurrency adoption has been on the rise in El Salvador in recent years, with the country becoming the first in the world to adopt Bitcoin (BTC) as a legal tender. This landmark decision has attracted the attention of the global cryptocurrency community and has sparked discussions on the potential benefits and challenges of widespread adoption. El Salvador’s controversial move with its cryptocurrency adoption would not have been possible if it was not due to President Nayib Bukele, who garnered international attention after announcing the Bitcoin adoption plan and passed it into law. The legislation required all businesses within the country to accept Bitcoin as a form of payment for goods and services. As a legal tender, Bitcoin now has the same status as traditional fiat currencies, ...

Wyre imposes up to a 90% withdrawal limit for all users

Crypto payment platform Wyre modified its withdrawal policy to limit users from cashing out up to 90% of their assets just days after two former employees allegedly hinted the possibility of a shutdown. On Jan. 7, 2023, Wyre imposed a withdrawal limit on its platform, citing “the best interest of our community.” Following the policy modification, Wyre users can withdraw up to 90% of their crypto funds as the company explores strategic options to circumvent the prolonged bear market. We are modifying our withdrawal policy. While customers will continue to be able to withdraw their funds, at this time, we are limiting withdrawals to no more than 90% of the funds currently in each customer account, subject to current daily limits. — Wyre (@sendwyre) January 7, 2023 In addition, the company ap...

FTX collapse may boost ‘further trust’ in crypto ecosystem — Nomura exec

The winds of crypto winter may be still blowing, but it doesn’t seem to be stopping venture capital firms from piling into cryptocurrencies. In fact, recent events influenced by the bear market, such as the collapse of FTX, could bring “further trust into the ecosystem,” according to Jez Mohideen, co-founder and CEO at Laser Digital, the recently launched digital assets arm of the Asian giant Nomura Holdings. “More traditional players are entering the space who can help to regulate the sector. This means players who understand regulation as well as the importance of clients’ aggregation, stability, and execution,” explained Mohideen, a long-time participant in the venture sector and former director at Barclays and partner at the hedge fund Brevan H...

Mastercard partners with Polygon to launch Web3 musician accelerator program

Global payments giant Mastercard is ramping up its exposure blockchain tech yet again, after announcing a Polygon-based accelerator program to help musicians build their careers via Web3. The firm announced the “Mastercard Artist Accelerator” program via a Jan. 7 blog post, outlining that from this spring, it will connect five emerging musicians from across the globe with mentors that will help them set up their brand in the Web3 music space. “The artists will gain exclusive access to special events, music releases and more. A first-of-its-kind curriculum will teach the artists how to build (and own) their brand through Web3 experiences like minting NFTs, representing themselves in virtual worlds and establishing an engaged community,” the post reads. The prog...

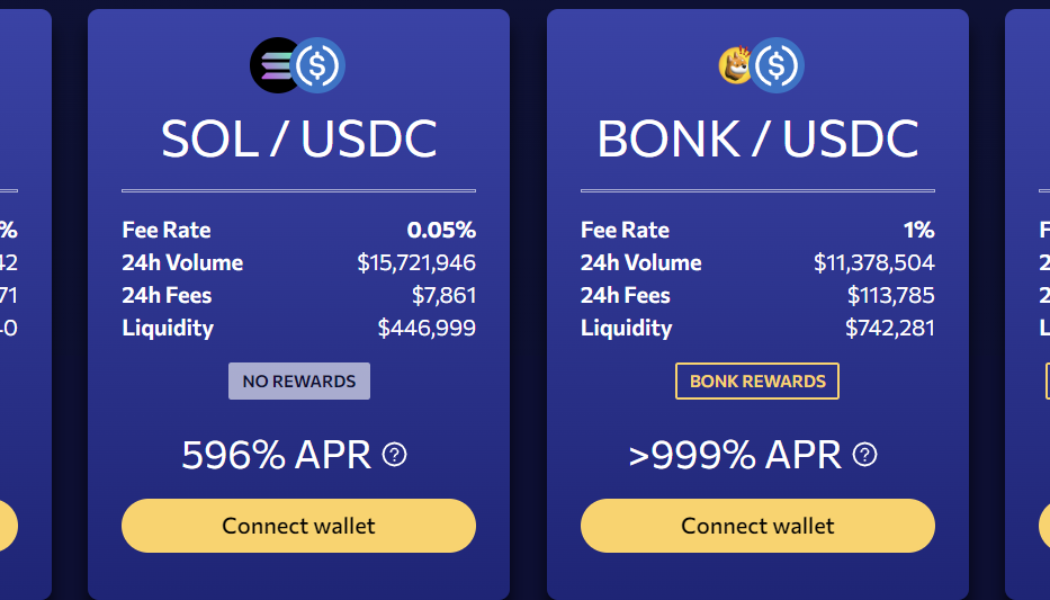

Bonk token goes bonkers as traders chase after high yields in the Solana ecosystem

Bonk, a meme token modeled after Shiba Inu (SHIB) that launched on Dec. 25, is skyrocketing and some traders believe the token’s trading volume is potentially driving Solana’s (SOL) price up. Over the past 48 hours, SOL price has gained 34%, and in the past 24 hours, Bonk has climbed 117%, according to data from CoinMarketCap. While the wider crypto market remains suppressed, traders are hoping that Bonk could present new opportunities during the downturn. According to the project’s website, Bonk is the first dog token on the Solana blockchain. Initially, 50% of the token supply was airdropped to Solana users with a mission to remove toxic Alameda-styled token economics. The airdrop resulted in more than $20 million in trading volume according to the Solana decentralized exchange Orc...

How time-weighted average price can reduce the market impact of large trades

Time-weighted average price is an algorithmic trade execution strategy commonly used in traditional finance tools. The goal of the strategy is to produce an average execution price that is relatively close to the time-weighted average price (TWAP) for the period that the user specifies. TWAP is mainly used to reduce a large order’s impact on the market by breaking it down into smaller orders and executing each one at regular intervals over a period of time. How TWAP can reduce the price impact of a large order Bids can influence the price of an asset in the order books or liquidity in the liquidity pools. For example, order books have multiple buy and sell orders at different prices. When a large buy order is placed, the price of an asset rises because all of the cheapest buy orders are be...

Models and fundamentals: Where will Bitcoin price go in 2023?

Bitcoin (BTC) had a bumpy ride throughout 2022, along with the rest of the digital asset market. The cryptocurrency began the year exchanging hands around $46,700 and is currently trading over 64% down at $16,560 at the time of writing. Consequently, the coin’s market capitalization took a tumble from around $900 billion on Jan. 1, 2022 to end the year at around $320 billion. Bitcoin Price Trend in 2022 While Bitcoin’s drop in price could be attributed to the extraordinary circumstances that the entire cryptocurrency market has been through this year, it is important to reevaluate the 2022 price predictions made by various market entities. One of the most popular predictions was that of analyst PlanB’s Bitcoin Stock-to-Flow (S2F) model. The S2F model predicted BTC to be at nearly $11...