Inflation

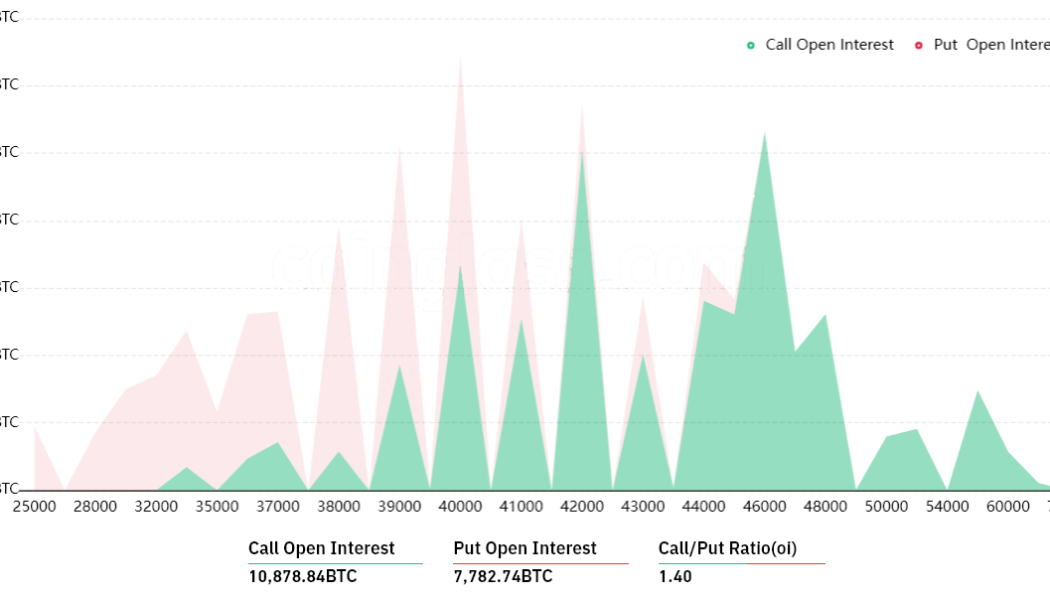

Bitcoin derivatives metrics reflect traders’ neutral sentiment, but anything can happen

