insolvency

Despite endless media appearances, SBF unlikely to testify on 13th

Former CEO of FTX, Sam Bankman-Fried, has signaled he’s unwilling to testify before the United States Congress until he’s “finished learning and reviewing what happened.” Bankman-Fried was responding to a Dec. 2 tweet from U.S. Representative Maxine Waters inviting him to testify in a scheduled U.S. House Committee on Financial Services hearing on Dec. 13 to discuss “what happened” at FTX. In a Dec. 4 response on Twitter, the former FTX CEO said he feels it is his “duty to appear before the committee and explain,” but only once he’s “finished learning and reviewing what happened,” adding he wasn’t “sure” whether it would happen by the 13th. Rep. Waters, and the House Committee on Financial Services: Once I have finished learning and reviewing what ...

Crypto trading firm Auros Global misses DeFi payment due to FTX contagion

Crypto trading firm Auros Global appears to be suffering from FTX contagion after missing a principal repayment on a 2,400 Wrapped Ether (wETH) decentralized finance (DeFi) loan. Institutional credit underwriter M11 Credit, which manages liquidity pools on Maple Finance, told its followers in a Nov. 30 Twitter thread that the Auros had missed a principal payment on the 2,400 wETH loan, which is worth in total around $3 million. M11 Credit suggests that it is always in close communication with its borrowers, particularly after events in the last month, and said Auros is experiencing a “short-term liquidity issue as a result of the FTX insolvency.” We remain committed to providing transparent updates whenever possible, and are working with Auros to provide a joint statement that provides fur...

CoinList addresses ‘FUD’ on withdrawals, cites technical issues for delays

Cryptocurrency exchange and initial coin offering (ICO) platform CoinList took to Twitter to address “FUD” after a blogger tweeted that users reported being unable to withdraw funds for over a week, sparking fears the company was having liquidity issues or w insolvent. “There is a lot of FUD going around that we would like to address head-on,” CoinList said in a Nov. 24 Twitter thread that stated that the exchange is “not insolvent, illiquid, or near bankruptcy.” It said, however, that its deposits and withdrawals are affected by “technical issues.” 2/ We are upgrading our internal ledger systems and are migrating wallet addresses involving multiple custodians. This is one of many efforts we are undertaking to offer our customers around the world better products and services while mai...

CoinList addresses ‘FUD’ on withdrawals, cites technical issues for delays

Cryptocurrency exchange and initial coin offering (ICO) platform CoinList took to Twitter to address “FUD” after a blogger tweeted that users reported being unable to withdraw funds for over a week, sparking fears the company was having liquidity issues or w insolvent. “There is a lot of FUD going around that we would like to address head-on,” CoinList said in a Nov. 24 Twitter thread that stated that the exchange is “not insolvent, illiquid, or near bankruptcy.” It said, however, that its deposits and withdrawals are affected by “technical issues.” 2/ We are upgrading our internal ledger systems and are migrating wallet addresses involving multiple custodians. This is one of many efforts we are undertaking to offer our customers around the world better products and services while mai...

Getting funds out of FTX could take years or even decades: Lawyers

While investors are eager to know when they will be able to get their funds back from the now-bankrupt crypto exchange FTX, insolvency lawyers warn it could take “decades.” The crypto exchange, along with 130 affiliates filed for Chapter 11 bankruptcy protection in the United States on Nov. 11. Insolvency lawyer Stephen Earel, partner at Co Cordis in Australia said it will be an “enormous exercise” in the liquidation process to “realize” the crypto assets then work out how to distribute the funds, with the process potentially taking years, if not “decades.” This is due to the complexities that come with cross-border insolvency issues and competing jurisdictions, he said. Earel said unfortunately FTX users are in the queue with everyone else including other creditors, investors and venture ...

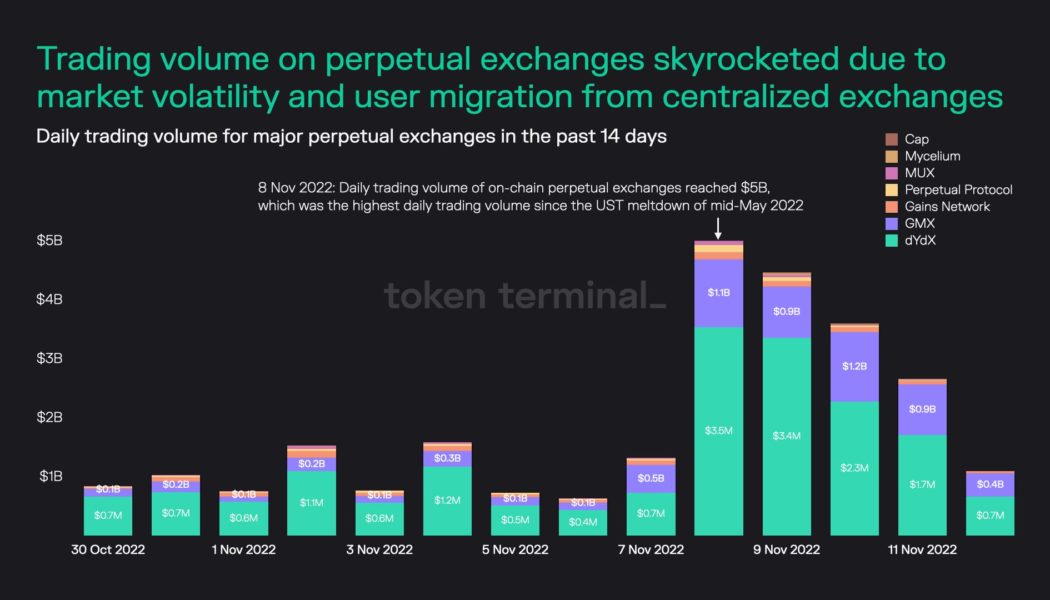

FTX is done — What’s next for Bitcoin, altcoins and crypto in general?

2022 was a tough year for crypto, and November was especially hard on investors and traders alike. While it was incredibly painful for many, FTX’s blowup and the ensuing contagion that threatens to pull other centralized crypto exchanges down with it could be positive over the long run. Allow me to explain. What people learned, albeit in the hardest way possible, is that exchanges were running fractional reserve-like banks to fund their own speculative, leveraged investments in exchange for providing users with a “guaranteed” yield. Somewhere across the crypto Twitterverse, the phrase “If you don’t know where the yield comes from, you are the yield!” is floating around. This was true for decentralized finance (DeFi), and it’s proven true for centralized crypto exchanges and platforms...