Inflation

Bitcoin price sees $24K, Ethereum hits 2-month high as US inflation shrinks

Bitcoin (BTC) regained $24,000 but failed to hit new multi-month highs on Aug. 10 as United States inflation appeared to be slowing. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView CPI cuts risk assets much-needed slack Data from Cointelegraph Markets Pro and TradingView confirmed hourly gains of around $1,000 after U.S. Consumer Price Index (CPI) data for July showed a slowdown versus the previous month. While managing $24,179 on Bitstamp, BTC/USD nonetheless did not attract enough momentum to challenge levels from the day prior. Nonetheless, relief among traders was palpable, as declining inflation should signal to the Federal Reserve that less aggressive interest rate hikes are necessary going forward. This, in turn, should reduce pressure on risk assets, includin...

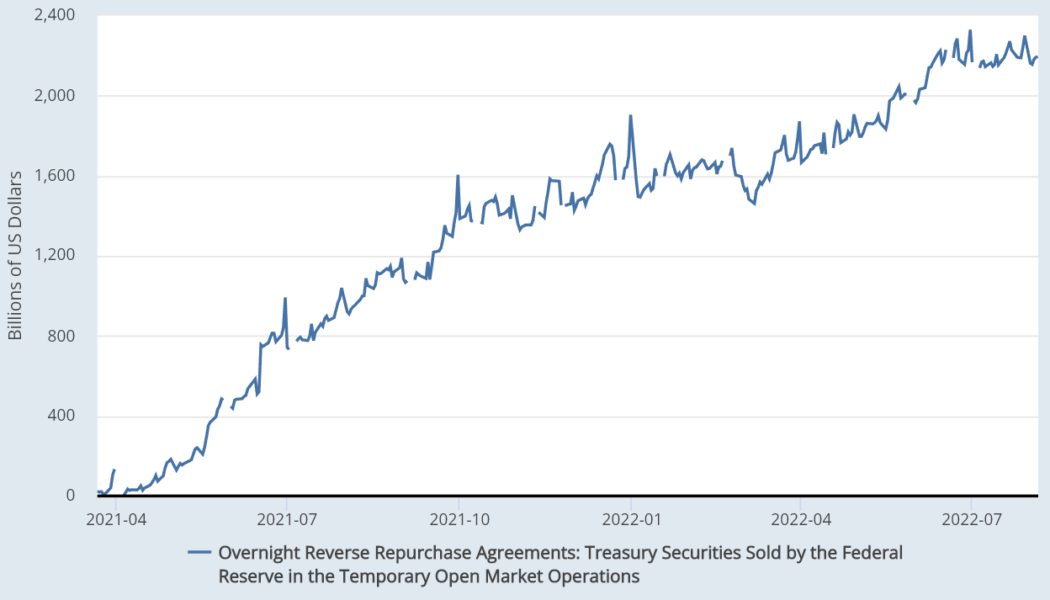

Fed reverse repo reaches $2.3T, but what does it mean for crypto investors?

The U.S. Federal Reserve (FED) recently initiated an attempt to reduce its $8.9 trillion balance sheet by halting billions of dollars worth of treasuries and bond purchases. The measures were implemented in June 2022 and coincided with the total crypto market capitalization falling below $1.2 trillion, the lowest level seen since January 2021. A similar movement happened to the Russell 2000, which reached 1,650 points on June 16, levels unseen since November 2020. Since this drop, the index has gained 16.5%, while the total crypto market capitalization has not been able to reclaim the $1.2 trillion level. This apparent disconnection between crypto and stock markets has caused investors to question whether the Federal Reserve’s growing balance sheet could lead to a longer than expecte...

Elon Musk: US ‘past peak inflation’ after Tesla sells 90% of Bitcoin

Bitcoin (BTC) is in short supply at Tesla, even as its CEO predicts that United States inflation has already peaked. Speaking at Tesla’s 2022 Annual Meeting of Stockholders on Aug. 5, Elon Musk predicted that an upcoming United States recession would only be “mild to moderate.” Musk on costs: “The trend is down” After recently selling almost all of its $1.5 billion BTC holdings, Tesla is seeing the emergence of exactly the kind of economic landscape in which risk assets thrive. During a Q&A session at the Annual Meeting, Musk revealed that six-month commodities pricing for Tesla parts is already getting cheaper, not more expensive. Commodities, he said, are trending down, providing a hint that inflation has already hit its highest levels. “We sort of have some insight ...

Bitcoin fails to beat $23.4K sellers as US payrolls upend inflation debate

Bitcoin (BTC) saw fresh rejection at $23,500 resistance on Aug. 5 as United States equities failed to embrace surprisingly strong payroll data. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “Collapsing real wages” poke fun at payroll print Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as bears kept the market in its intraday trading range. Wall Street opened with a whimper despite U.S. payrolls for July coming in at twice estimated levels. The curious reaction had some analysts arguing that the numbers did not in fact show economic strength, but rather existing workers taking on second jobs due to inflation. “The gain of 528K jobs in July as the labor force participation rate fell to 62.1, means that most of the new jobs went to people who a...

