Inflation

Ethereum price ‘bullish triangle’ puts 4-year highs vs. Bitcoin within reach

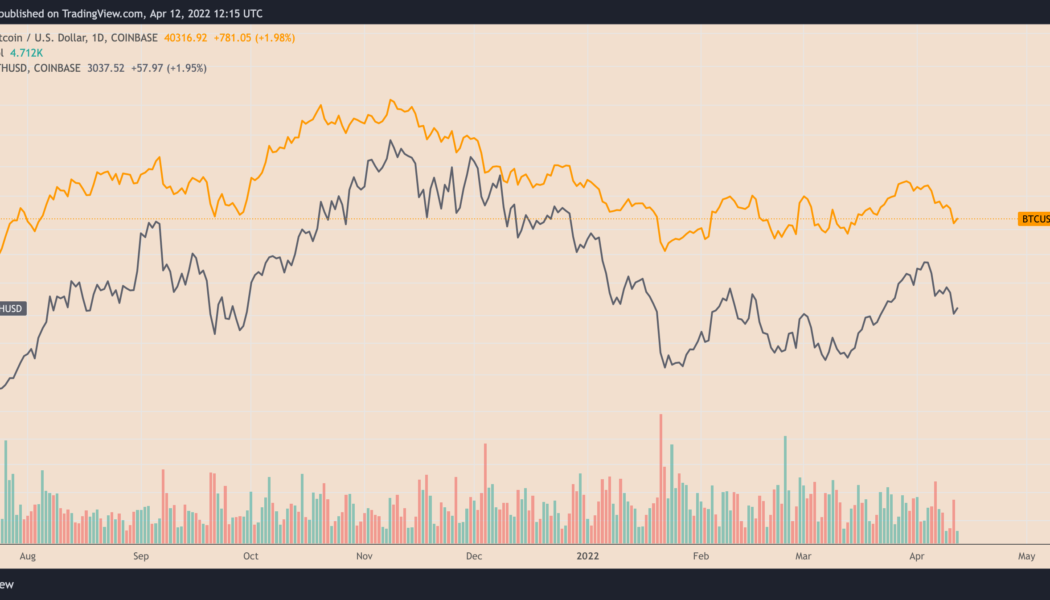

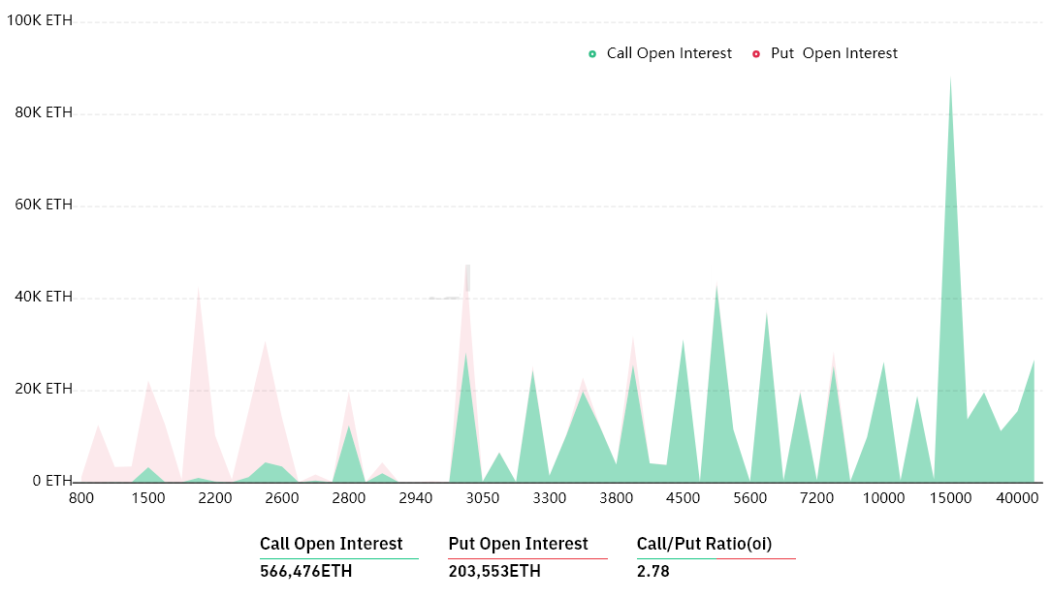

Ethereum’s native token Ether (ETH) has dropped about 17% against the U.S. dollar in the last two weeks. But its performance against Bitcoin (BTC) has been less painful with the ETH/BTC pair down 4.5% over the same period. The pair’s down-move appears as both ETH/USD and BTC/USD drop nearly in lockstep while reacting to the Federal Reserve’s potential to hike rates by 50 basis points and slash its balance sheet by $95 billion per month. The latest numbers released on April 12 show that consumer prices rose 8.5% in March, the most since 1981. BTC/USD vs. ETH/USD daily price chart. Source: TradingView ETH/BTC triangle breakout Several technicals remain bullish despite ETH/BTC dropping in the last two weeks. Based on a classic continuation pattern, the pair still l...

Bitcoin claws back $40K as 24-hour crypto liquidations near $500M

Bitcoin (BTC) attempted to reclaim $40,000 as support on April 12 after a troubling start to the week saw BTC/USD hit three-week lows. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “Extraordinarily elevated” CPI data due Data from Cointelegraph Markets Pro and TradingView showed the largest cryptocurrency bouncing to $40,200 on Bitstamp