HODL

Bitcoin hodlers targeting $100K is what’s preventing 40% price drawdown, data suggests

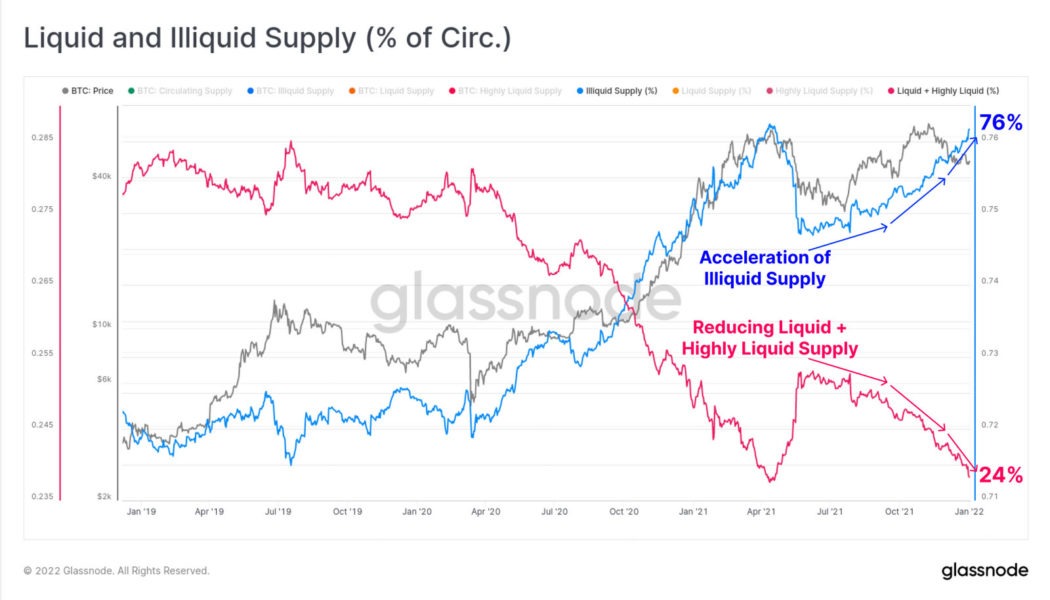

Bitcoin (BTC) dropping to $25,000 or lower is unlikely thanks to hodlers hoping for all-time highs, not speculative traders, new research says. In a series of tweets on April 19, popular analyst Root argued that there is “no real reason” for a dramatic Bitcoin sell-off. No major selling from “maturing” hodlers Bitcoin has yet to wow the market with its all-time highs this halving cycle, and this has contributed to a loss of faith among some investors. At the same time, on-chain indicators remain much more bullish than spot price action, and those investors still in the market support the idea that BTC/USD will go far higher in the future. This is thanks to a lack of short-term holders (STHs) on the market, Root notes. Even the most recent all-time highs of $69,000 last November...

