Indian Government

Web3 to inject $1.1T in India’s GDP by 2032, following 37x growth since 2020

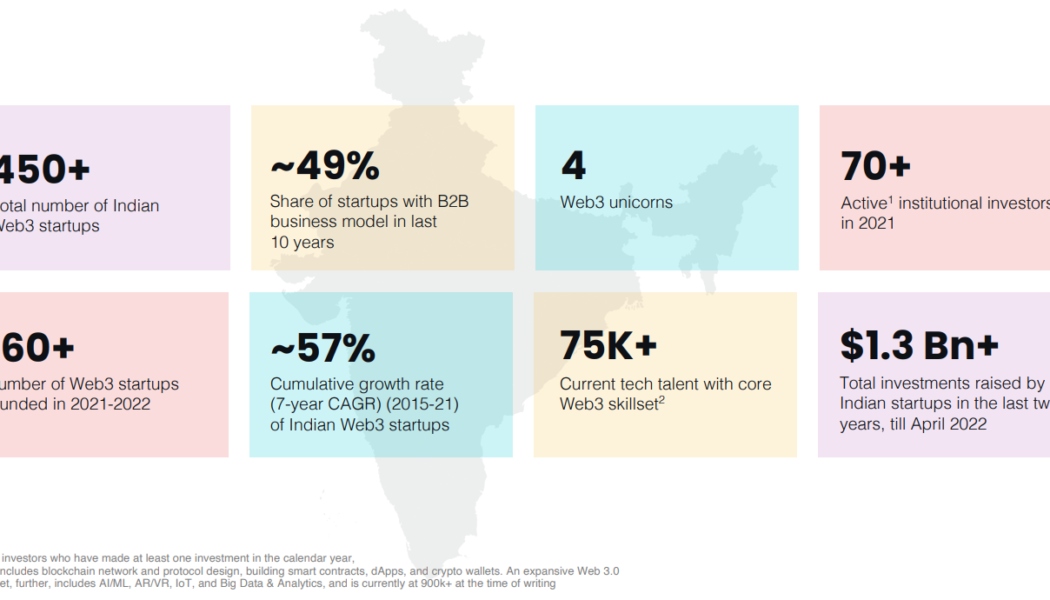

The global Web3 boom is expected to add $1.1 trillion to the Indian economy over the next decade, supporting the investment-based momentum driven by over 450 in-house startups, including CoinDCX, Polygon and CoinSwitch. A recent study from the National Association of Software and Service Companies (NASSCOM), an Indian non-governmental trade association and advocacy group, highlighted India’s position as a leading global player in the Web3 market owing to several factors spanning a large talent pool, high adoption rate and product development for international markets. Snapshot of India’s Web3 startup ecosystem in 2022. Source: NASSCOM The US-India Strategic Partnership Forum (USISPF) estimated that “Web3 can add $1.1 trillion of new economic value to the Indian GDP in the next 10 yea...

Indian authorities freeze $8.1M in WazirX funds as part of AML investigation

India’s Directorate of Enforcement, or ED, has announced it froze roughly $8.1 million in funds and conducted a search connected to cryptocurrency exchange WazirX as part of an investigation into instant personal loan fraud. In a Friday announcement, the Directorate of Enforcement alleged WazirX facilitated transactions by unnamed fintech firms “to purchase crypto assets and then launder them abroad” as part of a scheme involving Chinese-backed companies circumventing India’s licensing regulations. In its investigation, the ED said it ordered WazirX bank accounts containing 646.7 million Indian rupees — roughly $8.1 million at the time of publication — frozen and conducted a search connected to co-founder Sameer Mhatre. According to the regulator, the investigation was still ongoing. Howev...

India needs global collaboration to decide on crypto’s future, says finance minister

Indian finance minister Nirmala Sitharaman has called for global collaboration on cryptocurrencies, assessing their pros and cons to form a common standard and taxonomy. Addressing a question on cryptocurrency in the Lok Sabha, the lower house of the Indian parliament, Sitharaman said that the Indian central bank had advised the government to prohibit the use of cryptocurrencies as it poses a risk to financial stability. However, the government is looking for a global approach. She said: “Any legislation for regulation or banning can be effective only after significant international collaboration on evaluation of the risks and benefits and evolution of common taxonomy and standards.” She also reiterated the Indian central bank’s stance on crypto’s value is based on speculation....

