Inflation

Bitcoin is now in its longest-ever ‘extreme fear’ period

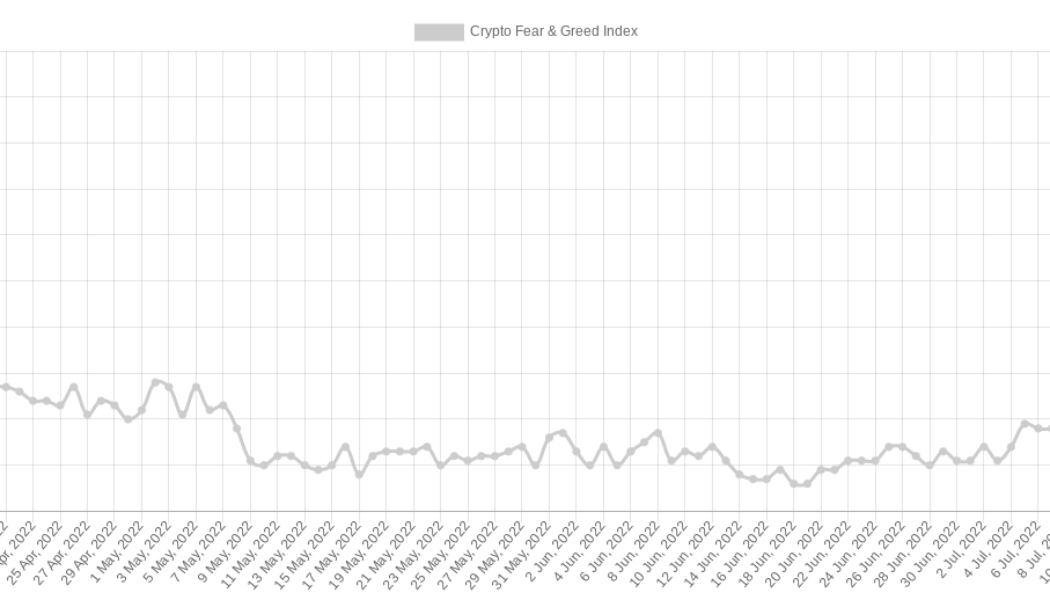

Bitcoin (BTC) may have avoided fresh losses since falling to $17,600 last month, but the sentiment is on the floor. Now, one classic crypto market mood gauge is showing just how long and hard the average investor has suffered. 70 days of “extreme fear” While crypto market sentiment was already “comparable to funeral” before the start of 2022, the subsequent price drawdown in Bitcoin and altcoins produced cold feet like never before. This has now been quantified by the Crypto Fear & Greed Index, a tool that takes multiple sources into account to create an overall score of how the markets are feeling. As of July 15, Fear & Greed has spent 70 days in its lowest bracket — “extreme fear” — marking of a new bearish record. The Index consists of f...

Bitcoin fights key trendline near $20K as US dollar index hits new 20-year high

Bitcoin (BTC) found a new focus just under $20,000 on July 14 as U.S. dollar strength hammered out yet another two-decade high. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView DXY moves bring yen, euro into focus Data from Cointelegraph Markets Pro and TradingView showed BTC/USD rebounding from lows sparked by a fresh 40-year high for U.S. inflation as per the Consumer Price Index (CPI). After briefly dipping under $19,000, the pair took a flight above $20,000 before consolidating immediately below that psychologically significant level. For on-chain analytics resource Material Indicators, it was now “do or die” for BTC price action when it came to a key rising trendline in place since mid-June. On the day, that trendline stood at around $19,600, with BTC/USD n...

USD stablecoin premiums surge in Argentina following economy minister’s resignation

Argentina, a country with one of the highest crypto adoption rates in the world, saw the price of dollar-pegged stablecoins surge across exchanges on Saturday after the abrupt resignation of its Economy Minister, Martin Guzman. The minister’s shock exit, confirmed on his Twitter account on July 3 via a seven-page letter, threatens to further destabilize a struggling economy battling high inflation and a depreciating national currency. According to data from Criptoya, the cost of buying Tether (USDT) using Argentinian pesos (ARS) is currently 271.4 ARS through the Binance exchange, which is around a 12% premium from before the resignation announcement, and a 116.25% premium compared to the current fiat exchange rate of USD/ARS. The local crypto price tracking website has also revealed...

Bitcoin’s inverse correlation with US dollar hits 17-month highs — what’s next for BTC?

