Gold

5 reasons why Bitcoin could be a better long-term investment than gold

The emergence of forty-year high inflation readings and the increasingly dire-looking global economy has prompted many financial analysts to recommend investing in gold to protect against volatility and a possible decline in the value of the United States dollar. For years, crypto traders have referred to Bitcoin (BTC) as “digital gold,” but is it actually a better investment than gold? Let’s take a look at some of the conventional arguments investors cite when praising gold as an investment and why Bitcoin might be an even better long-term option. Value retention One of the most common reasons to buy both gold and Bitcoin is that they have a history of holding their value through times of economic uncertainty. This fact has been well documented, and there’s no denying that gold has ...

The Future for Sustainable Mining in Africa Lies in Circular Thinking

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

21Shares launches hybrid Bitcoin and gold ETP to enable inflation hedge

21Shares, a major issuer of cryptocurrency exchange-traded products (ETP), is launching a new ETP tracking a mix of Bitcoin (BTC) and gold. The Switzerland-based firm on Wednesday announced the launch of the 21Shares ByteTree BOLD ETP (BOLD), a new product aiming to provide inflation protection by tracking an index providing risk-adjusted exposure to both BTC and gold. Listed on the SIX Swiss Exchange, the new hybrid ETP is subject to monthly rebalances according to the inverse historic volatility of each asset. At launch, BOLD comprises 18.5% of BTC and 81.5% of gold. The new ETP was developed in collaboration with the United Kingdom-based alternative investment provider, ByteTree Asset Management. The product is positioned as the world’s first combined BTC and gold ETP. “Gold has hi...

Crypto Biz: Proof of integrity? Gold industry wants blockchain to solve its biggest problems, March 25–31, 2022

As Bitcoin (BTC) continues to eat away at gold’s market share, the bullion industry is looking to blockchain — the technology first made famous by BTC — to solve its most enduring challenges. How’s that for irony? Someone should really check on Peter Schiff. Speaking of Bitcoin, a MicroStrategy subsidiary confirmed this week that it plans to buy more “digital gold” through a crypto-collateralized loan. Terraform Labs CEO Do Kwon also ramped up his Bitcoin purchases to provide solid backing for Terra’s UST stablecoin. This week’s Crypto Biz takes a deep dive into the gold industry and the latest business developments surrounding Bitcoin. Gold industry taps blockchain for supply chain management and fraud prevention Blockchain has been identified as a potential game-changer for the gol...

Gold industry taps blockchain for supply chain management and fraud prevention

Some of the most prominent organizations in the gold industry have joined forces to launch a new “integrity program” that utilizes blockchain technology for supply chain management — a move that’s intended to help market participants verify the authenticity of their bullion. London Bullion Market Association (LBMA) and the World Gold Council (WGC) announced Monday that they are collaborating to develop an “international system of gold bar integrity, chain of custody and provenance” that’s based on blockchain technology developed by companies aXedras and Peer Ledger. The ledger will be used to register and track gold bars at each stage of the production and distribution cycle, including mining, vaulting and purchase by jewelry manufacturers. The so-called Gold Bar Integrity Programme ...

Bitcoin maintains $40K support as Fed confirms rate hike in 4 years

Bitcoin (BTC) held $40,000 on March 17 after an anticipated key interest rate hike from the Federal Reserve delivered a strong response. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Fed singles out Ukraine war in inflation comments Data from Cointelegraph Markets Pro and TradingView showed BTC/USD climbing to local highs of $41,500 after the Fed announced it would raise rates by 25 basis points to 0.5% — the first such move since 2018. The Federal Open Market Committe (FOMC) voted almost unanimously for the raise, with an accompanying statement warning of persisting “upward pressure on inflation” thanks specifically to the war in Ukraine. “The invasion of Ukraine by Russia is causing tremendous human and economic hardship,” it read. “The im...

Cryptocurrencies against the ‘silent thief.’ Can Bitcoin protect capital from inflation?

The world is becoming increasingly volatile and uncertain. The assertion that “inflation is the silent thief” is becoming less relevant. In 2021, inflation has turned into a rather loud and brazen robber. Now, inflation is at its highest in the last forty years, already exceeding 5% in Europe and reaching 7.5% in the United States. The conflict between Russia and Ukraine affects futures for gold, wheat, oil, palladium and other commodities. High inflation in the U.S. and Europe has already become a real threat to the capital of tens of thousands of private investors around the world. Last week at the Federal Open Market Committee (FOMC) meeting, Federal Reserve Chairman Jerome Powell said that he would recommend a cautious hike in interest rates. At the same time, Powell mentioned that he ...

