Glassnode

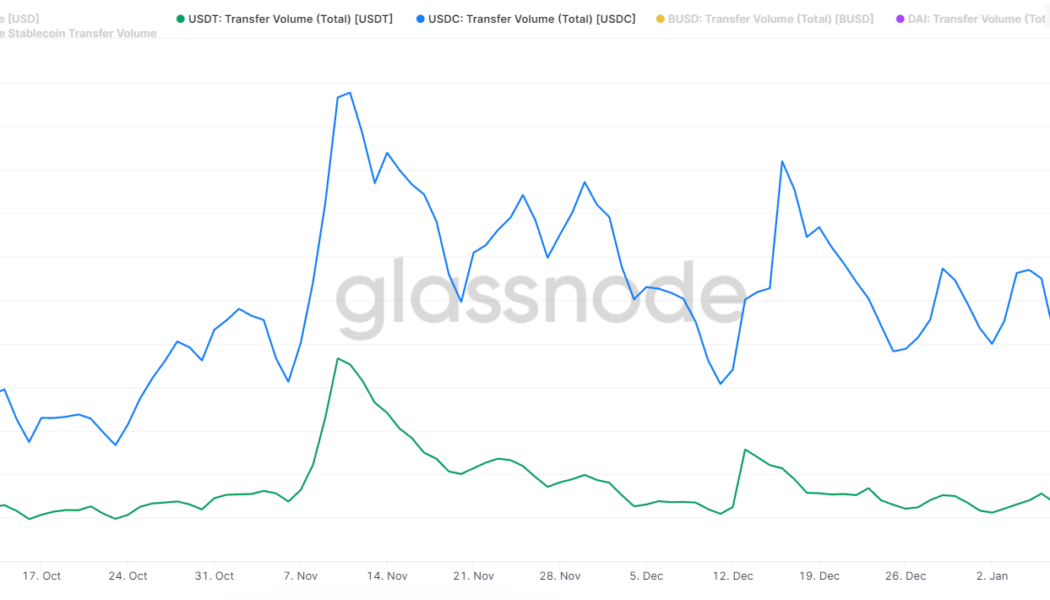

USDC transfer volume hit 5X USDT’s in fallout from FTX collapse

Stablecoin USD Coin (USDC) has grown in popularity since the collapse of FTX. It now frequently reaches daily transfer volumes four to five times that recorded by major competitor Tether (USDT) according to data from blockchain analytics firm Glassnode. That’s despite the market cap of USDT being $23 billion greater than USDC. As of Jan. 10, the difference was in USDC’s favor by a margin of four and a half times. Both stablecoins recorded surges in transfer volumes following an infamous tweet from Binance CEO Changpeng Zhao on Nov. 6 announcing Binance would liquidate its entire FTX Token (FTT) holdings. FTX went into bankruptcy soon after. Since then, USDC has been the preferred choice for crypto users, averaging over $12.5 billion more in transfer volume per day than USDT, according to G...

