Inflation

The total crypto market cap drops under $1.2T, but data show traders are less inclined to sell

An improving Tether discount in Asian markets and positive futures premiums for BTC and ETH suggest a slight recovery is in the making. The total crypto market capitalization has been trading in a descending channel for the past 29 days and currently displays support at the $1.17 trillion level. In the past 7 days, Bitcoin (BTC) presented a modest 2% drop and Ether (ETH) faced a 5% correction. Total crypto market cap, USD billion. Source: TradingView The June 10 consumer price index (CPI) report showed an 8.6% year-on-year increase and crypto and stock markets immediately felt the impact, but it’s not certain whether the figure will convince the U.S. Federal Reserve to hesitate in future interest rate hikes. Mid-cap altcoins dropped further, sentiment is still bearish The generalized beari...

BTC price snaps its longest losing streak in history — 5 things to know in Bitcoin this week

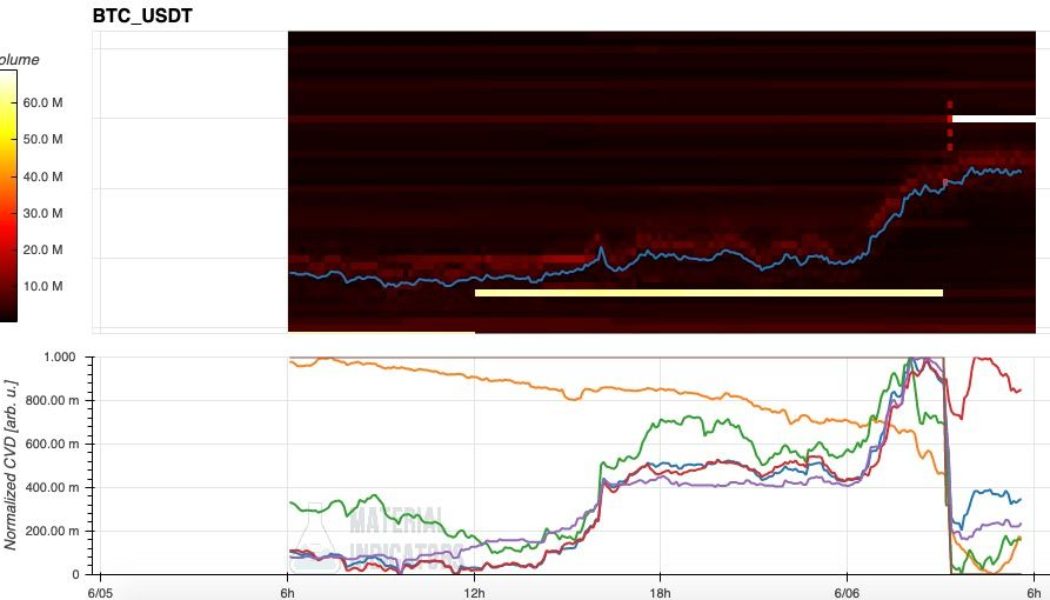

Bitcoin (BTC) starts a new week with some fresh hope for hodlers after halting what has been the longest weekly downtrend in its history. After battling for support throughout the weekend, BTC/USD ultimately found its footing to close out the week at $29,900 — $450 higher than last Sunday. The bullish momentum did not stop there, with the pair climbing through the night into June 6 to reach multi-day highs. The price action provides some long-awaited relief to bulls, but Bitcoin is far from out of the woods at the start of what promises to be an interesting trading week. The culmination will likely be United States inflation data, this itself a yardstick for the macroeconomic forces at world globally. As time goes on, the impact of anti-COVID policies, geopolitical tensions and supply shor...

5 reasons why Bitcoin could be a better long-term investment than gold

The emergence of forty-year high inflation readings and the increasingly dire-looking global economy has prompted many financial analysts to recommend investing in gold to protect against volatility and a possible decline in the value of the United States dollar. For years, crypto traders have referred to Bitcoin (BTC) as “digital gold,” but is it actually a better investment than gold? Let’s take a look at some of the conventional arguments investors cite when praising gold as an investment and why Bitcoin might be an even better long-term option. Value retention One of the most common reasons to buy both gold and Bitcoin is that they have a history of holding their value through times of economic uncertainty. This fact has been well documented, and there’s no denying that gold has ...

