Hong Kong

Tech giant Meitu loses over $43M of its crypto investment in bear market

Hong Kong tech giant Meitu made headlines in April last year after it reported nearly $100 million in crypto holdings. However, with the advent of the bear market, the tech firm has lost nearly half of the valuation of its crypto holdings. According to a local media report, Meitu reported an impairment loss of over 300 million yuan, approximately $43.4 million, on their crypto holdings. An impairment loss is a loss in value of an asset when it falls below the carrying value of the investment. The financial filing revealed that the impairment loss has more than doubled from the last quarter, something the firm had anticipated earlier. The tech giant has said that its crypto holdings could impact the net loss of the company by the end of the first half of the year. In a July exchan...

Silvestre De Sousa Is Leaving UK To Ride In Hong Kong

Silvester De Sousa, the three-time British Champion jockey has decided to upsticks from the UK to ride in Hong Kong – stating he’s without a stable or retainer now in England and better chances await abroad. Best Horse Racing Betting Offers & Free Bets Already claimed these betting offers? You can check out the best horse racing betting sites and add more top bookmakers to your portfolio. De Sousa Off To Hong Kong De Sousa, who was released from this contract as retiained rider for King Power Racing last year, has been given a licence by the Hong Kong Jockey Club from August 20th until February 20th so is packing his bags and heading east on 23rd August. He was crowned leading rider in the UK in 2015 and then followed that up with ‘back-to-back’ titles in 2017 and 2018. De Sousa (41) h...

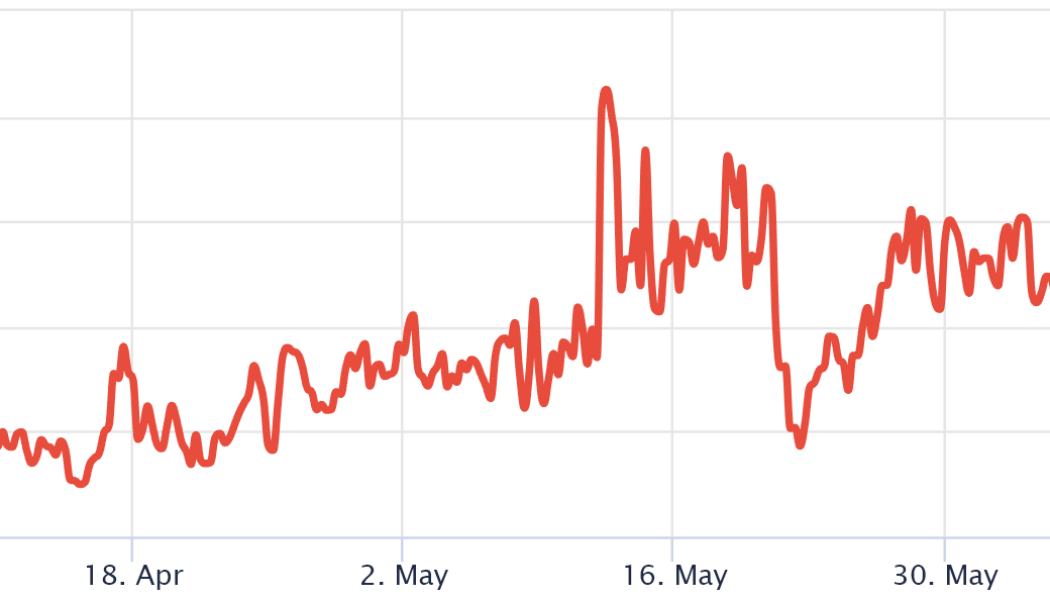

CoinFLEX resumes withdrawals, limiting users to 10%

Cryptocurrency exchange CoinFLEX is partially reopening user withdrawals, raising cautious optimism that the company was gradually recovering from liquidity constraints that were triggered by a high-profile client default. Beginning at 5 am UTC on Friday, all CoinFLEX users will be able to withdraw up to 10% of their funds, the company said. All existing withdrawal requests will be canceled and returned to their respective accounts, giving users the ability to initiate new requests in accordance with the 10% limit. The remaining 90% of user balances will be considered “locked funds,” or funds that appear on their balance but cannot be withdrawn, traded or used as collateral. The new guidelines apply to all assets except flexUSD, an interest-bearing stablecoin, which “cannot be withdr...

Samsung Asset Management to launch blockchain ETF in Hong Kong

Hong Kong-based Samsung Asset Management (SAMHK), a local subsidiary of Samsung’s investment arm, is moving forward with a blockchain-themed exchange-traded fund (ETF). The firm expects to launch its Samsung Blockchain Technologies ETF on the Hong Kong Stock Exchange on June 23, SAMHK announced on Thursday. The ETF seeks to achieve long-term capital growth by investing in stocks of companies actively involved in the development and adoption of blockchain technologies, the fund prospectus reads. The fund will invest in blockchain-related research and development firms, data providers, industry investment firms and others. The ETF’s composition will be managed by SAMHK’s portfolio management team, responsible for filtering out firms with “small market capitalization or low trading volume.”&n...

Hong Kong’s Securities and Futures Commission warn of nonfungible token risks

On Monday, Hong Kong’s Securities and Futures Commission (SFC) released a statement warning investors about the risks of nonfungible tokens, or NFTs, which have soared in popularity in recent years. The regulatory body wrote: “As with other virtual assets, NFTs are exposed to heightened risks, including illiquid secondary markets, volatility, opaque pricing, hacking and fraud. Investors should be mindful of these risks, and if they cannot fully understand them and bear the potential losses, they should not invest in NFTs.” However, it appears that the SFC’s specific concern lies in the securitization of NFTs. “The majority of NFTs observed by the SFC are intended to represent a unique copy of an underlying asset such as a digital image, artwork, music or...

