HODL

Crypto Stories: How Bitcoin helped a couple start a family

Bitcoin (BTC) gains helped “Noodle,” a London-based Bitcoiner, to afford in vitro fertilization (IVF) treatments for his family. Noodle’s story comes to life in the latest edition of Cointelegraph’s Crypto Stories. IVF treatments can be expensive, with success rates ranging from 4% to 38%, depending on various factors. Fortunately, profits from buying and holding Bitcoin provided the necessary funds for Noodle to start a family. Noodle, who first heard about Bitcoin in 2012, decided to sell some of his BTC to pay for IVF treatment for his wife. He favored selling BTC over taking out a loan, converting over $70,000 in Bitcoin into fiat currency over a few years to pay for the treatments. [embedded content] Noodle’s journey with Bitcoin began when he was at the gym. An acquaintance introduce...

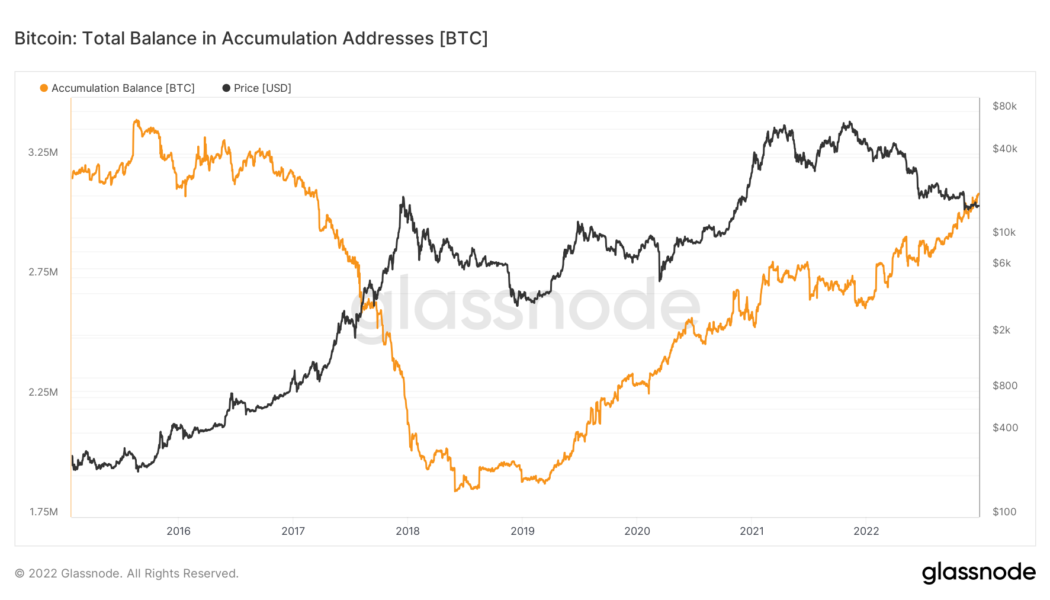

Bitcoin accumulation addresses near record 800K despite whale selling

Bitcoin (BTC) accumulation is nearing a new milestone this Christmas as the redistribution of the BTC supply continues. Data from on-chain analytics firm Glassnode shows that the total BTC balance of so-called “accumulation addresses” is nearing all-time highs. “HODL-only’ BTC addresses climb closer to 1 million mark Behind the scenes in the 2022 Bitcoin bear market, certain entities are in no doubt about their BTC investment strategy. According to Glassnode, Bitcoin accumulation addresses are more numerous than ever before, while the BTC balance they contain is almost at a record high. “Accumulation addresses are defined as addresses that have at least 2 incoming non-dust transfers and have never spent funds,” the firm’s description explains. Glassnode adds that exchange wallets and those...

Non-whale Bitcoin investors break new BTC accumulation record

Some non-whale Bitcoin (BTC) investors seem to have had zero issues with the cryptocurrency bear market as well as fear, uncertainty and doubt (FUD) around the fall of FTX, on-chain data suggests. Smaller retail investors have turned increasingly bullish on Bitcoin and started accumulating more BTC despite the ongoing market crisis, according to a report released by the blockchain intelligence platform Glassnode on Nov. 27. According to the data, there are at least two types of retail Bitcoin investors that have been accumulating the record amount of BTC following the collapse of FTX. The first type of investors — classified as shrimps — defines entities or investors that hold less than 1 Bitcoin, $16,500 at the time of writing, while the second type — crabs — are a category of addresses h...