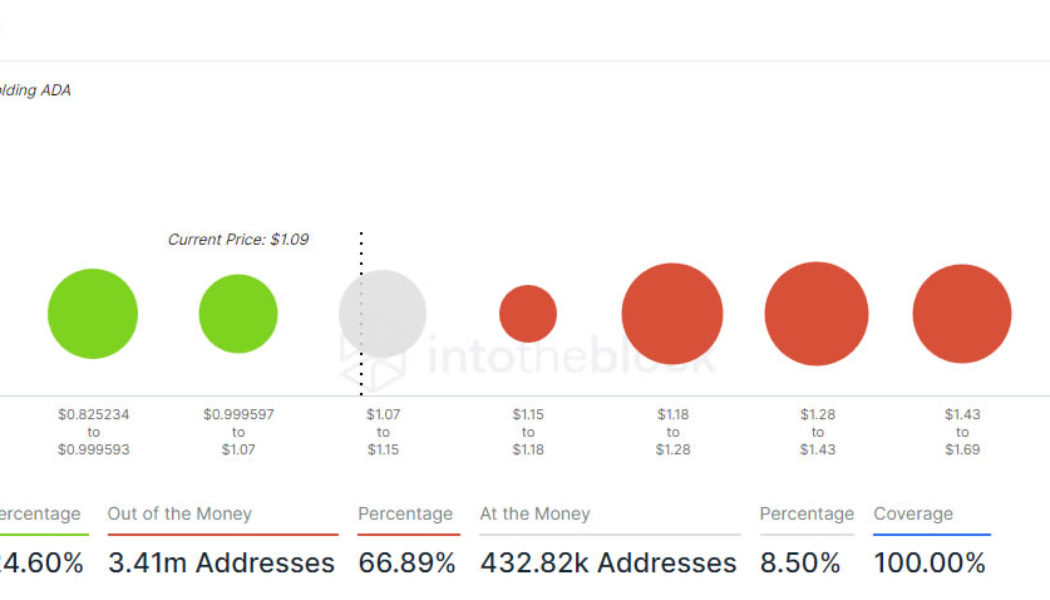

67% of Cardano holders underwater and most bought less than 1 year ago

As Cardano (ADA) prices fall back towards the psychological one dollar level, more and more investors are finding themselves with unrealized losses by holding on to the digital asset. Cardano’s ADA token has had a bearish week. The price has fallen 11.4% since Monday resulting in more holders being in the red. More significantly, ADA is now 64.7% below its September 2 all-time high of $3.09 and is in danger of falling below a dollar over the next few days should the trend continue. According to IntoTheBlock’s “in/out of the money” indicator, more than two-thirds, or 67% of ADA holders, are underwater. A quarter of Cardano investors are in the green, and 9% of them are at a breakeven point. The indicator identifies the average cost at which the tokens were purchased and compares it to the c...

Did rapper YG just flex a $30M BTC stack in his new music video?

Keenon Dequan Ray Jackson, the rapper who goes by the name YG, appears to show off a fat $30 million stack of Bitcoin (BTC) in his latest music video. The reveal appears to either be an eye-watering — but possibly fake — flex, or a crafty bit of product placement, as a cold storage device from crypto wallet provider Ledger is featured prominently in the video. The social team from Ledger was on it immediately too: We see you! @YG knows how to secure those bags of #bitcoin … not your keys, no your coins. — Ledger (@Ledger) February 11, 2022 In one of the scenes of the music video for the song titled “Scared Money” featuring J. Cole and Moneybagg Yo, YG is seen holding a Ledger wallet close to a smartphone which has a screen bearing a wallet application with more than $30.6 million of BTC in...

Willy Woo: ‘Peak fear’ but on-chain metrics say it’s not a bear market

Bitcoin analyst and co-founder of software firm Hypersheet Willy Woo believes that on-chain metrics show that BTC is not in a bear market despite observing “peak fear” levels. Speaking on the What Bitcoin Did podcast hosted by Peter McCormack on Jan. 30, Woo cited key metrics such as a strong number of long term holders (wallets holding for five months or longer) and growing rates of accumulation suggest that the market has not flipped the switch to bear territory: “Structurally on-chain, it’s not a bear market setup. Even though I would say we’re at peak fear. No doubt about it, people are really scared, which is typically […] an opportunity to buy.” I guess BTC is in demand lately pic.twitter.com/5h1IeMT2lK — Willy Woo (@woonomic) January 29, 2022 In the short term, Woo noted that ...

Bitcoin cycle is far from over and miners are in it for the long haul: Fidelity report

Fidelity Digital Assets — the crypto wing of Fidelity Investments which has $4.2 trillion assets under management–shared their “two sats” on the future of the digital assets space. The key takeaways touched upon miners’ behavior and Bitcoin (BTC) network adoption. In the annual report released last week, the group shared some insights into the world of BTC mining: “As Bitcoin miners have the most financial incentive tho make the best guess as to the adoption and value of BTC (…) the current bitcoin cycle is far from over and these miners are making investments for the long haul.” The report stated that the recovery in the hash rate in 2021 “was truly astounding”, particularly when faced the world’s second-largest economy China banning Bitcoin in 2021. The rebound in hash rate s...