The regulatory implications of India’s crypto transactions tax

The Indian crypto landscape lost some momentum this year as the government introduced two laws demanding crippling taxes on crypto-related unrealized gains and transactions. India’s first crypto law, which requires its citizens to pay a 30% tax on unrealized crypto gains, came into effect on April 1. A commotion among the Indian crypto community followed as investors and entrepreneurs tried to decipher the impact of the vague announcement with little or no success. Knowing that India’s second crypto law — a 1% tax deduction at source (TDS) on every transaction — would translate into an even greater impact on trading activities, numerous crypto entrepreneurs from India considered moving bases to friendlier jurisdictions. Following the imposition of additional taxes, Indian crypto exchanges ...

CBDCs can “kill” private crypto: India’s RBI deputy governor to IMF

In discussion with the International Monetary Fund (IMF), T Rabi Sankar, the deputy governor of the Reserve Bank of India (RBI), reflected an anti-crypto stance as he spoke about India’s potential to disrupt the crypto and blockchain ecosystem. Rabi Sankar started the conversation by highlighting the success of the Unified Payments Interface (UPI), India’s in-house fiat-based peer-to-peer payments system — which has seen an average adoption and transaction growth of 160% per anum over the last five years. “One of the reasons it is so successful is because it’s simple,” he added while comparing UPI’s growth with blockchain technology. According to Rabi Sankar: “Blockchain, which was introduced six-eight years before UPI started, even today is being referred to as a potentially revolut...

India to roll out CBDC using a graded approach: RBI Annual Report

Further cementing India’s decision to introduce an in-house central bank digital currency (CBDC) in 2022-23, the Reserve Bank of India (RBI) proposed a three-step graded approach for rolling out CBDC “with little or no disruption” to the traditional financial system. In February, while discussing the budget for 2022, Indian finance minister Nirmala Sitharaman spoke about the launch of a digital rupee to provide a “big boost” to the digital economy. In the annual report released Friday by India’s central bank, RBI revealed exploring the pros and cons of introducing a CBDC. In the report, RBI stressed the need for India’s CBDC to conform to India’s objectives related to “monetary policy, financial stability and efficient operations of currency and payment systems.” Based on this need, RBI is...

Indian central bank’s ‘informal pressure’ disrupted payments: Coinbase CEO

Just three days after debuting in the Indian market, United States-based crypto exchange Coinbase abruptly stopped using United Payments Interface (UPI), the most popular payment service in the region. Coinbase CEO Brian Armstrong later revealed that the service disruption was due to an “informal pressure” from India’s central bank. During Coinbase’s 2022 Quarterly Earnings call, Armstrong spoke about the company’s global expansion plans while acknowledging Coinbase’s role in starting the conversation with regulators related to crypto adoption. When asked about the impact of the recent disruption related to offering payment services in India, Armstrong stated: “So a few days after launching, we ended up disabling UPI because of some informal pressure from the Reserve Bank of Indi...

Brain drain: India’s crypto tax forces budding crypto projects to move

India’s 30% crypto tax came into law on March 31 and was effective April 1, despite warnings from several stakeholders about its possible ill impact on the budding crypto industry. As predicted, within just a couple of weeks of the new crypto tax law coming into effect, trading volume across major crypto exchanges dropped as much as 90%. The decline in trading activity was attributed to traders either moving their funds away from centralized crypto exchanges or adopting a holding strategy over trading. Many crypto exchanges were hoping that a crypto tax would at least offer some form of recognition to the crypto ecosystem and help them get easy access to banking services. However, the effect has been the opposite. On April 7, the National Payment Corporation of India (NPCI) issued a ...