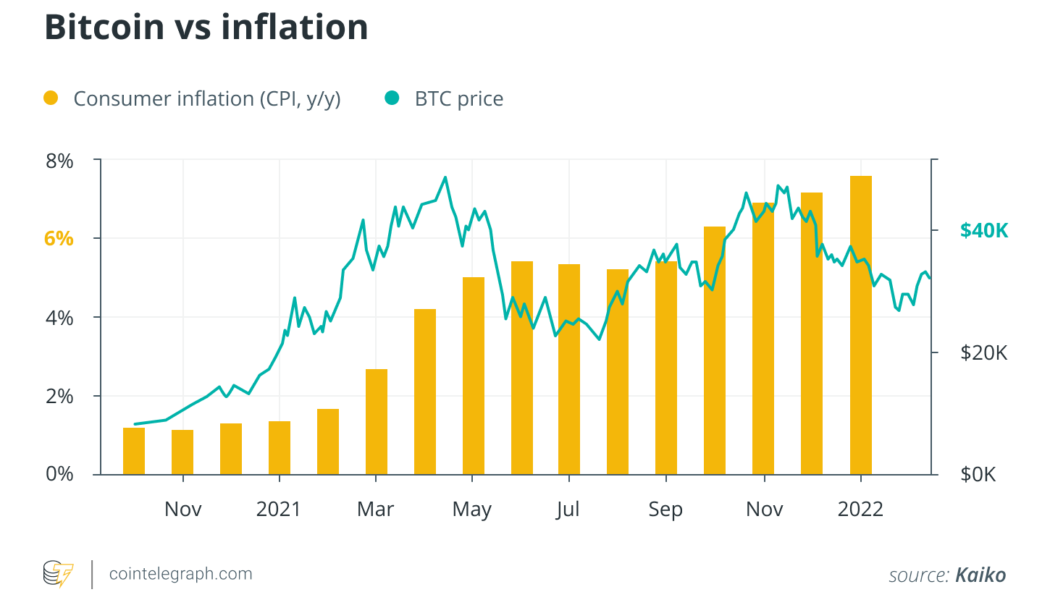

Bitcoin’s (BTC) last daily close above $45,000 was 66 days ago, but more importantly, the current $39,300 level was first seen on Jan. 7, 2021. The 13 months of boom and bust cycles culminated with BTC price hitting $69,000 on Nov. 10, 2021. It all started with the VanEck spot Bitcoin exchange-traded fund being rejected by the United States Securities and Exchange Commission (SEC) on Nov. 12, 2020. Even though the decision was largely expected, the regulator was harsh and direct on the rationale backing the denial. Curiously, nearly one year later, on Nov. 10, 2021, cryptocurrency markets rallied to an all-time high market capitalization at $3.11 trillion right as U.S. inflation as measured by the CPI index hit 6.2%, a 30-year high. Inflation also had negative consequences on risk ma...

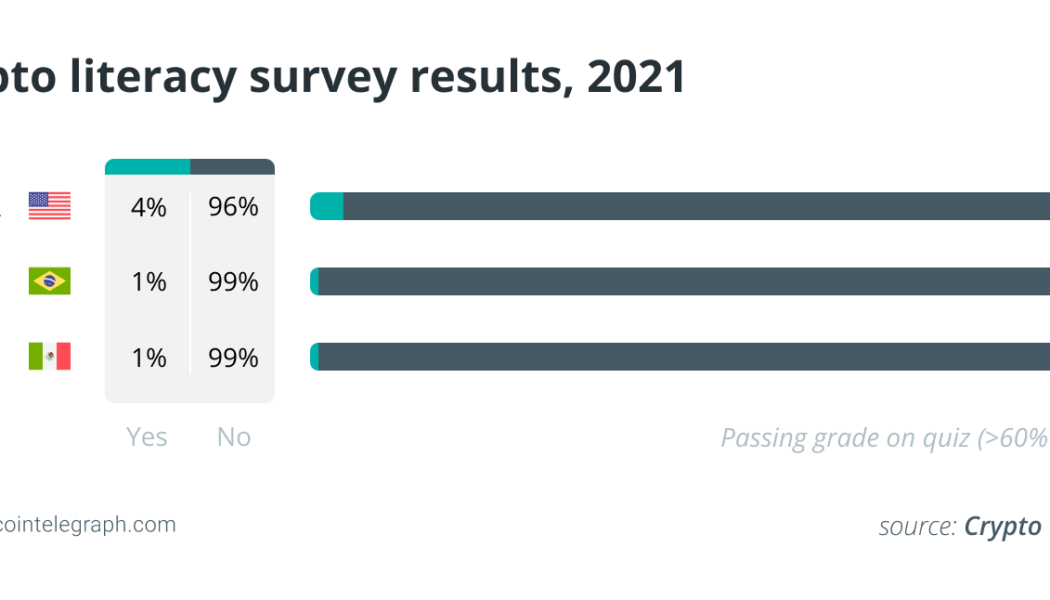

Crypto education can bring financial empowerment to Latin Americans

In October 2021, it was estimated that approximately 15% of the world’s supply of Bitcoin (BTC) was in circulation in Latin America. According to a recent report released by Crypto Literacy, however, 99% of Brazilian and Mexican respondents failed a basic assessment on crypto literacy. Crypto adoption is well underway across the region — on the rise even — but, people still lack a basic understanding of its underlying technology and use cases. When this lack of basic crypto literacy is considered in the context of developing markets across Latin America, where the use cases for blockchain technologies hold real significance, it becomes a serious concern. Latin American populations who lack crypto literacy risk missing out on stablecoins that can offer protection against Latin America...

Inflation spikes in Europe: What do Bitcoiners, politicians and financial experts think?

Rising prices are grabbing headlines all over the world. Across the pond in the United States, inflation recently broke a 40-year record. The situation is severe in Europe, with prices rising over 5% across the Eurozone and 4.9% in the United Kingdom. While prices rise, Bitcoin (BTC) is flatlining at around $39,000. It poses many questions: Is Bitcoin an effective hedge against rising prices, what role can Bitcoin play in a high inflation environment and did Bitcoiners know that inflation was coming? Experts from the world of Bitcoin, finance and even European politics responded to these questions, sharing their views with Cointelegraph about the alarming price rises in Europe. From data analysts Kaiko’s monthly report, the Bitcoin price marched ahead of inflation, implying...