Huobi Tech to launch crypto tracking ETF in Hong Kong for retail traders

Huobi Tech, a public listed fund manager in Hong Kong, plans to launch a cryptocurrency tracking exchange-traded fund (ETF) for retail investors. The Hong Kong Stock Exchange-listed company has reportedly submitted a proposal to the Securities and Futures Commission (SFC) for its crypto ETF. The new ETF product will be focused on retail investors with assets less than HK$8 million (US$1 million), reported South China Morning Post. The vice president of the firm Romeo Wang said stressed that a Hong Kong-regulated crypto ETF would offer better security to investors and also noted that they are actively engaged with the SFC and hopes to maintain positive communication to offer regulated crypto ETF products in the market. Huobi Tech didn’t respond to Cointelegraph’s requests for comments at th...

Cyber vigilante hunts down DeFi scammers running away with $25M rug pull

In the world of digital finance, where the weapon of choice for a heist is a computer rather than a semi-automatic firearm, tracking down scams and frauds from across the world becomes a near-impossible feat for centralized police forces. However, in an interview with Cointelegraph, an anonymous cyber vigilante shares insights into how he went about tracking down a group of decentralized finance (DeFi) scammers responsible for the $25 million StableMagnet rug pull, coordinating with police authorities and eventually having the stolen money returned back to the investors. [embedded content] The StableMagnet platform lured unwary investors under the pretext of high returns against stablecoin deposits. In a typical rug pull event, StableMagnet managed to run away with the $25 million th...

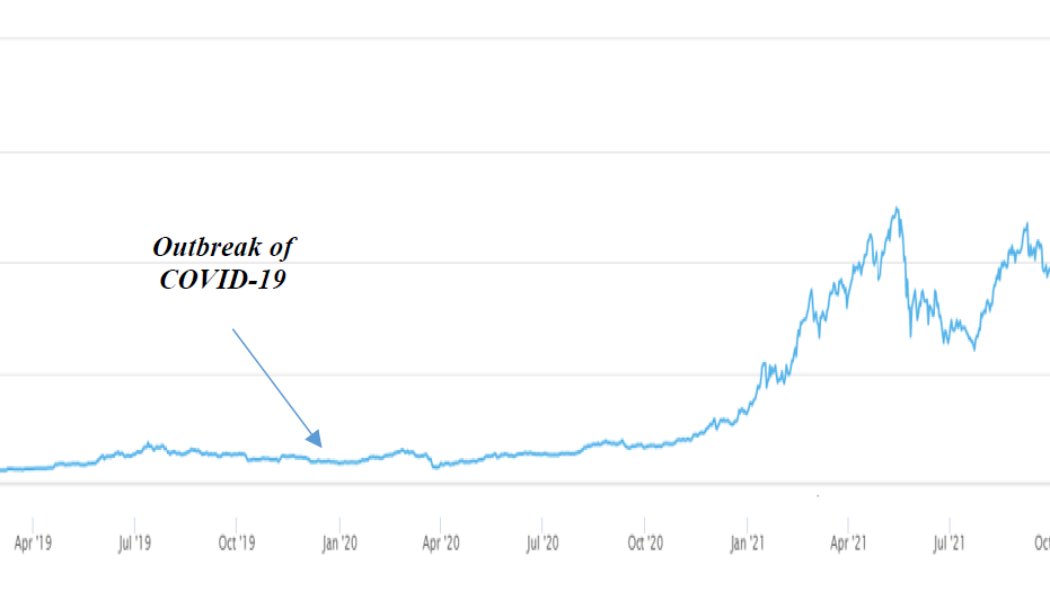

Hong Kong begins discussions to introduce stablecoin regulatory framework

Hong Kong’s central banking institution, the Hong Kong Monetary Authority (HKMA), released a questionnaire to gauge public opinion on regulations for crypto-assets and stablecoins. The state-backed regulator intends to establish a regulatory framework by 2023-24. HKMA’s “Discussion Paper on Crypto-assets and Stablecoins” highlights the explosive growth of the stablecoin market in terms of market capitalization since 2020 and the concurrent regulatory recommendations put forth by international regulators including the United States’ Financial Action Task Force (FATF), the Financial Stability Board (FSB) and The Basel Committee on Banking Supervision (BCBS). Market Capitalization of Crypto-assets. Source: HKMA According to the HKMA, the current size and trading activity of crypto-asset...

Japan-based crypto exchange DeCurret plans to sell to HK’s Amber Group: report

The holding company behind DeCurret, the Japan-based company offering trading and exchanges of digital assets, reportedly plans to sell its crypto business to investment platform Amber Group. According to a Wednesday report from the Nikkei newspaper, DeCurret Holdings intends to sell the crypto branch of its business to the Hong Kong-based company Amber Group in February. Though the details of the acquisition are unclear, the news outlet reported that the sale price would be in the millions of dollars. DeCurret established a new business structure in December 2021, launching a holding company, DeCurret Holdings, and separating its digital currency and crypto business into separate subsidiaries. Under the proposed arrangement, DeCurret Inc. will represent the company’s crypto exchange busin...