How to Crypto

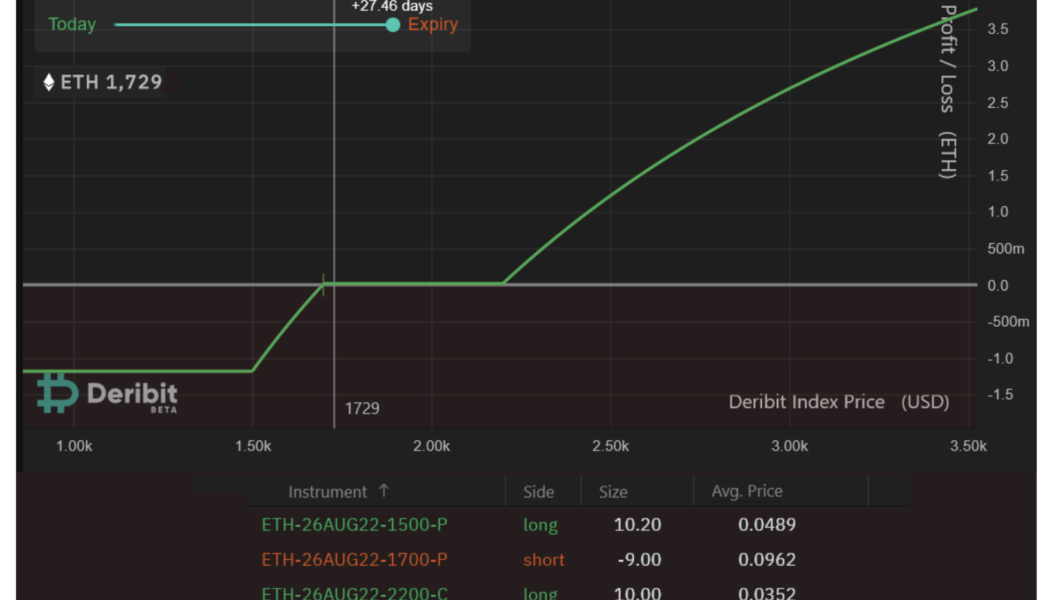

Pro traders may use this ‘risk averse’ Ethereum options strategy to play the Merge