Bitcoin declines with US stocks as nuclear threat ripples through markets

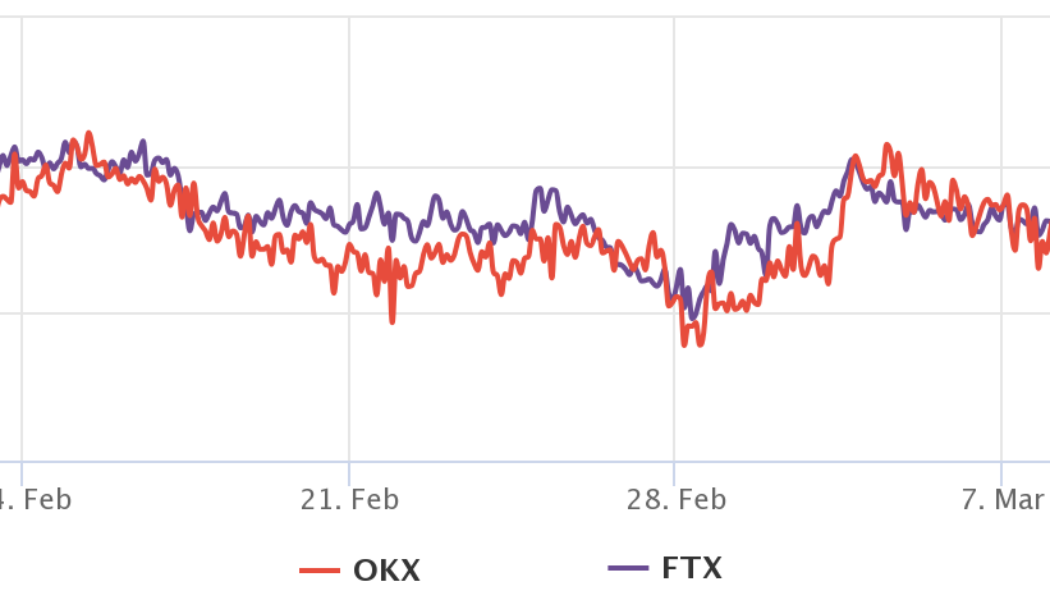

Bitcoin (BTC) bulls saw no relief at the Wall Street open on March 4 as the $40,000 support appeared on the horizon. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader: Markets “shaky,” but BTC could bounce Data from Cointelegraph Markets Pro and TradingView revealed new March lows of $40,551 for BTC/USD on Bitstamp, taking two-day losses to 10.2%. Fears over the security of Ukraine’s nuclear infrastructure drove not just crypto but traditional markets lower on the day, with the S&P 500 following European indexes to decline by 1.4%. “Bitcoin correcting as tensions around Ukraine are increasing, and fear is increasing too as Gold is rushing upwards,” Cointelegraph contributor Michaël van de Poppe explained in his latest Twitter update. “Might be seeing a b...

