Interest Rate

Ethereum price breaks out as ‘bad news is good news’ for stocks

Ethereum’s native token, Ether (ETH), gained alongside riskier assets as investors assessed weak U.S. economic data and its potential to cool down rate hike fears. Ether mirrors risk-on recovery ETH’s price climbed up to 8.31% on June 24 to $1,225, six days after falling below $880, its lowest level since January 2021. Overall, the upside retracement brought bulls 40% in gains, raising anticipation about an extended recovery in the future while alleviating fears of a “clean fakeout.” For instance, independent market analyst “PostyXBT” projected ETH’s price to close above $1,300 by the end of June. In contrast, analyst “Wolf” feared that bears would attempt to “push price back to $1,047,” albeit anticipating a run-up to...

Low inflation or bust: Analysts say the Fed has no choice but to continue raising rates

As economic conditions continue to worsen, financial experts worldwide are increasingly placing the blame at the feet of the United States Federal Reserve after the central bank was slow to respond to rising inflation early on. Financial markets are currently experiencing their worst stretch of losses in recent history, and it doesn’t appear that there is any relief in sight. May 24 saw the tech-heavy Nasdaq fall another 2%, while Snap, a popular social media company, shed 43.1% of its market cap in trading on May 23. This past couple of months have been absolutely brutal for the markets… 8 consecutive weeks of red candles in the #SPX, #NASDAQ and #BTC… no significant bounces pic.twitter.com/hgU2VwIoxh — Crypto Phoenix (@CryptoPheonix1) May 24, 2022 Much of the recent turmoil again c...

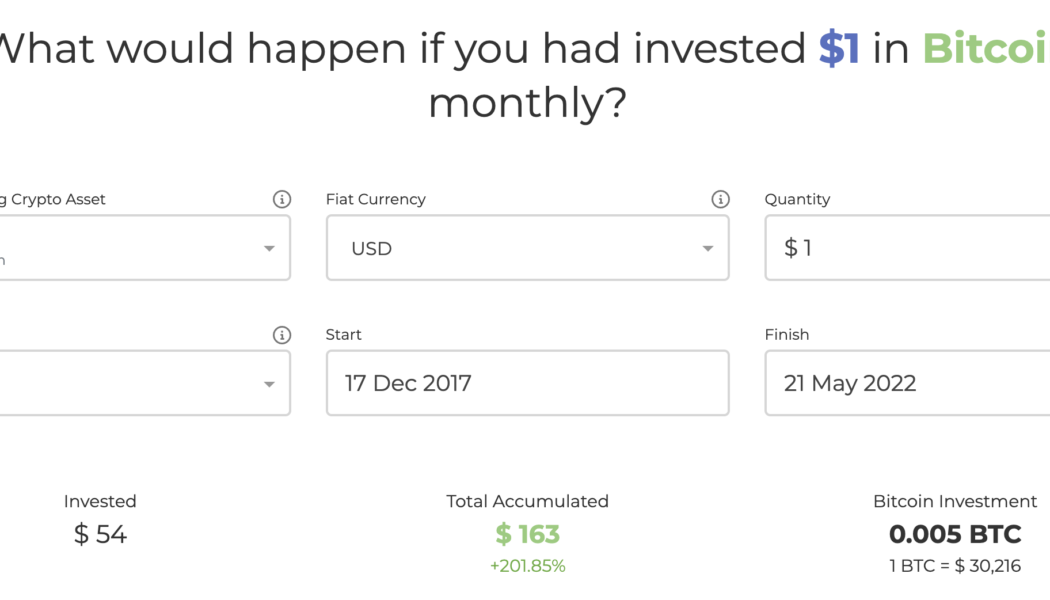

Dollar Cost Averaging or Lump-sum: Which Bitcoin strategy works best regardless of price?

Bitcoin (BTC) has declined by more than 55% six months after it reached its record high of $69,000 in November 2021. The massive drop has left investors in a predicament about whether they should buy Bitcoin when it is cheaper, around $30,000, or wait for another market selloff. The more you look at prior $BTC price history the more one can think it’s not the bottom After 190 days from the all-time high, Bitcoin still had another 150 to 200 days until it hit bottom last couple of cycles (red box) If time is any indicator, could be another 6 to 8 months pic.twitter.com/C1YHnfOzxC — Rager (@Rager) May 20, 2022 This is primarily because interest rates are lower despite Federal Reserve’s recent 0.5% rate hike. Meanwhile, cash holdings among the global fund managers have surged ...

