Hash Rate

US will see new ‘inflation spike’ — 5 things to know in Bitcoin this week

Bitcoin (BTC) begins the first week of 2023 in an uninspiring place as volatility stays away — along with traders. After failing to budge throughout the Christmas and new year break, BTC price action remains locked in a narrow range. Having sealed yearly losses of nearly 65% in 2022, Bitcoin has arguably seen a classic bear market year, but for the time being, few are actively predicting a recovery. The situation is complex for the average hodler, who is watching for macro triggers courtesy of the United States Federal Reserve and economic policy impact on dollar strength. Prior to Wall Street returning on Jan. 3, Cointelegraph takes a look at the factors at play when it comes to BTC price performance in the coming week and beyond. Bitcoin traders fear new lows amid flatlining price Bitcoi...

Rewind 2022: A crypto roundup of the year and stepping into 2023

Stepping into the year 2023, it’s time to pause and reflect on the accomplishments and struggles the global crypto community witnessed over the last 365 days. Starting from the very beginning of 2022, no investment strategy could help recover the falling portfolios across traditional and crypto ecosystems. January 2022 inherited a slightly collapsing market, wherein investments made on 2021 all-time high prices resulted in immediate losses. For many, especially the new entrants, falling crypto prices were perceived as an end game. But what went widely unnoticed was the community’s resilience and accomplishments against a global recession, orchestrated attacks and scams and an unforgiving bear market. As a result of falling prices, 2022 also inherited the 2021 hype around nonfun...

Record hash rates may see Big Oil become a major BTC mining player

Surging Bitcoin (BTC) network hash rates are causing problems for mining companies but might be rolling out the red carpet for energy giants. The Bitcoin hash rate, the amount of computing power given to the blockchain through mining, has reached another record peak. According to Blockchain.com, the metric hit an all-time high of 267 exahashes per second (EH/s) on Nov. 1 after increasing almost 60% since the beginning of the year. Commenting on the new peak, Capriole Fund founder Charles Edwards speculated that highly efficient government and oil company enterprises were entering the mining game at scale. New Bitcoin hash rate world record! 9% higher than the prior all time high set just a few days ago. I have no doubt that we have serious, highly efficient government & oil company ent...

Bitcoin price due sub-$20K dip, traders warn amid claim miners ‘capitulating’

Bitcoin (BTC) climbed back to $20,500 at the Oct. 28 Wall Street open as United States equities sought a stronger finish to the week. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bets that $20,000 will fail as support increase Data from Cointelegraph Markets Pro and TradingView showed BTC/USD capitalizing on renewed optimism as markets began trading. The atmosphere was volatile after tech stocks suffered a major out-of-hours rout, with Bitcoin managing to avoid sustaining knock-on losses to the same extent. At the time of writing, the S&P 500 and Nasdaq Composite Index were both up around 1.3%. “In this current range bound phase after a prolonged downtrend,” popular trader CryptoYoddha summarized to Twitter followers. “Smart money/Institutional players aim to build up or...

Bitcoin’s discount to hash rate highest since early 2020 — Mike McGlone

Bloomberg Intelligence senior commodity strategist Mike McGlone says Bitcoin’s (BTC) relative discount to its high hash rate in October — the largest since the first quarter of 2020 — could soon see Bitcoin return to “its propensity to outperform most assets.” In an Oct. 19 Twitter post, the Bloomberg analyst suggested that Bitcoin’s ever-increasing hash rate — a measure of the processing power and security of a blockchain — relative to its price points “to risk/reward leaning favorably.” Many believe that in theory, Bitcoin’s hash rate should go up relative to its price. McGlone pointed to a graph noting that the 10-day average of Bitcoin’s hash rate in October is “roughly equivalent” to the level it should be at around $70,000. However, the price is instead currently at $19,500...

Bitcoin mining difficulty set for 8-month record gains despite BTC price dip

Bitcoin (BTC) may have hit six-week lows of under $20,000 but its network fundamentals are anything but bearish. The latest on-chain data shows that, far from capitulating, hash rate and difficulty are making snap gains. Data supports “doozy” difficulty jump Despite being down around 7% in a week, BTC/USD is not putting off miners, who have recently exited their own multi-month capitulation phase. Now, with hardware and competition returning to the network, fundamental indicators are firmly in “up only” mode as August draws to a close. This is neatly captured by difficulty — an expression of, among other things, the scale of competition among miners for block subsidies — which is due to increase by an estimated 6.8% next week. According to data from on-chain monitor...

SBI lost 40% of hash rate after stopping mining in Russia: Data

Japanese financial giant SBI Holdings has partly terminated cryptocurrency mining in Russia due to geopolitical uncertainty and the crypto winter. SBI Holdings suspended mining operations in Russia’s crypto mining-rich region of Siberia, citing reasons like Russia-Ukraine conflict and the ongoing bear market, Bloomberg reported on Thursday. The Japanese online brokerage shut down the Siberian mining operations shortly after Russia started a military intervention in Ukraine on Feb. 24, a spokesperson for the firm reportedly said. The termination contributed to SBI’s crypto asset business reporting a pretax loss of 9.7 billion yen ($71 million) in Q2 202. As a result, the Sumitomo Mitsui Financial Group-backed group recorded a 2.4 billion yen ($17.5 million) in net losses, reportedly posting...

