GBTC

Grayscale gears up for legal battle with SEC over Bitcoin ETF

Grayscale CEO Michael Sonnenshein said the firm is gearing up for a legal fight if Grayscale’s Bitcoin Spot ETF product is denied by the United States Securities and Exchange Commission (SEC). In an interview with Bloomberg on Tuesday, March 29, Sonnenshein was asked if he would consider the Administrative Procedure Act (APA) lawsuit option if the application for its Bitcoin Spot ETF was denied by the financial regulator. “I think all options are on the table,” he responded, highlighting the importance of continuing to advocate for investors. The next decision date for the approval or denial of the investment product is July 6, 2022, it was previously delayed in February, and was originally filed in October 2021. “The Grayscale team has been putting the full resources of our firm behind co...

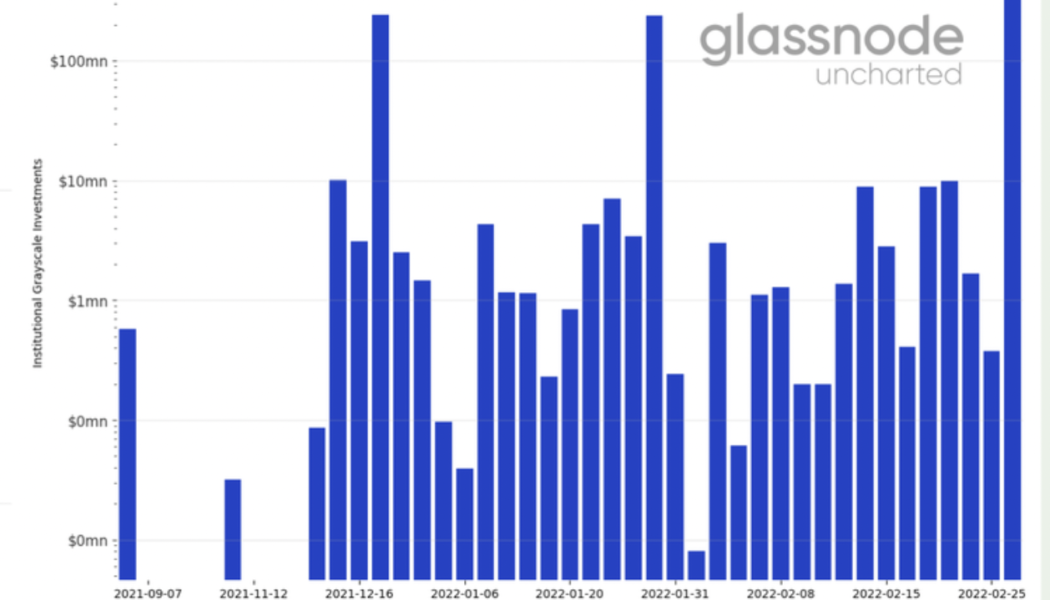

Institutions increase exposure to Grayscale Bitcoin Trust as GBTC discount nears 30%

Institutional investors are returning to accumulate Grayscale Bitcoin Trust (GBTC) shares as the discount to spot price his risen to nearly 30%, data on Glassnode shows. Since December 2021, some weekly sessions saw investors pouring in between $10 million and $120 million into Grayscale’s flagship fund. Meanwhile, the biggest capital inflow — amounting to nearly $140 million — appeared in the week ending on Feb. 25, as shown in the chart below. Institutional Grayscale Investments since September 2021. Source: Glassnode No selloff yet among high-profile GBTC backers The GBTC trust attracted investments as global markets faced back-to-back shocks in the past few months, including a dramatic selloff in the technology stocks, followed by Russia’s invasion of Ukraine that left many...

Institutions increase exposure to Grayscale Bitcoin Trust as GBTC discount nears 30%

Institutional investors are returning to accumulate Grayscale Bitcoin Trust (GBTC) shares as the discount to spot price his risen to nearly 30%, data on Glassnode shows. Since December 2021, some weekly sessions saw investors pouring in between $10 million and $120 million into Grayscale’s flagship fund. Meanwhile, the biggest capital inflow — amounting to nearly $140 million — appeared in the week ending on Feb. 25, as shown in the chart below. Institutional Grayscale Investments since September 2021. Source: Glassnode No selloff yet among high-profile GBTC backers The GBTC trust attracted investments as global markets faced back-to-back shocks in the past few months, including a dramatic selloff in the technology stocks, followed by Russia’s invasion of Ukraine that left many...

Overwhelming support for Grayscale BTC Trust ETF conversion proposal

The U.S. Securities and Exchange Commission has allowed comments and feedback on a proposed rule change that would convert Grayscale’s Bitcoin Trust to a spot-based exchange-traded fund (ETF). A notice of filing a proposed rule change to list and trade shares of Grayscale Bitcoin Trust as a spot-based ETF has generated a long list of comments with a large majority in approval. Bloomberg’s senior ETF analyst Eric Balchunas had a look through some of the more recent comments on Feb. 15 observing that 95% are in favor of the proposed conversion. Just glancing through the many comments from ppl to the SEC re converting $GBTC to an ETF and 95% are in favor of it and most using real names and pointing to the stupefying fact that futures ETF ok but spot not. eg: pic.twitter.com/j15iNYnh8R — Eric ...

SEC again delays decision on Grayscale’s Bitcoin ETF

The United States Securities and Exchange Commission (SEC) has once again delayed its ruling on whether to approve Grayscale’s application for a Bitcoin (BTC) exchange-traded fund (ETF), citing familiar concerns around manipulation, liquidity and transparency. In a notice published Friday afternoon, the SEC expressed concerns about how the digital asset manager intends to convert its Grayscale Bitcoin Trust (GBTC) into a spot ETF. Namely, the regulator wasn’t convinced that Grayscale’s proposal was designed to prevent alleged fraud and manipulation in the Bitcoin market. The SEC has invited the public to comment on these issues, giving interested parties 21 days to respond in writing. The SEC has just delayed their decision on whether GBTC can convert to a bitcoin ETF. — Pomp (@APomp...

Biggest GBTC discount ever — 5 things to watch in Bitcoin this week

Bitcoin (BTC) starts a new week with analysts looking for a bottom — but one which may not mean a dip to $40,000 or lower. After an unremarkable weekend, Bitcoin bulls now face a fresh week of bearish sentiment across the global economy as risk appetite stays tepid. Amid the lack of a “Santa rally” for practically anyone, there seem to be few triggers to help BTC/USD return higher in time for the new year. At the same time, on-chain metrics remain strong, and miners are refusing to spend. With Christmas almost here, Cointelegraph takes a look at what to look out for this week when it comes to assessing where Bitcoin may be headed. $50,000 seems far away for Bitcoin bulls Bitcoin failed to produce any significant moves over the weekend, but now, attention is turning to a potenti...

- 1

- 2