Interest Rate

Macroeconomic data points toward intensifying pain for crypto investors in 2023

Undoubtedly, 2022 was one of the worst years for Bitcoin (BTC) buyers, primarily because the asset’s price dropped by 65%. While there were some explicit reasons for the drop, such as the LUNA-UST crash in May and the FTX implosion in November, the most important reason was the U.S. Federal Reserve policy of tapering and raising interest rates. Bitcoin’s price had dropped 50% from its peak to lows of $33,100 before the LUNA-UST crash, thanks to the Fed rate hikes. The first significant drop in Bitcoin’s price was due to growing market uncertainty around potential rate hike rumors in November 2021. By January 2022, the stock market had already started showing cracks due to the increasing pressure of imminent tapering, which also negatively impacted crypto prices. BTC/USD daily price chart. ...

BTC price sees ‘double top’ before FOMC — 5 things to know in Bitcoin this week

Bitcoin (BTC) begins a key week of internal and macroeconomic events still trading above $20,000. After its highest weekly close since mid-September, BTC/USD remains tied to higher levels within a macro trading range. The bulls have been keen to shift the trend entirely, while warnings from more conservative market participants continue to call for macro lows to enter next. So far, a tug-of-war between the two parties is what has characterized BTC price action, and any internal or external triggers have only had a temporary effect. What could change that? The first week of November contains a key event that has the potential to shape price behavior going forward — a decision by the United States Federal Reserve on interest rate hikes. In addition to other macroeconomic data, this will form...

What is the economic impact of cryptocurrencies?

Although the cryptocurrency market appears to grow in a positive feedback loop, that does not mean that (un)expected events may not impact the trajectory of the ecosystem as a whole. Although blockchain and cryptocurrencies are fundamentally meant as ‘trustless’ technologies, trust remains key there where humans interact with one another. The cryptocurrency market is not only impacted by the broader economy, but it may also generate profound effects by itself. Indeed, the Terra case shows that any entity — were it a single company, a venture capital firm or a project issuing an algorithmic stablecoin — can potentially set into motion or contribute to a “boom” or “bust” of the cryptocurrency ma...

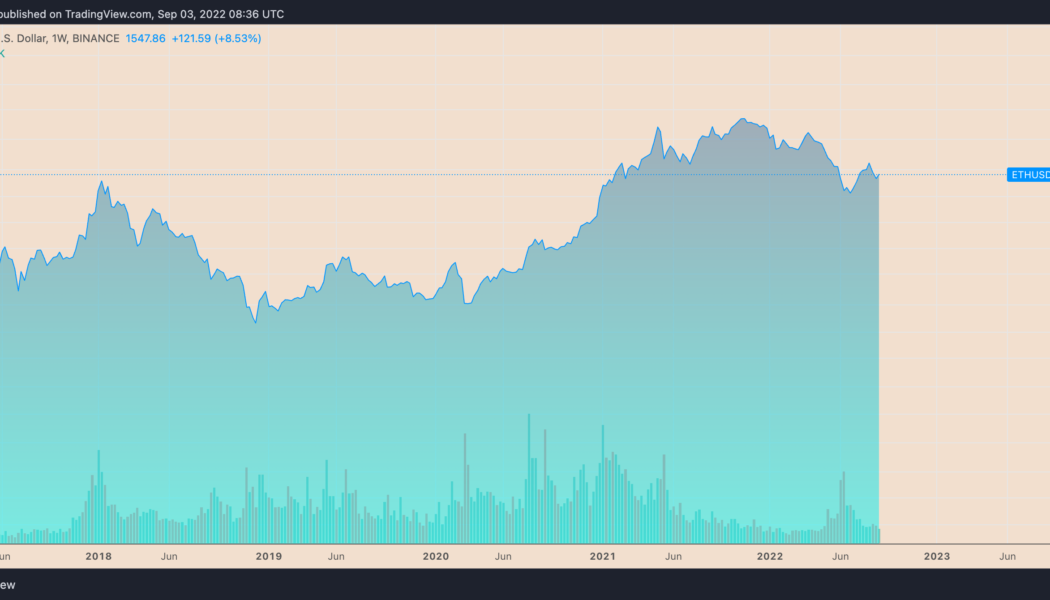

Ethereum risks another 10% drop versus Bitcoin as $15.4M exits ETH investment funds

Ethereum’s Merge on Sep. 15 turned out to be a sell-the-news event, which looks set to continue. Notably, Ether (ETH) dropped considerably against the U.S. dollar and Bitcoin (BTC) after the Merge. As of Sep. 22, ETH/USD and ETH/BTC trading pairs were down by more than 20% and 17%, respectively, since Ethereum’s switch to Proof-of-Stake (PoS. ETH/USD and ETH/BTC daily price chart. Source: TradingView What’s eating Ether bulls? Multiple catalysts contributed to Ether’s declines in the said period. First, ETH’s price fall against the dollar appeared in sync with similar declines elsewhere in the crypto market, driven by Federal Reserve’s 75 basis points (bps) rate hike. Second, Ethereum faced a lot of flak for becoming too centralized ...