Best monthly gains since October 2021 — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week and a new month on a cautiously positive footing after protecting crucial levels. After an intense July in which macro factors provided significant volatility, BTC price action managed to provide both a weekly and monthly candle favoring the bulls. The road to some form of recovery continues, and at some points in recent weeks, it seemed like Bitcoin would suffer even harder on the back of June’s 40% losses. Now, however, there is already a sense of optimism among analysts, but one thing remains clear — this “bear market rally” does not mean the end of the tunnel yet. As Summer 2022 enters its final month, Cointelegraph takes a look at the potential market triggers at play for Bitcoin as it lingers near its highest levels since mid-June. Spot price snatches ...

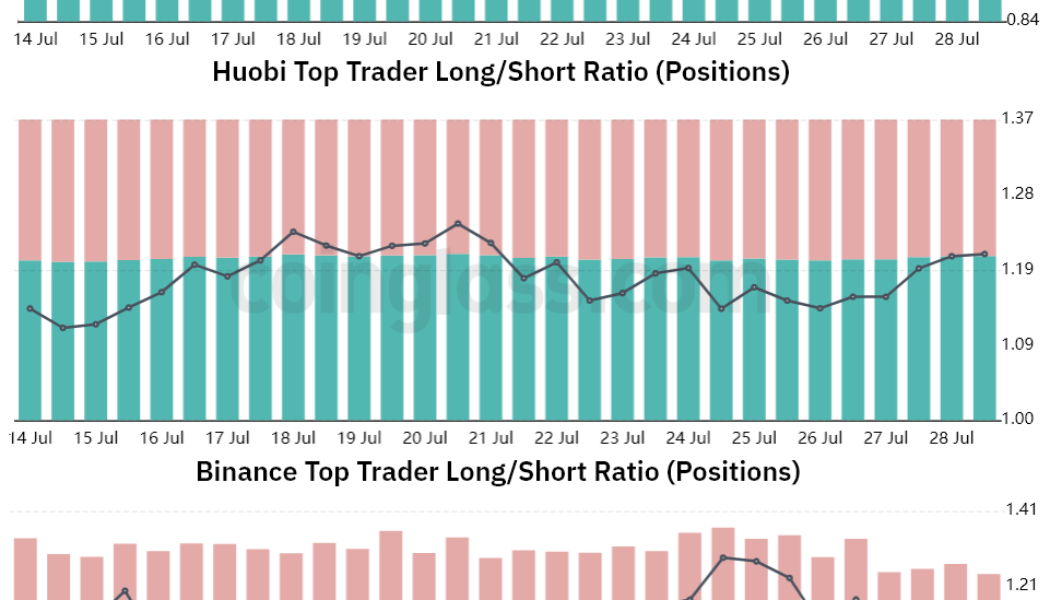

Bitcoin struggles to flip $24K to support, but data shows pro traders stacking sats

Bitcoin (BTC) rallied on the back of the United States Federal Reserve’s decision to hike interest rates on July 27. Investors interpreted Federal Reserve chairman Jeremy Powell’s statement as more dovish than the previous FOMC committee meeting, suggesting that the worst moment of tight economic policies is behind us. Another positive news for risk assets came from the U.S. personal consumption expenditures price (PCE) index, which rose 6.8% in June. The move was the biggest since January 1982, reducing incentives for fixed income investments. The Federal Reserve focuses on the PCE due to its broader measure of inflation pressures, measuring the price changes of goods and services consumed by the general public. Additional positive news came from Amazon after the e-commerce giant re...

Will the Fed prevent BTC price from reaching $28K? — 5 things to know in Bitcoin this week

Bitcoin (BTC) enters a new week with a question mark over the fate of the market ahead of another key United States monetary policy decision. After sealing a successful weekly close — its highest since mid-June — BTC/USD is much more cautious as the Federal Reserve prepares to hike benchmark interest rates to fight inflation. While many hoped that the pair could exit its recent trading range and continue higher, the weight of the Fed is clearly visible as the week gets underway, adding pressure to an already fragile risk asset scene. That fragility is also showing in Bitcoin’s network fundamentals as miner strain becomes real and the true cost of mining through the bear market shows. At the same time, there are encouraging signs from some on-chain metrics, with long-term investors still re...

Bitcoin heads into FOMC day on 24-hour highs amid concern over $24.3K top

Bitcoin (BTC) attempted to claw back losses on July 27 as a macro day of reckoning arrived for risk assets. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Analysis: $24,300 resistance “not a good sign” Data from Cointelegraph Markets Pro and TradingView confirmed a 24-hour high for BTC/USD prior to the Wall Street open on July 27. The pair had sunk below $21,000 in the first portion of the week, heightening nervousness among traders already wary of potential headwinds from the United States Federal Reserve. Likely chop for equities going into FOMC which expected $BTC and crypto chop around also today pic.twitter.com/GDj0GwlDXy — Rager (@Rager) July 26, 2022 July 27 is set to reveal the Federal Open Markets Committee‘s (FOMC) next base rate hike, expectations flitting between 7...