Bitcoin stems losses after US bans Russian oil, gold heads to record highs

Bitcoin (BTC) erased then recovered its daily gains later on March 8 as United States President Joe Biden announced a complete ban on Russian oil imports. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC comes full circle, while gold steals the show Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it targeted $38,000 an hour after Tuesday’s Wall Street open. Having hit $39,240, the pair swiftly changed trajectory as Biden confirmed the plans, which added to oil’s already strong gains and further pressured stocks and risk assets. “Today, I’m announcing that the United States is targeting the main artery of Russia’s economy,” he said at a press conference. “We’re banning all imports of Russian oil and gas and energy. That means that Russia...

Bitcoin steadies as gold hits $2K, US dollar strongest since May 2020

Bitcoin (BTC) stayed near one-week lows on March 7 as a flight to safety among investors did crypto markets no favors. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Gold, dollar spell sour times for stocks Data from Cointelegraph Markets Pro and TradingView showed BTC/USD bouncing at around $37,600 overnight before tracking around $1,000 higher. The pair had faced pressure into the weekly close, resulting in its lowest levels this month amid reports that Western sanctions against Russia could expand to include an oil embargo. An already panicky atmosphere thus fueled performance by safe haven gold, which returned to $2,000 per ounce for the first time since August 2020 Monday. XAU/USD 1-week candle chart. Source: TradingView Coming in step was the U.S. dollar, which surg...

3 reasons why Bitcoin can rally back to $60K despite erasing last week’s gains

Bitcoin (BTC) plunged to below $38,000 on Monday, giving up all the gains it had made last week, which saw BTC/USD rally over $45,000. BTC back below $40K as oil soars The losses appeared primarily in part due to selloffs across the risk-on markets, led by the 18% rise in international oil benchmark Brent crude to almost $139 per barrel early Monday, its highest level since 2008. Nonetheless, Bitcoin’s inability to offer a hedge against the ongoing market volatility also raised doubts over its “safe haven” status, with its correlation coefficient with Nasdaq Composite reaching 0.87 on Monday. BTC/USD weekly price chart featuring its correlation with Nasdaq and Gold. Source: TradingView Conversely, Bitcoin’s correlation with its top rival gold came to be minus 0...

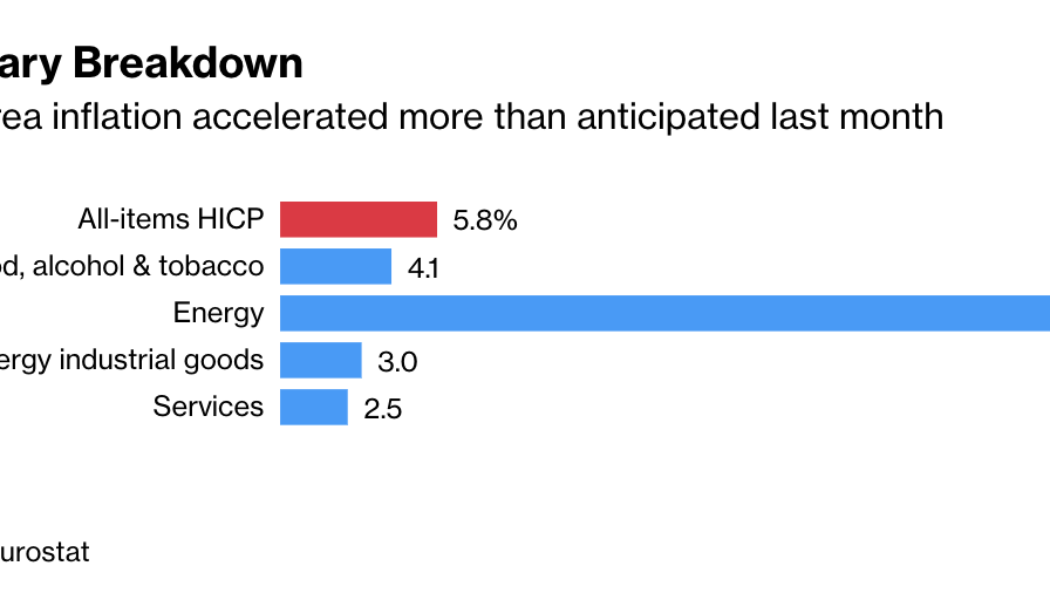

Bitcoin a ‘good bet’ if Fed continues easing to avoid a recession — analyst

Bitcoin (BTC) has the potential to become a “good bet” for investors if the Federal Reserve does everything it can to keep the U.S. economy afloat against impending recession risks, according to popular analyst Bitcoin Jack. The independent market analyst pitted the flagship cryptocurrency, often called “digital gold” by its enthusiasts, against the prospects of further quantitative easing by the U.S. central bank, noting that the ongoing military standoff between Ukraine and Russia had choked the supply chain of essential commodities, such as oil and wheat, resulting in higher global inflation. For instance, consumer prices in Europe jumped 5.8% year-over-year in February compared to 5.1% in the previous month, greater than the median economist forecast of 5.6% in ...