3 reasons why Bitcoin traders should be bullish on BTC

Bitcoin (BTC) has been in a rut, and BTC’s price is likely to stay in its current downtrend. But like I mentioned last week, when nobody is talking about Bitcoin, that’s usually the best time to be buying Bitcoin. In the last week, the price took another tumble, dropping below $19,000 on Sept. 6 and currently, BTC bulls are struggling to flip $19,000–$20,000 back to support. Just this week, Federal Reserve Chairman Jerome Powell reiterated the Fed’s dedication to doing literally whatever it takes to combat inflation “until the job is done,” and market analysts have increased their interest rate hike predictions from 0.50 basis points to 0.75. Basically, interest rate hikes and quantitative tightening are meant to crush consumer demand, which in turn, eventually leads to a decrease in...

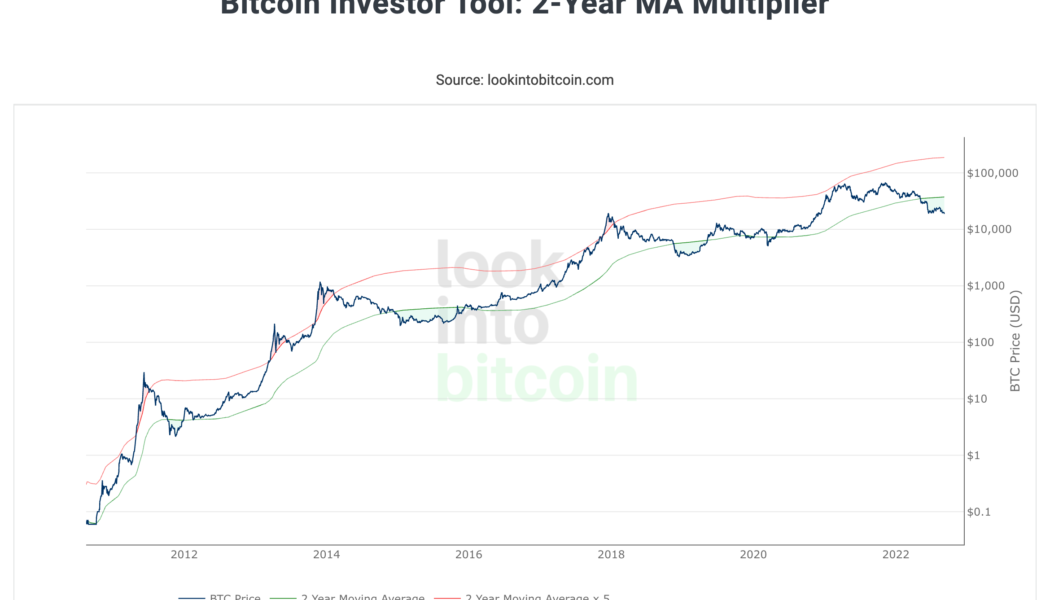

The Bitcoin bottom — Are we there yet? Analysts discuss the factors impacting BTC price

When Bitcoin was trading above $60,000, the smartest analysts and financial-minded folk told investors that BTC price would never fall below its previous all time high. These same individuals also said $50,000 was a buy the dip opportunity, and then they said $35,000 was a generational buy opportunity. Later on, they also suggested that BTC would never fall under $20,000. Of course, “now” is a great time to buy the dip, and one would think that buying BTC at or under $10,000 would also be the purchase of a lifetime. But by now, all the so-called “experts” have fallen quiet and are nowhere to be seen or heard. So, investors are left to their own devices and thoughts to contemplate whether or not the bottom is in. Should one be patient and wait for the forecast “drop to $10,000” ...

Surge or purge? Why the Merge may not save Ethereum price from ‘Septembear’

Ethereum’s native token, Ether (ETH), is not immune to downside risk in September after rallying approximately 90% from its bottom of around $880 in June. Much of the token’s upside move is attributed to the Merge, a technical upgrade that would make Ethereum a proof-of-stake (PoS) protocol, slated for Sep. 15. But despite logging impressive gains between June and September, Ether still trades almost 70% below its record high of around $4,950 from November 2021. Therefore, its possibility of heading lower remains on the cards. ETH/USD weekly price chart. Source: TradingView Here are three Ethereum bearish market indicators that show why more downside is likely. Sell the Ethereum Merge news Ethereum options traders anticipate Ether’s price to reach $2,200 f...

