Grayscale

Ethereum is like the best and worst parts of New York: Grayscale

Digital asset manager Grayscale has published a report on smart contract platforms in which it likens the Ethereum (ETH) blockchain to the best and worst parts of New York City. The report examines the granddaddy smart contract network Ethereum in comparison to newer competing blockchains such as Solana (SOL), Avalanche (AVAX), Polkadot (DOT), Cardano (ADA) and Stellar (XLM). The report comes in the wake of the firm launching a crypto fund dedicated to smart contract platforms excluding Ethereum. In a section titled “digital cities,” Grayscale analyzed Ethereum, Avalanche and Solana. The firm compared Ethereum to the Big Apple, noting that they both share similarities with issues that arise from their stature: “Ethereum is like New York City: it is vast, expensive, and congested in certain...

Grayscale considering lawsuit if SEC rules against its BTC Trust conversion

The digital assets management firm is not sparing any resources in converting its Bitcoin Trust offering to a Bitcoin ETF Grayscale CEO noted that the firm would go to all lengths to achieve the goal, including a legal battle with the SEC Pressure is mounting on the US Securities and Exchange Commission (SEC) in regards to a spot crypto ETF approval. The regulator has stood its ground, rejecting most Bitcoin ETF applications filed by asset managers and other financial institutions. The SEC recently rejected proposals from the Bitcoin-focused investment firm NYDIG and fund management company Global X. In January, the Gary Gensler-led agency punted (not the first time) on the NYDIG spot Bitcoin ETF proposal before finally delivering the blow this month. Thus far, the list of rejected spot bi...

Crypto Biz: Do you believe in Ethereum killers? Put your money where your mouth is, March 18–24

While crypto markets are still in a state of “fear,” as evidenced by Bitcoin’s Fear & Greed Index, the industry as a whole is giving us reasons to be bullish. Large venture funding rounds, growing adoption of decentralized governance models and new institutional-grade product offerings suggest that crypto is more than just daily chart patterns. This week’s Crypto Biz newsletter looks at a new Grayscale product that’s giving accredited investors more ways to bet on the so-called “Ethereum killers.” We also document two funding stories and draw your attention to the latest developments surrounding El Salvador’s Bitcoin (BTC) bond. Grayscale launches smart contract fund for Ethereum competitors Grayscale Investments, the world’s largest digital asset manager, has officially launched...

Cardano pares most of its Q1 losses as ADA rebounds 60% in a month — What’s next?

Cardano (ADA) inched higher on March 25, putting itself on course recoup a great portion of losses that it had incurred in the first two months of this year. Cardano: not so bullish yet? ADA’s price jumped by around 7.5% in trading Friday, reaching $1.19 over a month after bottoming out at around $0.75. The Cardano token’s huge rebound move netted around 60% in gains. Nonetheless, it remained at the risk of losing its upside momentum in the coming weeks. At the core of this bearish analogy is a multi-month descending channel pattern, with a reliable track record of causing and limiting ADA’s rebound attempts simultaneously since September 2021. The channel’s upper trendline particularly has served as an ideal selloff zone, now being tested again as resistance, as sh...

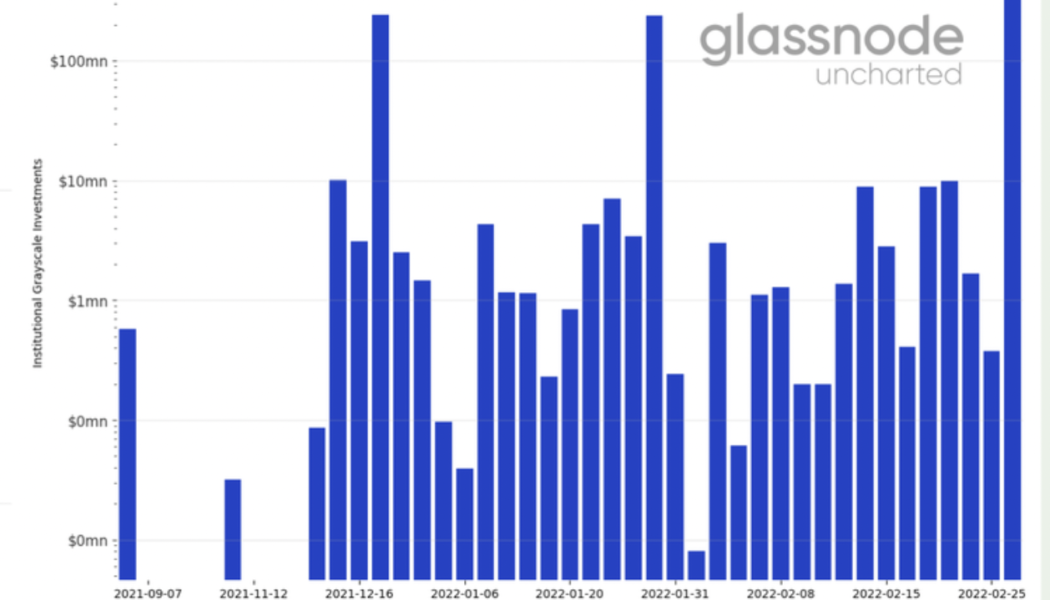

Institutions increase exposure to Grayscale Bitcoin Trust as GBTC discount nears 30%

Institutional investors are returning to accumulate Grayscale Bitcoin Trust (GBTC) shares as the discount to spot price his risen to nearly 30%, data on Glassnode shows. Since December 2021, some weekly sessions saw investors pouring in between $10 million and $120 million into Grayscale’s flagship fund. Meanwhile, the biggest capital inflow — amounting to nearly $140 million — appeared in the week ending on Feb. 25, as shown in the chart below. Institutional Grayscale Investments since September 2021. Source: Glassnode No selloff yet among high-profile GBTC backers The GBTC trust attracted investments as global markets faced back-to-back shocks in the past few months, including a dramatic selloff in the technology stocks, followed by Russia’s invasion of Ukraine that left many...