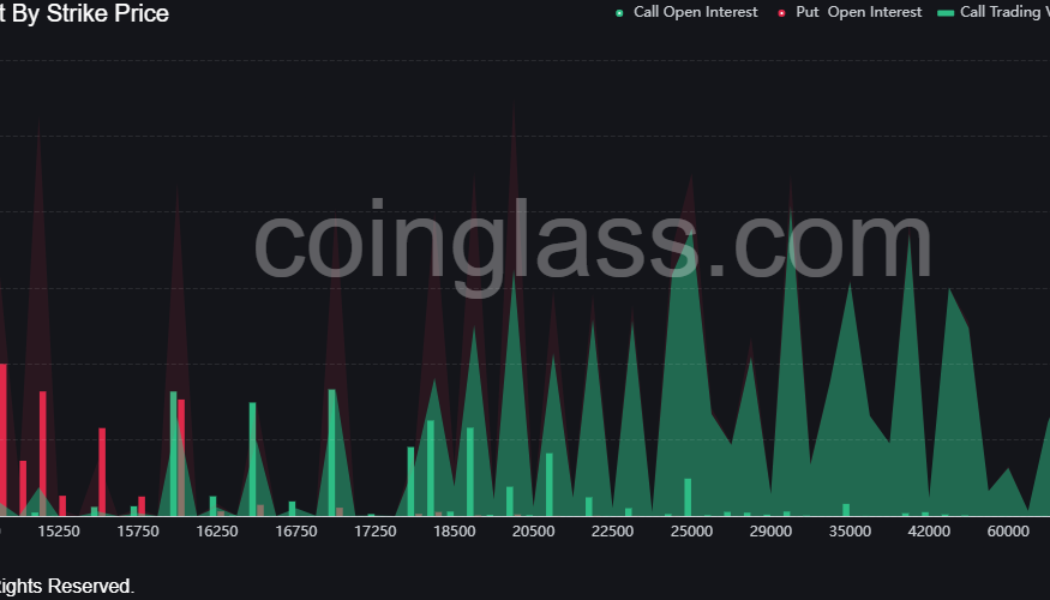

Why is Bitcoin price down today?

Bitcoin (BTC) price accelerated its sell-off on Nov. 21 to hit a new yearly low at $15,654. The move follows a market-wide decline that was catalyzed by investors running for the hills in fear that the FTX-induced contagion would infect every corner of the crypto sector. Stocks also closed the day in the red, with the tech-heavy Nasdaq down 1% and the S&P 500 losing 0.42% on the back of investors’ concerns about rising interest rates. Data from Coinglass shows over $100 million in leverage longs were liquidated on Nov. 20 and Nov. 21 as investors fear an accelerated sell-off if Digital Currency Group (DCG) and BlockFi fail to secure funding and are forced to declare bankruptcy. BTC open interest by strike price. Coinglass Some analysts are betting on Bitcoin price declining below...

Bitcoin hodling activity resembles previous market bottoms: Glassnode

The majority of Bitcoin has been “hodled” for at least three months in behavior bearing a striking resemblance to previous Bitcoin market bottoms, says blockchain analytics firm Glassnode. In a July 16 tweet, Glassnode noted that more than 80% of the total U.S. dollar (USD)-denominated wealth invested in Bitcoin has not been touched for at least three months. This signifies that the “majority of BTC coin supply is dormant” and that hodlers are “increasingly unwilling to spend at lower prices,” said the firm. Over 80% of the total USD denominated wealth invested in #Bitcoin has been HODLed for at least 3-months. This signifies that the majority of the $BTC coin supply is dormant, and HODLers are increasingly unwilling to spend at lower prices. Live Chart: https://t.co/lRtBe69Phz pic.twitter...