Dollar Cost Averaging or Lump-sum: Which Bitcoin strategy works best regardless of price?

Bitcoin (BTC) has declined by more than 55% six months after it reached its record high of $69,000 in November 2021. The massive drop has left investors in a predicament about whether they should buy Bitcoin when it is cheaper, around $30,000, or wait for another market selloff. The more you look at prior $BTC price history the more one can think it’s not the bottom After 190 days from the all-time high, Bitcoin still had another 150 to 200 days until it hit bottom last couple of cycles (red box) If time is any indicator, could be another 6 to 8 months pic.twitter.com/C1YHnfOzxC — Rager (@Rager) May 20, 2022 This is primarily because interest rates are lower despite Federal Reserve’s recent 0.5% rate hike. Meanwhile, cash holdings among the global fund managers have surged ...

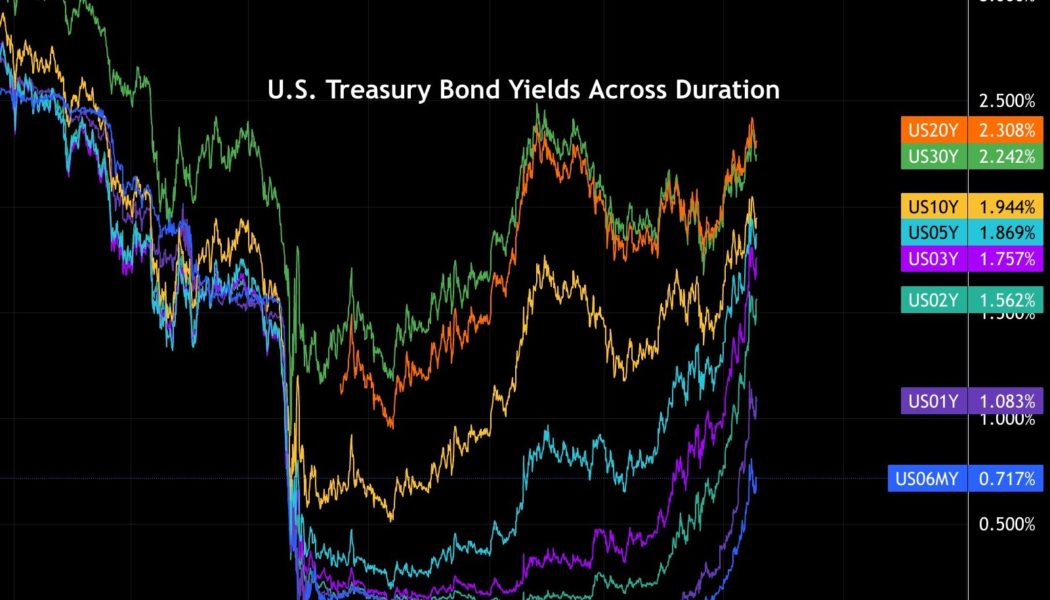

Hedge fund report says Bitcoin price is ‘at a relatively inexpensive place’

There has been a lot of focus on the performance of the stock and cryptocurrency markets over the past year or two as the trillions of dollars that have been printed into existence since the start of the COVID pandemic have driven new all-time highs, but analysts are now increasingly sounding the alarm over warning signs coming from the debt market. Despite holding interest rates at record low levels, the cracks in the system have become more prominent as yields for U.S. Treasury Bonds “have been rising dramatically” according to markets analyst Dylan LeClair, who posted the following chart showing the rise. U.S. Treasury bond yields across duration. Source: Twitter LeClair said, “Since November yields have been rising dramatically — bond investors begun to realize that w/ inflation ...

