Investment

Solana risks 35% price crash with SOL price chart ‘megaphone’ pattern

Solana (SOL) risks crashing 35% in the coming days as it comes closer to painting a so-called “megaphone” pattern. SOL price “megaphone” pattern In detail, megaphone setups consist of a minimum of lower lows and two higher highs and form during a period of high market volatility. But generally, these patterns consist of five consecutive swings, with the final one typically acting as a breakout signal. SOL has been sketching a similar pattern since the beginning of 2022, with the coin undergoing a pullback after testing the megaphone’s upper trendline near $140 as resistance — the fourth wing. As a result of the pattern, the Solana token could extend its decline to test the megaphone’s lower trendline as support near $65, about 35% below today’s pri...

Neutrino Dollar breaks peg, falls to $0.82 amid WAVES price ‘manipulation’ accusations

Neutrino Dollar (USDN), a stablecoin issued through Waves-backed Neutrino protocol, lost its U.S. dollar-peg on April 4 amid speculations that it could become “insolvent” in the future. USDN plunges 15% despite WAVES backing USDN dropped to as low as $0.822 on Monday with its market capitalization also diving to $824.25 million, down 14% from its year-to-date high of $960.25 million. Interestingly, the stablecoin’s plunge occurred despite Neutrino’s claims of backing its $1-peg via what’s called “over collateral,” i.e., when the total value of Waves (WAVES) tokens locked inside its smart contract is higher than the total USDN minted, also called the “backing ratio.” Neutrino Dollar price performance in the last 24 hours. Source: Co...

Cardano pares most of its Q1 losses as ADA rebounds 60% in a month — What’s next?

Cardano (ADA) inched higher on March 25, putting itself on course recoup a great portion of losses that it had incurred in the first two months of this year. Cardano: not so bullish yet? ADA’s price jumped by around 7.5% in trading Friday, reaching $1.19 over a month after bottoming out at around $0.75. The Cardano token’s huge rebound move netted around 60% in gains. Nonetheless, it remained at the risk of losing its upside momentum in the coming weeks. At the core of this bearish analogy is a multi-month descending channel pattern, with a reliable track record of causing and limiting ADA’s rebound attempts simultaneously since September 2021. The channel’s upper trendline particularly has served as an ideal selloff zone, now being tested again as resistance, as sh...

Mobile banking app Dave scores $100M investment from FTX US

On March 21, mobile banking application Dave announced a partnership with FTX US to provide cryptocurrency payments on the platform. It also announced a $100 million investment from FTX Ventures. In the statement, Dave said the investment would aid its strategy for future crypto-related initiatives, with FTX US serving as its partner for cryptocurrencies. Both companies said they’re currently exploring ways to introduce crypto payments into Dave’s platform. FTX US President Brett Harrison commented that it looks to align with companies that can help drive widespread adoption of digital assets, believing Dave was a fit in that regard. Jason Wilk, Chief Executive Officer of Dave, expressed his views on the technology. “We believe blockchain technology has the potential to level the financial...

Stacks price plunges hard after rallying 70% in a day — more STX losses ahead?

Stacks (STX) pared a considerable portion of the gains it made on March 10 as the euphoria surrounding its $165 million pledge to support Bitcoin (BTC) projects showed signs of fading. STX’s price dropped by over 30% to reach a level as low as $1.33 on Friday when measured from its week-to-date high of $1.94. The selloff, in part, appeared technical as the $1.94-top fell in the same range that served as solid support between October 2021 and January 2022, only to flip later to become a resistance area. STX/USD daily price chart. Source: TradingView It also appears that traders spotted selling opportunities due to STX’s long wick candlestick on March 10. Stacks rallied by as much as 73% into the day while forming a disproportionally long bullish wick on the daily chart that hint...

3 reasons why Bitcoin can rally back to $60K despite erasing last week’s gains

Bitcoin (BTC) plunged to below $38,000 on Monday, giving up all the gains it had made last week, which saw BTC/USD rally over $45,000. BTC back below $40K as oil soars The losses appeared primarily in part due to selloffs across the risk-on markets, led by the 18% rise in international oil benchmark Brent crude to almost $139 per barrel early Monday, its highest level since 2008. Nonetheless, Bitcoin’s inability to offer a hedge against the ongoing market volatility also raised doubts over its “safe haven” status, with its correlation coefficient with Nasdaq Composite reaching 0.87 on Monday. BTC/USD weekly price chart featuring its correlation with Nasdaq and Gold. Source: TradingView Conversely, Bitcoin’s correlation with its top rival gold came to be minus 0...