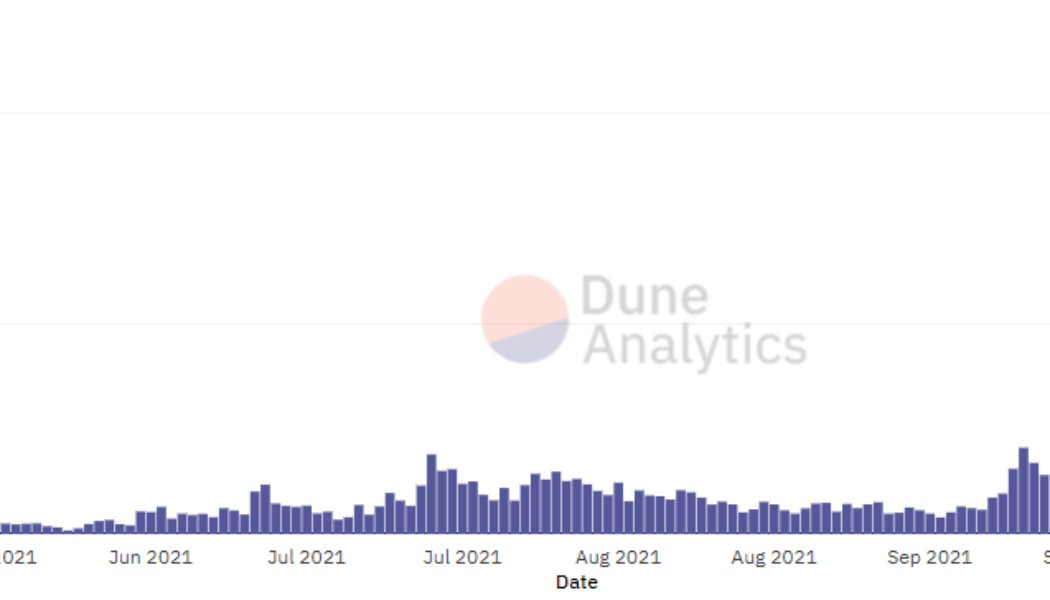

Ether (ETH) is reaching a make-it or break-it point as the network moves away from proof-of-work (PoW) mining. Unfortunately, many novice traders tend to miss the mark when creating strategies to maximize gains on potential positive developments. For example, buying ETH derivatives contracts is a cheap and easy mechanism to maximize gains. The perpetual futures are often used to leverage positions, and one can easily increase profits five-fold. So why not use inverse swaps? The main reason is the threat of forced liquidation. If the price of ETH drops 19% from the entry point, the leveraged buyer loses the entire investment. The main problem is Ether’s volatility and its strong price fluctuations. For example, since July 2021, ETH price crashed 19% from its starting point within 20 d...

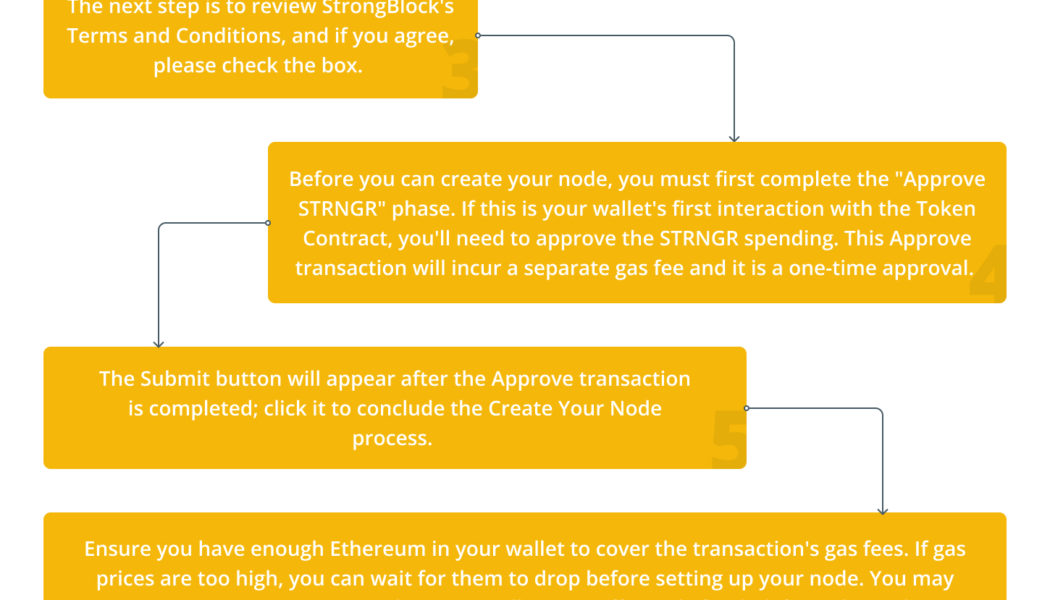

What is StrongBlock (STRONG) and how does it work?

The digital financial environment continues to develop almost every second, which is no surprise to those in the crypto sector. Among such technological advancements, a new project called StrongBlock has popularized the concept of the node as a service (NaaS) on the blockchain. NaaS is an alternative to running entire blockchain nodes on your own; it provides developer infrastructure and tools for setting up and managing blockchain nodes. Connected blockchain nodes relay, transmit and store decentralized blockchain data. But, what is a blockchain node? A node, also known as a Full Node, is a device that stores the blockchain’s whole transaction history. But, who is behind the creation of the StrongBlock ecosystem? The StrongBlock team includes CEO David Moss and chief technology offi...