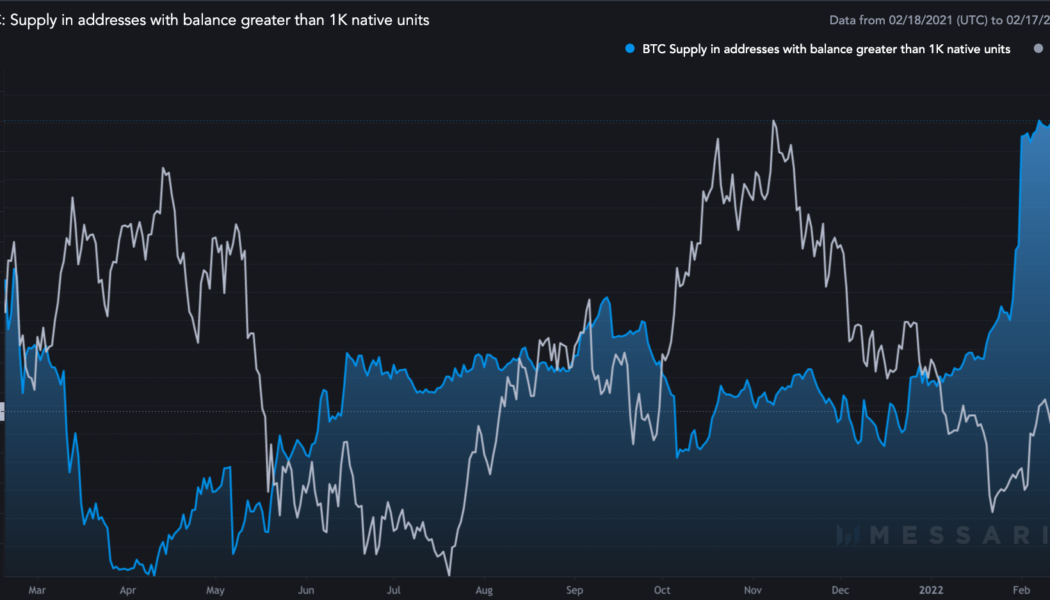

Bitcoin ‘whales’ and ‘fishes’ pause accumulation as markets weigh March 50bps hike odds

An uptick in Bitcoin (BTC) supply to whales’ addresses witnessed across January appears to be stalling midway as the price continues its intraday correction toward $42,000, the latest data from CoinMetrics shows. Whales, fishes take a break from Bitcoin The sum of Bitcoin being held in addresses whose balance was at least 1,000 BTC came to be 8.10 million BTC as of Feb. 16, almost 0.12% higher month-to-date. In comparison, the balance was 7.91 million BTC at the beginning of this year, up 2.4% year-to-date. Bitcoin supply in addresses with balance greater than 1,000 BTC. Source: CoinMetrics, Messari Notably, the accumulation behavior among Bitcoin’s richest wallets started slowing down after BTC closed above $40,000 in early February. Their supply fluctuated with...

Bitcoin price is ‘likely starting the next push up’ if $42K holds as support

The cryptocurrency market remains in a state of flux as investors are once again focused on what steps the U.S. Federal Reserve might take to combat rising inflation and markets wobble as the situation in Ukraine remains tense. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) has hovered around the $44,000 support level and traders are hopeful that an inverse head and shoulders chart pattern will lead to a sustained bullish breakout. BTC/USDT 1-day chart. Source: TradingView Here’s a survey of what several analysts in the market are keeping an eye on moving forward as global issues from inflation to war continue to make their presence felt in the cryptocurrency market. On-Balance Volume shows a bullish reversal Insight into what may lie ahead for Bi...