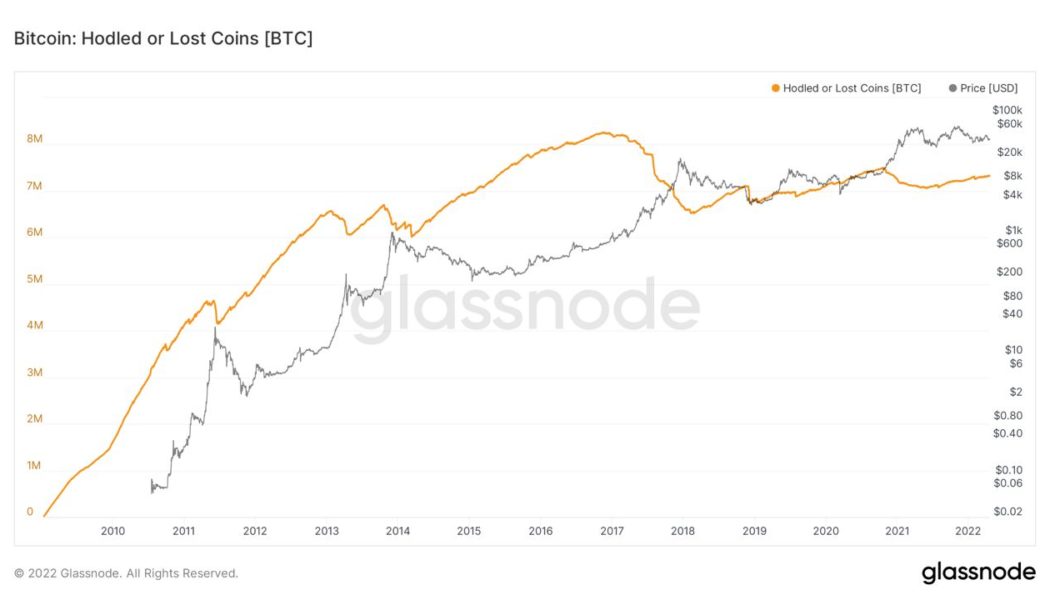

Wait and see approach: 3/4 of Bitcoin supply now illiquid

Bitcoin markets have been consolidating since the beginning of the year, but on-chain metrics are painting a more positive picture as more of the asset is becoming illiquid. On-chain analytics provider Glassnode has been delving into Bitcoin supply metrics to get a better view of the longer-term macro trends in its weekly report on Jan. 3. The findings revealed that although the asset has been trading sideways so far this year, more BTC has become illiquid. There has been an acceleration in illiquid supply growth which now comprises more than three quarters, or 76%, of the total circulating supply. Glassnode defines illiquidity as when BTC is moved to a wallet with no history of spending. Liquid supply BTC, which makes up 24% of the total, is in wallets that spend or trade regularly such a...

‘Twas the Night before Christmas: A Cointelegraph Story

‘Twas the night before Christmas, when all thro’ the Twittersphere Not a troll was stirring, not even a financier; The crypto was HODLed in cold storage with care, In hopes that Satoshi would soon reappear; The newbies avoided FUD and slept in their beds, While visions of lambos danc’d in their heads. And Pomp being occupied, and Schiff spewing crap, Weren’t calling attention to traders stacking sats. When in the trends came mentions of Nakamoto, I had to be sure it wasn’t just FOMO. Away to my portfolio my fingers did fly, And checked on the prices — man, were they high! Then, for a moment, I thought I was wrong. But no — a huge bull run, and eight altcoins going along. Who could have done this? Who answered my prayer? I knew in an instant the answer: Michael Saylo...

- 1

- 2