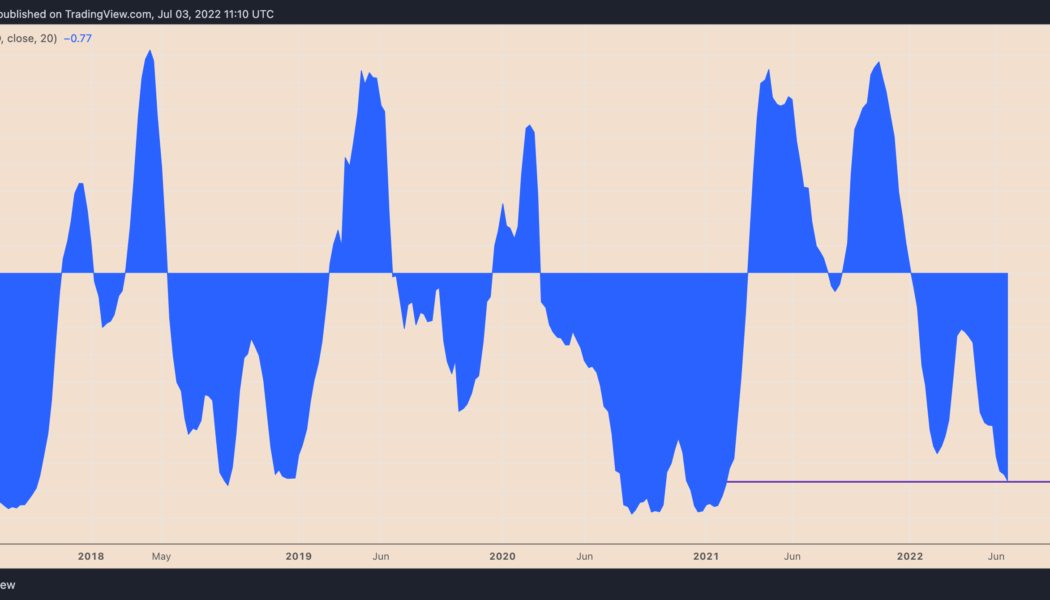

Bitcoin (BTC) has been moving in the opposite direction of the U.S. dollar since the beginning of 2022 — and now that inverse relationship is more extreme than ever. Bitcoin and the dollar go in opposite ways Notably, the weekly correlation coefficient between BTC and the dollar dropped to 0.77 below zero in the week ending July 3, its lowest in seventeen months. Meanwhile, Bitcoin’s correlation with the tech-heavy Nasdaq Composite reached 0.78 above zero in the same weekly session, data from TradingView shows. BTC/USD and U.S. dollar correlation coefficient. Source: TradingView That is primarily because of these markets’ year-to-date performances amid the fears of recession, led by the Federal Reserve’s benchmark rate hikes to curb rising inflation. Bitcoin, for example,...

Ethereum price breaks out as ‘bad news is good news’ for stocks

Ethereum’s native token, Ether (ETH), gained alongside riskier assets as investors assessed weak U.S. economic data and its potential to cool down rate hike fears. Ether mirrors risk-on recovery ETH’s price climbed up to 8.31% on June 24 to $1,225, six days after falling below $880, its lowest level since January 2021. Overall, the upside retracement brought bulls 40% in gains, raising anticipation about an extended recovery in the future while alleviating fears of a “clean fakeout.” For instance, independent market analyst “PostyXBT” projected ETH’s price to close above $1,300 by the end of June. In contrast, analyst “Wolf” feared that bears would attempt to “push price back to $1,047,” albeit anticipating a run-up to...

Polygon price jumps 60% in four days amid ‘pretty big’ MATIC accumulation

Polygon (MATIC) took a break from its prevailing bearish course, posting one of sharpest rebound in the crypto market this week. Notably, MATIC’s price has risen to $0.50 this June 23, four days after hitting $0.317, its lowest level since April 2021. This amounts to roughly a 60% gain, surpassing the performances of even Bitcoin (BTC) and Ether (ETH) in the same timeframe. MATIC/USD daily price chart. Source: TradingView Nevertheless, MATIC is still down significantly from its December 2021 high of $2.92, coinciding with the overall crypto bear market and a hawkish Fed putting pressure on risk-on assets. MATIC “in a pretty big accumulation” Meanwhile, some of its richest investors have been accumulating MATIC tokens despite the general downtrend, on-chain dat...

