Grayscale

Grayscale files brief in ETF suit against SEC, oral arguments may come within months

Grayscale filed a reply brief in its appeal of the United States Securities and Exchange Commission (SEC) denial of its application to convert its $12-billion Grayscale Bitcoin Trust (GBTC) into a spot-based Bitcoin (BTC) exchange-traded fund (ETF). The brief, filed in the District of Columbia Circuit Court, addressed points made in the SEC reply brief filed in December and restated its own arguments. The SEC based its decision on findings that Grayscale’s proposal did not sufficiently protect against fraud and manipulation. The agency had made similar findings in a number of earlier applications to create spot-based BTC ETFs. 1/ As part of our suit challenging the SEC’s decision to deny $GBTC conversion to a spot #bitcoin #ETF, @Grayscale just filed our Reply Brief with the DC Circu...

Grayscale CEO highlights 20% GBTC share buyback option if ETF conversion fails

The proposed offer would require both SEC relief and shareholders’ approval. According to an end-of-year letter to investors published on Dec. 10, Grayscale Investments’ CEO Michael Sonnenshein said that the firm may consider “a tender offer for a portion of the outstanding shares of GBTC [Grayscale Bitcoin Trust]” if the latter’s exchange-traded fund conversion process is ultimately unsuccessful. Sonnenshein stated that “such tender offer would be for no more than 20% of the outstanding shares of GBTC” and would require both regulatory “relief” from the U.S. Securities and Exchange Commission as well as shareholder approval to approve such offer. Grayscale and its subsidiary over-the-counter traded fund GBTC is currently embroiled in a...

BTC price faces 20% drop in weeks if Bitcoin avoids key level — Analyst

Bitcoin (BTC) stayed rigid below $17,000 at the Dec. 19 Wall Street open as skeptical traders feared more downside. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC traders call time on upside potential Data from Cointelegraph Markets Pro and TradingView showed BTC/USD lingering around the $16,700 mark, practically unmoved over the weekend. The pair saw only fractional volatility at the open, as United States equities fell slightly. At the time of writing, the S&P 500 and Nasdaq Composite Index were down 0.5% and 1%, respectively. For Bitcoin traders, there was little to celebrate, with consensus forming around the potential for testing lower levels next. “Bearish as long as it stays below the $19k,” Crypto Poseidon summarized alongside a chart. BTC/USD annotated chart. ...

Crypto Biz: Institutions short Bitcoin as SBF is ‘deeply sorry’ for FTX collapse

The monumental collapse of FTX will go down as one of the biggest corporate scandals of all time. But, at least Sam Bankman-Fried, or SBF, is sorry. On Nov. 22, the disgraced founder of FTX penned a letter to his former employees describing his role in the company’s bankruptcy. “I never intended this to happen,” he wrote. “I did not realize the full extent of the margin position, nor did I realize the magnitude of the risk posed by a hyper-correlated crash.” Get this: SBF still thinks the company can be saved because “there are billion of dollars of genuine interest from new investors.” Shouldn’t he be preoccupied with trying to avoid jail right now? Bitcoin (BTC) and the broader crypto market have been reeling in the wake of the scandal. While this has allowed many diamond handed hodlers ...

Disaster looms for Digital Currency Group thanks to regulators and whales

The cryptocurrency tide is flowing out, and it looks more and more like Digital Currency Group (DCG) has been skinny dipping. But let’s be clear: The current crypto contagion isn’t a failure of crypto as a technology or long-term investment. DCG’s problem is one of failure by regulators and gatekeepers. Since its 2013 inception, DCG’s Grayscale Bitcoin Trust (GBTC), the largest Bitcoin (BTC) trust in the world, has offered investors the ability to earn a high rate of interest — above 8% — simply by purchasing cryptocurrency and lending it to or depositing it with DCG. In many ways, the company performed a major service to the crypto industry: making investments into crypto understandable and lucrative for beginners and retail investors. And during the crypto market’s bull run, everything s...