Australia-based crypto miner doubles hash rate after energizing Canadian rigs

Australian Bitcoin miner Iris Energy said it had increased its hash rate to more than 2.3 exahashes per second following the completion of phase two of its operations in Mackenzie, Canada. In a Monday announcement, Iris Energy said it had brought 41 megawatts of operating capacity in the British Columbia municipality online roughly two months ahead of schedule, adding 1.5 EH/s to its existing hash rate. In addition, the Bitcoin (BTC) miner expects to bring another 50 MW online in Prince George by the end of the third quarter of 2022, increasing its operating capacity to 3.7 EH/s. Iris Energy co-founder and co-CEO Daniel Roberts said the firm had energized the facility on schedule “despite the current market backdrop and ongoing international supply chain challenges.” The firm planned to de...

Will the Fed prevent BTC price from reaching $28K? — 5 things to know in Bitcoin this week

Bitcoin (BTC) enters a new week with a question mark over the fate of the market ahead of another key United States monetary policy decision. After sealing a successful weekly close — its highest since mid-June — BTC/USD is much more cautious as the Federal Reserve prepares to hike benchmark interest rates to fight inflation. While many hoped that the pair could exit its recent trading range and continue higher, the weight of the Fed is clearly visible as the week gets underway, adding pressure to an already fragile risk asset scene. That fragility is also showing in Bitcoin’s network fundamentals as miner strain becomes real and the true cost of mining through the bear market shows. At the same time, there are encouraging signs from some on-chain metrics, with long-term investors still re...

Bitcoin network difficulty drops to 27.693T as hash rate eyes recovery

The difficulty in mining a block of Bitcoin (BTC) was reduced further by 5% to 27.693 trillion as network difficulty maintains its three-month-long downward streak ever since reaching an all-time high of 31.251 trillion back in May 2022. Network difficulty is a means devised by Bitcoin creator Satoshi Nakamoto to ensure the legitimacy of all transactions using raw computing power. The reduced difficulty allows Bitcoin miners to confirm transactions using lower resources, enabling smaller miners a fighting chance to earn the mining rewards. Despite the minor setback, zooming out on blockchain.com’s data reveals that Bitcoin continues to operate as the most resilient and immutable blockchain network. While the difficulty adjustment is directly proportional to the hashing power of miner...

Bitcoin’s bottom might not be in, but miners say it ‘has always made gains over any 4-year period’

Your favorite trader is saying Bitcoin (BTC) bottomed. At the same time, the top on-chain indicators and analysts are citing the current price range as a “generational buy” opportunity. Meanwhile, various crypto and finance media recently reported that Bitcoin miners sending a mass of coins to exchanges are a sign that $17,600 was the capitulation move that pins the market bottom. There’s so much assurity from various anon and doxed analysts on Crypto Twitter, yet Bitcoin price is still in a clear downtrend, and the metrics don’t fully reflect that traders are buying every dip. A critical component of BTC price that many investors often overlook is the condition and sentiment of Bitcoin miners, which is exactly why Cointelegraph had a chat with Rich Ferolo of Blockware Solutions and ...

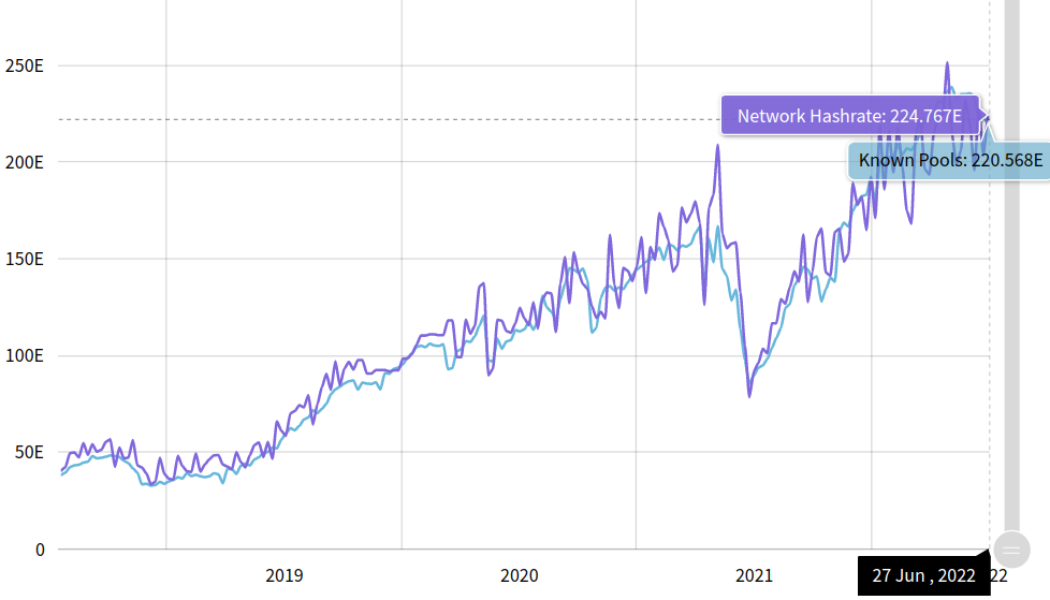

3 charts showing this Bitcoin price drop is unlike summer 2021

Bitcoin (BTC) bear markets come in many shapes and sizes, but this one has given many reason to panic. BTC has been described as facing “a bear of historic proportions” in 2022, but just one year ago, a similar feeling of doom swept crypto markets as Bitcoin saw a 50% drawdown in weeks. Beyond price, however, 2022 on-chain data looks wildly different. Cointelegraph takes a look at three key metrics demonstrating how this Bitcoin bear market is not like the last. Hash rate Everyone remembers the Bitcoin miner exodus from China, which effectively banned the practice in one of its most prolific areas. While the extent of the ban has since come under suspicion, the move at the time saw huge numbers of network participants relocate — mostly to the United States — in a matter of week...