IMF

Crypto’s adaptability, openness key to ideal monetary system, say BIS execs

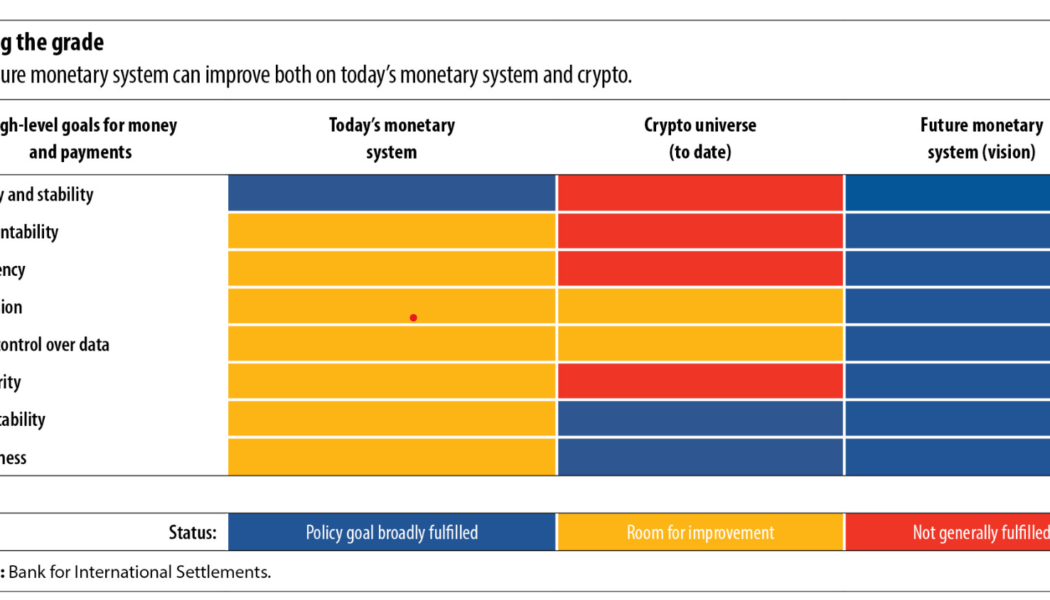

Governments across the globe see central bank digital currencies (CBDC) as a means to improve the existing fiat ecosystem. Cryptocurrency’s technical prowess supported by the central bank’s underlying trust is key to enabling a rich monetary ecosystem, suggests an International Monetary Fund (IMF) publication. “Digital technologies promise a bright future for the monetary system,” reads the publication attributed to IMF deputy managing director Agustín Carstens and BIS executives Jon Frost and Hyun Song Shin. A BIS study from June revealed that cryptocurrencies outdo fiat ecosystems when it comes to achieving the high-level goals of a future monetary system. Some of the most significant flaws preventing present-day cryptocurrencies from mainstream adoption, pointed out by the BIS exe...

Coinbase, Binance and Kraken under scrutiny: Law Decoded, July 25-August 1

Despite some good signs of the crypto prices recovery, last week could hardly be called bright for the market, as the major news came from the enforcers and not the regulators. According to a report from the New York Times, the United States Treasury Department’s Office of Foreign Assets Control (OFAC) has been investigating crypto exchange Kraken for allegedly allowing users based in Iran and other countries to buy and sell crypto in a potential violation of U.S. sanctions. In the other hemisphere, the Philippines’ think tank Infrawatch PH filed a twelve-page complaint calling on the local Securities and Exchange Commission (SEC) to crack down on Binance’s activities in the country. The news comes shortly after the Philippines’ Department of Trade and Industry (DTI) waved off a Bina...

CBDCs can “kill” private crypto: India’s RBI deputy governor to IMF

In discussion with the International Monetary Fund (IMF), T Rabi Sankar, the deputy governor of the Reserve Bank of India (RBI), reflected an anti-crypto stance as he spoke about India’s potential to disrupt the crypto and blockchain ecosystem. Rabi Sankar started the conversation by highlighting the success of the Unified Payments Interface (UPI), India’s in-house fiat-based peer-to-peer payments system — which has seen an average adoption and transaction growth of 160% per anum over the last five years. “One of the reasons it is so successful is because it’s simple,” he added while comparing UPI’s growth with blockchain technology. According to Rabi Sankar: “Blockchain, which was introduced six-eight years before UPI started, even today is being referred to as a potentially revolut...