First time Bear market? Advice from Bitcoin Bull Michael Saylor

First-time bear market? It’s also the first Bitcoin (BTC) bear market for Michael Saylor, one of the world’s biggest Bitcoin bulls. Executive chairman of one of the world’s largest pro-Bitcoin companies, Saylor took a moment out of his busy schedule at the Los Angeles Pacific Bitcoin conference to speak with Cointelegraph. Crucially, Saylor told Cointelegraph that when it comes to Bitcoin, “you have to take a long frame time perspective.” “If you’re buying [Bitcoin] and you’ve got less than a four-year time horizon, you’re just speculating in it. And once you’ve got more than a four-year time horizon, then the obvious thing is you dollar-cost average.” Dollar-cost averaging is a way of reducing exposure to the volatility of an investment. Saylor continued, “You buy the asse...

What are crypto whale trackers and how do they work?

There are dedicated solutions to track the actions of crypto whales. These solutions can provide analytics on whale actions and, in some instances, can also make investment/trading decisions for the user. Crypto traders and investors constantly track the amount of cryptocurrencies going in and out of exchanges. When a cryptocurrency like Bitcoin or Ether (ETH) is moved in large quantities into an exchange, it is expected to see some sell action resulting in a fall in price. Conversely, if cryptocurrencies flow out of exchanges into wallets, it is considered a precursor to a rise in price. This is because when exchanges have a high net outflow of cryptocurrencies, they have reduced supply resulting in an increase in price. Oftentimes, a whale could buy cryptocurrencies on an exchange and mo...

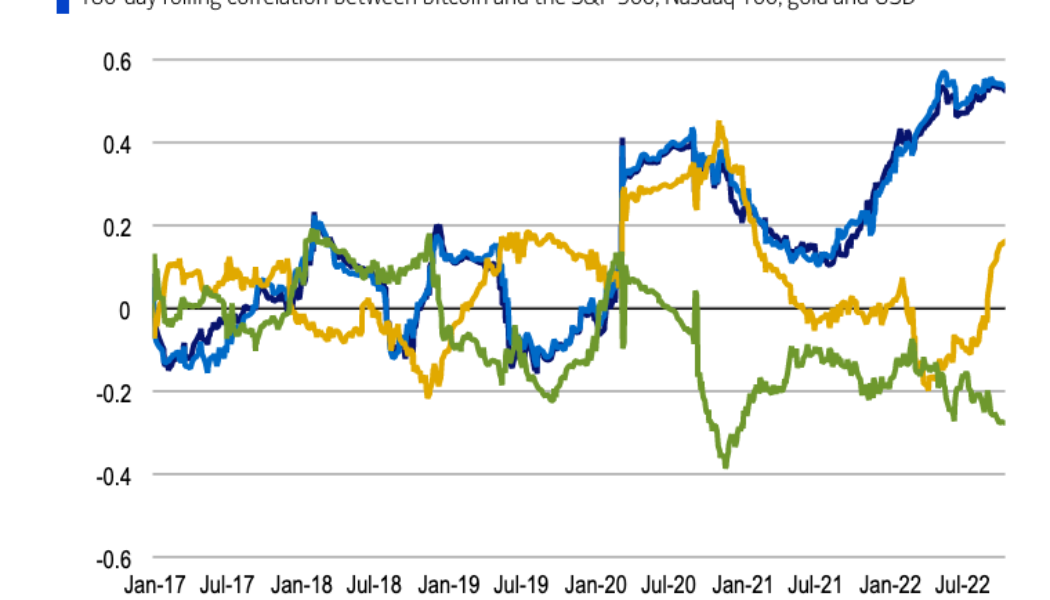

Gold vs BTC correlation signals Bitcoin becoming safe haven: BofA

Despite the ongoing cryptocurrency bear market, investors have been increasingly looking at Bitcoin (BTC) as a safe haven, a new study suggests. The rise in the correlation between Bitcoin and gold (XAU) is one of the major indicators demonstrating investors’ confidence in BTC amid the ongoing economic downturn, according to digital strategists at the Bank of America. Bitcoin’s correlation with gold — which is commonly viewed as an inflation hedge — has been on the rise this year, hitting its highest yearly levels in early October. The growing correlation trend started on Sept. 5 after remaining close to zero from June 2021 and turning negative in March 2022, BofA strategists Alkesh Shah and Andrew Moss said in the report. “Bitcoin is a fixed-supply asset that may eventually become an infl...

