Hedge Fund

Three Arrows Capital creditors express frustration with bankruptcy process during call

Kyle Davies, the co-founder of bankrupt hedge fund Three Arrows Capital (3AC), disclosed via a Twitter thread on Jan. 11 the creation of a 3AC creditors group amid complaints from creditors over bankruptcy costs. According to Davies, creditors continue to express frustration with the ongoing costs and handling of assets during the bankruptcy process, suggesting that “intercreditor disputes are delaying the process, and the estate value is not being maximized.” Today we held an ad hoc 3AC creditor meeting. All creditors are open to join and this will be a regular meeting. Here is an overview of the points discussed: 0/n — Kyle Davies (@KyleLDavies) January 11, 2023 The group’s first meeting discussed several topics, including ways to reduce “ongoing legal costs, pursue claims on a contingen...

3AC bankruptcy process faces challenges amid unknown whereabouts of founders

Liquidators for Three Arrows Capital (3AC) will have to present further documents in order to be granted permission to subpoena the now-bankrupt crypto hedge fund’s founders through Twitter, according to a decision from Judge Martin Glenn during a virtual hearing for the Southern District of New York Bankruptcy Court on Dec. 2. Lawyers representing the liquidators claimed that Zhu Su and Kyle Davies, co-founders of the hedge fund, have repeatedly failed to engage with liquidators over the recent months. “A communication protocol was agreed between the liquidators and founders but has not yielded satisfactory cooperation,” according to a hearing presentation. The liquidators claimed that the founders of the company are located in Indonesia and the United Arab Emirates, where it is difficult...

Why are institutions accumulating crypto in 2022? Fidelity researcher explains

Institutions’ investment in crypto has increased in 2022 despite the bear market, according to a recent survey by Fidelity Digital Assets. In particular, the amount of large investors betting on Ethereum have doubled in the last two years, as revelead by Chris Kuiper, the Head of Research at Fidelity Digital Assets in a recent interview with Cointelegraph. “The percentage of respondents saying they were invested in Ethereum doubled from two years ago”, pointed out Kuiper. Kuiper pointed out that Ethereum’s appeal in the eyes of institutions is likely to increase even more now that after the Merge, Ether has become a more environmentally friendly, yield-bearing asset. In general, according to the same survey, institutional players are accumulating crypto despite the cr...

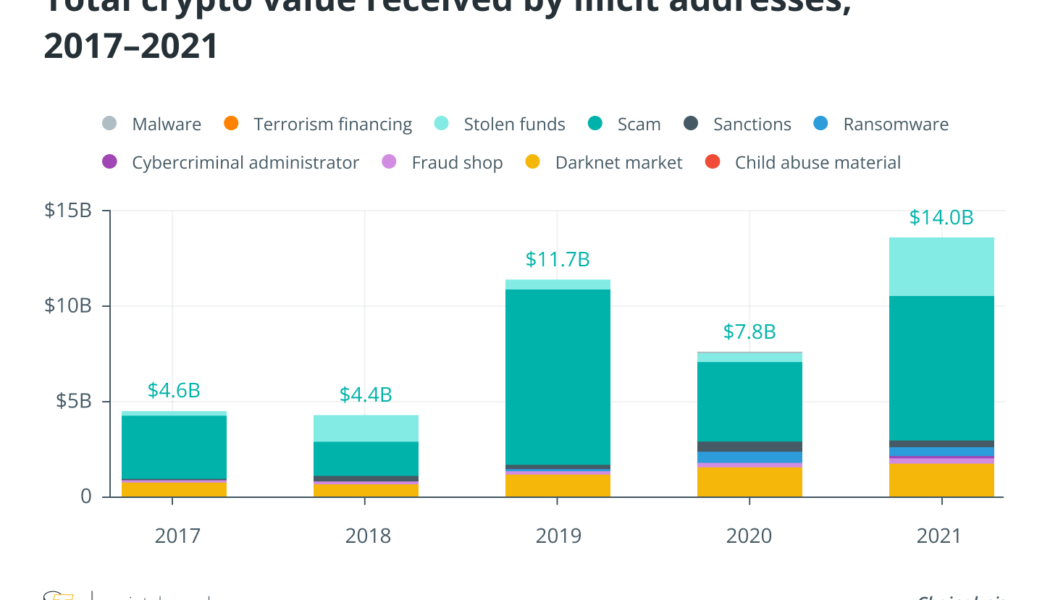

Institutional crypto adoption requires robust analytics for money laundering

Institutions have begun to take crypto seriously and have entered the space in numerous ways. As noted in a previous analysis, this has resulted in banks and fintechs looking at custody products and services for their clients. However, as custodians of clients’ assets, banks must also ensure they are clean assets and stay compliant. This is where on-chain analytics solutions have a huge role to play in understanding patterns in transactions to identify money laundering and other spurious activities within the cryptocurrency and digital assets space. According to a report by Chainalysis, over $14 billion of illicit transactions took place in 2021. Therefore, it is critical to build the foundational infrastructure around Anti-Money Laundering (AML) to support the growing institutional ...

