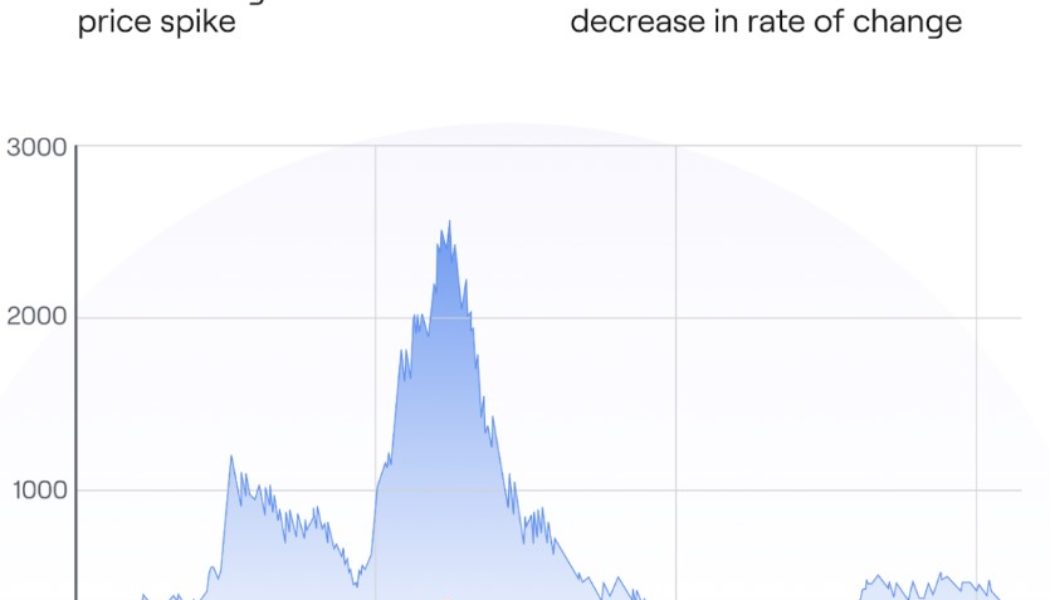

gas fees

Polygon primed for hard fork aimed at reducing gas fee spikes: New details revealed

Ethereum layer-2 scaling solution Polygon will undergo a hard fork on Jan. 17 in order to address gas spikes and chain reorganizations issues that has affected user experience on the Polygon proof-of-stake (POS) chain. Polygon officially confirmed the hard fork event in Jan. 12 a blog post, which came after weeks of preliminary discussion on Polygon Improvement Proposal (PIP) forum page in late December. GET READY FOR THE HARDFORK The proposed hardfork for the #Polygon PoS chain will make key upgrades to the network on Jan 17th. This is good news for devs & users — & will make for better UX. You will NOT need to do anything differently. Details:https://t.co/RaBWDjEGrI pic.twitter.com/nipa15YQdZ — Polygon (@0xPolygon) January 12, 2023 A Polygon spokesperson also provided...

Downsides of Proof-of-Work and Proof-of-Stake, explained

Proof-of-Work and Proof-of-Stake are arguably the best-known consensus mechanisms — but new ones are continually emerging. PoW blockchains have long dominated the cryptocurrency landscape, with both Bitcoin and Ethereum using this model. This means miners are responsible for securing the network and validating transactions — and they get rewarded with new coins as a result. However, a common criticism surrounding Proof-of-Work relates to how much energy it uses, and the impact such blockchains have on the environment. Miners need to use vast amounts of computing power to solve arbitrary mathematical equations. More advanced hardware has been required as the industry matured, with electricity usage surging too. This has led Proof-of-Stake to be regarded as a mo...

Ethereum Foundation clarifies that the upcoming Merge upgrade will not reduce gas fees

According to a new clarification by the Ethereum Foundation on Wednesday, the network’s upcoming proof-of-stake transitory upgrade — dubbed the “Merge,” — will not reduce gas fees. Regarding this, the Ethereum Foundation wrote: “Gas fees are a product of network demand relative to the network’s capacity. The Merge deprecates the use of proof-of-work, transitioning to proof-of-stake for consensus, but does not significantly change any parameters that directly influence network capacity or throughput.” The Merge, which seeks to join the existing execution layer of the Ethereum mainnet with its new proof-of-stake consensus layer, the Beacon Chain, will eliminate the need for energy-intensive mining. It is expected to land within the third or final qua...

