Glassnode

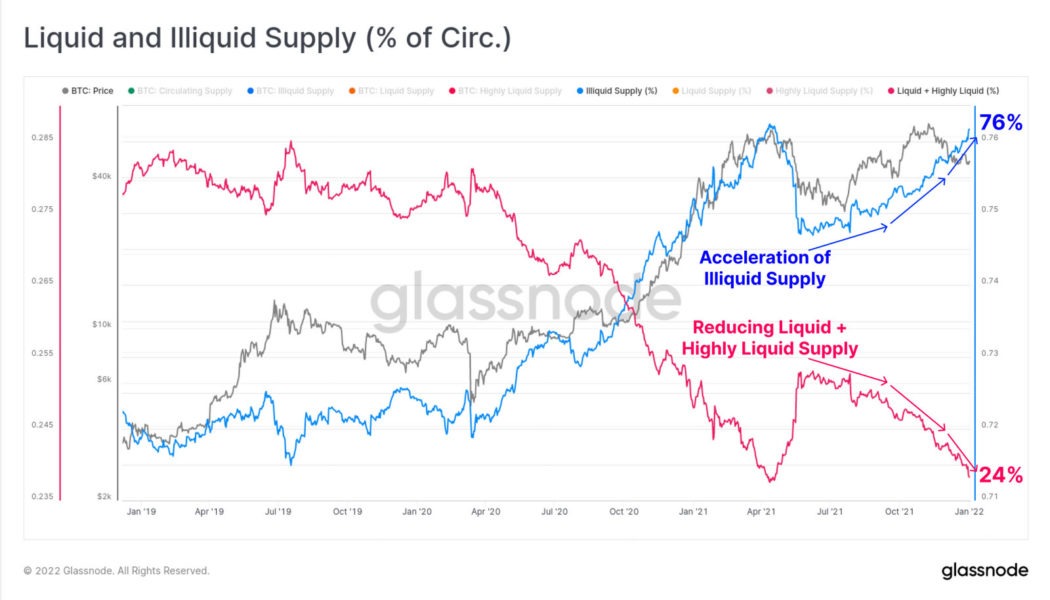

Wait and see approach: 3/4 of Bitcoin supply now illiquid

Bitcoin markets have been consolidating since the beginning of the year, but on-chain metrics are painting a more positive picture as more of the asset is becoming illiquid. On-chain analytics provider Glassnode has been delving into Bitcoin supply metrics to get a better view of the longer-term macro trends in its weekly report on Jan. 3. The findings revealed that although the asset has been trading sideways so far this year, more BTC has become illiquid. There has been an acceleration in illiquid supply growth which now comprises more than three quarters, or 76%, of the total circulating supply. Glassnode defines illiquidity as when BTC is moved to a wallet with no history of spending. Liquid supply BTC, which makes up 24% of the total, is in wallets that spend or trade regularly such a...

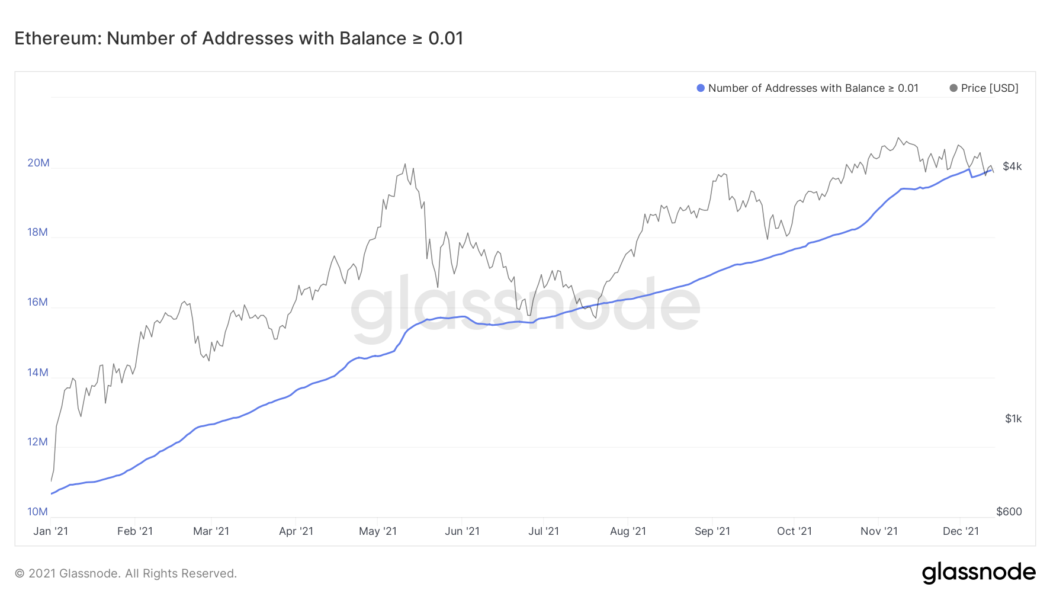

Small Ethereum investors increase exposure as ETH loses $4K level

Ethereum’s native token Ether (ETH) has dropped by over 18% after establishing an all-time high around $4,867 on Nov. 10, now trading near $3,900. Nonetheless, the plunge has not deterred retail investors from buying the token in small quantities. According to data gathered by Glassnode — a blockchain analytics platform, the number of Ether addresses holding less than or equal to 0.01 ETH reached a record high level of 19.95 million on Dec. 4, the day ETH dropped to as low as $3,575 (data from Coinbase). Ethereum addresses with balances less than or equal to 0.01. Source: Glassnode Meanwhile, the number of Ethereum wallets with balances of at least 0.1 ETH also kept climbing despite Ether’s correction from $4,867 to $3,575, eventually hitting a new all-time high of 6.37 million...

- 1

- 2