Crypto Biz: The Voyager Digital auction is over — What now?

Voyager Digital filed for Chapter 11 bankruptcy in July after its exposure to the toxic Three Arrows Capital led to its ultimate downfall. This week, rumblings of a Voyager Digital auction surfaced, with Cointelegraph breaking the story on the afternoon of Sept. 26 after a reputable source confirmed the parties involved. A few hours later, a winner was announced: crypto exchange FTX US. But, not everyone is convinced that Voyager’s depositors will be taken care of. This week’s Crypto Biz chronicles the bidders involved in the Voyager Digital auction. It also documents the resignation of a disgruntled crypto boss and major funding plans from a blockchain-focused hedge fund. FTX US wins auction for Voyager Digital’s assets Cointelegraph reported this week that crypto exchanges FTX, Binance a...

Pantera plans to raise $1.25B for second blockchain fund: Report

Dan Morehead, founder and CEO of Pantera Capital, reportedly said the hedge fund was planning to raise $1.25 billion for a second blockchain fund. According to a Sept. 28 Bloomberg report, Morehead said Pantera aimed to close the blockchain fund by May. The fund will reportedly invest in digital tokens and equity in an effort to appeal to institutional investors. “We want to provide liquidity for people that are kind of giving up because we’re still very bullish for the next 10 or 20 years,” said the Pantera CEO, according to the report. Pantera Capital is seeking $1.25 billion for its second blockchain fund, founder Dan Morehead says https://t.co/H5AXy55hqa — Bloomberg Crypto (@crypto) September 28, 2022 Launched in 2013, Pantera was one of the first crypto funds in the United States at a...

CFTC and SEC open comments for proposal to amend crypto reporting rules for large hedge funds

The United States Securities and Exchange Commission, or SEC, and the Commodity Futures Trading Commission, or CFTC, have called for comments on a proposal which would require large advisers to certain hedge funds to report exposure to crypto. In a joint proposed rule published to the Federal Register on Sept. 1, the SEC and CFTC established a 40-day comment period for amendments to Form PF, the confidential reporting document for certain investment advisers to private funds of at least $500 million. The proposal suggested qualifying hedge funds report exposure to crypto in a different category other than “cash and cash equivalents,” as the current iteration of Form PR does not specifically mention cryptocurrencies. Members of the public have until Oct. 11 to submit comments regarding the ...

