Gold

Trump Brags On Bling’d Out White House

With the government facing an impending shutdown, the Epstein files still not released and no money for cancer research, President Donald Trump took to social media to brag about his golden remake of the Oval Office, and other parts of the White House, which he claims has caused world leaders to “freak out” when they […]

Bitcoin price stays near $23K as data shows hodlers not selling BTC

Seasoned Bitcoin market participants are anything but willing to take profit, even with the BTC price up 40% in January. Market Update Own this piece of history Collect this article as an NFT Bitcoin (BTC) refused to surrender gains at the Jan. 23 Wall Street open as United States equities opened higher. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Dollar sags as risk assets reject retracement Data from Cointelegraph Markets Pro and TradingView showed BTC/USD continuing to circle $22,800 at the time of writing. The pair had managed to conserve its trading range over the weekend, with a local low of $22,315 allowing bulls to avoid a major setback. The mood remained buoyant among risk assets on the day, with the S&P 500 up 1.3% and Nasdaq Composite Index trading 2% higher....

Bitcoin eyes $21.4K zone as analyst predicts BTC price will chase gold

Bitcoin (BTC) rose toward new multi-month highs on Jan. 20 as analysis predicted a new trading range above $18,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin price range “well defined” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD testing but preserving support at $21,000. The pair edged higher at the Wall Street open, in line with United States equities as the third trading week of an explosive January drew to an end. Despite misgivings over the rally’s fundamental strength, Bitcoin continued to avoid significant corrections, with exchange order book analysis revealing $23,000 as the next big resistance zone to crack. “I view the lack of BTC liquidity below $18k and above $23k as a lack of sentiment for those levels at this time,”...

Bitcoin price would surge past $600K if ‘hardest asset’ matches gold

Bitcoin (BTC) is due to copy gold’s explosive 1970s breakout as it becomes the world’s “hardest asset” in 2024. That was one forecast from the latest edition of the Capriole Newsletter, a financial circular from research and trading firm Capriole Investments. Bitcoin due big moves “and more” in 2020s Despite BTC price action flagging at nearly 80% below its latest all-time high, not everyone is bearish about even its mid-term outlook. While calls for a further drop before BTC/USD finds its new macro bottom remain, Capriole believes that 2023 will be bright for Bitcoin as a reserve asset. The reason, it says, lies in the world economy’s financial history of the past century, and in particular, the United States after the dollar deanchored from gold completely in 1971. Gold, as t...

Bitcoin price reaches $21K as crypto market cap nears $1T

Bitcoin (BTC) returned to $21,000 for the first time since September after the Oct. 26 Wall Street open as buyers solidified gains. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC bulls “eat” ask liquidity Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it hit local highs of $21,012 on Bitstamp. At the time of writing, the pair continued to explore territory out of reach for over six weeks. Liquidations also kept flowing, with the past 24 hours delivering $750 million in liquidated positions on Bitcoin alone, according to data from Coinglass. Cross-crypto liquidations totaled $1.43 billion, adding to what was already the highest tally in 2022 so far. Crypto liquidations chart. Source: Coinglass The impetus did not come from United States equities on ...

