Investment

Ethereum preparing a ‘bear trap’ ahead of the Merge — ETH price to $4K next?

Ethereum’s native token, Ether (ETH), continues to face downside risks in a higher interest rate environment. But one analyst believes that the token’s next selloff move could turn into a bear trap as the market factors in the possible release of the Merge this coming August. ETH to $4K? Ether’s price could reach $4,000 by 2022’s end, according to a technical setup shared on May 20 by Wolf, an independent market analyst. The analyst envisioned ETH moving inside a multi-month ascending triangle pattern, which comprises a horizontal trendline resistance and rising trendline support. Notably, ETH’s latest retest of the structure’s lower trendline could initiate a big rebound toward its upper trendline, which sits around the $4,000-level, as s...

$1.9T wipeout in crypto risks spilling over to stocks, bonds — stablecoin Tether in focus

The cryptocurrency market has lost $1.9 trillion six months after it soared to a record high. Interestingly, these losses are bigger than those witnessed during the 2007’s subprime mortgage market crisis — around $1.3 trillion, which has prompted fears that creaking crypto market risk will spill over across traditional markets, hurting stocks and bonds alike. Crypto market capitalization weekly chart. Source: TradingView Stablecoins not very stable A massive move lower from $69,000 in November 2021 to around $24,300 in May 2022 in Bitcoin’s (BTC) price has caused a selloff frenzy across the crypto market. Unfortunately, the bearish sentiment has not even spared stablecoins, so-called crypto equivalents of the U.S. dollar, which have been unable to stay as “stable” a...

ApeCoin rebounds after APE price crashes 80% in two weeks: Dead cat bounce or bottom?

ApeCoin (APE) has undergone a sharp recovery after falling to its lowest level in two months. But its strong correlation with Bitcoin (BTC) and U.S. equities amid macro risks suggests more losses could be in store. APE rebounds after 80% losses in two weeks APE rebounded by nearly 45% to $7.30 on May 12. The upside retracement move came after APE dropped circa 81% to $5 on May 11, from its record high near $27.50, established on April 28. The seesaw price action mirrored similar volatile moves elsewhere in the crypto market, led by the chaos around TerraUSD (UST) — an “algorithmic stablecoin” whose value plunged to $0.23 earlier this week, and the Federal Reserve’s hawkish response to rising inflation. APE/USD versus USTUSD. Source: TradingView Meanwhile, the correla...

Law Decoded: Crypto retirement plans get hot with Warren and Lummis making their moves, May 2–9, 2022

Retirement plans still largely remain at the periphery of both crypto adoption and the regulatory discussion. But last week, a major development emerged in this department. United States Senators Elizabeth Warren of Massachusetts and Tina Smith of Minnesota became concerned about Fidelity’s recent announcement of adding Bitcoin (BTC) to its clients’ 401(k) retirement investment menu. In a letter to the company’s CEO Abigail Johnson, the lawmakers expressed their uneasiness over a “conflict of interests” and the “significant risks of fraud, theft and loss,” requesting from Fidelity a detailed outline of risk mitigation actions. Crypto 401(k) plans are still relatively rare, but they have already drawn suspicious attention from the U.S. Department of Labor. Crypto retirement investment...

