Investment

Jay-Z’s Roc Nation Joins S. Korean Firm Musicow, Allowing Fans To Invest In Music Royalties

Jay-Z's Roc Nation has partnered with Musicow, a South Korean firm that will allow fans to invest in artist music royalties.

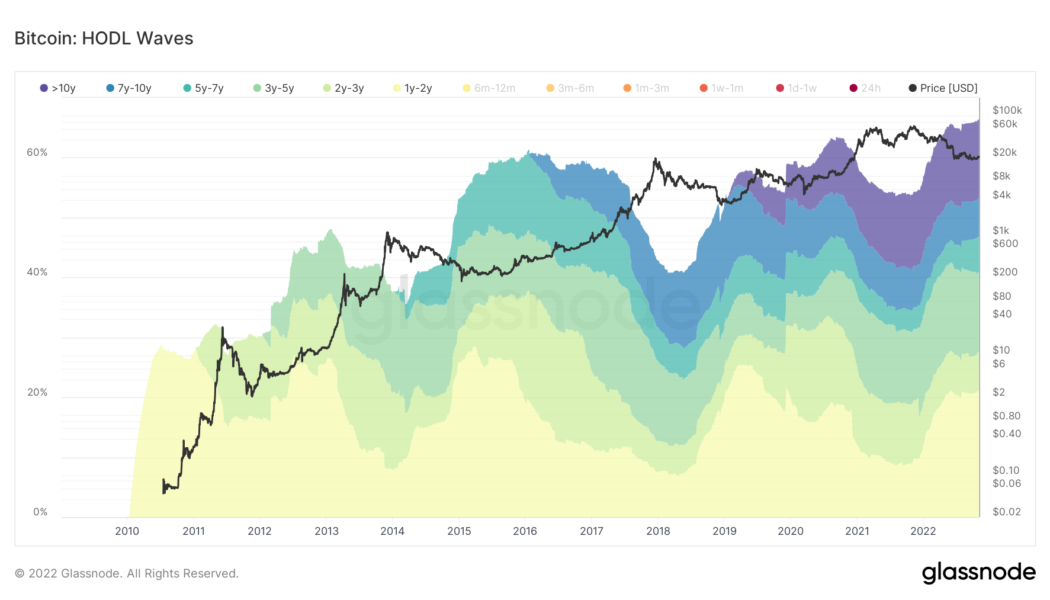

Bitcoin price bottom takes shape as ‘old coins’ hit a record 78% of supply

Bitcoin (BTC) and the rest of the crypto market have been in a bear market for almost a year. The top cryptocurrency has seen its market valuation plummet by more than $900 billion in the said period, with macro fundamentals suggesting more pain ahead. Another bear cycle produces more BTC hodlers But the duration of Bitcoin’s bear market has coincided with a substantial rise in the percentage of BTC’s total supply held by investors for at least six months to one year. Notably, the percentage of coins held for at least a year has risen from nearly 54% on Oct. 28, 2021, to a record high of 66% on Oct. 28, 2022, data shows. Bitcoin hodl waves. Source: Glassnode This evidence suggests that long-term investors are increasingly looking at Bitcoin as a store of value, asserts Charles Edward...

3 reasons why Quant Network’s QNT token may have topped after 450% gains since June

The price of Quant Network (QNT) eyes a sharp reversal after an impressive 450% rally in the past four months. QNT’s downside outlook takes cues from a flurry of technical and on-chain indicators, all suggesting that investors who backed its price rally have likely reached the point of exhaustion. QNT/USD daily price chart. Source: TradingView Here are three reasons why it could be happening. Quant’s daily active addresses drop Interestingly, the period of QNT’s massive uptrend coincided with similar upticks in its number of daily active addresses (DAA). This metric represents the number of unique addresses active on the network as a sender or receiver. As of Oct. 17, the Quant Network’s DAA reached an all-time high of 10,949, up from around 5,850 four months a...

Central African Republic court says new $60,000 citizenship-by-crypto-investment program is unconstitutional

According to Reuters, the Constitutional Court of the Central African Republic (CAR) said on Monday that the purchase of citizenship, e-residency and land using its government-backed Sango digital currency is unconstitutional because a nationality has no market value. Earlier in July, the CAR unveiled its Sango crypto hub to attract global crypto talent and enthusiasts, boost Bitcoin (BTC) adoption and implement new crypto regulatory frameworks. The Sango blockchain is built on top of the Bitcoin blockchain, similar to a layer-2 solution. Part of the program includes a citizenship-by-investment program, where foreign nationals can effectively purchase citizenship in the CAR for $60,000 in crypto, with an equivalent amount of Sango tokens held as collateral and returned...

