Hedge

USD stablecoin premiums surge in Argentina following economy minister’s resignation

Argentina, a country with one of the highest crypto adoption rates in the world, saw the price of dollar-pegged stablecoins surge across exchanges on Saturday after the abrupt resignation of its Economy Minister, Martin Guzman. The minister’s shock exit, confirmed on his Twitter account on July 3 via a seven-page letter, threatens to further destabilize a struggling economy battling high inflation and a depreciating national currency. According to data from Criptoya, the cost of buying Tether (USDT) using Argentinian pesos (ARS) is currently 271.4 ARS through the Binance exchange, which is around a 12% premium from before the resignation announcement, and a 116.25% premium compared to the current fiat exchange rate of USD/ARS. The local crypto price tracking website has also revealed...

More billionaires turning to crypto on fiat inflation fears

Previously anti-crypto investors are increasingly turning to Bitcoin and its brethren as a hedge against fiat currency inflation concerns. One example is Hungarian-born billionaire Thomas Peterffy who, in a Jan. 1 Bloomberg report, said that it would be prudent to have 2-3% of one’s portfolio in crypto assets just in case fiat “goes to hell”. He is reportedly worth $25 billion. Peterffy’s firm, Interactive Brokers Group Inc., announced that it would be offering crypto trading to its clients in mid-2020 following increased demand for the asset class. The company currently offers Bitcoin, Ethereum, Litecoin, and Bitcoin Cash, but will be expanding that selection by another 5-10 coins this month. Peterffy, who holds an undisclosed amount of crypto himself, said that it is possible that digita...

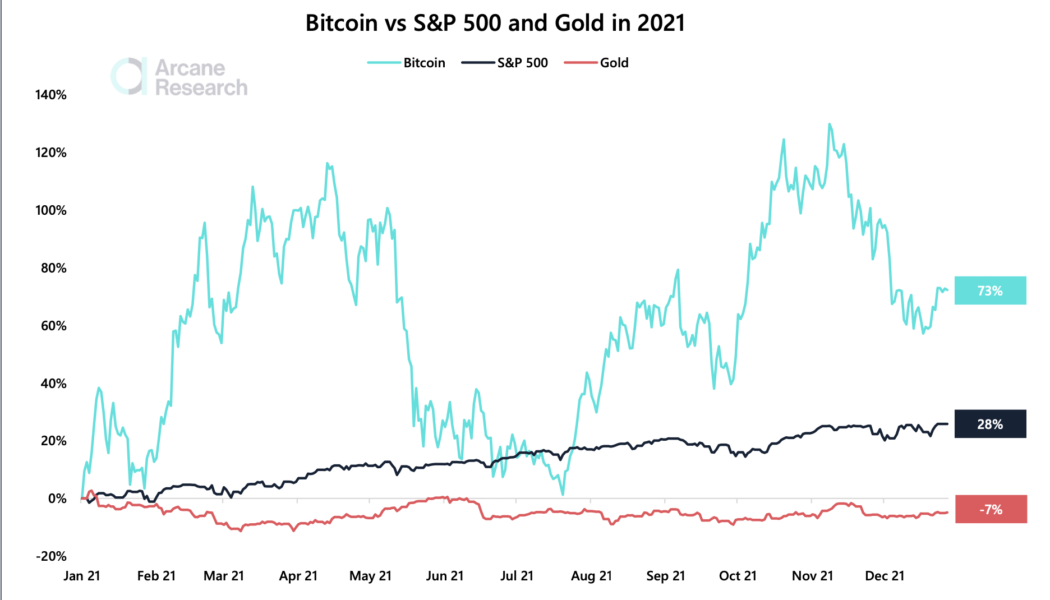

What BTC price slump? Bitcoin outperforms stocks and gold for 3rd year in a row

Bitcoin (BTC) may be down over 30% from its record high of $69,000, but it has emerged as one of the best-performing financial assets in 2021. BTC has bested the United States benchmark index the S&P 500 and gold. Arcane Research noted in its new report that Bitcoin’s year-to-date performance came out to be nearly 73%. In comparison, the S&P 500 index surged 28%, and gold dropped by 7% in the same period, which marks the third consecutive year that Bitcoin has outperformed the two. Bitcoin vs. S&P 500 vs. gold in 2021. Source: Arcane Research, TradingView At the core of Bitcoin’s extremely bullish performance was higher inflation. The U.S. consumer price index (CPI) logged its largest 12-month increase in four decades this November. “Most economists didn’t see the hig...