Interest Rates

Ethereum crashed by 94% in 2018 — Will history repeat with ETH price bottoming at $375?

Ethereum’s native token Ether (ETH) is showing signs of bottoming out as ETH price bounced off a key support zone. Notably, ETH price is now holding above the key support level of the 200-week simple moving average (SMA) near $1,196. The 200-week SMA support seems purely psychological, partly due to its ability to serve as bottom levels in the previous Bitcoin bear markets. Independent market analyst “Bluntz” argues that the curvy level would also serve as a strong price floor for Ether where accumulation is likely. He notes: “BTC has bottomed 4x at the 200wma dating back to 2014. [Probably] safe to assume it’s a pretty strong level. Sure we can wick below it, but there [are] also six days left in the week.” ETH/USD weekly pric...

5 reasons why Bitcoin could be a better long-term investment than gold

The emergence of forty-year high inflation readings and the increasingly dire-looking global economy has prompted many financial analysts to recommend investing in gold to protect against volatility and a possible decline in the value of the United States dollar. For years, crypto traders have referred to Bitcoin (BTC) as “digital gold,” but is it actually a better investment than gold? Let’s take a look at some of the conventional arguments investors cite when praising gold as an investment and why Bitcoin might be an even better long-term option. Value retention One of the most common reasons to buy both gold and Bitcoin is that they have a history of holding their value through times of economic uncertainty. This fact has been well documented, and there’s no denying that gold has ...

Low inflation or bust: Analysts say the Fed has no choice but to continue raising rates

As economic conditions continue to worsen, financial experts worldwide are increasingly placing the blame at the feet of the United States Federal Reserve after the central bank was slow to respond to rising inflation early on. Financial markets are currently experiencing their worst stretch of losses in recent history, and it doesn’t appear that there is any relief in sight. May 24 saw the tech-heavy Nasdaq fall another 2%, while Snap, a popular social media company, shed 43.1% of its market cap in trading on May 23. This past couple of months have been absolutely brutal for the markets… 8 consecutive weeks of red candles in the #SPX, #NASDAQ and #BTC… no significant bounces pic.twitter.com/hgU2VwIoxh — Crypto Phoenix (@CryptoPheonix1) May 24, 2022 Much of the recent turmoil again c...

Ethereum preparing a ‘bear trap’ ahead of the Merge — ETH price to $4K next?

Ethereum’s native token, Ether (ETH), continues to face downside risks in a higher interest rate environment. But one analyst believes that the token’s next selloff move could turn into a bear trap as the market factors in the possible release of the Merge this coming August. ETH to $4K? Ether’s price could reach $4,000 by 2022’s end, according to a technical setup shared on May 20 by Wolf, an independent market analyst. The analyst envisioned ETH moving inside a multi-month ascending triangle pattern, which comprises a horizontal trendline resistance and rising trendline support. Notably, ETH’s latest retest of the structure’s lower trendline could initiate a big rebound toward its upper trendline, which sits around the $4,000-level, as s...

Ethereum in danger of 25% crash as ETH price forms classic bearish technical pattern

Ethereum’s native token Ether (ETH) looks ready to undergo a breakdown move in May as it forms a convincing “bear pennant” structure. ETH price to $1,500? ETH’s price has been consolidating since May 11 inside a range defined by two converging trendlines. Its sideways move coincides with a drop in trading volumes, underscoring the possibility that ETH/USD is painting a bear pennant. Bear pennants are bearish continuation patterns, meaning they resolve after the price breaks below the structure’s lower trendline and then falls by as much as the height of the previous move downside (called the flagpole). ETH/USD two-hour price chart. Source: TradingView As a result of this technical rule, Ether risks closing below its pennant structure, followed by additional mo...