What is dollar-cost averaging (DCA) and how does it work?

Many crypto enthusiasts just start investing in cryptocurrencies without a strategy behind it. However, they should be aware that an investment plan is essential when you begin investing in crypto. By sticking to a strategy, you will have a clear overview and become less susceptible to the substantial price fluctuations in the crypto market. Related: A beginner’s guide to cryptocurrency trading strategies For each investor, this investment strategy can be different. After all, you invest in a way that suits your financial goals and that you feel comfortable with. For many people, the dollar cost average method (DCA) is the way to invest their wealth. This is because through this investment method, you make clear agreements that feel manageable for many people. In addition, you can adapt th...

Unizen ‘CeDeFi’ smart exchange secures $200M investment from GEM

Cryptocurrency exchange Unizen has scored a $200 million investment from private equity group Global Emerging Markets (GEM) which it will use to expand its business and its ecosystem. Rather than receiving the $200 million in funding all at once, Unizen noted on June 27 that the investment will come in the form of a “capital commitment’, with part of the funding released upfront and the rest will be provided later based on achieved milestones. Unizen did not disclose what particular criteria it had to achieve to receive the funding. Unizen calls itself a “CeDeFi” exchange mixing features of both centralized exchanges (CEXs) and decentralized exchanges (DEXs), it runs on the BNB Chain, formerly called the Binance Smart Chain. It aims to attract both retail and institutional investors by fin...

XRP price rally stalls near key level that last time triggered a 65% crash

Ripple’s (XRP) ongoing upside retracement risks exhaustion as its price tests a resistance level with a history of triggering a 65% price crash. XRP price rebounds 30% XRP’s price gained nearly 30%, rising to $0.36 on June 24, four days after rebounding from $0.28, its lowest level since January 2021. The token’s retracement rally could extend to $0.41 next, according to its cup-and-handle pattern shown in the chart below. XRP/USD four-hour price chart featuring “cup and handle” pattern. Source: TradingView Interestingly, the indicator’s profit target is the same as XRP’s 50-day exponential moving average (50-day EMA; the red wave). XRP/USD daily price chart featuring 50-day EMA upside target. Source: TradingView Major resistance hurdle The cup-and-handle bullis...

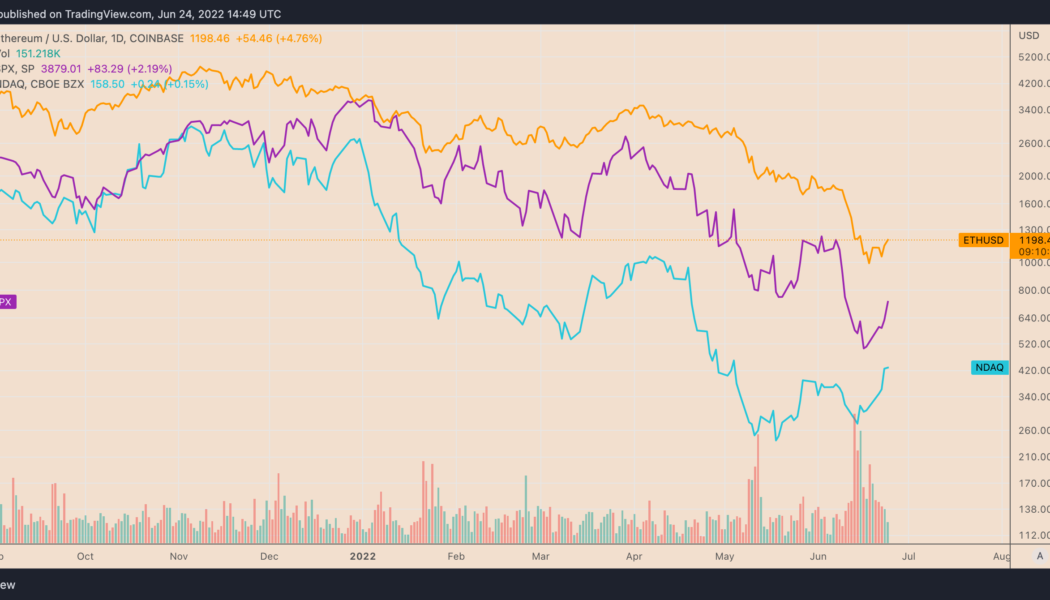

Ethereum price breaks out as ‘bad news is good news’ for stocks

Ethereum’s native token, Ether (ETH), gained alongside riskier assets as investors assessed weak U.S. economic data and its potential to cool down rate hike fears. Ether mirrors risk-on recovery ETH’s price climbed up to 8.31% on June 24 to $1,225, six days after falling below $880, its lowest level since January 2021. Overall, the upside retracement brought bulls 40% in gains, raising anticipation about an extended recovery in the future while alleviating fears of a “clean fakeout.” For instance, independent market analyst “PostyXBT” projected ETH’s price to close above $1,300 by the end of June. In contrast, analyst “Wolf” feared that bears would attempt to “push price back to $1,047,” albeit anticipating a run-up to...