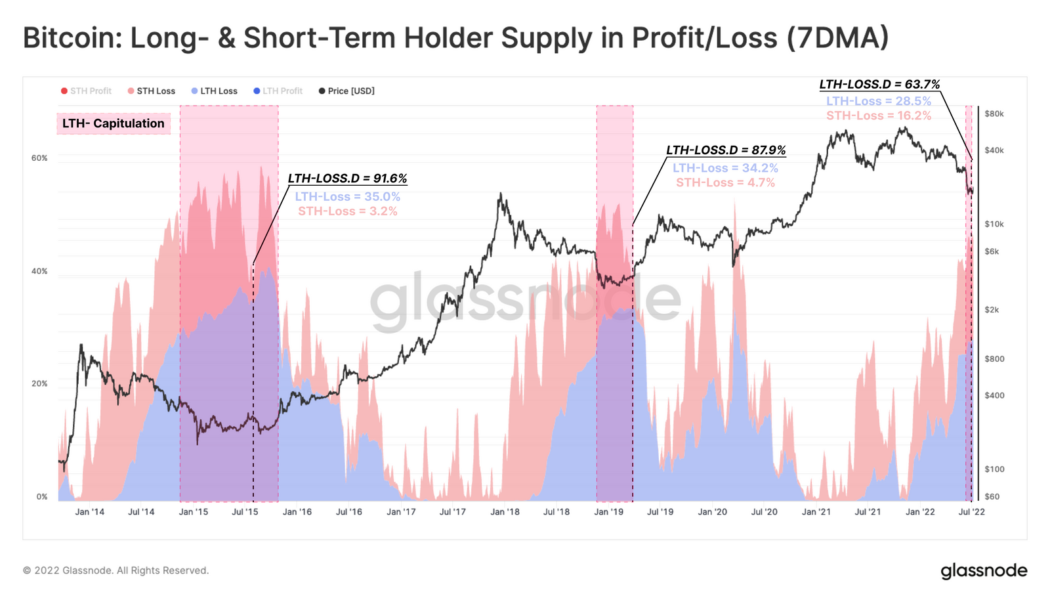

Capitulation ongoing but markets not at the bottom yet: Glassnode

Bitcoin wealth is being distributed from weak hands to strong hands due to ongoing capitulation from retail investors and miners, signaling that the bottom may be close. The latest ‘The Week On-Chain’ report from blockchain analysis firm Glassnode on July 11 explains that market capitulations have been ongoing for about a month and that several other signals suggest bottom formations in Bitcoin prices. However, Glassnode analysts wrote that the bear market “still requires an element of duration” as Long-Term Holders (LTH), who tend to have greater confidence in Bitcoin as a technology, increasingly bear the greatest unrealized losses. “For a bear market to reach an ultimate floor, the share of coins held at a loss should transfer primarily to those who are the least sensitive to price, and...

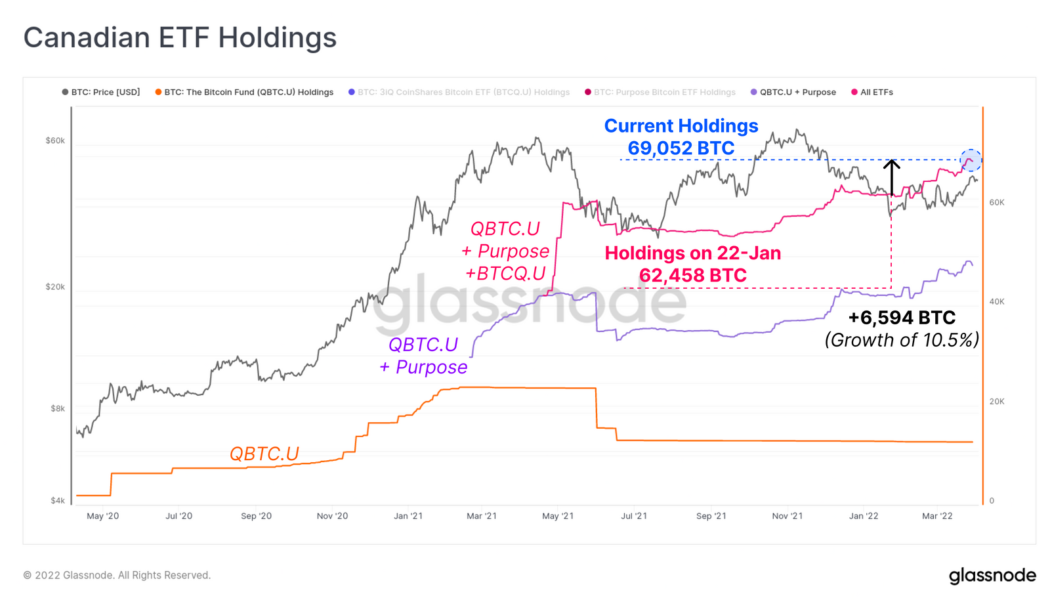

Inflows to Canadian Bitcoin ETFs hit all-time high: Glassnode

Canadian Bitcoin exchange-traded fund (ETF) holdings have increased to all-time highs according to recent research, and spot-based products are leading the way. Canadian Bitcoin ETFs have increased their holdings by 6,594 Bitcoin (BTC) since January to reach an all-time high of 69,052 total BTC held. The Purpose Bitcoin ETF saw the biggest increase in holdings over that time period with a net growth of 18.7% to 35,000 BTC, according to Glassnode. An ETF is an exchange-traded fund that allows investors to speculate on the price of an asset without having to hold any themselves. The Purpose Bitcoin ETF, a spot Bitcoin ETF, currently has about $1.68 billion in assets under management. No such spot Bitcoin ETF is currently available in the U.S. but the metrics show that investors are hung...