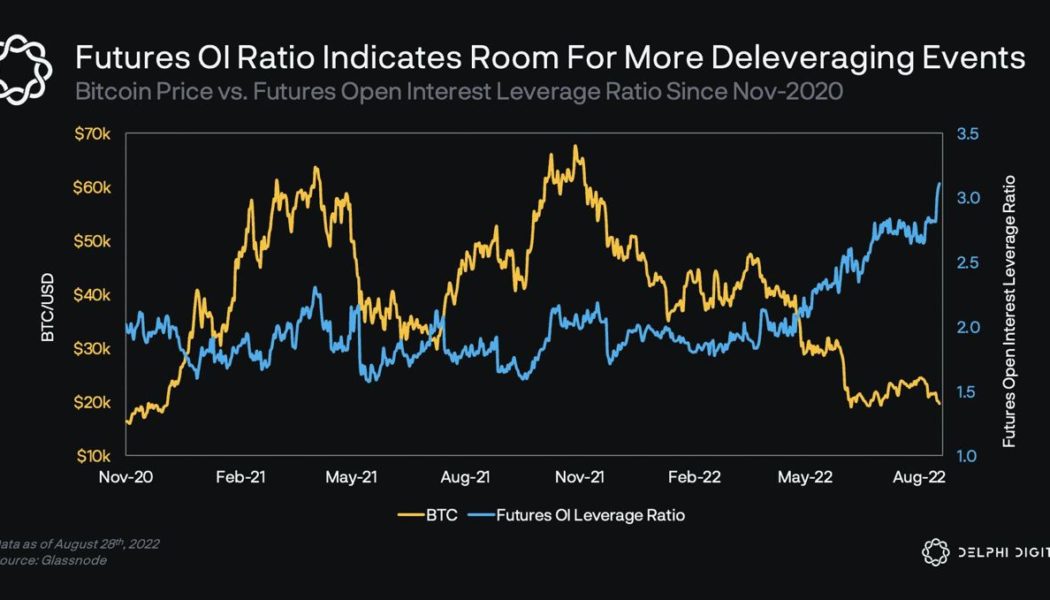

Bitcoin holds $20K, but analysts say BTC open interest leaves room for ‘more deleveraging’

Bitcoin (BTC) price continues to struggle at $20,000 and repeat dips under this level have led some analysts to project deeper downside in the short-term. Earlier in the week, independent market analyst Philip Swift tweeted that the Crypto Fear and Greed Index had dropped back to back to “Extreme Fear,” reflecting softening sentiment among investors. The market is not enjoying $BTC hanging around $20k. Back into Extreme Fear today. Live chart: https://t.co/Jr5151zN7I pic.twitter.com/UnztrZP7FP — Philip Swift (@PositiveCrypto) August 31, 2022 On Aug 29, analytics firm Delphi Digital highlighted Bitcoin open interest hitting a new record-high and said: “The Futures Open Interest Leverage Ratio for BTC reached its highest level ever recorded at more than 3% of BTC market cap, following ...

A bullish Bitcoin trend reversal is a far-fetched idea, but this metric is screaming ‘buy’

Bitcoin (BTC) price remains pinned below $22,000 as the lingering impact of the Aug. 19 sell-off at $25,200 continues to be felt across the market. According to analysts from on-chain monitoring resource Glassnode, BTC’s tap at the $25,000 level was followed by “distribution” as profit-takers and short-term holders sold as price encountered a trendline resistance following a 23-consecutive-day uptrend that saw BTC trading above it’s realized price ($21,700). Bitcoin total inflows and outflows to all exchanges (USD). Source: glassnode The firm also noted that the “total inflows and outflows to all exchanges” metric shows exchange flows at multi-year lows and back to “late-2020 levels,” which reflects a “general lack of speculative interest.” Stocks and crypto clearly risk off until we...

Warren Buffett pivots to U.S. Treasuries — a bad omen for Bitcoin’s price?

Warren Buffett has put most of Berkshire Hathaway’s cash in short-term U.S. Treasury bills now that they offer as much as 3.27% in yields. But while the news does not concern Bitcoin (BTC) directly, it may still be a clue to the downside potential for BTC price in the near term. Berkshire Hathaway seeks safety in T-bills Treasury bills, or T-Bills, are U.S. government-backed securities that mature in less than a year. Investors prefer them over money-market funds and certificates of deposits (COD) because of their tax benefits. Related: Stablecoin issuers hold more US debt than Berkshire Hathaway: Report Berkshire’s net cash position was $105 billion as of June 30, out of which $75 billion, or 60%, was held in T-bills, up from $58.53 billion at the beginning of 2022 o...

XRP price rally stalls near key level that last time triggered a 65% crash

Ripple’s (XRP) ongoing upside retracement risks exhaustion as its price tests a resistance level with a history of triggering a 65% price crash. XRP price rebounds 30% XRP’s price gained nearly 30%, rising to $0.36 on June 24, four days after rebounding from $0.28, its lowest level since January 2021. The token’s retracement rally could extend to $0.41 next, according to its cup-and-handle pattern shown in the chart below. XRP/USD four-hour price chart featuring “cup and handle” pattern. Source: TradingView Interestingly, the indicator’s profit target is the same as XRP’s 50-day exponential moving average (50-day EMA; the red wave). XRP/USD daily price chart featuring 50-day EMA upside target. Source: TradingView Major resistance hurdle The cup-and-handle bullis...