‘Bitcoin dead’ Google searches hit new all-time high

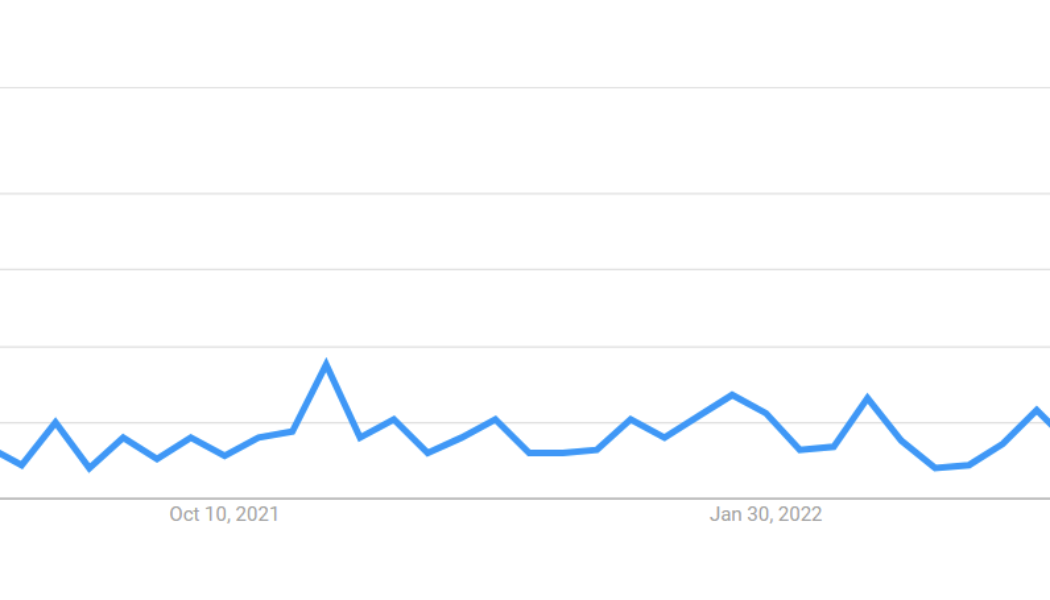

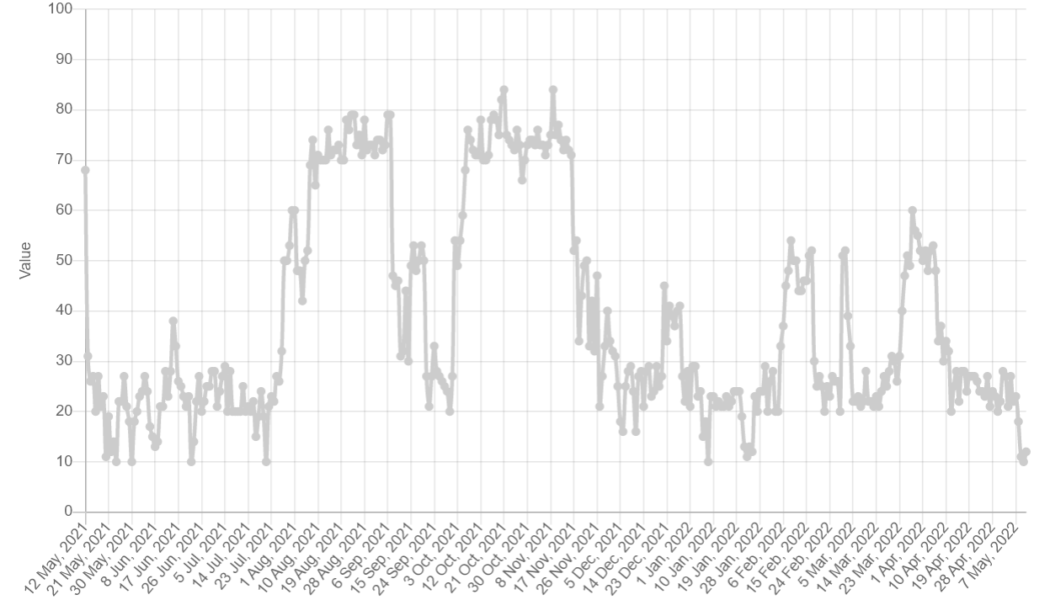

Collapsing Bitcoin (BTC) prices are reviving renewed speculation about the demise of the leading cryptocurrency, according to Google search trends. Google searches for “Bitcoin dead” spiked in the week ending Friday, June 18, and likely reached the highest level on record. Google Trends tracks interest in search terms over time, assigning scores of 1 to 100 based on the total number of user queries. The data are anonymized, categorized by topic and aggregated based on location. Google searches for “bitcoin dead” hit all time highs over the weekend. pic.twitter.com/oDXNqGEeIL — Alex Krüger (@krugermacro) June 20, 2022 “Bitcoin dead” achieved a score of 100 for the period between June 12–18 based on preliminary data that is reflected by the dotted line. The last time the se...

Crypto Biz: Smart Money is betting big on Web3, layer 2, May 19-25

Billions and billions. That’s what venture capitalists are spending to get ahead of the curve in crypto. Their latest fixation is Ethereum layer-2 scaling solutions and Web3, an umbrella term that describes the next stage of the internet’s evolution. So, while the cryptocurrency market is in a state of extreme fear, smart money investors — TradFi folks who invest with expert knowledge — continue to pour countless sums into the space. This week’s Crypto Biz newsletter gives you the latest funding stories from the world of blockchain and explores interesting developments surrounding Google and Sam Bankman-Fried. Andreessen Horowitz closes $4.5 billion crypto fund amid market turmoil The crypto market selloff of 2022 hasn’t deterred Andreessen Horowitz from pledging additional billions ...

Google seeks fresh talent to lead global Web3 team

Following the establishment of a Web3 team under Google Cloud on May 6, tech giant Alphabet’s Google is now on the lookout for a full-time candidate to lead its Global Web3 marketing strategies. As seen on the job listing, the Google Cloud division opened up a ‘Head of Product Marketing’ role who will be tasked with raising awareness about Google Cloud’s Web3 initiatives in addition to eventually building customer demand for the related offerings. new: Google Cloud is forming a Web3 product and engineering organization that will build services for developers. new job postings have appeared on Google’s internal Grow tool, Amit Zavery is telling employees in an email today https://t.co/sLC8VlqgBf — Jordan Novet (@jordannovet) May 6, 2022 In an email shared with employees right before t...

Bitcoin fights to hold $29K as fear of regulation and Terra’s UST implosion hit crypto hard

Bitcoin (BTC) price initially bounced from its recent low at $29,000 but the overall market sentiment after a 25% price drop in five days is still largely negative. Currently, the crypto “Fear and Greed Index,” which uses volatility, volume, social metrics, Bitcoin dominance and Google trends data, has plunged to its lowest level since March 2020 and at the moment, there appears to be little protecting the market against further downside. Crypto “Fear and Greed index”. Source: Alternative.me Regulation continues to weigh down the markets Regulation is still the main threat weighing on markets and it’s clear that investors are taking a risk-off approach to high volatility assets. Earlier this week, during a hearing of the Senate Banking Committee, United S...