Insurance

FDIC acting chair says no crypto firms or tokens are backed by agency

Federal Deposit Insurance Corporation acting chair Martin Gruenberg said the agency does not back any crypto firms in the United States, nor does its insurance cover losses from tokens. In a Nov. 15 hearing of the Senate Banking Committee on the oversight of financial regulators, New Jersey Senator Bob Menendez said lawmakers needed to “take a serious look at crypto exchanges and lending platforms” over risky behavior. Gruenberg responded to Menendez’s questions confirming there were “no cryptocurrency firms backed by the FDIC” and “FDIC insurance does not cover cryptocurrency of any kind.” FDIC acting chair Martin Gruenberg addressing the Senate Banking Committee on Nov. 15 FDIC insurance normally protects deposits at financial institutions in the United States in the event of bank failur...

Smart contract-enabled insurance holds promise, but can it be scaled?

A new insurance world is coming where smart contracts replace insurance documents, blockchain “oracles” supplant claim adjusters, and decentralized autonomous organizations (DAOs) take over traditional insurance carriers. Millions of poor farmers in Africa and Asia will be eligible for coverages like crop insurance too, whereas before, they were too poor and too dispersed to justify the cost of underwriting. That is the vision, anyway, on display in the recent Smartcon 2022, a two-day conference that sought to provide “exclusive insights into the next generation of Web3 innovation.” Subsistence farms, where families basically live off what they grow and almost nothing is left over, account for as much as two-thirds of the developing world’s three billion rural people, according to the Unit...

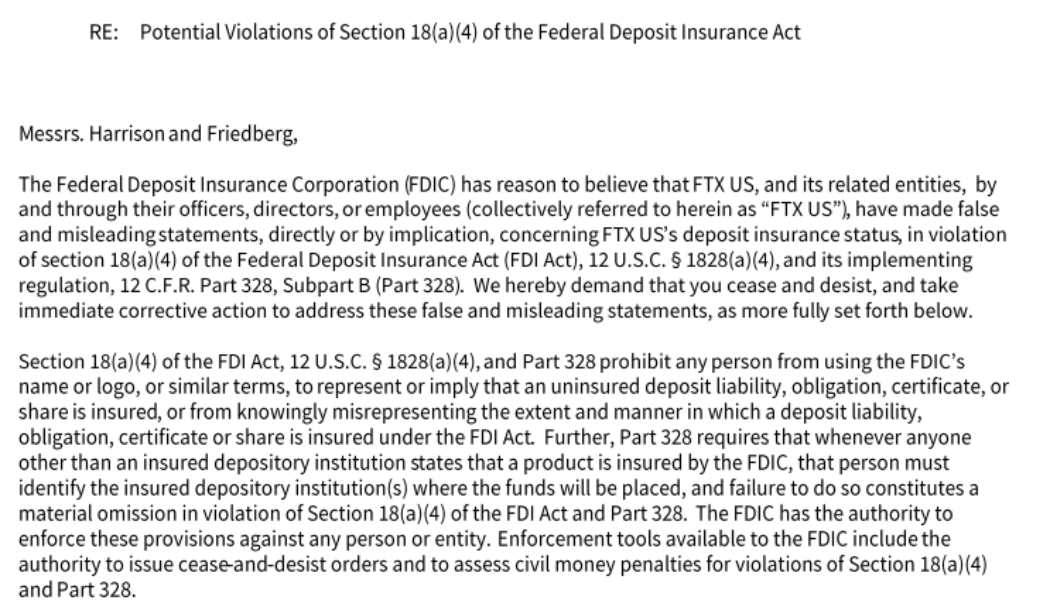

FTX US among 5 companies to receive cease and desist letters from FDIC

The Federal Deposit Insurance Corporation (FDIC) has issued cease and desist letters to five companies for allegedly making false representations about deposit insurance related to cryptocurrencies. FDIC issued a Friday press release disclosing cease and desist letters for cryptocurrency exchange FTX US and websites SmartAssets, FDICCrypto, Cryptonews and Cryptosec. In the letters, which were issued on Thursday, the government agency alleges that these organizations misled the public about certain cryptocurrency-related products being insured by FDIC. “These representations are false or misleading,” the FDIC said in regard to “certain crypto-related products” being FDIC-insured or that “stocks held in brokerage accounts are FDIC-insured.” The regulator said these companies must “take immed...

HARTi and Mitsui Sumitomo roll out NFT insurance coverage for claims

As announced on Tuesday, Japanese NFT Platform HARTi and insurance group Mitsui Sumitomo (三井住友海上) will roll out nonfungible token, or NFT, insurance for all digital artworks exhibited within the HARTi app. The insurance will attach to the NFT pieces on display by sellers free of charge, with HARTi responsible for the premium payments. Under the scheme, Mitsui Sumitomo will compensate owners of insured NFTs if their digital assets are compromised by unauthorized third-party access (such as through phishing, theft or wallet hacks) or become bugged or glitched during transfers. In such events, the policy will payout compensation to the NFT owner based on the exhibition price of each item and up to a maximum value of 500,000 yen ($3,661). The two parties expect to expand their collaborat...

11% of US insurers invest — or are interested in investing — in crypto

United States-based insurers are the most interested in cryptocurrency investment according to a Goldman Sachs global survey of 328 chief financial and chief investment officers regarding their firm’s asset allocations and portfolios. The investment banking giant recently released its annual global insurance investment survey, which included responses regarding cryptocurrencies for the first time, finding that 11% of U.S. insurance firms indicated either an interest in investing or a current investment in crypto. Speaking on the company’s Exchanges at Goldman Sachs podcast on Tuesday, Goldman Sachs global head of insurance asset management Mike Siegel said he was surprised to get any result: “We surveyed for the first time on crypto, which I thought would get no respondents, but I was surp...