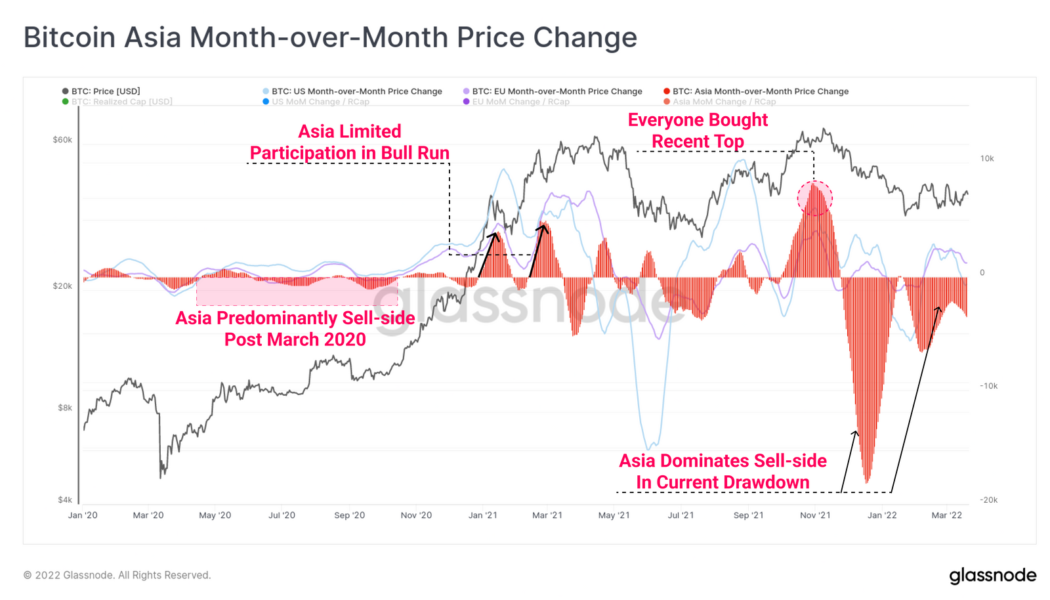

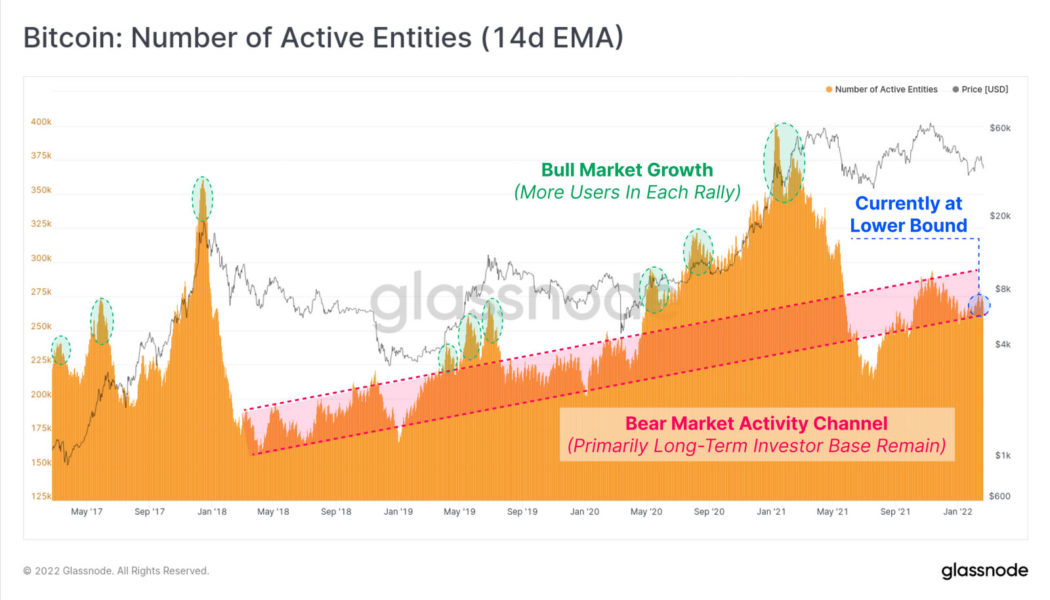

Crypto market selling pressure remains Asia dominated: Glassnode

The Bitcoin network’s on-chain activity still appears to be in a bear market as U.S. and E.U. buyers are struggling to stay ahead of sellers based in Asia. Blockchain analytics firm Glassnode’s latest report on the weekly activity of the Bitcoin (BTC) network shows that the price of the largest crypto by market cap has stayed firmly within the same tight $5,000 range from $37,680 to $42,312. However, on March 22 the asset saw a sudden spike in price which elevated prices to a two-week high. Overall, the network is in a demonstrable lull according to Glassnode’s weekly review: “Bitcoin network utilization and on-chain activity remains firmly within bear market territory, albeit is recovering.” The research concluded that there is a distinct difference in the behavior of the average BTC inve...