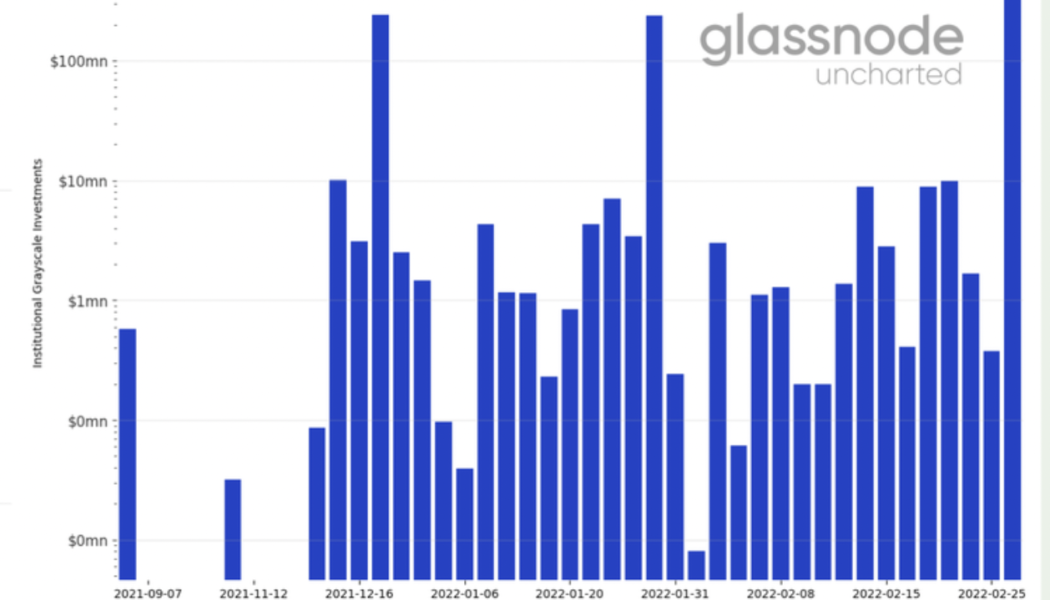

Institutions increase exposure to Grayscale Bitcoin Trust as GBTC discount nears 30%

Institutional investors are returning to accumulate Grayscale Bitcoin Trust (GBTC) shares as the discount to spot price his risen to nearly 30%, data on Glassnode shows. Since December 2021, some weekly sessions saw investors pouring in between $10 million and $120 million into Grayscale’s flagship fund. Meanwhile, the biggest capital inflow — amounting to nearly $140 million — appeared in the week ending on Feb. 25, as shown in the chart below. Institutional Grayscale Investments since September 2021. Source: Glassnode No selloff yet among high-profile GBTC backers The GBTC trust attracted investments as global markets faced back-to-back shocks in the past few months, including a dramatic selloff in the technology stocks, followed by Russia’s invasion of Ukraine that left many...

Institutions increase exposure to Grayscale Bitcoin Trust as GBTC discount nears 30%

Institutional investors are returning to accumulate Grayscale Bitcoin Trust (GBTC) shares as the discount to spot price his risen to nearly 30%, data on Glassnode shows. Since December 2021, some weekly sessions saw investors pouring in between $10 million and $120 million into Grayscale’s flagship fund. Meanwhile, the biggest capital inflow — amounting to nearly $140 million — appeared in the week ending on Feb. 25, as shown in the chart below. Institutional Grayscale Investments since September 2021. Source: Glassnode No selloff yet among high-profile GBTC backers The GBTC trust attracted investments as global markets faced back-to-back shocks in the past few months, including a dramatic selloff in the technology stocks, followed by Russia’s invasion of Ukraine that left many...