Cambridge University launches crypto research project with IMF and BIS

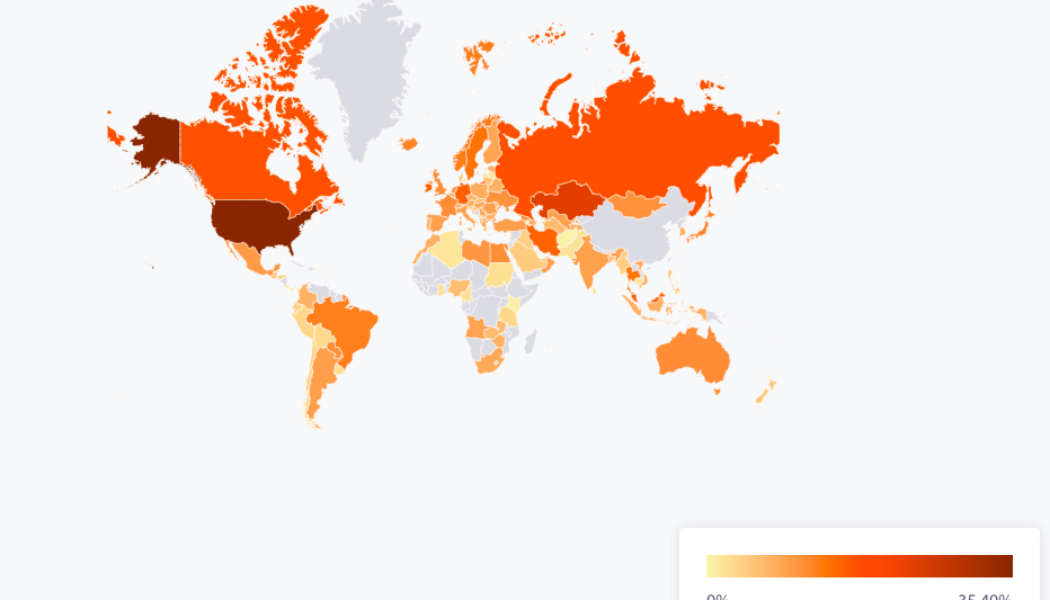

The University of Cambridge is collaborating with some of the world’s top banking institutions and private companies to introduce a new project targeting cryptocurrency research. The Cambridge Center for Alternative Finance, or CCAF, has launched a research initiative aiming to bring more insights on the rapidly growing digital asset industry, the CCAF announced to Cointelegraph on Monday. Dubbed the Cambridge Digital Assets Programme, or CDAP, the project is a public-private collaboration with 16 companies including public institutions like the Bank for International Settlements Innovation Hub and the International Monetary Fund. The initiative also includes banks like Goldman Sachs, financial giants like Mastercard and Visa, as well as major exchange-traded fund providers like Invesco. O...

Does the IMF have a hidden script for El Salvador’s Bitcoin play?

On Jan. 25, the International Monetary Fund’s (IMF) directors asked El Salvador to “narrow the scope” of its Bitcoin Law by “removing Bitcoin’s legal tender status.” Adopting a cryptocurrency as the Central American country has done “entails large risks for financial and market integrity, financial stability and consumer protection,” the fund wrote. Why did the IMF ask El Salvador to effectively pull the plug on its cryptocurrency experiment? Surely this small country — ranked 104th globally in gross domestic product (GDP) — is no threat to the international bank’s balance sheet. Moreover, 70% of El Salvador’s populace is unbanked, and one-fifth of its GDP is from United States remittances. Arguably, it could profit from Bitcoin’s (BTC) use. Then again, it’s only been half a year since El ...

Law Decoded: First-mover advantage in a CBDC conversation, Jan. 10–17

Last week saw an unlikely first move in the opening narrative battle around a prospective U.S. central bank digital currency: Congressperson Tom Emmer came forward with an initiative to legally restrict the Federal Reserve’s capacity to issue a retail CBDC and take on the role of a retail bank. This could be massively consequential as we are yet to see a similarly sharp-cut expression of an opposing stance. As a matter of fact, it is not even clear whether other U.S. lawmakers have strong opinions on the matter other than, perhaps, condemning privately issued stablecoins as a digital alternative to the dollar. By framing a potential Fed CBDC as a privacy threat first, Emmer could tilt the conversation in the direction that is friendly to less centralized designs of digital money. Below is ...

Bukele’s Bitcoin trade raises El Salvador’s sovereign credit risk: Moody’s

El Salvador’s historic embrace of Bitcoin (BTC) could have negative consequences on the country’s sovereign credit outlook, according to Moody’s Investors Service. Moody’s analyst Jaime Reusche told Bloomberg this week that El Salvador’s Bitcoin gambit “certainly adds to the risk portfolio” of a country that has struggled with liquidity issues in the past. Under the leadership of President Nayib Bukele, El Salvador has recognized Bitcoin as legal tender and issued a state-run crypto wallet to facilitate payments, transfers and ownership. Along the way, El Salvador has amassed a treasure chest of 1,391 BTC, with President Bukele famously “buying the dip” on several occasions by using Bitcoin’s volatility to add to his country’s holdings. Buying the dip 150 new coins added.#BitcoinDay ...

CISLAC raises concerns over Nigeria’s debt profile, coronavirus accountability

The Civil Society Legislative Advocacy Centre (CISLAC), has expressed concerns over $2.18 billion foreign loan request to the Nigerian Senate to fund the 2021 Appropriations Act, by President Muhammadu Buhari. It has therefore urged the National Assembly to insist on an analysis of debt repayment strategy to be in place as its key priority to approvals. In a statement by Executive Director, CISLAC and Head of Transparency International – Nigeria, Auwal Ibrahim Musa Rafsanjani, he said national public finance management regime is meant to save the nation’s economic system from collapse: rescuing jobs, supporting livelihoods and bailing out many businesses on the brink. He warned the government to avoid the catastrophe that the international finance institutions forced on Greece: destroying ...

France, African leaders push to redirect $100 billion in IMF SDR reserves by October

French President Emmanuel Macron said on Tuesday a summit in Paris on Africa financing had agreed to work towards persuading rich nations by October to reallocate $100 billion in IMF special drawing rights monetary reserves to African states. Impoverished African economies must not be left behind in the post-pandemic economic recovery and a substantial financial package is needed to provide much-needed economic stimulus, African and European leaders concluded at a summit in Paris. In the immediate term, that meant accelerating the COVID-19 vaccine rollout and creating the fiscal breathing room for African nations, which will face a spending shortfall of some $285 billion over the next two years, the summit communique showed. The communique set out a two-pronged response based on addressing...

- 1

- 2