Huobi

Doubts mount over Huobi’s future as harsh layoff rumors denied

Speculation on Twitter that crypto exchange Huobi has laid off staff and shuttered internal communications have prompted the community to advise users to withdraw funds, despite an adviser to the exchange denying the rumors. In a Jan. 5 tweet, Huobi adviser Justin Sun addressed rumors of purported insolvency, saying the business development of the exchange was “good” and the “security of users’ assets will always be fully protected.” Sun also seemingly brushed off speculation around disgruntled staff, saying Huobi will “fully respect the legal demands of local employees.” Earlier, on Jan. 3, crypto journalist Colin Wu reported that Sun changed Huobi employee salaries from being paid in fiat to being paid in either Tether (USDT) or USD Coin (USDC). Wu claimed the staff who disagreed with th...

‘Old money has all but fled,’ Huobi co-founder discusses challenges of running $400M VC fund

In a new Twitter post dated Dec. 12, Du Jun, co-founder of cryptocurrency exchange Huobi Global, shared new insight on his experience of running ABCDE Capital, a $400 million Web 3.0 venture capital (VC) fund, in June this year. According to Jun, the idea for ABCDE Capital came in March, and by April, it was already registered in Singapore. However, amidst the $40 billion Terra Luna implosion in May, Jun said that “old money has all but fled” after the incident. We chose to start @ABCDECapital at the most difficult time of the market. Hope to bring a glimmer of light to builders and bring more fairness, innovation and strength to crypto industry. https://t.co/GmxFFsG7qL — Du Jun (@DujunX) June 17, 2022 Undeterred, Jun continued that in August, the VC fund was fully operational,...

Dominica works with Huobi for digital identity program

Cryptocurrency exchange Huobi has partnered with the Commonwealth of Dominica to roll out a digital identity and national token service that promises digital citizenship of the West Indian island nation. Not to be confused with the nearby, larger Dominican Republic, Dominica is home to some 72,000 people and is situated in the middle of the Lesser Antilles archipelago. The government is looking to explore metaverse and Web3 technology to drive its development and attract talent from the cryptocurrency and blockchain ecosystem. The island nation is one of the first Caribbean countries to adopt a citizenship-by-investment program. Dominica passports allow access to over 130 countries around the world, including mainland China, Hong Kong, the European Union, Switzerland, the United Kingdom an...

Huobi wins license in the British Virgin Islands, no timeline for the UK yet

Major cryptocurrency exchange Huobi continues to expand its global footprint by entering the British Virgin Islands, a British Overseas Territory. Huobi officially announced on Friday that it secured an investment business license from the Financial Services Commission (FSC) of the British Virgin Islands. The approval allows Huobi to operate a virtual asset exchange under the subsidiary Brtuomi Worldwide Limited (BWL). According to the announcement, BWL plans to offer a range of crypto trading services, including spot trading of cryptocurrencies like Bitcoin (BTC) and Ether (ETH) as well as derivatives trading. The company positions itself as the first digital asset trading platform operator in the British Virgin Islands licensed to run an institutional-grade crypto trading platform for bo...

Sam Bankman-Fried denies report FTX plans to purchase stake in Huobi

Global crypto exchange FTX will not be acquiring a majority stake in Huobi, according to CEO Sam Bankman-Fried, or SBF. In a Monday tweet, SBF explicitly denied a Bloomberg report that claimed FTX was planning to purchase crypto exchange Huobi. Cointelegraph reported on Aug. 12 that Huobi co-founder Leon Li was considering selling his majority stake, valued at more than $1 billion, in the company. “We are not planning to acquire Huobi,” said SBF. Just to be explicit because apparently a lot of people are saying this: No, we are not planning to acquire Huobi. — SBF (@SBF_FTX) August 29, 2022 Under SBF’s leadership, both FTX and Alameda Research have stepped in a few times amid the bear market to bail out crypto firms facing liquidity issues. In a June NPR interview, Bankman-Fried...

Huobi co-founder reportedly looks to sell majority stake valued at over $1B

Leon Li, the co-founder of global crypto exchange Huobi, is reportedly in talks to sell the majority of his stake in the company, which could be valued at over $1 billion. Li reportedly had discussions with multiple financiers seeking to offload a 60% stake in the crypto company, which could be valued at over $1 billion and some believe could fetch as high as $3 billion, reported Bloomberg. A Huobi spokesperson confirmed to Bloomberg, without disclosing details, that the co-founder is engaging with numerous international giants to sell his majority share in the crypto exchange. Li reportedly informed other backers of the company of his decisions during a shareholder meeting in July this year. Li has transferred his CEO duties to Hua Zhu to focus on his health. The report also claimed ...

How crypto is attracting some institutional investors — Huobi Global sales head

James Hume, head of sales at Huobi Global, said that while some institutional investors have gotten “cold feet” over crypto, many with billions of dollars are exploring the space. Speaking to Cointelegraph at the European Blockchain Convention on Tuesday, Hume said that the crypto exchange had observed increasing interest from institutional investors within the last one to two years in entering the digital asset space. According to Hume, it took a long time for certain firms and hedge funds to “build teams, raise capital and understand the infrastructure” to participate in crypto, estimating that 20–30 firms with more than $1 billion could start trading within the year. “I think it’s a pretty exciting time,” said Hume. “A lot of the more speculative bets in crypto… Some have got a bit of c...