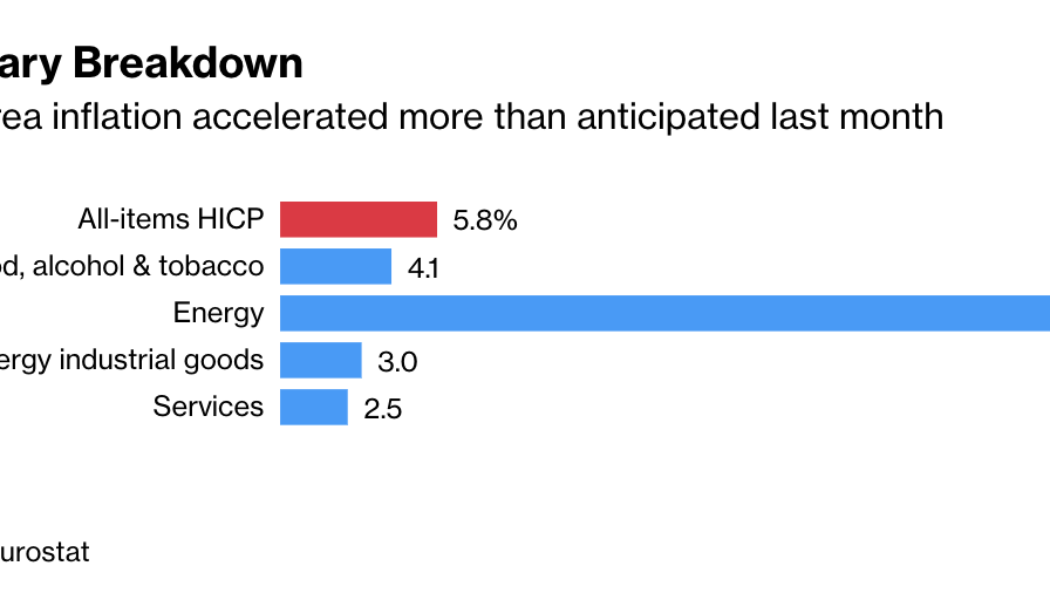

Bitcoin a ‘good bet’ if Fed continues easing to avoid a recession — analyst

Bitcoin (BTC) has the potential to become a “good bet” for investors if the Federal Reserve does everything it can to keep the U.S. economy afloat against impending recession risks, according to popular analyst Bitcoin Jack. The independent market analyst pitted the flagship cryptocurrency, often called “digital gold” by its enthusiasts, against the prospects of further quantitative easing by the U.S. central bank, noting that the ongoing military standoff between Ukraine and Russia had choked the supply chain of essential commodities, such as oil and wheat, resulting in higher global inflation. For instance, consumer prices in Europe jumped 5.8% year-over-year in February compared to 5.1% in the previous month, greater than the median economist forecast of 5.6% in ...

Bitcoin price spike to $39K leads traders to say ‘the panic is over for a few days’

Global financial markets and crypto markets were pummeled over the past 24-hours as the invasion of Ukraine by Russian forces sent investors scrambling and sell-offs took place across most asset classes. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) hit a low of $34,333 in the early trading hours on Feb. 24, shortly after the Ukraine incursion began, and has since climbed its way back to $38,500 after an unexpected short-squeeze may have rapped bearish investors on the knuckles. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts are saying about BTC price and how the ongoing conflict could impact crypto markets in the short-term. BTC in a “great buy area” Bitcoin’s collapse on the night of Feb. 23 was not unexp...

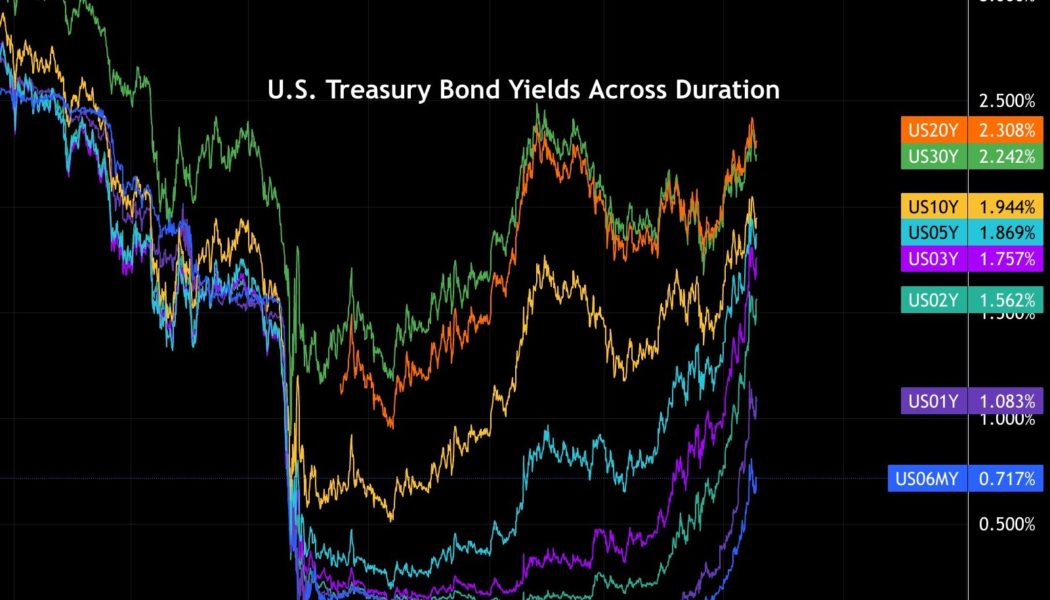

Hedge fund report says Bitcoin price is ‘at a relatively inexpensive place’

