Inflation

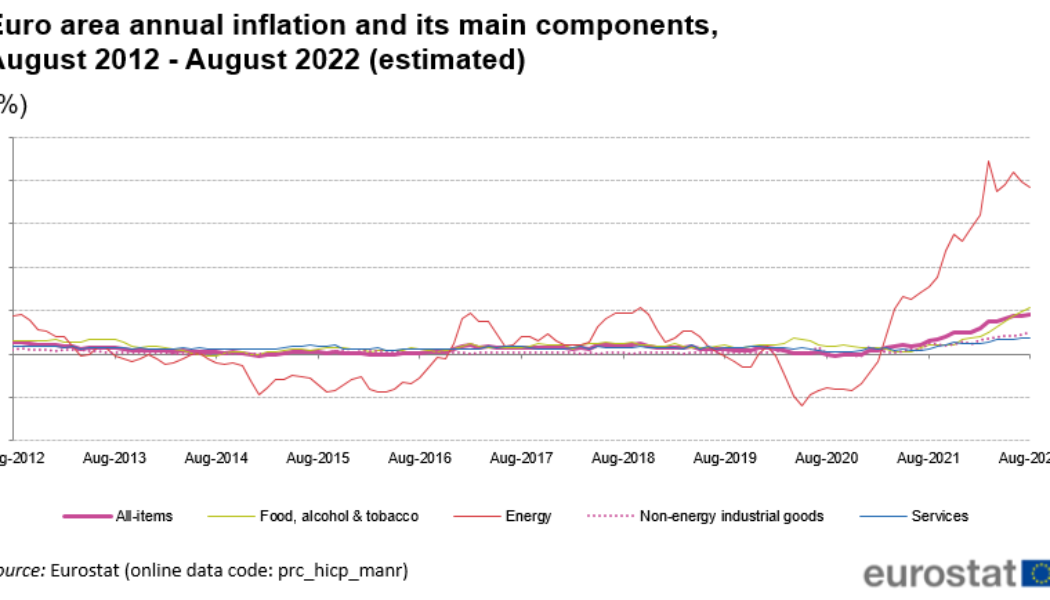

Eurozone hits record inflation of 9.1% amid gas and energy crisis

August marks the ninth consecutive month of rising inflation for the Eurozone at 9.1%. In July, the official inflation numbers landed at 8.9%. The Eurozone consists of 19 countries, including Germany, France and Belgium. This comes as the European Union (EU) faces a massive energy and gas crisis, largely as a result of the ongoing conflict in Ukraine. Current prices for daily necessities such as food, gas and electricity have soared across the continent. Over the last month, energy prices made up the largest price push, up by an annual rate of 38.3%, While food, alcohol and tobacco all rose by an annual rate of over 10%. Former EU member the United Kingdom also hit a 40-year-high inflation rate of 10.1% in July, as reported by the Organization of National Statistics (ONS). Eurozone countri...

UBS raises US recession odds to 60%, but what does this mean for crypto prices?

On Aug. 30, global investment bank UBS increased its view on the risk of the United States entering a recession within one year to 60%, up from 40% in June. According to economist Pierre Lafourcade, the latest data showed a 94% chance of the economy contracting, but added that it “does not morph into a full-blown recession.” Partially explaining the difference is the “extremely low levels” of non-performing loans, or defaults exceeding 90 days from credit borrowers. According to Citigroup Chief Executive Jane Fraser, the institution “feels very good about” liquidity and credit quality. Furthermore, Reuters states that the financial industry wrote off merely 0.1% of its loans in the 2Q. The problem is that even in the now-improbable scenario of avoiding a...

Crypto will become an inflation hedge — just not yet

In theory, Bitcoin (BTC) should serve as a hedge against inflation. It’s easy to access, its supply is predictable, and central banks cannot arbitrarily manipulate it. However, investors aren’t treating it that way. Instead, the cryptocurrency market is mirroring the stock market. Why is that? Let’s dive into what prevents cryptocurrencies from acting as a hedge against inflation, and what needs to happen to make them a hedge in the future. Crypto could be a hedge, but it comes with inconveniences Cryptocurrencies present a unique solution, given their lack of a central governing bank. You can’t lose trust in something that doesn’t exist. Its supply is finite, so it naturally appreciates in value. People using a blockchain with proof-of-stake protocols can access their funds at any time, w...

US stocks lose $1.25T in a day — more than entire crypto market cap

Bitcoin (BTC) and altcoins lost big on Aug. 26 after the United States Federal Reserve delivered hawkish remarks on economic policy. Across the board, risk assets took a major hit — U.S. equities shed around $1.25 trillion in a single session. Analyst: Powell retiring “soft landing” rhetoric As comments by Fed Chair, Jerome Powell, suggested that larger rate hikes were still firmly on the table despite recent data hinting that inflation was already slowing, investors rushed to cut risk. “Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy,” Powell said at the annual Jackson Hole economic symposium. The S&P 500 closed down 3.4% on the...