Institutions increase exposure to Grayscale Bitcoin Trust as GBTC discount nears 30%

Institutional investors are returning to accumulate Grayscale Bitcoin Trust (GBTC) shares as the discount to spot price his risen to nearly 30%, data on Glassnode shows. Since December 2021, some weekly sessions saw investors pouring in between $10 million and $120 million into Grayscale’s flagship fund. Meanwhile, the biggest capital inflow — amounting to nearly $140 million — appeared in the week ending on Feb. 25, as shown in the chart below. Institutional Grayscale Investments since September 2021. Source: Glassnode No selloff yet among high-profile GBTC backers The GBTC trust attracted investments as global markets faced back-to-back shocks in the past few months, including a dramatic selloff in the technology stocks, followed by Russia’s invasion of Ukraine that left many...

Grayscale Bitcoin ETF proposal sees support from the public

The US Securities and Exchange Commission (SEC) made a provision for comments from the people on the subject of Grayscale converting its BTC Trust into a spot ETF The financial watchdog has in the past publicly shown inclination towards indirect crypto ETFs as opposed to spot ETFs Earlier this month, the SEC shared its concerns on the Grayscale Bitcoin Trust exchange-traded fund (ETF) conversion proposal – mostly revolving around manipulation, fraud and investor protection. The commission also expressed its uncertainty over the propriety of Bitcoin as the underlying asset, asking the public to give its views on the same. The agency set a 21-day window for providing the comments and 14 days for replies to the shared view. The US markets regulator has since received many comments regarding t...

Overwhelming support for Grayscale BTC Trust ETF conversion proposal

The U.S. Securities and Exchange Commission has allowed comments and feedback on a proposed rule change that would convert Grayscale’s Bitcoin Trust to a spot-based exchange-traded fund (ETF). A notice of filing a proposed rule change to list and trade shares of Grayscale Bitcoin Trust as a spot-based ETF has generated a long list of comments with a large majority in approval. Bloomberg’s senior ETF analyst Eric Balchunas had a look through some of the more recent comments on Feb. 15 observing that 95% are in favor of the proposed conversion. Just glancing through the many comments from ppl to the SEC re converting $GBTC to an ETF and 95% are in favor of it and most using real names and pointing to the stupefying fact that futures ETF ok but spot not. eg: pic.twitter.com/j15iNYnh8R — Eric ...

SEC again delays decision on Grayscale’s Bitcoin ETF

The United States Securities and Exchange Commission (SEC) has once again delayed its ruling on whether to approve Grayscale’s application for a Bitcoin (BTC) exchange-traded fund (ETF), citing familiar concerns around manipulation, liquidity and transparency. In a notice published Friday afternoon, the SEC expressed concerns about how the digital asset manager intends to convert its Grayscale Bitcoin Trust (GBTC) into a spot ETF. Namely, the regulator wasn’t convinced that Grayscale’s proposal was designed to prevent alleged fraud and manipulation in the Bitcoin market. The SEC has invited the public to comment on these issues, giving interested parties 21 days to respond in writing. The SEC has just delayed their decision on whether GBTC can convert to a bitcoin ETF. — Pomp (@APomp...

Early birds: U.S. legislators invested in crypto and their digital asset politics

According to some estimates, as many as 20% of Americans were invested in cryptocurrencies as of August 2021. While the exact number can vary significantly from one poll to another, it is clear that cryptocurrencies are no longer just a niche passion project for tech enthusiasts or a tool for financial speculation. Rather, digital assets have become a widespread investment vehicle with the prospect of becoming mainstream. Optimistic as that is, this level of mass adoption still does not enjoy a commensurate political representation, with senior United States politicians largely lagging behind the curve of crypto adoption. This makes the very narrow group of congresspeople who are also hodlers particularly interesting. As a lawmaker, does owning crypto, or at least having some crypto ...

Crypto funds attracted $9.3B in inflows in 2021 as institutional adoption grew

Institutional cryptocurrency funds attracted record inflows in 2021, as demand for digital assets such as Bitcoin (BTC) and Ether (ETH) continued to grow during a volatile and often unpredictable bull market. Crypto investment products registered $9.3 billion in inflows during the year, up from $6.8 billion in 2020, according to the latest CoinShares data, which was released on Tuesday. Bitcoin funds attracted $6.3 billion worth of capital last year, while Ether products saw inflows totaling nearly $1.4 billion. Multi-asset funds were also popular, attracting $775 million in investor capital. A total of 37 investment products launched in 2021, compared with 24 that hit the market the year before. Notably, crypto assets that were included in investment products expanded to 15 from nin...

Grayscale rebalances DeFi Fund dropping Balancer (BAL) and UMA

Crypto asset manager Grayscale Investments has rebalanced its Grayscale DeFi Fund and adjusted weightings of its Digital Large Cap Fund. A Jan. 3 announcement detailed the changes Grayscale made to its two funds. The DeFi Fund’s weightings have been rebalanced with AMP, the native collateral token of the Flexa payment network being added, while Bancor’s (BNT) and Universal Market Access (UMA) have been removed. Flexa uses the AMP token to collateralize crypto payments and settles them in fiat to recipients enabling merchants to accept crypto easily. Grayscale reshuffled weightings but did not change the token list of The Grayscale Digital Large Cap Fund (GDLC). We have just announced updated component weightings for Grayscale #DeFi Fund, which now includes $AMP. This is the first time AMP ...