Billionaire Bill Miller calls Bitcoin ‘insurance’ against financial catastrophe

Bill Miller the billionaire founder and Chief Investment Officer of investment firm Miller Value Partners, has said he considers Bitcoin (BTC) an “insurance policy against financial catastrophe.” Appearing on an episode of the “Richer, Wiser, Happier” podcast on May 24 Miller backed the cryptocurrency as a means for those caught in conflict to still access financial products. He used the collapse of financial infrastructure in Afghanistan after the US withdrawal in August 2021 as an example. “When the US pulled out of Afghanistan, Western Union stopped sending remittances there or taking them from Afghanistan, but if you had Bitcoin, you were fine. Your Bitcoin is there. You can send it to anybody in the world if you have a phone.” Miller said examples of how the crypto can function as ins...

Low inflation or bust: Analysts say the Fed has no choice but to continue raising rates

As economic conditions continue to worsen, financial experts worldwide are increasingly placing the blame at the feet of the United States Federal Reserve after the central bank was slow to respond to rising inflation early on. Financial markets are currently experiencing their worst stretch of losses in recent history, and it doesn’t appear that there is any relief in sight. May 24 saw the tech-heavy Nasdaq fall another 2%, while Snap, a popular social media company, shed 43.1% of its market cap in trading on May 23. This past couple of months have been absolutely brutal for the markets… 8 consecutive weeks of red candles in the #SPX, #NASDAQ and #BTC… no significant bounces pic.twitter.com/hgU2VwIoxh — Crypto Phoenix (@CryptoPheonix1) May 24, 2022 Much of the recent turmoil again c...

ApeCoin rebounds after APE price crashes 80% in two weeks: Dead cat bounce or bottom?

ApeCoin (APE) has undergone a sharp recovery after falling to its lowest level in two months. But its strong correlation with Bitcoin (BTC) and U.S. equities amid macro risks suggests more losses could be in store. APE rebounds after 80% losses in two weeks APE rebounded by nearly 45% to $7.30 on May 12. The upside retracement move came after APE dropped circa 81% to $5 on May 11, from its record high near $27.50, established on April 28. The seesaw price action mirrored similar volatile moves elsewhere in the crypto market, led by the chaos around TerraUSD (UST) — an “algorithmic stablecoin” whose value plunged to $0.23 earlier this week, and the Federal Reserve’s hawkish response to rising inflation. APE/USD versus USTUSD. Source: TradingView Meanwhile, the correla...

21Shares launches hybrid Bitcoin and gold ETP to enable inflation hedge

21Shares, a major issuer of cryptocurrency exchange-traded products (ETP), is launching a new ETP tracking a mix of Bitcoin (BTC) and gold. The Switzerland-based firm on Wednesday announced the launch of the 21Shares ByteTree BOLD ETP (BOLD), a new product aiming to provide inflation protection by tracking an index providing risk-adjusted exposure to both BTC and gold. Listed on the SIX Swiss Exchange, the new hybrid ETP is subject to monthly rebalances according to the inverse historic volatility of each asset. At launch, BOLD comprises 18.5% of BTC and 81.5% of gold. The new ETP was developed in collaboration with the United Kingdom-based alternative investment provider, ByteTree Asset Management. The product is positioned as the world’s first combined BTC and gold ETP. “Gold has hi...

CityCoins expanding services via 11 new incubated projects

The Stacks Ventures project incubator has accepted 11 projects to help make CityCoins more appealing to global mayors who want to utilize a digital asset to receive rewards and bolster their economies. Stacks Ventures is a $4 million incubator for projects on the Stacks (STX) Bitcoin layer-2 smart contract solution. CityCoins is a project that enables partnered city governments to launch their own token on Stacks, with Miami City And New York City being the first two to sign on with MiamiCoin and NYCCoin. As part of the partnerships, the local governments earn CityCoin rewards and stake the asset to receive additional rewards in Bitcoin (BTC). In its second cohort of 24 projects to be incubated, Stacks Ventures will incubate 11 that add wireless networking, Web3, gaming, nonfungible token ...

Bitcoin price slides below $40K following a ‘lackluster’ breakout

Extreme fear is once again the dominating sentiment across the cryptocurrency community after Bitcoin (BTC) faced another day of trading below the $40,000 level and the United States grapples with the highest Consumer Price Index (CPI) print since 1981. Crypto Fear & Greed Index. Source: Alternative.me Data from Cointelegraph Markets Pro and TradingView shows that an early morning attempt to rally above $40,000 ran into a wall of resistance at $40,650 and BTC price eventually tumbled back below $39,600. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts are saying about the current state of Bitcoin and what could potentially come next as financial markets grapple with an increasing amount of uncertainty. Bitcoin is simply re-testing a major S/R zone ...