Tuesday after falling to just $39,300. Spurred on by a bleed-out in tech stocks in particular, Bitcoin looked decidedly unappetizing on short timeframes, and those previously betting on bullish continuation were left empty-handed. According to on-chain monitoring resource Coinglass, the past 24 hours cost crypto traders a total of $428 million in liquidated long positions — the most in a day since Jan. 22. Crypto liquidations ...

BTC starts 2022 all over again — 5 things to know in Bitcoin this week

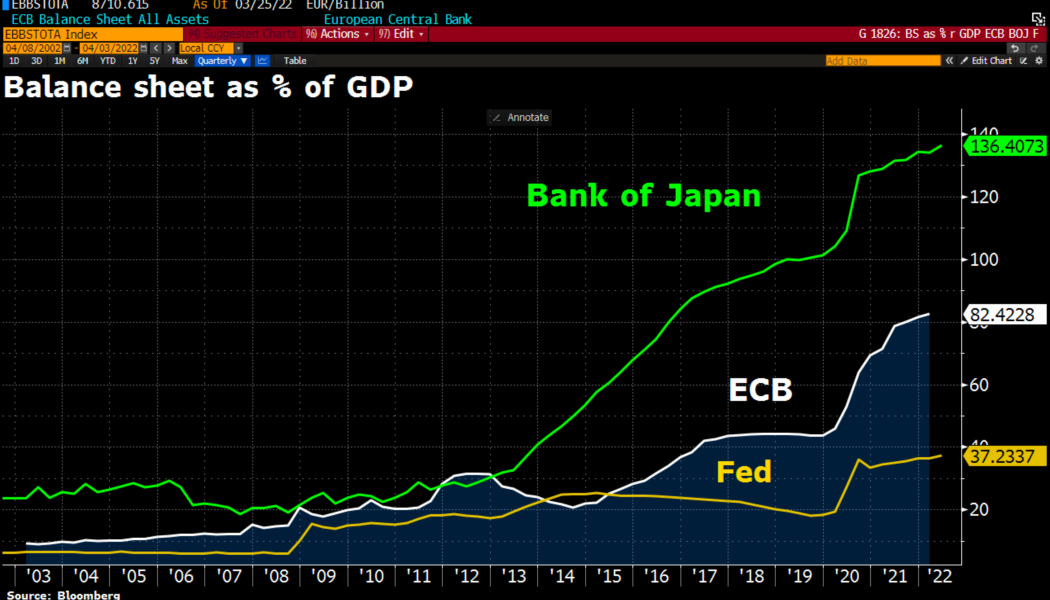

Bitcoin (BTC) starts a new week and a new quarter as if it were starting the new year — at just over $46,000. In what will seem like some serious deja-vu for hodlers, BTC/USD is at practically the same level it was on Jan. 1, 2022. Price action has been quiet — too quiet, perhaps — in recent days, but behind the declining volatility, there are signs that the market is busy deciding future direction. From macro to on-chain, there are in fact plenty of cues to keep an eye on in April, amid a backdrop of Bitcoin — at least so far — retaining its yearly open price as support. Cointelegraph takes a look at five of these factors as they pertain to BTC price performance over the coming week. Inflation meets fresh money printing There has been much talk of the end of the post-COVID “easy money” pe...