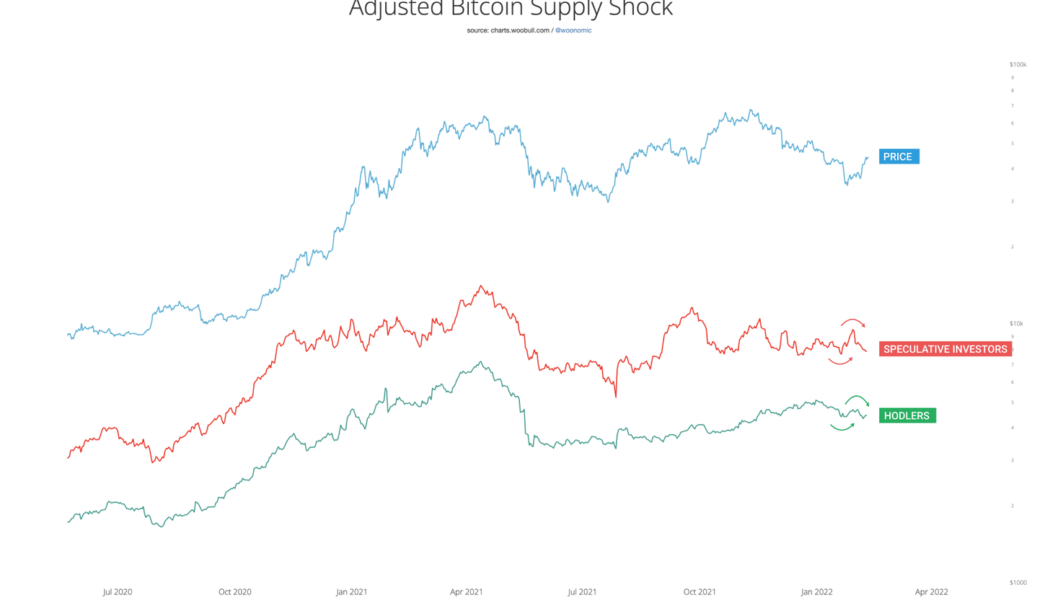

Bitcoin on-chain data hints at institutions ‘deploying capital’ at expense of ‘hodlers’

“Sophisticated passive buying” on Bitcoin (BTC) spot exchanges coincides with the trend of BTC leaving exchanges to cold storage. Adjusted Bitcoin supply shock. Source: Willy Woo The price recovery witnessed in the Bitcoin market across the last two weeks coincided with a rise in hodlers and speculative investors selling their coins, according to data provided by researcher Willy Woo. Nonetheless, BTC’s price ability to withstand the selling pressure meant there was buying pressure coming from elsewhere. As Cointelegraph reported earlier this week, so-called Bitcoin whales are accumulating BTC at current price levels. “This selling is contrasted by exchange data showing sophisticated passive buying on spot exchanges and movement of coins to whale-controlled wallets,...

Can Ethereum price reach $4K after a triple-support bounce?

Ethereum’s native token Ether (ETH) looks ready to continue its ongoing rebound move toward $4,000, according to a technical setup shared by independent market analyst Wolf. Classic bullish reversal pattern in the works? The pseudonymous chart analyst discussed the role of at least three support levels in pushing the ETH price up by nearly 30% from its local bottom of $2,160. These price floors included a 21-month exponential moving average, the 0.786 Fib level of a Fibonacci retracement graph drawn from $1,716-swing low to $4,772-swing high, and the lower boundary of an ascending triangle pattern. ETH/USD daily price chart featuring the three-supports. Source: TradingView Wolf noted that the triple-support scenario could push Ether price to $3,330. In doing so, ...

Ethereum bulls aim to flip $2.8K to support before calling a trend reversal

The dire predictions calling for the onset of an extended bear market may have been premature as prices appear to be in recovery mode on Jan. 26 following a signal from the U.S. Federal Reserve that interest rates will remain near 0% for the time being. After the Fed announcement from, prices across the cryptocurrency market began to rise with Bitcoin (BTC) up 4.11% and making a strong push for $39,000. This sparked a wave of momentum that helped to lift a majority of tokens in the market, but at the time of writing BTC price has pulled back to the $37,000 zone. Data from Cointelegraph Markets Pro and TradingView shows that the top smart contract platform Ethereum (ETH) also responded positively to the rise in bullish sentiment as its price climbed 8.11% on the 24-hour chart to hit a...

Nigerian government borrows over N2 trillion from bond investors in 2020

Leveraging on excess liquidity that persisted in the banking system and the near zero yields on treasury bills (TBs), the Federal Government, through the Debt Management Office (DMO), raised N2.1 trillion from investors in its monthly bond issuance programme in 2020. This represents 33 percent, year-on-year, (y/y) increase when compared with the N1.58 trillion raised by the DMO in 2019. The N2.1 trillion raised in 2020 also represents 31 percent more than the N1.6 trillion funding target for the DMO under the Revised 2020 Budget. Meanwhile, the monthly bond auctions conducted by the DMO in 2020 recorded 275 percent oversubscription, reflecting scramble for the high yielding FGN bonds by investors. Newsmen report on monthly bond auction results show that the DMO offered N1.825 trillion wort...

CBN: Naira to fall further in January

Barely five days to the end of the year 2020, the Central Bank of Nigeria has disclosed that a survey carried out by its Statistics Department revealed that the naira is expected to depreciate further in January 2021. The report, titled, ‘December 2020 Business Expectations Survey Report’ added that there might also be a steady rise in interest rate from December till the next six months. The naira witnessed a sharp fall in recent weeks, reaching its lowest on November 30, 2020, when it exchanged for N500/$1. Since then, the dollar has been hovering between N460 and N470. As of Friday, however, one dollar exchanged for 465 in the parallel market. Also, the Nigerian economy had on November 21 slid into its second recession in five years when the economy shrank again in the third quarter. Th...