Grayscale Bitcoin Trust

The biggest Bitcoin fund just hit a record -35% discount — A warning for BTC price?

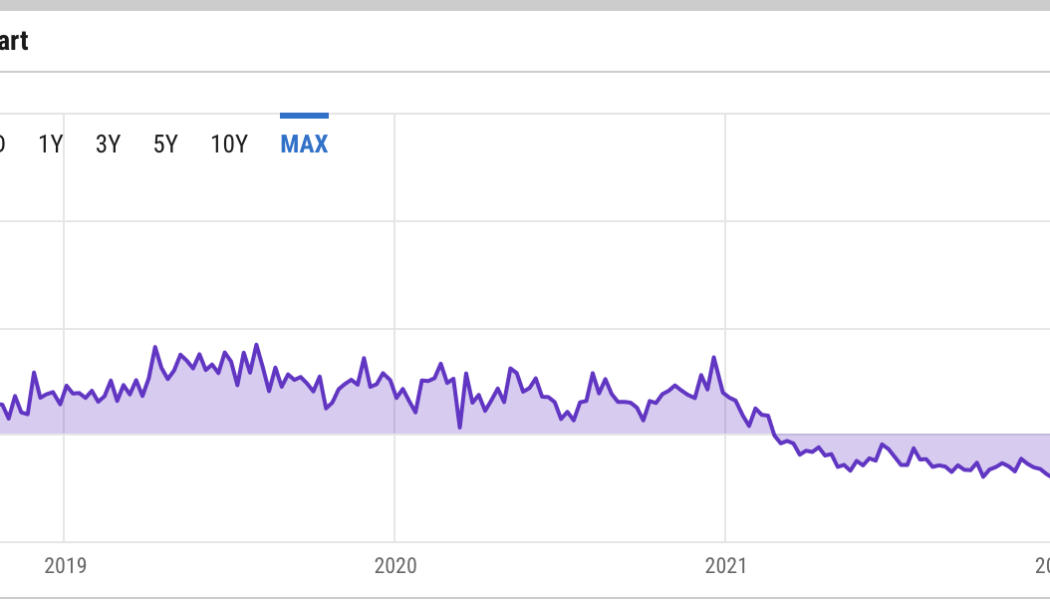

Grayscale Bitcoin Trust (GBTC), a cryptocurrency fund that currently holds 3.12% of the total Bitcoin (BTC) supply, or over 640,000 BTC, is trading at a record discount compared to the value of its underlying assets. Institutional interest in Grayscale dries up On Sep. 23, the $12.55 billion closed-end trust was trading at a 35.18% discount, according to the latest data. GBTC discount versus spot BTC/USD price. Source: YCharts To investors, GBTC has long served as a great alternative to gain exposure in the Bitcoin market despite its 2% annual management fee. This is primarily because GBTC is easier to hold for institutional investors because it can be managed via a brokerage account. For most of its existence, GBTC traded at a hefty premium to spot Bitcoin prices. But It starte...

Grayscale considering lawsuit if SEC rules against its BTC Trust conversion

The digital assets management firm is not sparing any resources in converting its Bitcoin Trust offering to a Bitcoin ETF Grayscale CEO noted that the firm would go to all lengths to achieve the goal, including a legal battle with the SEC Pressure is mounting on the US Securities and Exchange Commission (SEC) in regards to a spot crypto ETF approval. The regulator has stood its ground, rejecting most Bitcoin ETF applications filed by asset managers and other financial institutions. The SEC recently rejected proposals from the Bitcoin-focused investment firm NYDIG and fund management company Global X. In January, the Gary Gensler-led agency punted (not the first time) on the NYDIG spot Bitcoin ETF proposal before finally delivering the blow this month. Thus far, the list of rejected spot bi...