There has been a lot of focus on the performance of the stock and cryptocurrency markets over the past year or two as the trillions of dollars that have been printed into existence since the start of the COVID pandemic have driven new all-time highs, but analysts are now increasingly sounding the alarm over warning signs coming from the debt market. Despite holding interest rates at record low levels, the cracks in the system have become more prominent as yields for U.S. Treasury Bonds “have been rising dramatically” according to markets analyst Dylan LeClair, who posted the following chart showing the rise. U.S. Treasury bond yields across duration. Source: Twitter LeClair said, “Since November yields have been rising dramatically — bond investors begun to realize that w/ inflation ...

Solana’s weekend bounce risks turning into a bull trap — Can SOL price fall to $60 next?

A rebound move witnessed in the Solana (SOL) market this weekend exhausted midway as its price dropped below the $90 level from a high of $96 on Feb. 21. In doing so, SOL price technicals are now risking a classic bearish reversal setup. Solana price risks dropping to $60 Dubbed head-and-shoulders (H&S), the technical pattern emerges when the price forms three peaks in a row atop a common support level (called a neckline). As it typically turns out, the pattern’s middle peak, called a “head,” comes longer than the other two peaks, called theleft and right shoulders, which come to be of similar heights. The H&S pattern tends to send the prices lower—at length equal to the maximum distance between the head and the neckline—once they decisively break below its ...

Can Bitcoin break out vs. tech stocks again? Nasdaq decoupling paints $100K target

A potential decoupling scenario between Bitcoin (BTC) and the Nasdaq Composite can push BTC price to reach $100,000 within 24 months, according to Tuur Demeester, founder of Adamant Capital. Bitcoin outperforms tech stocks Demeester depicted Bitcoin’s growing market valuation against the tech-heavy U.S. stock market index, highlighting its ability to break out every time after a period of strong consolidation. “It may do so again within the coming 24 months,” he wrote, citing the attached chart below. BTC/USD vs. Nasdaq Composite weekly price chart. Source: Tuur Demeester, StockCharts.com BTC’s price has grown from a mere $0.06 to as high as $69,000 more than a decade after its introduction to the market, as per data tracked by the BraveNewCoin Liquid Index fo...

U.S. inflation breaks 40-year record: Can Bitcoin serve as a hedge asset?

On Feb. 9, the United States Bureau of Labor Statistics reported that the Consumer Price Index, a key measure capturing the change in how much Americans pay for goods and services, has increased by 7.5% compared to the same time last year, marking the greatest year-on-year rise since 1982. In 2019, before the global COVID-19 pandemic broke out, the indicator stood at 1.8%. Such a sharp rise in inflation makes more and more people consider the old question: Could Bitcoin, the world’s largest cryptocurrency, become a hedge asset for high-inflation times? What’s up with the inflation spike? Ironically, the fundamental reason behind the unprecedented inflation spike is the U.S. economy’s strong health. Immediately after the COVID-19 crisis, when 22 million jobs were slashed and national econom...

Crypto ‘best place’ to store wealth during Fed rate hike: Pantera CEO

The CEO and founder of leading blockchain venture fund Pantera Capital, Dan Morehead, stated that digital assets will be the “best place” to store capital following the potential fallout of interest rate hikes from the U.S. Federal Reserve. Investors across stock and crypto markets are currently fixated on the direction the Fed might take to combat rising inflation which topped 7.5% as of this month. Bitcoin and crypto markets have often moved in correlation to trends in the stock market, however, Morehead argued in his Feb. 16 newsletter that bonds, stocks, and real estate will cop the brunt of the Fed‘s “massive policy U-turn,” in relation to hiking interest rates. Despite the crypto market suffering a downturn since late 2021, the CEO suggested that digital assets will be the “best plac...