Is Bitcoin a hedge against inflation?

Putting money in store of value investments like gold, real estate, stocks and crypto helps curb inflation. As cash loses purchasing power over time, keeping cash leads to people losing their savings. This has prompted people to put their money in store of value investments such as gold, real estate, stocks and, now, crypto. Will Bitcoin protect against inflation has been a question in the town ever since. To be held as a store for value, an asset should be able to hold its purchasing power over time. In other words, it should increase in value or at least remain stable. Key properties associated with such assets are scarcity, accessibility and durability. Gold as a hedge against inflation During past inflationary periods, gold has had a mixed track record. In the 1980s, there were times w...

Bitcoin sentiment hits ‘greed’ in 2022 first amid calls for $45K BTC price pullback

Bitcoin (BTC) sentiment is seeing its first significant test of the rally to year-to-date highs as bullish gains dry up. The start of Wall Street trading on March 30 failed to induce a fresh advance on BTC/USD, which threatened to lose support at $47,000. From “extreme fear” to “greed” in one week After gaining nearly 30% since March 14, Bitcoin has managed to cling to its yearly opening price as support, this previously marking the resistance ceiling of its trading range for throughout 2022. Now, however, hopes of a retracement appear to be coming true, as momentum shows signs of — at least temporary — fatigue. Data from Cointelegraph Markets Pro and TradingView captured the turnaround overnight on March 30, with $48,000 currently the level proving stubborn fo...

Bitcoin beats owning COIN stock by 20% since Coinbase IPO

Buying a Coinbase stock (COIN) to gain indirect exposure in the Bitcoin (BTC) market has been a bad strategy so far compared to simply holding BTC. Notably, COIN is down by nearly 50% to almost $186, if measured from the opening rate on its IPO on April 14, 2021. In comparison, Bitcoin outperformed the Coinbase stock by logging fewer losses in the same period — a little over 30% as it dropped from nearly $65,000 to around $41,700 BTC/USD (orange) vs. COIN price (blue). Source: TradingView What’s bothering Coinbase? The correlation between Coinbase and Bitcoin has been largely positive to date, however, suggesting that many investors consider them as assets with similar value propositions. That is primarily due to the buzz around how COIN could become a simpler onboarding experi...

Crypto vs. physical: Musk-Saylor inflation debate boils down to scarcity

As rising inflation threatens to eat up further the purchasing power of the global fiat ecosystem, finding the perfect hedge against a falling economy has become the need of the hour — especially for the general public across the world. Joining this discussion online, Tesla CEO Elon Musk asked publicly about the probable inflation rate over the next few years to gauge the notion of global investors. Sharing his thoughts on the matter, American billionaire and MicroStrategy CEO Michael J. Saylor opined that with rising inflation, he expects the capital cash flow will move away from traditional fiat into scarce assets such as Bitcoin (BTC). USD consumer inflation will continue near all time highs, and asset inflation will run at double the rate of consumer inflation. Weaker currencies ...

Cryptocurrencies against the ‘silent thief.’ Can Bitcoin protect capital from inflation?

The world is becoming increasingly volatile and uncertain. The assertion that “inflation is the silent thief” is becoming less relevant. In 2021, inflation has turned into a rather loud and brazen robber. Now, inflation is at its highest in the last forty years, already exceeding 5% in Europe and reaching 7.5% in the United States. The conflict between Russia and Ukraine affects futures for gold, wheat, oil, palladium and other commodities. High inflation in the U.S. and Europe has already become a real threat to the capital of tens of thousands of private investors around the world. Last week at the Federal Open Market Committee (FOMC) meeting, Federal Reserve Chairman Jerome Powell said that he would recommend a cautious hike in interest rates. At the same time, Powell mentioned that he ...