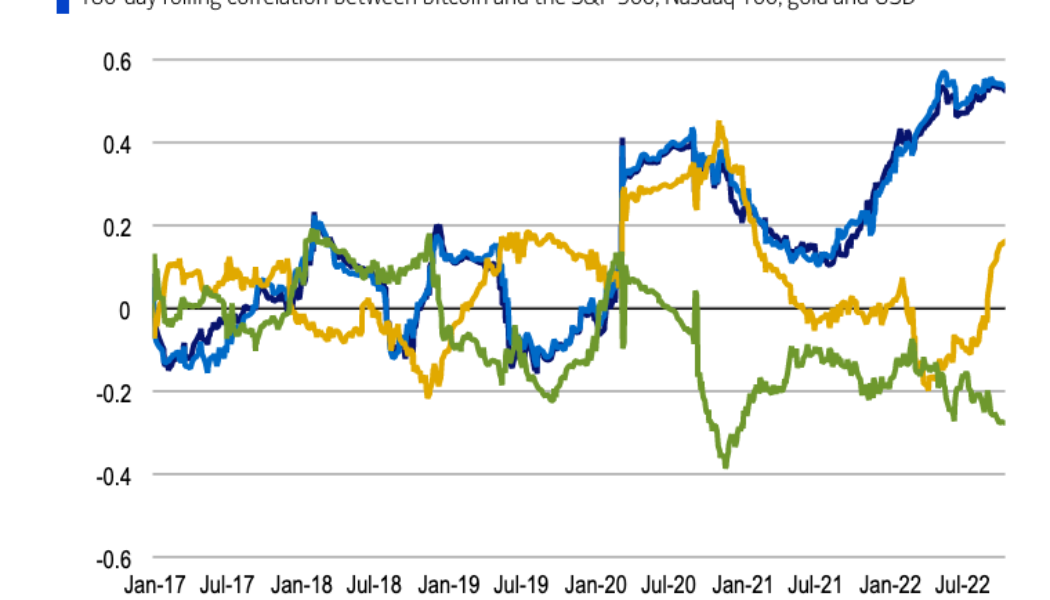

Gold vs BTC correlation signals Bitcoin becoming safe haven: BofA

Despite the ongoing cryptocurrency bear market, investors have been increasingly looking at Bitcoin (BTC) as a safe haven, a new study suggests. The rise in the correlation between Bitcoin and gold (XAU) is one of the major indicators demonstrating investors’ confidence in BTC amid the ongoing economic downturn, according to digital strategists at the Bank of America. Bitcoin’s correlation with gold — which is commonly viewed as an inflation hedge — has been on the rise this year, hitting its highest yearly levels in early October. The growing correlation trend started on Sept. 5 after remaining close to zero from June 2021 and turning negative in March 2022, BofA strategists Alkesh Shah and Andrew Moss said in the report. “Bitcoin is a fixed-supply asset that may eventually become an infl...

BTC to outperform ‘most major assets’ in H2 2022 — Bloomberg analyst

Senior commodity strategist at Bloomberg Intelligence, Mike McGlone, stated October has historically been the best month for Bitcoin (BTC) since 2014, averaging gains of about 20% for the month, and that commodities appearing to peak could imply that Bitcoin has reached its bottom. In an Oct. 5 Bloomberg Crypto Outlook report, McGlone says while the rise of interest rates globally is putting downwards pressure on most assets, Bitcoin is gaining the upper hand when compared with commodities and tech stocks like Tesla, with the report noting: “When the ebbing economic tide turns, we see the propensity resuming for Bitcoin, Ethereum, and the Bloomberg Galaxy Crypto Index to outperform most major assets.” McGlone notes that Bitcoin has its lowest ever volatility against the Bloomberg Comm...

Researchers allege Bitcoin’s climate impact closer to ‘digital crude’ than gold

The Bitcoin (BTC) bashing has continued unabated even in the depths of a bear market with more research questioning its energy usage and impact on the environment. The latest paper by researchers at the department of economics at the University of New Mexico, published on Sept. 29, alleges that from a climate-damage perspective, Bitcoin operates more like “digital crude” than “digital gold.” The research attempts to estimate the energy-related climate damage caused by proof-of-work Bitcoin mining and make comparisons to other industries. It alleges that between 2016 and 2021, on average each $1 in BTC market value created was responsible for $0.35 in global “climate damages,” adding: “Which as a share of market value is in the range between beef production and crude oil burned as gasoline,...

Is it Bitcoin’s time to shine? British pound drops to all-time low against the dollar

On Sept. 26, the British pound hit a record low against the U.S. dollar following the announcement of tax cuts and further debt increases to curb the impact of a possible economic recession. The volatility simply reflects investors’ doubts about the government’s capacity to withstand the growing costs of living across the region. The U.S. dollar has been the clear winner as investors seek shelter in the largest global economy, but the British pound’s weakness could be a net positive for Bitcoin. The GBP, or British pound, is the world’s oldest currency still in use and it has been in continuous use since its inception. Fiat currencies are a 52-year old experiment The British pound, as we currently know, started its journey in 1971 after its convertibility with gold ...