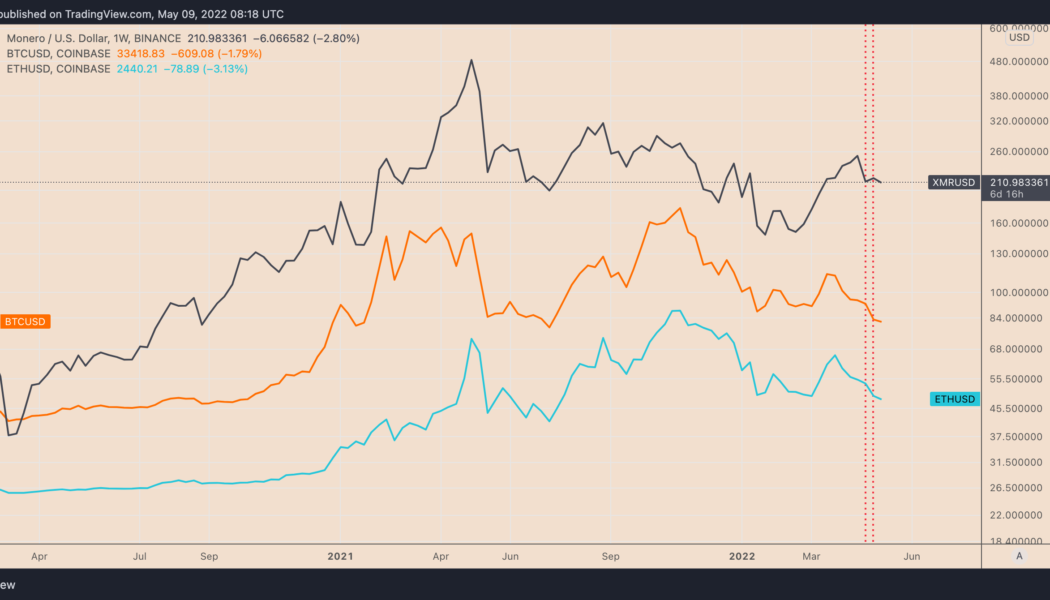

Monero avoids crypto market rout, but XMR price still risks 20% drop by June

Monero (XMR) has shown a surprising resilience against the United States Federal Reserve’s hawkish policies that pushed the prices of most of its crypto rivals — including the top dog Bitcoin (BTC) — lower last week. XMR price closed the previous week 2.37% higher at $217, data from Binance shows. In comparison, BTC, which typically influences the broader crypto market, finished the week down 11.55%. The second-largest crypto, Ether (ETH), also plunged 11% in the same period. XMR/USD vs. BTC/USD vs. ETH/USD weekly price chart. Source: TradingView While the crypto market wiped off $163.25 billion from its valuation last week, down nearly 9%, Monero’s market cap increased by $87.7 million, suggesting that many traders decided to seek safety in this privacy-focused coin. XMR near ...

DOT rallies 12% in a day as Polkadot gears up to solve a major blockchain hacking problem

Polkadot (DOT) price ticked higher in the past 24 hours on anticipations that its new cross-chain communications protocol would solve a long-standing problem in the blockchain sector. DOT price gains 12% on XCM launch Bulls pushed DOT’s price to $16.44 on May 5 from $14.72 a day before, gaining a little over 12% as they assessed the launch of XCM, a messaging system that allows parachains — individual blockchains that operate in parallel inside the Polkadot ecosystem — to communicate with each other. DOT/USD daily price chart. Source: TradingView As Cointelegraph reported, future updates in the XCM protocol would see parachains exchanging messages without relying on Polkadot’s central blockchain, the Relay Chain. That expects to eliminate bridge hacks that have cost the in...

BoJ official says digital yen won’t be used to achieve negative interest rate

The Bank of Japan (BoJ) has said that its Central Bank Digital Currency (CBDC), the digital yen, will not be used to help attain negative interest rates. The BoJ’s Executive Director, Shinichi Uchida made the announcement in his most recent public speech. “While the idea of using such a functionality as a means to achieve a negative interest rate is sometimes discussed in academia, the Bank will not introduce CBDC on this ground.” Japan initially adopted negative interest rates in 2016 in an attempt to combat decades of deflation by encouraging borrowing and spending. Negative interest rates are only used as a last resort by central banks during a recession to stimulate an economy by encouraging borrowing and spending, with interest being paid to borrowers rather than lenders. Echoin...

Ethereum price ‘bullish triangle’ puts 4-year highs vs. Bitcoin within reach

Ethereum’s native token Ether (ETH) has dropped about 17% against the U.S. dollar in the last two weeks. But its performance against Bitcoin (BTC) has been less painful with the ETH/BTC pair down 4.5% over the same period. The pair’s down-move appears as both ETH/USD and BTC/USD drop nearly in lockstep while reacting to the Federal Reserve’s potential to hike rates by 50 basis points and slash its balance sheet by $95 billion per month. The latest numbers released on April 12 show that consumer prices rose 8.5% in March, the most since 1981. BTC/USD vs. ETH/USD daily price chart. Source: TradingView ETH/BTC triangle breakout Several technicals remain bullish despite ETH/BTC dropping in the last two weeks. Based on a classic continuation pattern, the pair still l...

‘People should invest in all of the major layer-1s,’ says a veteran trader

Scott Melker, veteran trader and pocaster, is convinced that major layer-1 protocols should be part of everyone’s investment portfolio. Instead of picking individual crypto projects, such as NFTs or blockchain games, Melker thinks it makes more sense to bet on the blockchain infrastructure on which these projects are built. “Any of these small projects could absolutely go nuts. But you’re going to have trouble choosing what they are. You should just own the layer-1 and the infrastructure that they’re all built on,” he said in an exclusive interview with Cointelegraph. “You may not own a Bored Ape, but Ethereum holders have certainly benefited from the success of Bored Apes!” he pointed out. Talking about his portfolio construction, Melker revealed that about 6...

Why the rise of a Bitcoin standard could deter war-making

Alex Gladstein, the CSO at the Human Rights Foundation, says that if Bitcoin was adopted as a global reserve currency, nation-states would be less incentivized to start wars. According to Gladstein, the U.S. was able to sustain its “forever wars” in Iraq and Afghanistan mainly by borrowing capital. That was possible largely because of the Federal Reserve’s monetary policy, which has been keeping interest rates relatively low through quantitative easing. “We literally print money, we sell bonds to the open market for a promise to pay in the future and we use the income from the bond sales to pay for these wars.”, explained Gladstein in a latest interview with Cointelegraph. Unlike fiat currency, Bitcoin’s total supply is immutable. That ...