Could a Grayscale Bitcoin Trust collapse be the next black swan event? Watch The Market Report

On this week’s The Market Report show, Cointelegraph’s resident experts discuss what the ramifications would be if Grayscale Bitcoin Trust were to collapse. We start off this week’s show with the latest news in the markets: GBTC next BTC price black swan? — 5 things to know in Bitcoin this week Bitcoin (BTC), the largest cryptocurrency, just like the rest of the crypto industry, remains highly susceptible to downside risk as it continues to deal with the fallout from the implosion of exchange FTX. Contagion is the word on everyone’s lips as November grinds on — just like the Terra collapse earlier this year — and fears are that new victims of FTX’s giant liquidity vortex will continue to surface. Grayscale Bitcoin Trust (GBTC) seems to be on everyone’s radar this week for all the wrong rea...

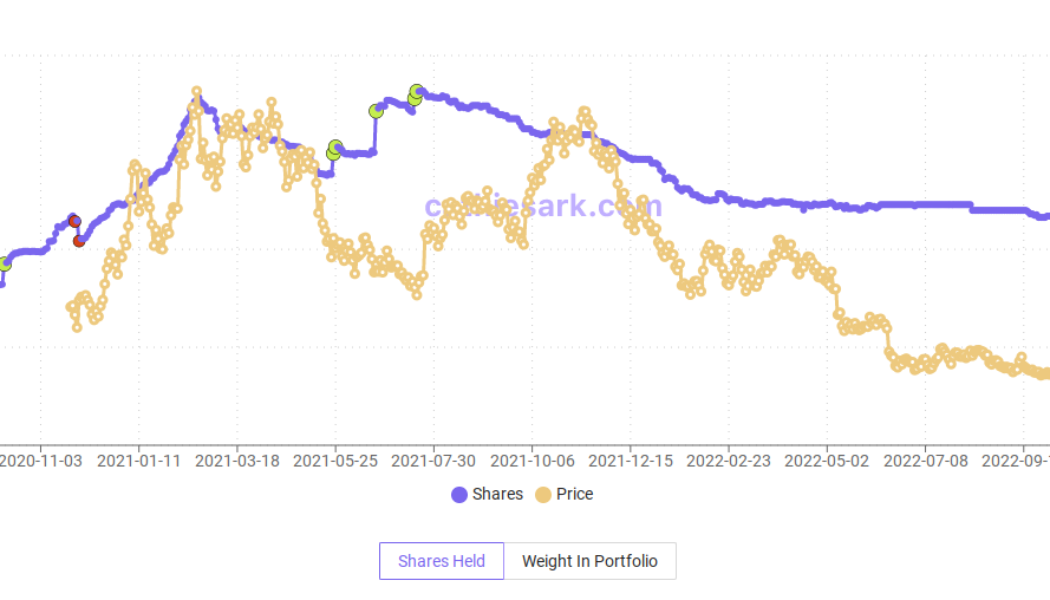

Cathie Wood’s ARK Invest adds more Bitcoin exposure as GBTC, Coinbase stock hit new lows

Bitcoin (BTC) firms’ shares are a major “buy” for asset manager ARK Invest in the midst of the FTX meltdown. The latest data confirms that ARK continues to up its holdings of both exchange Coinbase (COIN) and the Grayscale Bitcoin Trust (GBTC). Cathie Wood buys the dip With FTX contagion still rippling through the crypto industry, ARK’s decision to add exposure to two firms caught in the firing line stands out. According to numbers supplied by CEO Cathie Wood’s dedicated tracking resource, Cathie’s Ark, the firm added 176,945 GBTC shares on Nov. 21. These join a larger tranche of 273,327 shares from Nov. 15, that purchase completed just a week after FTX fell apart. ARK Invest GBTC holdings chart (screenshot). Source: Cathie’s Ark Since then, GBTC has come under the spotlight as ...