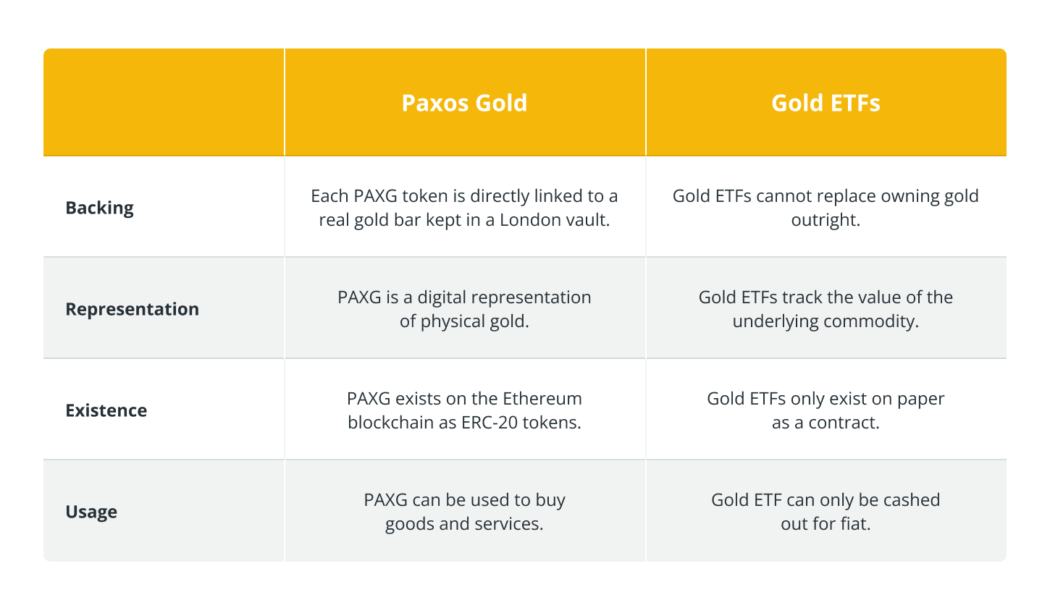

What is PAX Gold (PAXG) and how does it work?

In recent years, nonfungible tokens (NFTs), cryptocurrencies and other modern investment options have become trendy. However, physical commodities such as gold are still in high demand. In 2021, the global market capitalization for cryptocurrency surpassed $2 trillion. Now, investors must ask themselves: which option should I choose — crypto or gold? Gold is a commodity that dates back thousands of years as a store of value and as a means of exchange and is still successful today. Even with the invention of decentralized digital cryptocurrency, gold has remained just as prominent. Although, for most individual investors, owning gold can be difficult and out of reach. There is one crypto company, PAX Gold (PAXG), whose goal is to make gold ownership more democratic and available to everyday...

Warren Buffett pivots to U.S. Treasuries — a bad omen for Bitcoin’s price?

Warren Buffett has put most of Berkshire Hathaway’s cash in short-term U.S. Treasury bills now that they offer as much as 3.27% in yields. But while the news does not concern Bitcoin (BTC) directly, it may still be a clue to the downside potential for BTC price in the near term. Berkshire Hathaway seeks safety in T-bills Treasury bills, or T-Bills, are U.S. government-backed securities that mature in less than a year. Investors prefer them over money-market funds and certificates of deposits (COD) because of their tax benefits. Related: Stablecoin issuers hold more US debt than Berkshire Hathaway: Report Berkshire’s net cash position was $105 billion as of June 30, out of which $75 billion, or 60%, was held in T-bills, up from $58.53 billion at the beginning of 2022 o...

Bitcoin likely to transition to a risk-off asset in H2 2022, says Bloomberg analyst

Bitcoin is likely to transition from a risk-on to a risk-off asset in the second half of 2022, as the macroeconomic environment is rapidly shifting towards a recession, said Mike McGlone, senior commodity strategist at Bloomberg, in a recent interview with Cointelegraph. McGlone predicted: “ I see it transitioning to be more of a risk-off asset like bonds and gold, then less of a risk-on asset like the stock market.” According to the analyst, the crypto market has flushed out most of the speculative excesses that marked 2021 and it is now ripe for a fresh rally. McGlone also pointed out that the Fed’s aggressive hiking of interest rates will lead the global economy to a deflationary recession, which will ultimately favor Bitcoin: “I fully expect we’re going to have a prett...