Weekly Report: The latest on Panama’s crypto bill, Huobi to exit Thailand market, Circle launches a Euro-backed stablecoin, and more

Here are all the interesting headlines you missed outside the crypto market this week: Panama’s President vetoes crypto bill over money-laundering concerns Panama President Laurentino Cortizo on Thursday shot down a crypto bill introduced in September 2021 with a scope covering several cryptocurrencies, unlike El Salvador’s that major in Bitcoin. Cortizo partially vetoed the bill, citing non-compliance with the recent FAFT recommendation on fiscal transparency and prevention of money laundering. If the bill were to be approved, it would allow Panamanian natives to buy everyday goods and services using digital assets like Bitcoin, Ethereum, and Litecoin among other crypto coins. The bill would also make digital assets mainstream for settling taxes or any fee owed by the state. Additionally,...

Huobi Global launches $1B investment arm focused on DeFi and Web3

Digital asset exchange Huobi Global has spun out a new investment arm focused on decentralized finance (DeFi) and Web3 projects, further highlighting venture capital interest in the blockchain economy. Dubbed Ivy Blocks, the new investment arm has over $1 billion in crypto assets under management to deploy, a spokesperson for Huobi confirmed. These funds have been earmarked for “identifying and investing in promising blockchain projects,” the company said. In addition to financing, Ivy Blocks will offer various services to selected projects, including an asset management platform, a new blockchain incubator and a dedicated research arm. The firm’s asset management department will provide “liquidity investments” to help DeFi and Web3 projects get up and running, according to Lily Zhan...

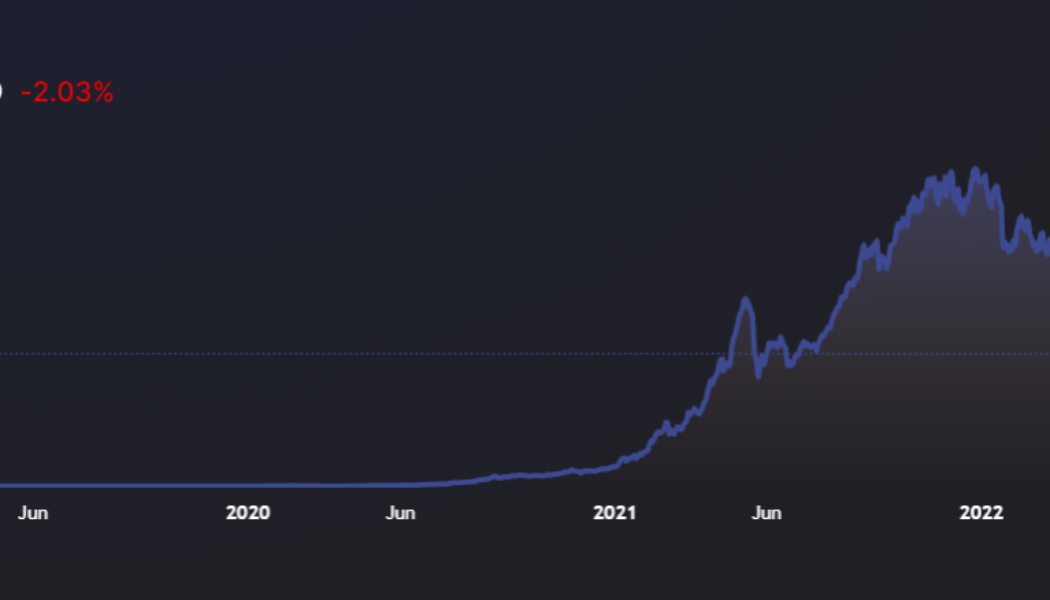

Huobi Global acquires Latin American crypto exchange Bitex

Late last week, Huobi Global announced that it completed an acquisition of digital currency trading platform Bitex with the terms of the agreement remaining undisclosed. Bitex, founded in 2014, operates primarily in the Latin American countries of Argentina, Chile, Paraguay, and Uruguay – a stage Huobi is keen to take root in. The former will retain its branding and management as part of the arrangement with the leading crypto global crypto entity. Huobi reported a growth in crypto and adoption rate in Latin America of 1,370% rise between 2019, when it launched Huobi Argentina, and 2021. The Bitex website shows that the exchange supported more than 15 stablecoins and several fiat currencies. “Since Huobi Group first entered the Latin American market, we have seen rema...

Huobi Tech to launch crypto tracking ETF in Hong Kong for retail traders

Huobi Tech, a public listed fund manager in Hong Kong, plans to launch a cryptocurrency tracking exchange-traded fund (ETF) for retail investors. The Hong Kong Stock Exchange-listed company has reportedly submitted a proposal to the Securities and Futures Commission (SFC) for its crypto ETF. The new ETF product will be focused on retail investors with assets less than HK$8 million (US$1 million), reported South China Morning Post. The vice president of the firm Romeo Wang said stressed that a Hong Kong-regulated crypto ETF would offer better security to investors and also noted that they are actively engaged with the SFC and hopes to maintain positive communication to offer regulated crypto ETF products in the market. Huobi Tech didn’t respond to Cointelegraph’s requests for comments at th...

Huobi is planning a comeback in the US market, but not as an exchange

Huobi Tech co-founder Du Jun confirmed in an interview that the exchange is mulling a return into the US The exchange is, however, seeking to re-enter the market in the lines of asset management as opposed to an exchange Crypto exchange Huobi has plans to enter the US market, targeting a different sub-niche. Speaking in an interview with CNBC’s Arjun Kharpal, Huobi co-founder Du Jun expressed the company’s desire to expand into the US. Jun explained that Huobi was ready to get back into the competitive US market after redefining its strategy. The Huobi brand operated in the US market for a short while between 2018 and 2019 through– a US-based entity called Huobi US. The entity failed to stick the landing and consequently withdrew from the market in December 2019, citing regulat...

- 1

- 2