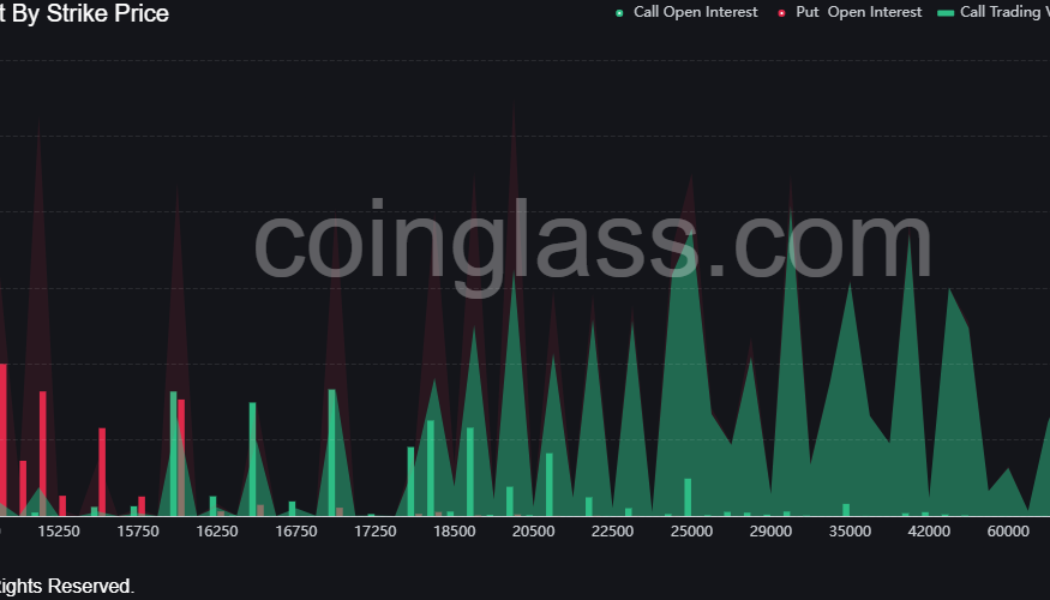

Why is Bitcoin price down today?

Bitcoin (BTC) price accelerated its sell-off on Nov. 21 to hit a new yearly low at $15,654. The move follows a market-wide decline that was catalyzed by investors running for the hills in fear that the FTX-induced contagion would infect every corner of the crypto sector. Stocks also closed the day in the red, with the tech-heavy Nasdaq down 1% and the S&P 500 losing 0.42% on the back of investors’ concerns about rising interest rates. Data from Coinglass shows over $100 million in leverage longs were liquidated on Nov. 20 and Nov. 21 as investors fear an accelerated sell-off if Digital Currency Group (DCG) and BlockFi fail to secure funding and are forced to declare bankruptcy. BTC open interest by strike price. Coinglass Some analysts are betting on Bitcoin price declining below...

GBTC next BTC price black swan? — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week still replaying November 2020 after its lowest weekly close in two years. The largest cryptocurrency, just like the rest of the crypto industry, remains highly susceptible to downside risk as it continues to deal with the fallout from the implosion of exchange FTX. Contagion is the world on everyone’s lips as November grinds on — just like the Terra LUNA collapse earlier this year, fears are that new victims of FTX’s giant liquidity vortex will continue to surface. The stakes are decidedly high — the initial shock may be over, but the consequences are only just beginning to surface. These include issues beyond just financial losses, as lawmakers attempt to grapple with FTX and place renewed emphasis on urgent Bitcoin and crypto regulation. With that, it is n...

GBTC Bitcoin discount nears 50% on FTX woes as investors stock up

The largest Bitcoin (BTC) institutional investment vehicle is coming under suspicion as it trades at a record discount. The Grayscale Bitcoin Trust (GBTC) is the latest Bitcoin industry entity to feel the heat from the debacle over defunct exchange FTX. FTX woes see Coinbase pledge trust in GBTC owner With contagion and fears over a deeper market rout everywhere in Bitcoin and altcoins at present, misgivings are impacting even the best-known — and trusted — crypto industry names. In recent days, it was the turn of GBTC, the long-embattled Bitcoin investment fund, amid problems at a related crypto firm, Genesis Trading. As Cointelegraph reported, parent company Digital Currency Group (DCG), as well as operator Grayscale itself, swiftly sought to reassure investors and the market that its fl...