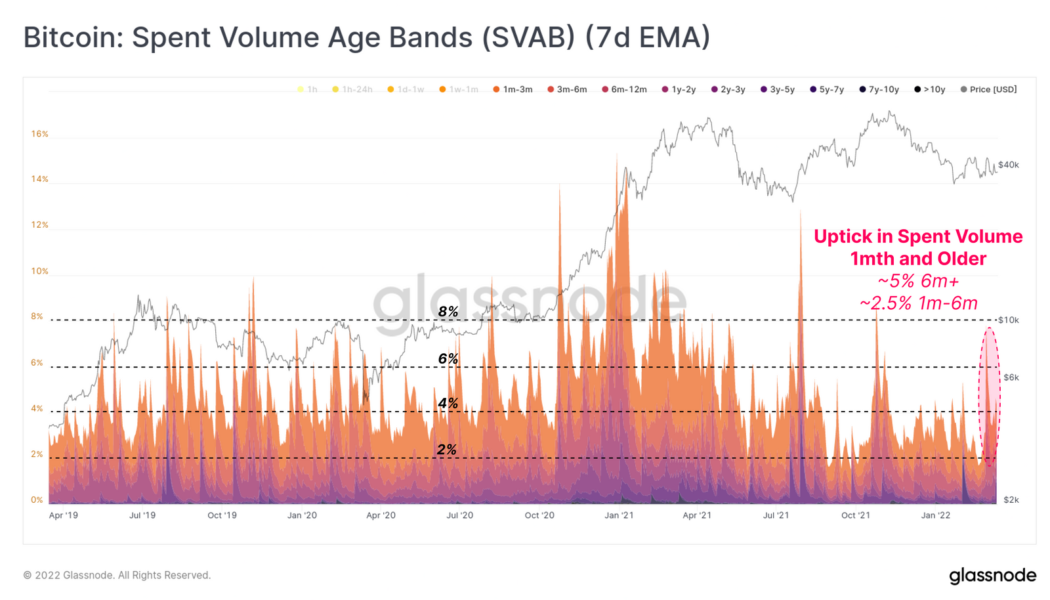

Short term Bitcoin buyers transition to long term holders: Glassnode

Over the past week, long-term holders of Bitcoin increased their spending to a level that suggests de-risking from the market, but hodling remains the predominant investing strategy. Uncertain macroeconomic headwinds are likely to have precipitated the increase in the sell-offs last week by long-term holders and shaken some short-term holders out of their positions according to data from blockchain analytics firm Glassnode. Last week, coins older than six months accounted for 5% of total spending, which is a level not seen since last November. Short-term holders (STH) who have held coins for less than 155 days continue to decline in number, but not necessarily due to selling. Glassnode suggests that while it is generally more common for STH to sell, the recent decline in STH supply “can on...