5 metrics to monitor before investing in crypto during a bear market

Cryptocurrency bear markets destroy portfolio value and they have a dangerous tendency to drag on for longer than anyone expects. Fortunately, one of the silver linings of market-wide pullbacks is that it gives investors time to re-focus and spend time researching projects that could thrive when the trend turns bullish again. Here’s five areas to focus on when deciding whether to invest in a crypto project during a bear market. Is there a use case? The cryptocurrency sector has no shortage of flashy promises and gimmicky protocols, but when it comes down to it there are only a handful of projects that have delivered a product that has demand and utility. When it comes down to determining if a token should continue to be held, one of the main questions to ask is “Why does this project ...

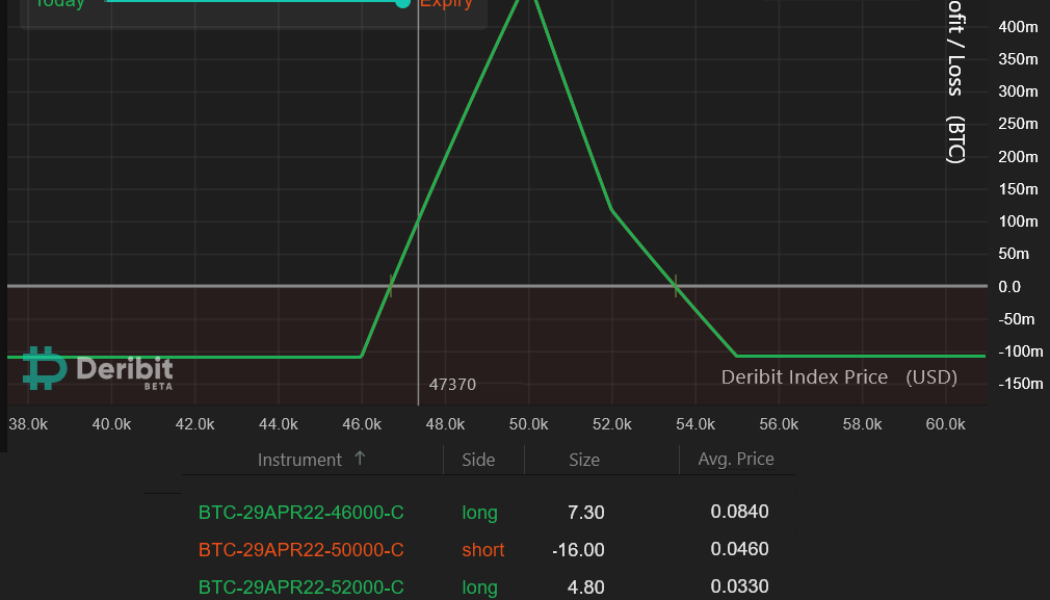

Here’s how pro traders use Bitcoin options to profit even during a sideways market

Bitcoin (BTC) price swings might be impossible to predict, but there is a strategy frequently used by pro traders that yields high returns with minimal cost. Typically, retail traders rely on leveraged futures positions which are highly susceptible to forced liquidations. However, trading Bitcoin options provide excellent opportunities for investors aiming to maximize gains while limiting their losses. Using multiple call (buy) options can create a strategy capable of returns six times higher than the potential loss. Moreover, these can be used in bullish and bearish circumstances, depending on the investors’ expectations. The regulatory uncertainty surrounding cryptocurrencies has long been a significant setback for investors and this is another reasons why neutral market strategies...

Altcoin Roundup: 3 metrics that traders can use to effectively analyze DeFi tokens

Much to the chagrin of cryptocurrency proponents who call for the immediate mass adoption of blockchain technology, there are many “digital landmines” that exist in the crypto ecosystem such as rug pulls and protocol hacks that can give new users the experience of being lost at sea. There’s more to investing than just technical analysis and gut feelings. Over the past year, a handful of blockchain analysis platforms launched dashboards with metrics that help provide greater insight into the fundamentals supporting — or the lack thereof — a cryptocurrency project. Here are three key factors to take into consideration when evaluating whether an altcoin or decentralized finance (DeFi) project is a sound investment. Check the project’s community and developer activity One of the basic wa...