Insurance Industry

Proven Consult Partners with Leading Insurance Firm in Africa to Provide Intelligent Business Automation

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

11% of US insurers invest — or are interested in investing — in crypto

United States-based insurers are the most interested in cryptocurrency investment according to a Goldman Sachs global survey of 328 chief financial and chief investment officers regarding their firm’s asset allocations and portfolios. The investment banking giant recently released its annual global insurance investment survey, which included responses regarding cryptocurrencies for the first time, finding that 11% of U.S. insurance firms indicated either an interest in investing or a current investment in crypto. Speaking on the company’s Exchanges at Goldman Sachs podcast on Tuesday, Goldman Sachs global head of insurance asset management Mike Siegel said he was surprised to get any result: “We surveyed for the first time on crypto, which I thought would get no respondents, but I was surp...

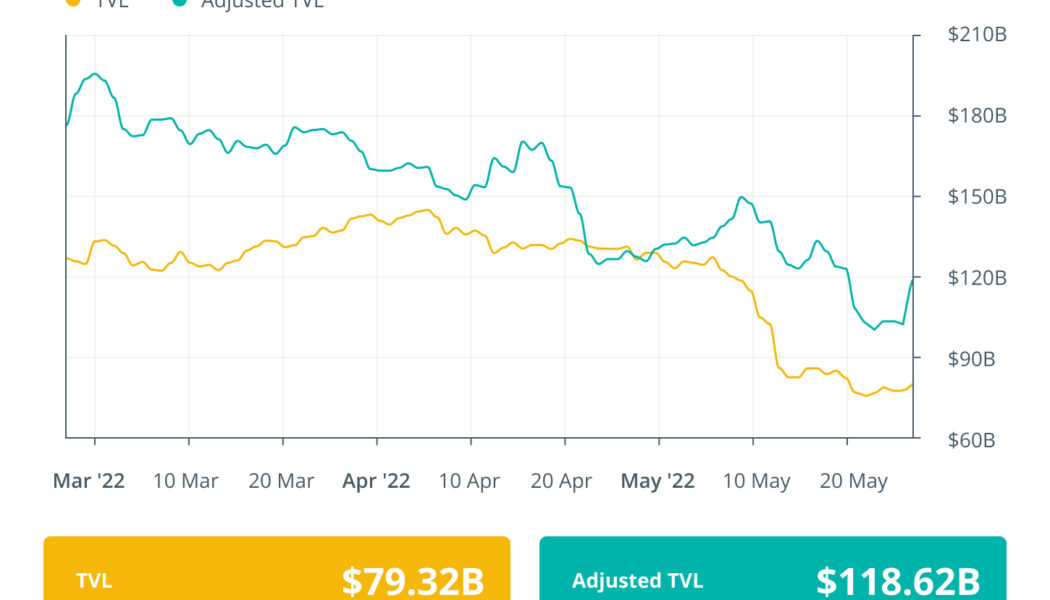

Finance Redefined: Uniswap breaches $1T volume, WEF 2022 discussion on Terra, and more

The decentralized finance (DeFi) ecosystem continues to struggle with the ongoing market volatility and after-effects of the Terra ecosystem collapse. Over the past week, major DeFi protocols showed signs of increased trading activity, with Uniswap breaching the $1 trillion trading volume mark. Terra remained the focus of most of the discussions around blockchain and crypto at the World Economic Forum (WEF), with analysts suggesting Terra was offering unsustainable yields. DeFi insurance protocol to pay out millions after Terra collapse, while interest in Ethereum Name Services (ENS) shattered new records. Top DeFi tokens by market cap had a mixed week of price action, with several tokens in the top 100 registering double-digit gains over the past week, while many others continue to trade ...

NAICOM: Don’t shun insurance despite inflation, harsh business environment

File Photo As businesses and individuals adopt cost reduction measures in response to rising inflation and the harsh business environment, the National Insurance Commission, NAICOM, has charged Nigerians to avoid the tendency to shun insurance of their assets. Commissioner for Insurance, Mr. Sunday Thomas, who gave the charge noted that despite the biting inflation in the country, even as people reduce the cost of expenses, this is not the best of time to reduce insurance consumption. Thomas stated this at a webinar organised by Coronation Insurance Plc in partnership with Access Bank Plc, with the theme: “Managing Business Risks at a Time of Uncertainty.” Thomas, who was represented by Mr. Taiwo Adeoye, Technical Adviser to the Commissioner for Insurance, noted that sometimes the gain in ...

NAICOM issues operating licenses to 4 insurers, 1 reinsurance firms

File Photo The National Insurance Commission (NAICOM) has granted operating licenses to four insurance firms and one reinsurance company to operate in the nation’s insurance industry. The four insurance firms are Heirs Insurance Limited (General); Stanbic IBTC Insurance Limited; Heirs Life Assurance Limited; Enterprise Life Company Nigeria Limited; and FBS Reinsurance Limited. The Commissioner for Insurance, Sunday Thomas, while presenting the licenses to the companies in Abuja, said that they have met the statutory requirements to carry out insurance business in Nigeria. Meanwhile, Heirs Insurance Limited (general) has appointed Olaniyi Stephen Onifade as its Managing Director; Stanbic IBTC Insurance Limited appointed Akinjide Orimolade as Managing Director; Heirs Life Assurance Limited a...