Polygon price jumps 60% in four days amid ‘pretty big’ MATIC accumulation

Polygon (MATIC) took a break from its prevailing bearish course, posting one of sharpest rebound in the crypto market this week. Notably, MATIC’s price has risen to $0.50 this June 23, four days after hitting $0.317, its lowest level since April 2021. This amounts to roughly a 60% gain, surpassing the performances of even Bitcoin (BTC) and Ether (ETH) in the same timeframe. MATIC/USD daily price chart. Source: TradingView Nevertheless, MATIC is still down significantly from its December 2021 high of $2.92, coinciding with the overall crypto bear market and a hawkish Fed putting pressure on risk-on assets. MATIC “in a pretty big accumulation” Meanwhile, some of its richest investors have been accumulating MATIC tokens despite the general downtrend, on-chain dat...

Solana price just one breakdown away from a 40% slide in June — here’s why

Solana (SOL) is nearing a decisive breakdown moment as it inches towards the apex of its prevailing “descending triangle” pattern. SOL’s 40% price decline setup Notably, SOL’s price has been consolidating inside a range defined by a falling trendline resistance and horizontal trendline support, which appears like a descending triangle—a trend continuation pattern. Therefore, since SOL has been trending lower, down about 85% from its November 2021 peak of $267, its likelihood of breaking below the triangle range is higher. As a rule of technical analysis, a breakdown move followed by the formation of a descending triangle could last until the price has fallen by as much as the triangle’s maximum height. This puts SOL’s bearish price target at $22.50 ...

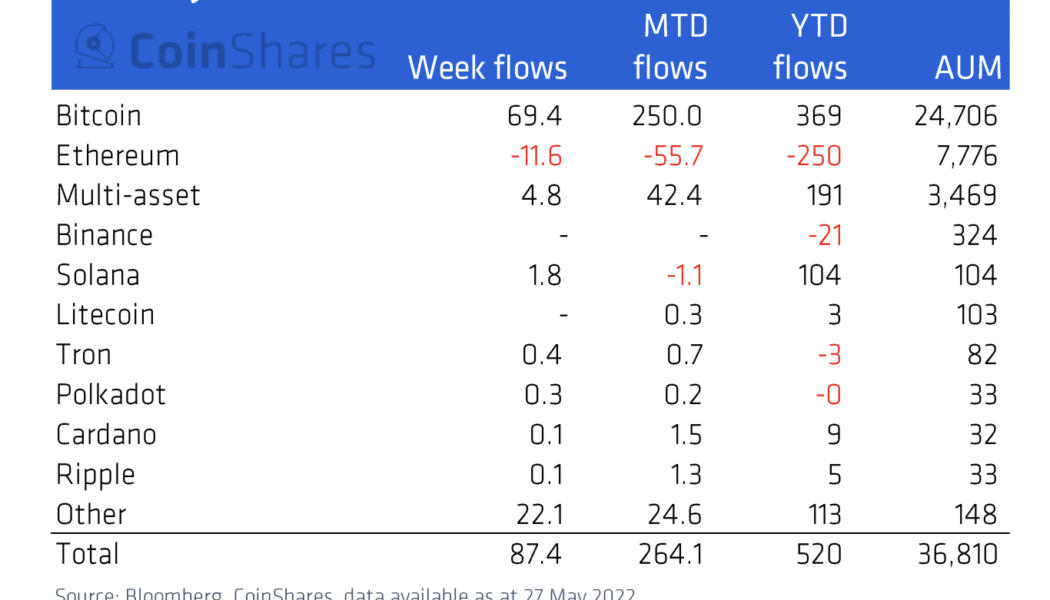

3 reasons Ethereum price risks 25% downside in June

Ethereum’s native token Ether (ETH) has dropped more than half of its value in 2022 in dollar terms, while also losing value against Bitcoin (BTC) and now remains pinned below $2,000 for several reasons. What’s more, ETH price could face even bigger losses in June due to another slew of factors, which will be discussed below. Ethereum funds lose capital en masse Investors have withdrawn $250 million out of Ethereum-based investment funds in 2022, according to CoinShares’ weekly market report published May 31. The massive outflow appears in contrast to other coins. For instance, investors have poured $369 million into Bitcoin-based investment funds in 2022. Meanwhile, Solana and Cardano, layer-one blockchain protocols competing with Ethereum, have attracted $104 million and ...