Hard Fork

EOS price jumps 20% for biggest gain in 15 months — What’s fueling the uptrend?

EOS rose approximately 20% to reach $1.66 on Aug. 17 and was on track to log its best daily performance since May 2021. Initially, the EOS rally came in the wake of its positive correlation with top-ranking cryptocurrencies like Bitcoin (BTC) and Ether (ETH), which gained over 2% and 3.75%, respectively. But, the upside move was also driven by a flurry of uplifting updates emerging from the EOS ecosystem. EOS/USD daily price chart. Source: TradingView EOS incentive program launch On Aug. 14, the EOS Network Foundation (ENF), a nonprofit organization that oversees the growth and development of the EOS blockchain, opened registrations for its upcoming Yield+ incentive program. The Yield+ is a liquidity incentive and reward program to attract decentralized finance (DeFi) application...

Vitalik: Centralized USDC could decide the future of contentious ETH hard forks

Ethereum co-founder Vitalik Buterin says that centralized stablecoins such as Tether (USDT) and Circle USD (USDC) could become “a significant decider in future contentious hard forks.” Buterin was speaking at the BUIDL Asia conference in Seoul on Aug. 3, along with Illia Polosukhin, the co-founder of Near Protocol (NEAR) to discuss Ethereum’s upcoming Merge. The Ethereum co-founder argued that centralized stablecoins could be a “significant” decider of which blockchain protocol the industry would “respect” in hard forks. A hard fork occurs when there is a radical change to the protocol of a blockchain network that effectively results in two versions. Usually, one chain ends up being preferred over another. “At the moment of the merge, you will have two [separate] networks […] and then you ...

Ethereum futures backwardation hints at 30% ‘airdrop rally’ ahead of the Merge

Ether (ETH) bulls like a positive spread between its spot and ETH futures prices because the so-called contango reflects optimism about a higher rate in the future. But as of Aug. 1, the Ethereum futures curve slid in the opposite direction. Ethereum quarterly futures in backwardation On the daily chart, Ethereum futures quarterly contracts, scheduled to expire in December 2022, have slipped into backwardation, a condition opposite to contango, wherein the futures price becomes lower than the spot price. The spread between Ethereum’s spot and futures price grew to -$8 on Aug. 1. ETH230-ETHUSD daily price chart. Source: TradingView One one hand, the current ETH spot price being higher than its year-end outlook appears like a bearish sign. However, the conditions surrou...

Can Cardano’s July hard fork prevent ADA price from plunging 60%?

Cardano (ADA) has started painting a bearish continuation pattern on its longer-timeframe charts, raising its likelihood of undergoing a major price crash by August. ADA price in danger of a 60% plunge Dubbed the “bear pennant,” the pattern forms when the price consolidates inside a range defined by a falling trendline resistance and rising trendline support after a strong move downside. Additionally, the consolidation moves accompany a decrease in trading volumes. Bear pennants typically resolve after the price breaks below their trendline support and, as a rule, could fall by as much as the height of the previous big downtrend, called a “flagpole,” as illustrated in the chart below. ADA/USD three-day price chart featuring “bear pennant'”setup. So...

Terra (LUNA) 2.0 relaunches according to Do Kwon’s revival plan

Do Kwon, the co-founder and CEO of Terraform Labs, confirmed the relaunch of Terra’s new chain, Terra 2.0, which aims to revive the fallen Terra (LUNA) and TerraUSD (UST) ecosystem. Kwon’s revival plan for Terra involves hard forking the existing blockchain and reissuing LUNA tokens to existing investors based on a snapshot before the death spiral bled the LUNA and UST markets — effectively resulting in unrecoverable losses for investors. Pheonix-1 mainnet is now live and producing blocks – public node services, wallets and explorers should be going live shortly. pic.twitter.com/cpxiNKl6aX — Do Kwon (@stablekwon) May 28, 2022 Dubbed Phoenix-1, the Terra 2.0 mainnet went live today, May 28, as per the original timeline set by Terra developers and started producing blocks. ...

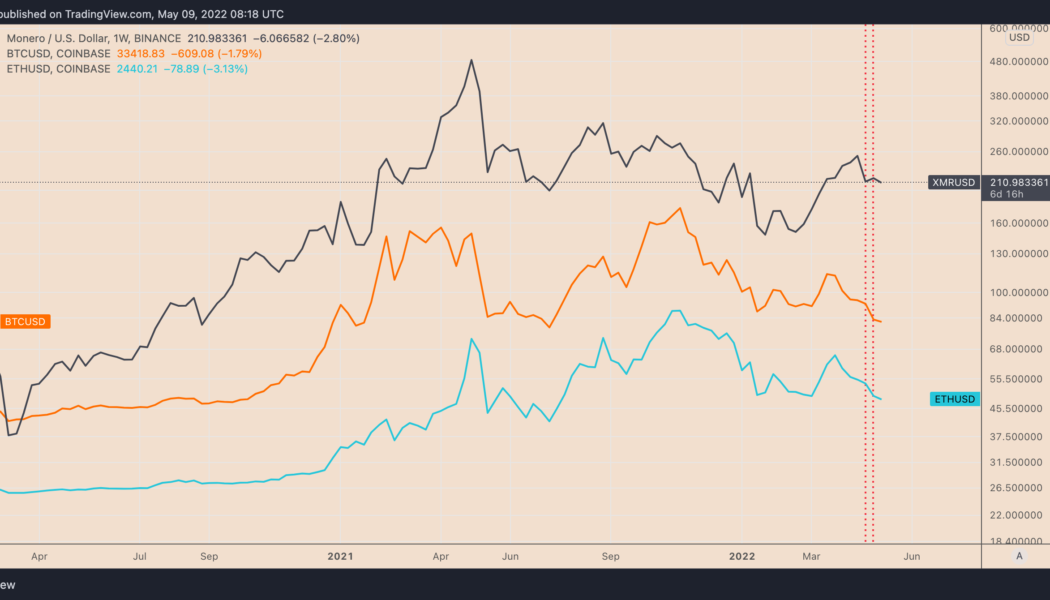

Monero avoids crypto market rout, but XMR price still risks 20% drop by June

Monero (XMR) has shown a surprising resilience against the United States Federal Reserve’s hawkish policies that pushed the prices of most of its crypto rivals — including the top dog Bitcoin (BTC) — lower last week. XMR price closed the previous week 2.37% higher at $217, data from Binance shows. In comparison, BTC, which typically influences the broader crypto market, finished the week down 11.55%. The second-largest crypto, Ether (ETH), also plunged 11% in the same period. XMR/USD vs. BTC/USD vs. ETH/USD weekly price chart. Source: TradingView While the crypto market wiped off $163.25 billion from its valuation last week, down nearly 9%, Monero’s market cap increased by $87.7 million, suggesting that many traders decided to seek safety in this privacy-focused coin. XMR near ...

Monero ‘falling wedge’ breakout positions XMR price for 75% rally

Monero (XMR) price dropped by nearly 10% three days after establishing a week-to-date high around $290 on April 24. Nonetheless, several technical indicators suggest that the XMR/USD pair is poised to resume its uptrend over the next few months. Falling wedge breakout underway Notably, XMR’s price broke out of its “falling wedge” structure in late March. It continued its move upside in the later daily sessions, with rising volumes indicating bullish sentiment among Monero traders. Traditional analysts consider falling wedges as bullish reversal patterns, i.e., the price first consolidates within a contracting, descending channel, followed by a strong bounce to the upside. As a rule, the falling wedge’s breakout target comes to be near the level at length equal to th...

- 1

- 2