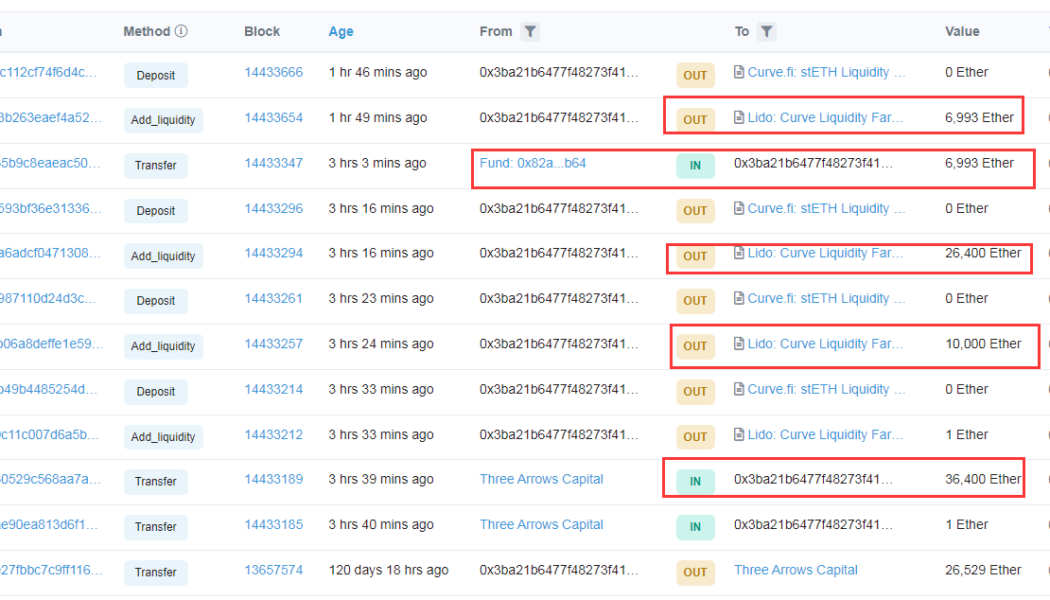

ETH price hits $3K as major crypto fund adds over $110M Ethereum to Lido’s staking pool

Ethereum’s native token Ether (ETH) rose above $3,000 on March 22 as fresh data suggests Three Arrows Capital staked at least $110 million worth of ETH into Lido’s liquidity pools. The Singapore-based hedge fund manager provided liquidity worth 36,401 ETH to Lido’s “Curve stETH pool” using a third-party Ether wallet, data from Etherscan shows. As a result, it became eligible to receive at least 36,401 stacked Ether (stETH) tokens from Lido: to ensure low slippage when un-staking those tokens for real ETH plus staking reward. Third-party Ethereum wallet that received ETH from Three Arrow Capital. Source: Etherscan.io Almost an hour later, another Ether address, marked with the word “fund,” sent 6,993 ETH (worth $21.12 million) to the ...

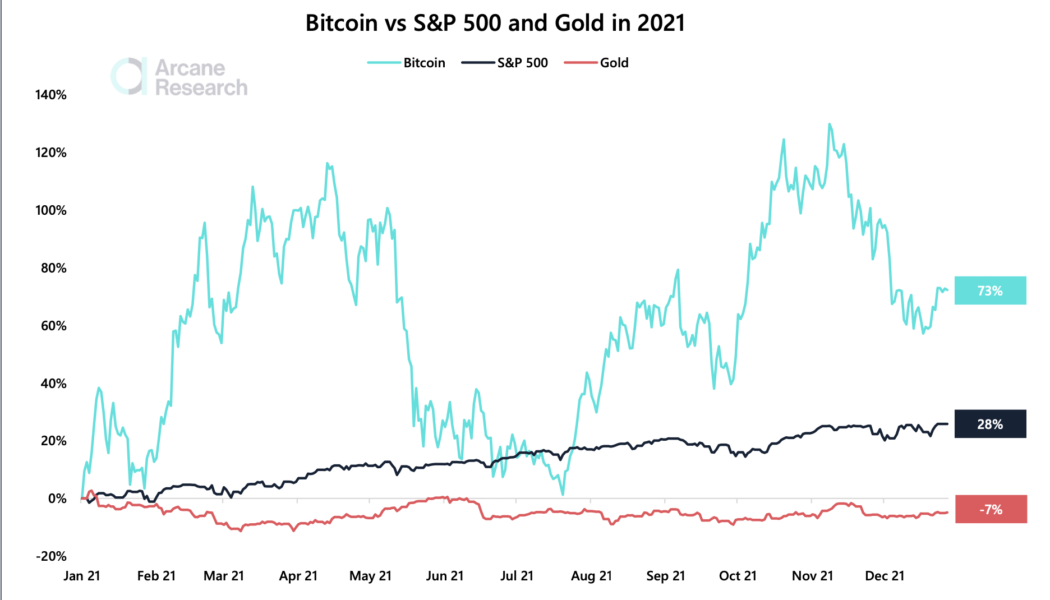

What BTC price slump? Bitcoin outperforms stocks and gold for 3rd year in a row

Bitcoin (BTC) may be down over 30% from its record high of $69,000, but it has emerged as one of the best-performing financial assets in 2021. BTC has bested the United States benchmark index the S&P 500 and gold. Arcane Research noted in its new report that Bitcoin’s year-to-date performance came out to be nearly 73%. In comparison, the S&P 500 index surged 28%, and gold dropped by 7% in the same period, which marks the third consecutive year that Bitcoin has outperformed the two. Bitcoin vs. S&P 500 vs. gold in 2021. Source: Arcane Research, TradingView At the core of Bitcoin’s extremely bullish performance was higher inflation. The U.S. consumer price index (CPI) logged its largest 12-month increase in four decades this November. “Most economists didn’t see the hig...