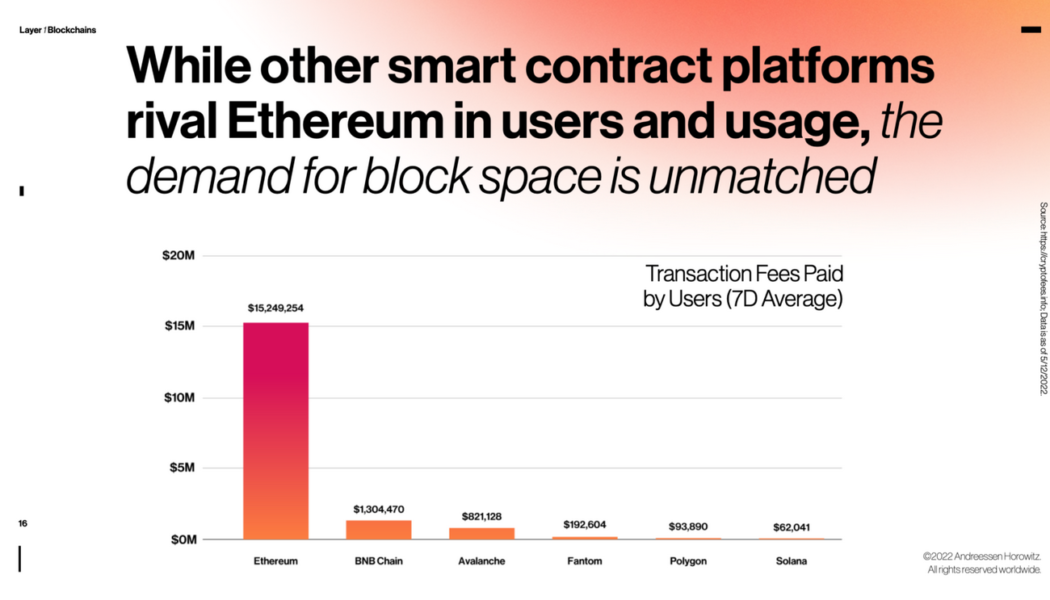

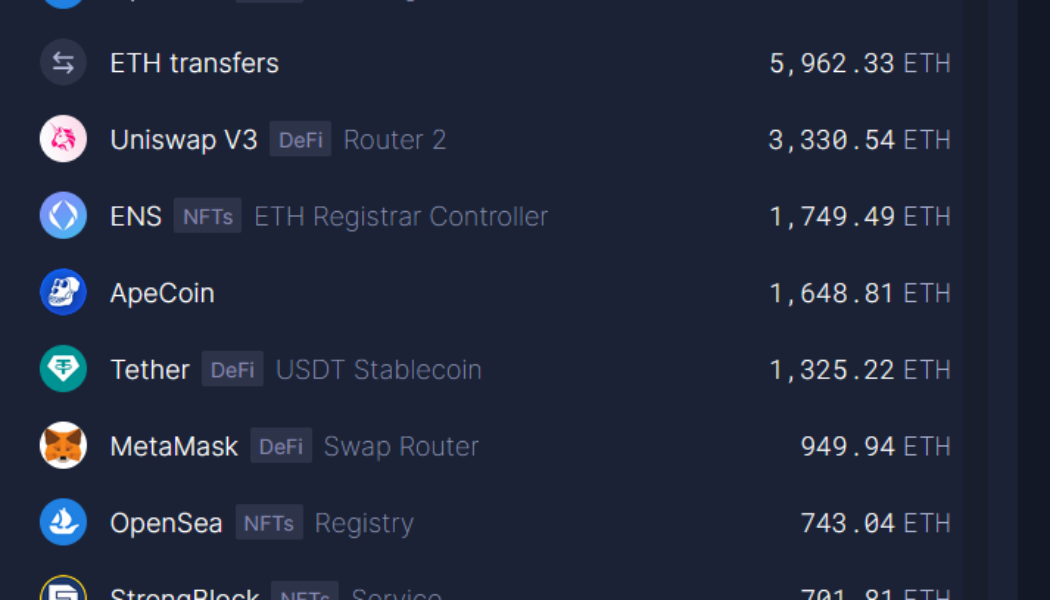

Ethereum’s popularity ‘a double-edged sword’ — a16z’s State of Crypto report

Crypto venture fund giant Andreessen Horowitz (a16z) has highlighted that development and demand on Ethereum is “unmatched” despite the network’s high transaction fees. The firm does warn, however, that its “popularity is also a double-edged sword” given Ethereum prioritizes decentralization over scaling, resulting in competing blockchains stealing market share with “promises of better performance and lower fees.” The comments came via a blog post introducing a16z’s 2022 “State of Crypto” report, with the firm’s data scientist Daren Matsuoka, head of protocol design and engineering Eddy Lazzarin, General Partner Chris Dixon, and head of content Robert Hackett all working together to provide five key takeaways from the study. Outside of Ethereum, the report focuses on topics such as Web3 de...

Vitalik proposes new ‘multidimensional’ Ethereum fee structure

Ethereum co-founder Vitalik Buterin has put his thinking cap on again in an attempt to improve the current fee structure for the network. The proposal titled “Multidimensional EIP-1559” was laid out in a blog post on Jan. 5 in which Buterin noted that different resources in the Ethereum Virtual Machine (EVM) have different demands in terms of gas usage. He added that there are different limits for short-term “burst” capacity as opposed to “sustained” capacity within the EVM citing examples of block data storage, witness data storage, and block state size changes. “The scheme we have today, where all resources are combined together into a single multidimensional resource (‘gas’), does a poor job at handling these differences.” The problem is that channeling all the different res...