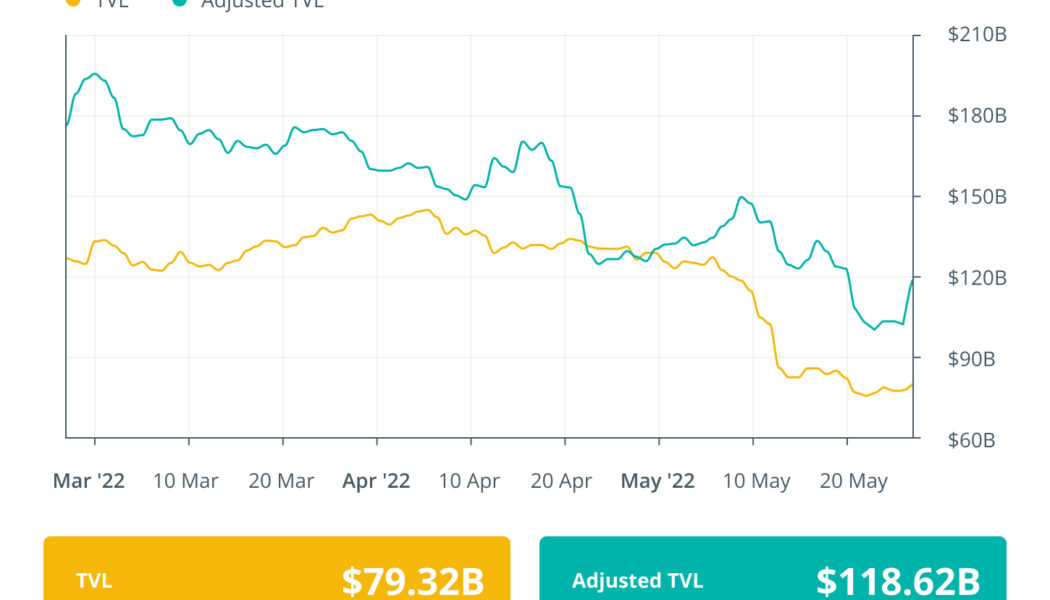

Finance Redefined: Uniswap breaches $1T volume, WEF 2022 discussion on Terra, and more

The decentralized finance (DeFi) ecosystem continues to struggle with the ongoing market volatility and after-effects of the Terra ecosystem collapse. Over the past week, major DeFi protocols showed signs of increased trading activity, with Uniswap breaching the $1 trillion trading volume mark. Terra remained the focus of most of the discussions around blockchain and crypto at the World Economic Forum (WEF), with analysts suggesting Terra was offering unsustainable yields. DeFi insurance protocol to pay out millions after Terra collapse, while interest in Ethereum Name Services (ENS) shattered new records. Top DeFi tokens by market cap had a mixed week of price action, with several tokens in the top 100 registering double-digit gains over the past week, while many others continue to trade ...

Safaricom Hires Managing Director of Citibank

Managing Director of Citi Bank, Michael Mutiga, now part of Safaricom. Image sourced from Shava TV. Safaricom, a Kenyan telecommunications service provider, has hired the managing director of Citibank to be in charge of strategy and acquisitions. The telco is currently seeking regulatory approvals to launch insurance, unit trust, and savings products in an endeavour to compete with larger financial services and expand its mobile money platform M-Pesa. Michael Mutiga, MD of Citibank and head of corporate finance for sub-Saharan Africa from 2019 will be the new chief business development and strategy officer, according to an internal memo that was first seen by Business Daily. Mutiga will be replacing former Safaricom’s chief of special projects and acting chief business development and stra...

The FDIC wants US banks to report on current and intended crypto-related activities

The Federal Deposit Insurance Corporation, the United States government corporation that insures depositors at U.S. commercial and savings banks, issued a financial institution letter Thursday. The letter requests the institutions supervised by the agency to notify the appropriate regional director of their activities with crypto-related assets or their intentions to engage in crypto-related activities. According to the letter, “It is difficult for institutions, as well as the FDIC, to adequately assess the safety and soundness, financial stability, and consumer protection implications without considering each crypto-related activity on an individual basis.” Consequently, the FDIC wants to receive all information necessary for it to “engage with the institution regarding related risk...

Lagos marks 70 houses for demolition, 20 on the Island

The Lagos State Building Control Agency (LASBCA) said it is set to demolish 70 distressed buildings in the state. Twenty of the buildings are on Lagos Island. The agency made this known after bulldozing a partially collapsed house at 19 Church Street on the Island. LASBCA spokesman, Mr Gbadeyan Abdulraheem, said the General Manager of the agency Mr Gbolahan Oki, supervised the demolition. Oki said it has became an urgency to immediately remove the dilapidated and distressed building, which were no longer fit for human habitation, to prevent collapse. He said many defective buildings had been marked for removal in a bid to end the era of building collapses. Oki noted that his team had earlier visited the distressed buildings to get an on the spot assessment and asked the residents to reloca...

Rivers governor calls for workable life insurance scheme for police

Concerned about the recent spate of dastardly attacks on police officers, the Governor of Rivers State, Nyeson Ezenwo Wike, has urged the Federal government to put in place a workable life insurance scheme for all police personnel. The governor said the life insurance scheme should be considered a necessity so that when a police officer dies on duty protecting the public, his loved ones will not be financially divested afterwards. He made the suggestion when the President, Police Officers Wives Association (POWA), Hajia Hajara Alkali Baba, paid him a courtesy call at the Government House, Port Harcourt on Friday. Governor Wike observed that policing has become a risky occupation, and concerted effort must be made by the Federal government to ensure those police officers who risk their live...