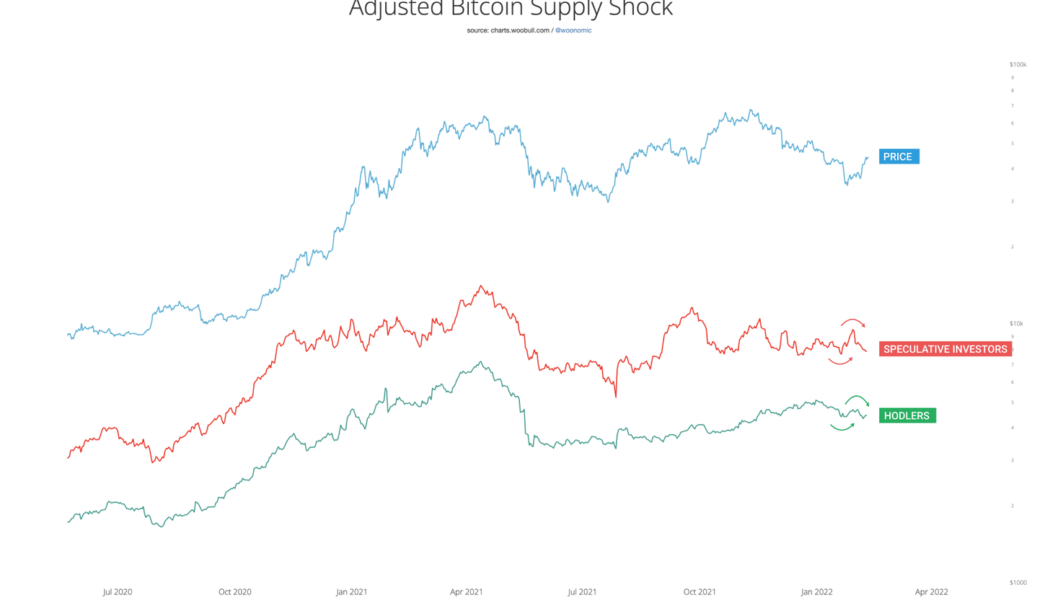

Bitcoin on-chain data hints at institutions ‘deploying capital’ at expense of ‘hodlers’

“Sophisticated passive buying” on Bitcoin (BTC) spot exchanges coincides with the trend of BTC leaving exchanges to cold storage. Adjusted Bitcoin supply shock. Source: Willy Woo The price recovery witnessed in the Bitcoin market across the last two weeks coincided with a rise in hodlers and speculative investors selling their coins, according to data provided by researcher Willy Woo. Nonetheless, BTC’s price ability to withstand the selling pressure meant there was buying pressure coming from elsewhere. As Cointelegraph reported earlier this week, so-called Bitcoin whales are accumulating BTC at current price levels. “This selling is contrasted by exchange data showing sophisticated passive buying on spot exchanges and movement of coins to whale-controlled wallets,...

MicroStrategy CEO won’t sell $5B BTC stash despite crypto winter

Despite a 40% drop in the value of Bitcoin (BTC), MicroStrategy’s Michael Saylor has no intention of selling his firm’s $5-billion stash. Even if BTC suffers a lengthy bear market, Saylor told Bloomberg that he is a “Bitcoin bull” and does not intend to alter MicroStrategy’s multi-billion-dollar BTC acquisition plan. He took a firm stance against cashing out BTC: “Never. No. We’re not sellers. We’re only acquiring and holding Bitcoin, right? That’s our strategy.” This current crypto winter doesn’t have Michael Saylor feeling all that cold. He tells @emilychangtv why in Studio 1.0 https://t.co/EsUlY5sscN pic.twitter.com/zWStdl5qsF — Bloomberg TV (@BloombergTV) January 20, 2022 MicroStrategy became the first publicly listed corporation in the United States to acquire and hold Bitcoin a...

More billionaires turning to crypto on fiat inflation fears

Previously anti-crypto investors are increasingly turning to Bitcoin and its brethren as a hedge against fiat currency inflation concerns. One example is Hungarian-born billionaire Thomas Peterffy who, in a Jan. 1 Bloomberg report, said that it would be prudent to have 2-3% of one’s portfolio in crypto assets just in case fiat “goes to hell”. He is reportedly worth $25 billion. Peterffy’s firm, Interactive Brokers Group Inc., announced that it would be offering crypto trading to its clients in mid-2020 following increased demand for the asset class. The company currently offers Bitcoin, Ethereum, Litecoin, and Bitcoin Cash, but will be expanding that selection by another 5-10 coins this month. Peterffy, who holds an undisclosed amount of crypto himself, said that it is possible that digita...