Crypto lender Hodlnaut seeks judicial management to avoid forced liquidation

Singapore-based crypto lending platform Hodlnaut is seeking judicial management to manage its ongoing liquidity crisis and avoid the forced liquidation of assets in the current bear market. The crypto lender informed its users in a Tuesday announcement that they have applied to the Singapore High Court to be placed under judicial management. The firm said: “We are aiming to avoid a forced liquidation of our assets as it is a suboptimal solution that will require us to sell our users’ cryptocurrencies such as BTC, ETH and WBTC at these current depressed asset prices. Instead, we believe that undergoing judicial management would provide the best chance of recovery.” Judicial management is a law in Singapore that allows financially troubled firms to rehabilitate themselves. Und...

Bitcoin hodling activity resembles previous market bottoms: Glassnode

The majority of Bitcoin has been “hodled” for at least three months in behavior bearing a striking resemblance to previous Bitcoin market bottoms, says blockchain analytics firm Glassnode. In a July 16 tweet, Glassnode noted that more than 80% of the total U.S. dollar (USD)-denominated wealth invested in Bitcoin has not been touched for at least three months. This signifies that the “majority of BTC coin supply is dormant” and that hodlers are “increasingly unwilling to spend at lower prices,” said the firm. Over 80% of the total USD denominated wealth invested in #Bitcoin has been HODLed for at least 3-months. This signifies that the majority of the $BTC coin supply is dormant, and HODLers are increasingly unwilling to spend at lower prices. Live Chart: https://t.co/lRtBe69Phz pic.twitter...

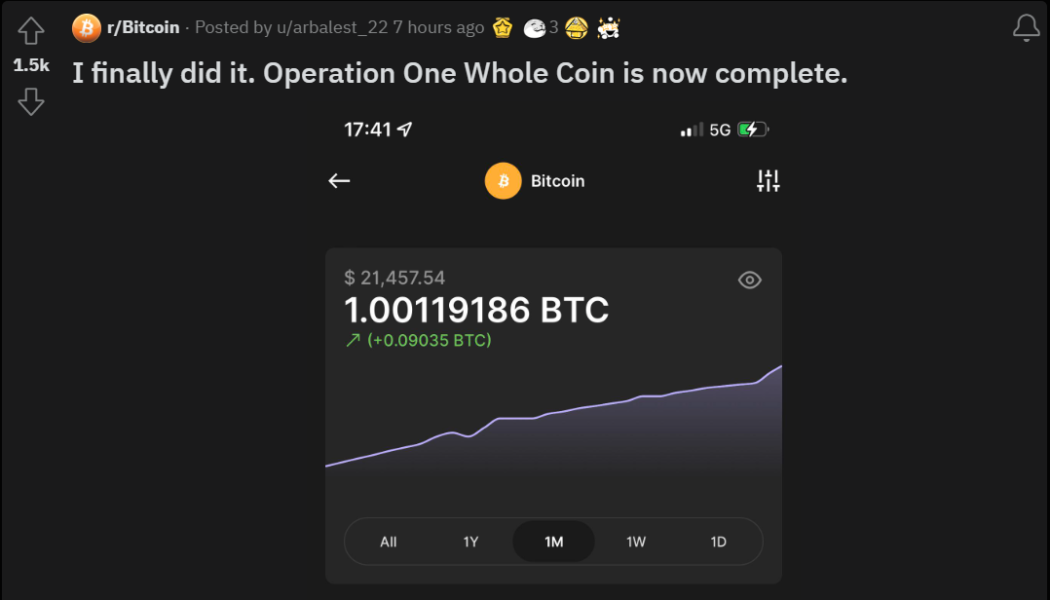

Small-time investors achieve the 1 BTC dream as Bitcoin holds $20k range

Ever since early Bitcoin (BTC) investors woke up millionaires as the ecosystem gained tremendous popularity alongside the mainstreaming of the internet, investors across the globe have been in the rush to accumulate as many of the 21 million BTC — one Satoshi at a time. With BTC recently trading at the $20,000 range for the first time since 2020, small-time investors found a small window of opportunity to achieve their dream of owning at least 1 BTC. On June 20, Cointelegraph reported that the number of Bitcoin wallet addresses containing one BTC or more increased by 13,091 in just 7 days. While the total number of addresses holding 1 BTC saw an immediate reduction in days to come, the crypto community on Reddit continues to welcome new crypto investors that hodled their way into becoming ...