Bitcoin price briefly loses $20K on ‘bunch of nothing’ Powell speech

Bitcoin (BTC) analysts were keen to draw fresh price targets on Aug. 27 after the largest cryptocurrency briefly fell below $20,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Sub-$20,000 BTC price targets stay in place Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting $19,945 on Bitstamp the night after hawkish comments from the United States Federal Reserve. Intraday losses for the pair neared 9% and United States equities cratered over the outlook for inflation policy, which looks to increasingly abandon the “soft landing” narrative. “Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained...

Bitcoin price gains 3.5% as US PCE data supports shrinking inflation

Bitcoin (BTC) rose rapidly later on Aug. 26 as fresh economic data from the United States furthered hopes of a pivot from the Federal Reserve. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin bounces but preserves intraday trend Data from Cointelegraph Markets Pro and TradingView tracked a 3.55% rise for BTC/USD on the day, allowing the pair to match highs from earlier in the week. The move marked a surprise about-turn for Bitcoin, which hours before had seen selling pressure as markets awaited cues from Fed Chair Jerome Powell’s Jackson Hole symposium speech. With that speech still to come at the time of writing, abullish catalyst came in the form of the latest Personal Consumption Expenditures Price Index (PCE) readout, which was lower than expected. Analyst...

Bitcoin price taps $21.3K ahead of Fed Chair Powell Jackson Hole speech

Bitcoin (BTC) fell to daily lows on Aug. 26 as market nerves heightened into new macro triggers. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Pre-Fed blues hit BTC markets Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping to $21,332 on Bitstamp ahead of fresh commentary from Jerome Powell, Chair of the United States Federal Reserve. Part of the Fed’s Jackson Hole annual symposium, Powell was set to deliver a speech on the day that spectators hoped would provide new cues on economic policy going forward. With U.S. Consumer Price Index (CPI) inflation slowing since June, interest remained high over the extent of key interest rate hikes in September. Summarizing the current economic situation in the U.S., macro analyst David Hunter argued that the Fed w...

Is Bitcoin really a hedge against inflation?

While Bitcoin (BTC) has failed in countering this year’s rampant global inflation, it should still be considered as an inflation hedge, says Steven Lubka, the managing director of private consumers at Swan Bitcoin. According to Lubka, Bitcoin works well as a hedge against rising prices when inflation is caused by monetary expansion. It is less effective when inflation is caused by the disruption of the food supply and energy, which he sees as the leading cause of this year’s rampant inflation. [embedded content] “In a world where the price of goods is going up because there’s been a radical loss of abundance, Bitcoin isn’t going to protect investors from that,” Lubka said. He also points out that Bitcoin is a better hedge against inflat...

Is Bitcoin really a hedge against inflation?

While Bitcoin (BTC) has failed in countering this year’s rampant global inflation, it should still be considered as an inflation hedge, says Steven Lubka, the managing director of private consumers at Swan Bitcoin. According to Lubka, Bitcoin works well as a hedge against rising prices when inflation is caused by monetary expansion. It is less effective when inflation is caused by the disruption of the food supply and energy, which he sees as the leading cause of this year’s rampant inflation. [embedded content] “In a world where the price of goods is going up because there’s been a radical loss of abundance, Bitcoin isn’t going to protect investors from that,” Lubka said. He also points out that Bitcoin is a better hedge against inflat...

Solana (SOL) price is poised for a potential 95% crash — Here’s why

Solana (SOL) price rallied by approximately 75% two months after bottoming out locally near $25.75, but the token’s splendid upside move is at risk of a complete wipeout due to an ominous bearish technical indicator. A major SOL crash setup surfaces Dubbed a “head-and-shoulders (H&S),” the pattern appears when the price forms three consecutive peaks atop a common resistance level (called the neckline). Notably, the middle peak (head) comes to be higher than the other two shoulders, which are of almost equal height. Head and shoulders patterns resolve after the price breaks below their neckline. In doing so, the price falls by as much as the distance between the head’s peak and the neckline when measured from the breakdown point, per a rule of technical analysis....

Solana (SOL) price is poised for a potential 95% crash — Here’s why

Solana (SOL) price rallied by approximately 75% two months after bottoming out locally near $25.75, but the token’s splendid upside move is at risk of a complete wipeout due to an ominous bearish technical indicator. A major SOL crash setup surfaces Dubbed a “head-and-shoulders (H&S),” the pattern appears when the price forms three consecutive peaks atop a common resistance level (called the neckline). Notably, the middle peak (head) comes to be higher than the other two shoulders, which are of almost equal height. Head and shoulders patterns resolve after the price breaks below their neckline. In doing so, the price falls by as much as the distance between the head’s peak and the neckline when measured from the breakdown point, per a rule of technical analysis....

Crypto markets bounced and sentiment improved, but retail has yet to FOMO

An ascending triangle formation has driven the total crypto market capitalization toward the $1.2 trillion level. The issue with this seven-week-long setup is the diminishing volatility, which could last until late August. From there, the pattern can break either way, but Tether and futures markets data show bulls lacking enough conviction to catalyze an upside break. Total crypto market cap, USD billion. Source: TradingView Investors cautiously await further macroeconomic data on the state of the economy as the United States Federal Reserve (FED) raises interest rates and places its asset purchase program on hold. On Aug. 12, the United Kingdom posted a gross domestic product (GDP) contraction of 0.1% year-over-year. Meanwhile, inflation in the U.K. reached 9.4% in July, the highest figur...