Bitcoin price falls below $20K for first time since 2020, Ethereum dips under $1K

Bitcoin (BTC) achieved a bear market first on June 18 as BTC price action gave up $20,000 support. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC price crosses under 2017 all-time high Data from Cointelegraph Markets Pro and TradingView confirmed BTC/USD sliding under $20,000 for the first time since December 2020, reaching press-time lows of $19,066. As nerves heightened after the United States Federal Reserve’s comments on the inflation outlook, crypto markets bore the brunt of a sell-off, which began after shock Consumer Price Index (CPI) figures last week. Losing the psychologically significant $20,000 mark, Bitcoin also achieved a lifetime first — dropping below its previous halving cycle’s high for the first time in its history. There’s a first...

Bitcoin bounces 8% from lows amid warning BTC price bottom ‘shouldn’t be like that’

Bitcoin (BTC) spared hodlers the pain of losing $20,000 on June 15 after BTC/USD came dangerously close to last cycle’s high. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin “bottom” fools nobody Data from Cointelegraph Markets Pro and TradingView showed BTC/USD surging higher after reaching $20,079 on Bitstamp. In a pause from its sell-off, the pair followed United States equities higher on the Wall Street open, hitting $21,700. The S&P 500 gained 1.4% after the opening bell, while the Nasdaq Composite Index managed 1.6%. The renewed market strength, commentators said, was thanks to the majority already pricing in outsized key rate hikes by the Federal Reserve, due to be confirmed on the day. Nonetheless, it was crypto taking the worst hit in...

BTC price crashes to $20.8K as ‘deadly’ candles liquidate $1.2 billion

Bitcoin (BTC) came within $1,000 of its previous cycle all-time highs on June 14 as liquidations mounted across crypto markets. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin price hits 18-month lows Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting $20,816, on Bitstamp, its lowest since the week of December 14, 2020. A sell-off that began before the weekend intensified after the June 13 Wall Street opening bell, with Bitcoin and altcoins falling in step with United States equities. The S&P 500 finished the day down 3.9%, while the Nasdaq Composite Index shed 4.7% ahead of key comments from the U.S. Federal Reserve on its anti-inflation policy. The worst of the rout was reserved for crypto, however, and with that, BTC/USD lost 22...

BTC price crashes to $20.8K as ‘deadly’ candles liquidate $1.2 billion

Bitcoin (BTC) came within $1,000 of its previous cycle all-time highs on June 14 as liquidations mounted across crypto markets. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin price hits 18-month lows Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting $20,816, on Bitstamp, its lowest since the week of December 14, 2020. A sell-off that began before the weekend intensified after the June 13 Wall Street opening bell, with Bitcoin and altcoins falling in step with United States equities. The S&P 500 finished the day down 3.9%, while the Nasdaq Composite Index shed 4.7% ahead of key comments from the U.S. Federal Reserve on its anti-inflation policy. The worst of the rout was reserved for crypto, however, and with that, BTC/USD lost 22...

Ethereum price enters ‘oversold’ zone for the first time since November 2018

Ethereum’s native token Ether (ETH) entered its “oversold” territory this June 12, for the first time since November 2018, according to its weekly relative strength index (RSI). This is the last time $ETH went oversold on the weekly (hasn’t confirmed here yet). I had no followers, but macro bottom ticked it. Note, you can push way lower on weekly rsi, not trying to catch a bottom. https://t.co/kLCynTKTcS — The Wolf Of All Streets (@scottmelker) June 12, 2022 ETH eyes oversold bounce Traditional analysts consider an asset to be excessively sold after its RSI reading fall below 30. Furthermore, they also see the drop as an opportunity to “buy the dip,” believing an oversold signal would lead to a trend reversal. Ether’s previous oversold reading appeared i...

Bitcoin price threatens lowest weekly close since 2020 as inflation spooks markets

Bitcoin (BTC) dropped to two-week lows on June 11 as the week’s Wall Street trading ended with bears in control. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView U.S. inflation print proves setback Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it reached $28,528 on Bitstamp, its lowest since May 28. The pair had fallen in step with stock markets on June 10, these finishing the week noticeably down — the S&P 500 and Nasdaq Composite lost 2.9% and 3.5% respectively. This was on the back of surprisingly high inflation data from the United States, which took a turn for the worst in stark contrast to expectations. As Cointelegraph reported, at 8.6%, annual inflation came in at the highest since December 1981. Reacting, market commentators were thus firml...