El Salvador president addresses bear market concerns with Bitcoin hopium

El Salvador introduced BTC as legal tender on September 7, 2021, when its market price was around $50,000. Ever since, Bukele’s government made significant returns on their initial BTC investments as Bitcoin rallied to its all-time high of $69,000, which was redirected to the country’s various infrastructure development initiatives. However, as tensions rise amid falling BTC prices, Bukele decided to share advice for fellow Bitcoin investors that may be concerned about the prolonged bear market. Nayib Bukele, the president who helped Bitcoin (BTC) gain legal tender status in El Salvador, addressed the rising concerns of investors as BTC began trading for under $20,000 for the first time in 18 months. I see that some people are worried or anxious about the #Bitcoin market price. My advice: ...

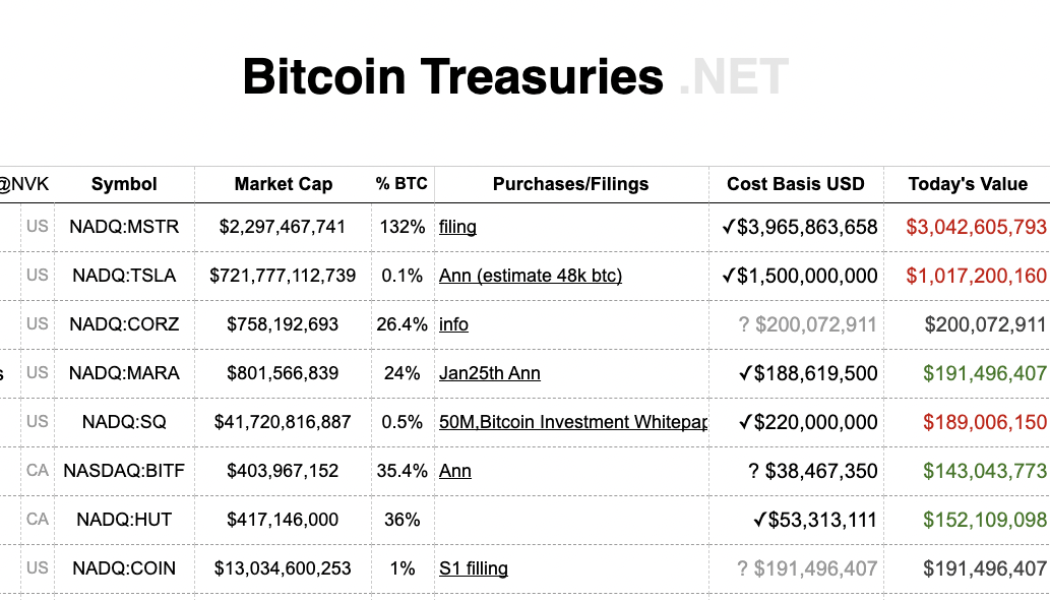

In this together: Musk and Saylor down a combined $1.5B on Bitcoin buys

As the bear market bites, holding crypto investments can be a tough pill to swallow. Consider two of the largest bag holders of publicly traded companies. They are down by almost $2 billion dollars on their Bitcoin buys. According to Bitcointreasuries.net, the 130,000 and 43,00 Bitcoin (BTC) held by Microstrategy and Tesla respectively are worth considerable sums less. The top “Hodlers” of Bitcoin according to Bitcointreasuries.net For Microstrategy, Michael Saylor splashed out almost $4 billion ($3,965,863,658) on 129,218 BTC, approximately 0.615% of the 21 million total supply. The Bitcoin price nosedive has ripped away earlier gains: the investment is worth $3.1 billion ($3,074,987,824), a loss of $900 million. Plus, in premarket trading on June 13, Microstrategy ...

Bitcoin Pizza Day rewind: A homage to weird and wonderful BTC purchases

Happy Bitcoin Pizza Day! Before you dial for a Margherita to commemorate the world’s first real-world Bitcoin transaction, here’s a slice of trivia: What do a family holiday to Japan, a 50 Cent album, a steak dinner, and a framed cat photo all have in common? They were all paid for with Bitcoin (BTC) by members of the Cointelegraph Bitcoin community! And just like the Bitcoin pizzas that cost 10,000 BTC, which are now worth more than $300 million, the community’s Bitcoin purchases have also skyrocketed. Benjamin de Waal, the VP of Engineering at Bitcoin exchange Swan Bitcoin told Cointelegraph, “I spent 7 BTC on a family trip to Japan a few years back.” In today’s value, 7 BTC is worth well over $200,000 — but Ben’s happy because his kids are happy: “It would have be...

- 1

- 2