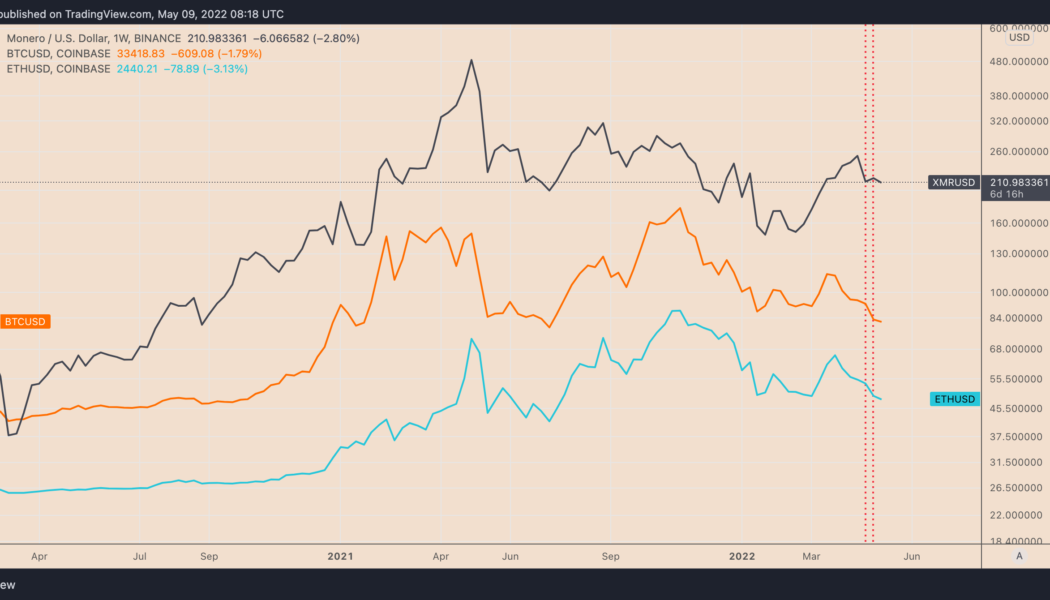

Monero avoids crypto market rout, but XMR price still risks 20% drop by June

Monero (XMR) has shown a surprising resilience against the United States Federal Reserve’s hawkish policies that pushed the prices of most of its crypto rivals — including the top dog Bitcoin (BTC) — lower last week. XMR price closed the previous week 2.37% higher at $217, data from Binance shows. In comparison, BTC, which typically influences the broader crypto market, finished the week down 11.55%. The second-largest crypto, Ether (ETH), also plunged 11% in the same period. XMR/USD vs. BTC/USD vs. ETH/USD weekly price chart. Source: TradingView While the crypto market wiped off $163.25 billion from its valuation last week, down nearly 9%, Monero’s market cap increased by $87.7 million, suggesting that many traders decided to seek safety in this privacy-focused coin. XMR near ...

DOT rallies 12% in a day as Polkadot gears up to solve a major blockchain hacking problem

Polkadot (DOT) price ticked higher in the past 24 hours on anticipations that its new cross-chain communications protocol would solve a long-standing problem in the blockchain sector. DOT price gains 12% on XCM launch Bulls pushed DOT’s price to $16.44 on May 5 from $14.72 a day before, gaining a little over 12% as they assessed the launch of XCM, a messaging system that allows parachains — individual blockchains that operate in parallel inside the Polkadot ecosystem — to communicate with each other. DOT/USD daily price chart. Source: TradingView As Cointelegraph reported, future updates in the XCM protocol would see parachains exchanging messages without relying on Polkadot’s central blockchain, the Relay Chain. That expects to eliminate bridge hacks that have cost the in...

Ethereum risks 35% drop by June with ETH price confirming ‘ascending triangle’ fakeout

Ethereum’s native token Ether (ETH) faces the possibility of a 35% price correction in Q2 as it comes closer to breaking below its “ascending triangle” pattern. ETH price breakdown ahead? Ether’s price swung between profits and losses on May 2 while trading around $2,825, showing indecisiveness among traders about their next bias. Interestingly, the Ethereum token wobbled in the proximity of a rising trendline that constitutes an ascending triangle pattern in conjugation with a horizontal line resistance. To recap, ascending triangles are typically continuation patterns. That being said, Ether’s price was trending lower before forming its ascending triangle, raising its chances of a breakdown in the next few weeks. Another bearish sign comes from Ether&#...

Fireblocks expands institutional access to Terra’s DeFi ecosystem

Fireblocks, a digital asset custody platform, announced that it has enabled institutional DeFi access to Terra (LUNA), the second-largest decentralized finance (DeFi) protocol by total value locked (TVL). As per the announcement, Fireblocks users can now securely access all the decentralized applications (DApps) built on the Terra blockchain. The launch is in response to Fireblocks’ Early Access Program users, who invested over $250 million into the Terra DeFi ecosystem within the first 72 hours of its integration going live. According to Michael Shaulov, CEO of Fireblocks, institutional demand for DeFi is only continuing to grow, adding that: “As their appetite expands, so will their desire to be able to access all of the latest and greatest innovations across different blockchain e...

Could XRP price lose another 70% by Q3?

Ripple (XRP) continued its correction trend on April 25, falling by 5.5% to reach $0.64, its lowest level since Feb. 28. More XRP price downside ahead? The plunge increased the possibility of triggering a bearish reversal setup called descending triangle. While these patterns form usually during a downtrend, their occurrences following strong bullish moves usually mark the end of the uptrend. XRP has been in a similar trading channel since April 2022, bounded by two trendlines: a lower horizontal and an upper downward sloping. The pattern now nears its resolve as XRP pulls back toward the support trendline that’s also coinciding with the 50-week exponential moving average (50-week EMA; the blue wave), five weeks after testing the upper trendline as resistance. XRP/USD weekl...

Monero ‘falling wedge’ breakout positions XMR price for 75% rally

Monero (XMR) price dropped by nearly 10% three days after establishing a week-to-date high around $290 on April 24. Nonetheless, several technical indicators suggest that the XMR/USD pair is poised to resume its uptrend over the next few months. Falling wedge breakout underway Notably, XMR’s price broke out of its “falling wedge” structure in late March. It continued its move upside in the later daily sessions, with rising volumes indicating bullish sentiment among Monero traders. Traditional analysts consider falling wedges as bullish reversal patterns, i.e., the price first consolidates within a contracting, descending channel, followed by a strong bounce to the upside. As a rule, the falling wedge’s breakout target comes to be near the level at length equal to th...

DOGE price analysis hints at 30% drop despite Elon Musk’s Twitter bid

The brief Dogecoin (DOGE) price rally last week following Tesla CEO Elon Musk’s bid to buy Twitter appears to be fizzling out as DOGE closes the week over 8%. DOGE’s price dropped to $0.142 on April 17, three days after peaking out locally at $0.149. The Dogecoin correction, albeit modest, raised its potential to trigger a classic bearish reversal pattern with an 85% success rate of reaching its downside target. DOGE price eyes drop under $0.10 Dubbed head and shoulders (H&S), the pattern appears when the price forms three peaks in a row, with the middle one, called the “head,” in between the other two, which are of almost equal height, and are thus called the left and right “shoulders.” These three peaks hold above a common support ...