Hyperinflation

Global inflation mounts: How stablecoins are helping protect savings

Economies around the world are facing a motley of challenges caused by rising inflation. High inflation devalues national currencies, which, in turn, pushes up the cost of living, especially in scenarios where earnings remain unchanged. In the United States, the government has responded aggressivelyto inflation. The nation hit a 9.1% inflation rate in June, prompting the Federal Reserve to implement a series of fiscal countermeasures designed to prevent the economy from overheating. Hiking interest rates was one of them. Soaring Fed interest rates have consequently slowed down consumer spending and business growth in the country. The counter-inflation approach has also strengthened the value of the U.S. dollar against other currencies due to tight dollar liquidity checks. As 79.5% of all i...

Is Bitcoin really a hedge against inflation?

While Bitcoin (BTC) has failed in countering this year’s rampant global inflation, it should still be considered as an inflation hedge, says Steven Lubka, the managing director of private consumers at Swan Bitcoin. According to Lubka, Bitcoin works well as a hedge against rising prices when inflation is caused by monetary expansion. It is less effective when inflation is caused by the disruption of the food supply and energy, which he sees as the leading cause of this year’s rampant inflation. [embedded content] “In a world where the price of goods is going up because there’s been a radical loss of abundance, Bitcoin isn’t going to protect investors from that,” Lubka said. He also points out that Bitcoin is a better hedge against inflat...

Is Bitcoin really a hedge against inflation?

While Bitcoin (BTC) has failed in countering this year’s rampant global inflation, it should still be considered as an inflation hedge, says Steven Lubka, the managing director of private consumers at Swan Bitcoin. According to Lubka, Bitcoin works well as a hedge against rising prices when inflation is caused by monetary expansion. It is less effective when inflation is caused by the disruption of the food supply and energy, which he sees as the leading cause of this year’s rampant inflation. [embedded content] “In a world where the price of goods is going up because there’s been a radical loss of abundance, Bitcoin isn’t going to protect investors from that,” Lubka said. He also points out that Bitcoin is a better hedge against inflat...

5 reasons why Bitcoin could be a better long-term investment than gold

The emergence of forty-year high inflation readings and the increasingly dire-looking global economy has prompted many financial analysts to recommend investing in gold to protect against volatility and a possible decline in the value of the United States dollar. For years, crypto traders have referred to Bitcoin (BTC) as “digital gold,” but is it actually a better investment than gold? Let’s take a look at some of the conventional arguments investors cite when praising gold as an investment and why Bitcoin might be an even better long-term option. Value retention One of the most common reasons to buy both gold and Bitcoin is that they have a history of holding their value through times of economic uncertainty. This fact has been well documented, and there’s no denying that gold has ...

Low inflation or bust: Analysts say the Fed has no choice but to continue raising rates

As economic conditions continue to worsen, financial experts worldwide are increasingly placing the blame at the feet of the United States Federal Reserve after the central bank was slow to respond to rising inflation early on. Financial markets are currently experiencing their worst stretch of losses in recent history, and it doesn’t appear that there is any relief in sight. May 24 saw the tech-heavy Nasdaq fall another 2%, while Snap, a popular social media company, shed 43.1% of its market cap in trading on May 23. This past couple of months have been absolutely brutal for the markets… 8 consecutive weeks of red candles in the #SPX, #NASDAQ and #BTC… no significant bounces pic.twitter.com/hgU2VwIoxh — Crypto Phoenix (@CryptoPheonix1) May 24, 2022 Much of the recent turmoil again c...

Crypto vs. physical: Musk-Saylor inflation debate boils down to scarcity

As rising inflation threatens to eat up further the purchasing power of the global fiat ecosystem, finding the perfect hedge against a falling economy has become the need of the hour — especially for the general public across the world. Joining this discussion online, Tesla CEO Elon Musk asked publicly about the probable inflation rate over the next few years to gauge the notion of global investors. Sharing his thoughts on the matter, American billionaire and MicroStrategy CEO Michael J. Saylor opined that with rising inflation, he expects the capital cash flow will move away from traditional fiat into scarce assets such as Bitcoin (BTC). USD consumer inflation will continue near all time highs, and asset inflation will run at double the rate of consumer inflation. Weaker currencies ...

Inflation spikes in Europe: What do Bitcoiners, politicians and financial experts think?