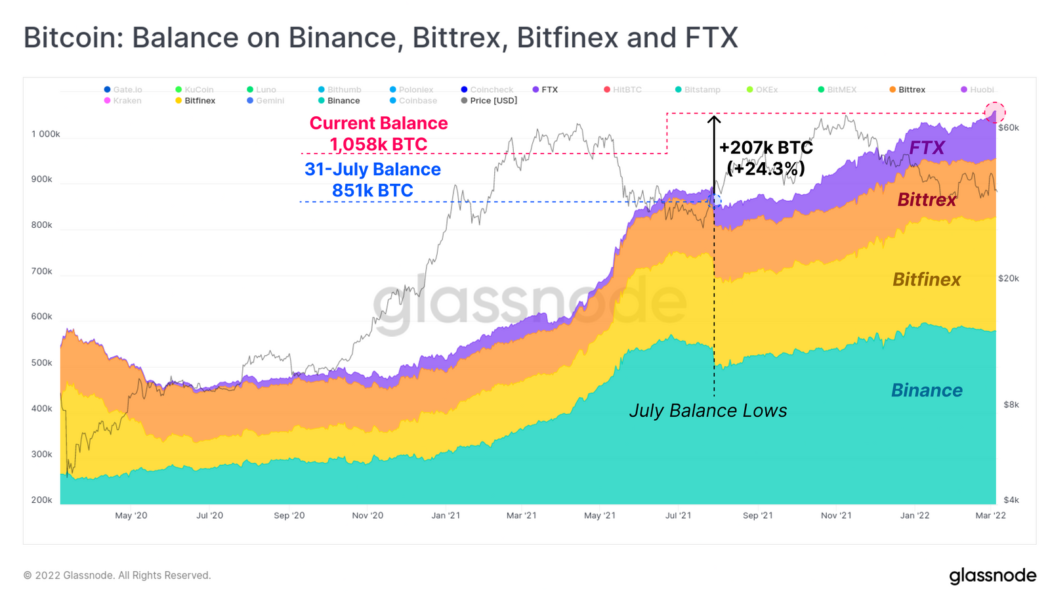

Total exchange BTC inflows have been net negative since July ’21

Bitcoin inflows across all exchanges have been net negative since last July, but four major exchanges have been running contrary to this trend with nearly an equal amount of net positive inflows. There have been total net outflows of 46,000 BTC (worth around $1.8 billion at current prices) from all crypto exchanges since last July. Only Binance, Bittrex, Bitfinex, and FTX have seen net positive inflows of 207,000 Bitcoin (BTC), according to data from blockchain analytics firm Glassnode’s March 7 newsletter. Over the same time period, net outflows have totaled 253,000 BTC from all other exchanges tracked. FTX, Binance, Bittrex, and Bitfinex have seen net positive inflows of BTC since July, 2021 – Glassnode FTX and Huobi have experienced the most dramatic shift in their BTC holdings si...

On-chain metrics hint at a bearish outlook for Bitcoin

Blockchain analytics provider Glassnode has depicted a bearish scenario for Bitcoin as on-chain metrics suggest increased selling pressure is imminent. In its weekly analytics report on Feb. 21, on-chain metrics firm Glassnode said that Bitcoin bulls “face a number of headwinds,” referring to increasingly bearish network data. The researchers pointed at the general weakness in mainstream markets alongside wider geopolitical issues as the reason for the current risk-off sentiment for crypto assets. “Weakness in both Bitcoin, and traditional markets, reflects the persistent risk and uncertainty associated with Fed rate hikes expected in March, fears of conflict in Ukraine, as well as growing civil unrest in Canada and elsewhere.” It added that as the downtrend deepens, “the probability of a ...

Can Ethereum price reach $4K after a triple-support bounce?

Ethereum’s native token Ether (ETH) looks ready to continue its ongoing rebound move toward $4,000, according to a technical setup shared by independent market analyst Wolf. Classic bullish reversal pattern in the works? The pseudonymous chart analyst discussed the role of at least three support levels in pushing the ETH price up by nearly 30% from its local bottom of $2,160. These price floors included a 21-month exponential moving average, the 0.786 Fib level of a Fibonacci retracement graph drawn from $1,716-swing low to $4,772-swing high, and the lower boundary of an ascending triangle pattern. ETH/USD daily price chart featuring the three-supports. Source: TradingView Wolf noted that the triple-support scenario could push Ether price to $3,330. In doing so, ...

- 1

- 2