Institutions increase exposure to Grayscale Bitcoin Trust as GBTC discount nears 30%

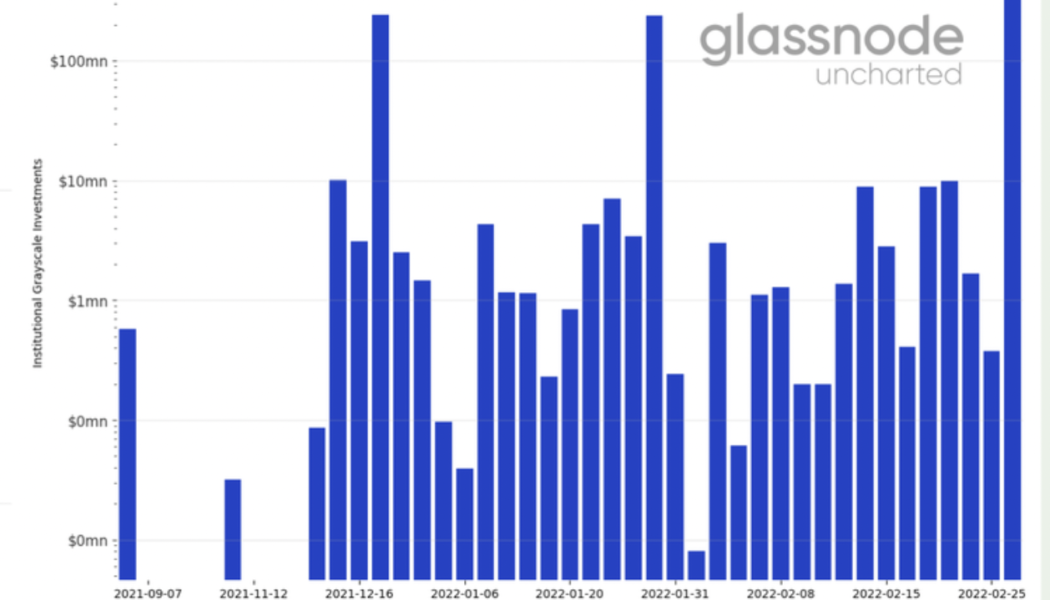

Institutional investors are returning to accumulate Grayscale Bitcoin Trust (GBTC) shares as the discount to spot price his risen to nearly 30%, data on Glassnode shows. Since December 2021, some weekly sessions saw investors pouring in between $10 million and $120 million into Grayscale’s flagship fund. Meanwhile, the biggest capital inflow — amounting to nearly $140 million — appeared in the week ending on Feb. 25, as shown in the chart below. Institutional Grayscale Investments since September 2021. Source: Glassnode No selloff yet among high-profile GBTC backers The GBTC trust attracted investments as global markets faced back-to-back shocks in the past few months, including a dramatic selloff in the technology stocks, followed by Russia’s invasion of Ukraine that left many...

Institutions increase exposure to Grayscale Bitcoin Trust as GBTC discount nears 30%

Institutional investors are returning to accumulate Grayscale Bitcoin Trust (GBTC) shares as the discount to spot price his risen to nearly 30%, data on Glassnode shows. Since December 2021, some weekly sessions saw investors pouring in between $10 million and $120 million into Grayscale’s flagship fund. Meanwhile, the biggest capital inflow — amounting to nearly $140 million — appeared in the week ending on Feb. 25, as shown in the chart below. Institutional Grayscale Investments since September 2021. Source: Glassnode No selloff yet among high-profile GBTC backers The GBTC trust attracted investments as global markets faced back-to-back shocks in the past few months, including a dramatic selloff in the technology stocks, followed by Russia’s invasion of Ukraine that left many...

Grayscale Bitcoin ETF proposal sees support from the public

The US Securities and Exchange Commission (SEC) made a provision for comments from the people on the subject of Grayscale converting its BTC Trust into a spot ETF The financial watchdog has in the past publicly shown inclination towards indirect crypto ETFs as opposed to spot ETFs Earlier this month, the SEC shared its concerns on the Grayscale Bitcoin Trust exchange-traded fund (ETF) conversion proposal – mostly revolving around manipulation, fraud and investor protection. The commission also expressed its uncertainty over the propriety of Bitcoin as the underlying asset, asking the public to give its views on the same. The agency set a 21-day window for providing the comments and 14 days for replies to the shared view. The US markets regulator has since received many comments regarding t...