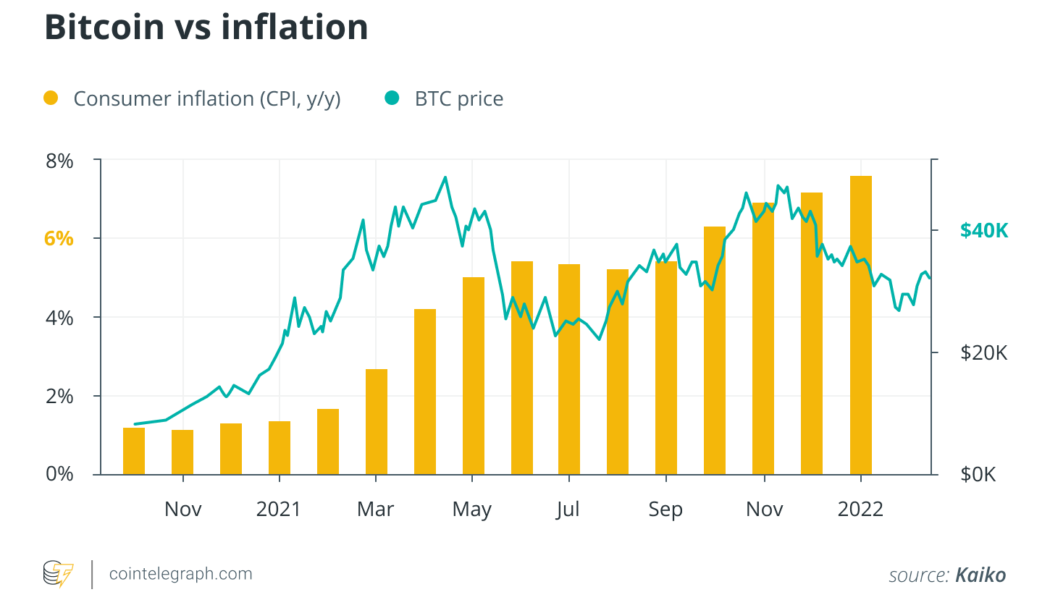

Rising prices are grabbing headlines all over the world. Across the pond in the United States, inflation recently broke a 40-year record. The situation is severe in Europe, with prices rising over 5% across the Eurozone and 4.9% in the United Kingdom. While prices rise, Bitcoin (BTC) is flatlining at around $39,000. It poses many questions: Is Bitcoin an effective hedge against rising prices, what role can Bitcoin play in a high inflation environment and did Bitcoiners know that inflation was coming? Experts from the world of Bitcoin, finance and even European politics responded to these questions, sharing their views with Cointelegraph about the alarming price rises in Europe. From data analysts Kaiko’s monthly report, the Bitcoin price marched ahead of inflation, implying...

Digital Denarius: How a crypto revolution could have saved the Roman Empire

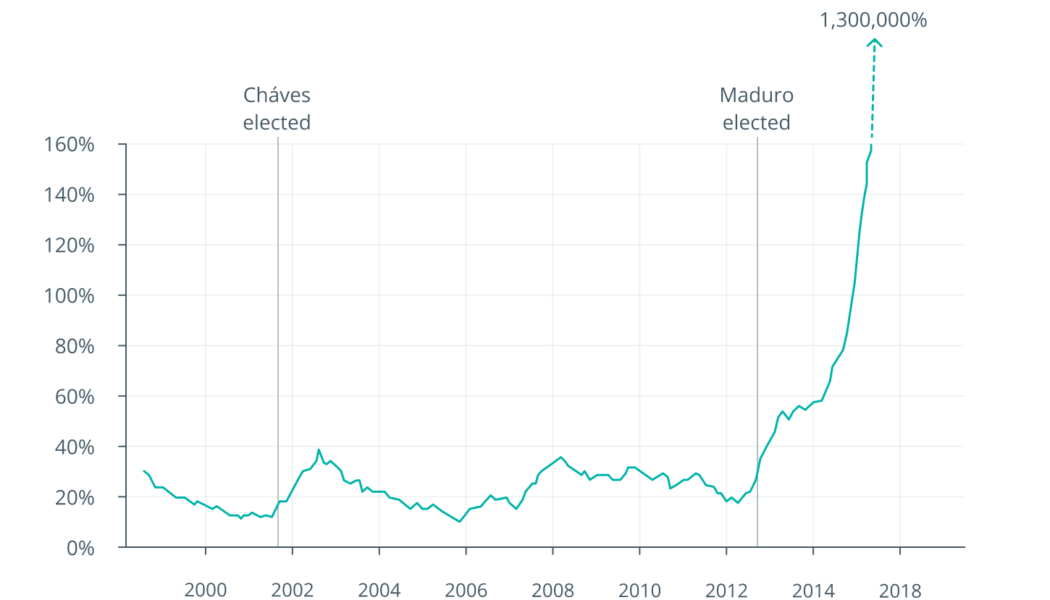

Two currency crises two thousand years apart. Modern-day Venezuela and the Roman Empire have more in common than you might think. Both know too well the dangers of soaring inflation and a collapse in investor confidence. But, only one has crypto on its side. Venezuela’s official currency, the bolívar, has suffered from hyperinflation for half a decade due to repeated currency devaluations, minimum wage rises and significant public spending increases. For a sustained period of several centuries, the Roman Empire enjoyed the enormous trade and commercial benefits associated with the world’s first fiat currency, as explored in my book Pugnare: Economic success and failure. The Roman currency was comprised of three coins: gold (Aureus), silver (Denarius) and copper or brass coins (Sestertius a...

Turkey’s crypto law is ready for parliament, President Erdoğan confirms

Turkey’s President Recep Tayyip Erdoğan has reportedly confirmed the completion of a crypto law draft that will soon be shared with the Parliament for mainstream implementation in the country. In an effort to counter the falling value of the Turkish lira, President Erdoğan shared plans to implement a new economic model while speaking at a press conference in Istanbul. As reported by local media NTV, Erdoğan said that the cryptocurrency bill is ready, adding: “We will take steps on this issue by sending it to Parliament without delay.” Acknowledging the country’s recent inflationary episode, Erdoğan said that the currency event is not related to mathematics but a matter of process — implying a possibility and potential of lira’s value growth: “With this understanding, we intend to cha...

Analysts: Printing currency could hurt economy

Analysts have expressed concerns over a recent claim that the federal government resorted to printing money to augment the monthly allocation to the three tiers of government, warning that it could heighten inflationary pressure with dire consequences for the country’s exchange rate and economy. The analysts, in separate interviews with newsmen, warned that a sustained policy of printing the currency, if not well managed, would hurt the economy. The concern came on the heels of recent revelation by Governor of Edo State, Mr. Godwin Obaseki, that due to the dwindling revenue in the face of declining oil revenue arising from the growing sources of alternative sustainable energy, the federal government had to print money to augment the amount available for sharing by the federal, state and lo...