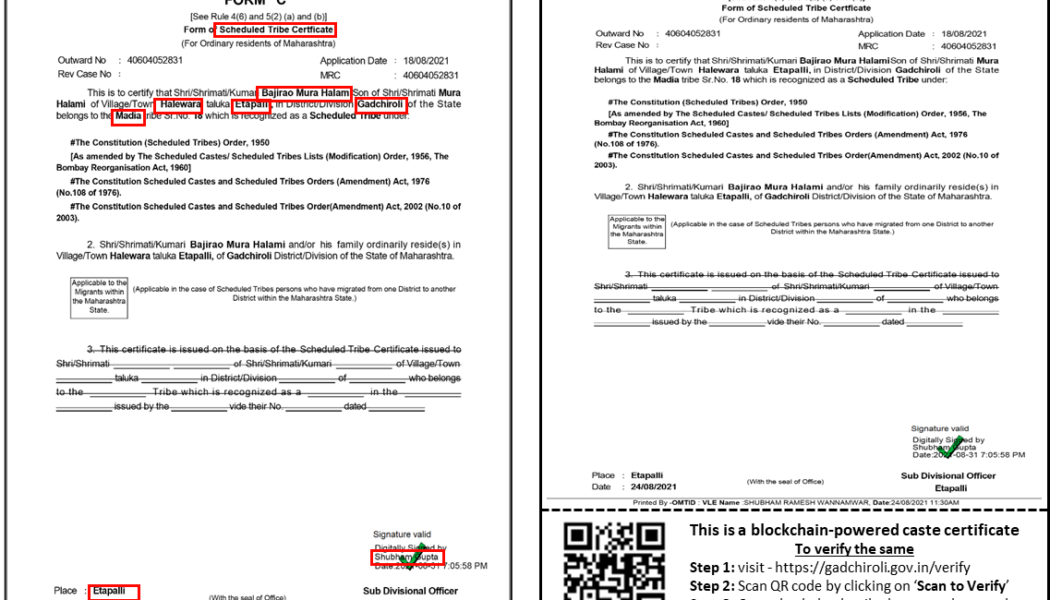

Indian state gov’t uses Polygon to issue verifiable caste certificates

The Government of Maharashtra, one of India’s state governments, has started issuing caste certificates over the Polygon blockchain to citizens residing in Etapalli village, Gadchiroli district, as a part of the Digital India campaign. In partnership with LegitDoc, a blockchain-based application, the Maharashtra state government is in the process of rolling out 65,000 caste certificates to aid the process of delivering governmental schemes and benefits. Speaking to Cointelegraph, Indian Administrative Service (IAS) officer Shubham Gupta revealed that the Indian government is always on the lookout to implement disruptive technologies that can help democratize citizen services, adding: “Web3 takes the concept of democratization to a whole new level, whereby, data/informatio...

Law Decoded: Crypto taxes and taxes on crypto, March 21–28.

It was relatively quiet in the digital asset policy department last week, as regulators and lawmakers in most key jurisdictions retreated to their offices to do the necessary homework. In the U.S., federal agencies got on with the various reports that President Joe Biden’s recent executive orders directed them to produce. Over in the United Kingdom, both the central bank and the Financial Conduct Authority also dropped position papers on crypto-related issues. After thorough deliberation, Thailand’s financial authorities spoke out against using crypto as a means of payment, while rumors of potential legal tender adoption of crypto emerged and died in Honduras. One theme that has been conspicuous throughout the week is the relationship between digital assets and taxation. Few would argue th...

Crypto tax policy framework passes India’s parliament despite pushback from lawmakers

A tax framework on cryptocurrencies introduced by India’s Finance Minister Nirmala Sitharaman will become law in the country after being passed as an amendment to the Finance Bill. On Friday, India’s lower house of parliament, the Lok Sabha, passed the 2022 Finance Bill, which included 39 amendments proposed by Sitharaman. The amendment on crypto established a 30% tax targeting digital asset and nonfungible token transactions and did not allow for deductions from trading losses while calculating income. In addition, taxpayers in India will have an additional 1% tax deducted at source, or TDS. As per the new amendment proposed in the Finance bill 2022 to sections of crypto tax. Loss cant be set off against any profit. Similar to betting tax rules. #reducecryptotax — Aditya Singh (@CryptooAd...

Bitcoin, Ether and NFTs will ‘never become legal tender’ in India, says Finance Secretary

T.V. Somanathan, the finance secretary for the Indian government, is reportedly pushing back against the narrative that cryptocurrencies will be widely accepted in the country — by dismissing the possibility of using them as legal tender. According to a Wednesday tweet from Asian News International, Somanathan said that a digital rupee backed by the Reserve Bank of India, or RBI, will be accepted as legal tender, but major cryptocurrencies have no chance of doing so. The finance secretary added that because digital assets including Bitcoin (BTC) and Ether (ETH) do not have authorization from the government, they will likely remain “assets whose value will be determined between two people.” “Digital rupee issued by RBI will be a legal tender,” said Somanathan. “Rest all aren’t legal t...

- 1

- 2