Futures

2 key metrics point toward further downside for the entire crypto market

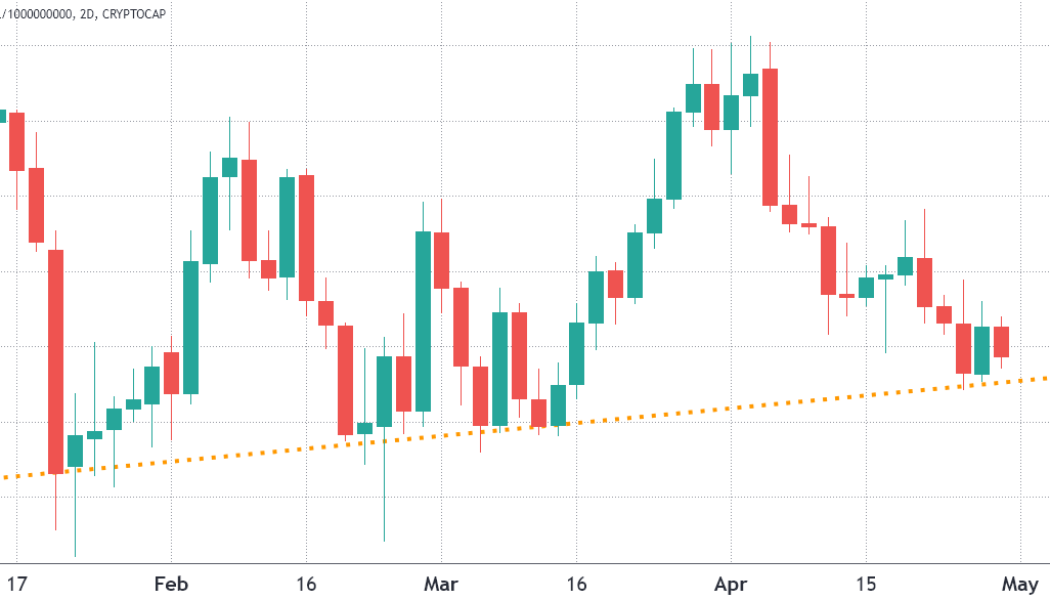

The total crypto market capitalization has been holding a slightly ascending trend for the past 3 months and the $1.75 trillion support was most recently tested on April 27 as Bitcoin (BTC) bounced at $38,000 and Ether (ETH) at $2,800 on April 27. Total crypto market cap, USD billion. Source: TradingView The crypto market’s aggregate capitalization showed a 3.5% decrease in the last 7 days and notable losers were a 18.8% loss from XRP, a 10.2% loss from Cardano (ADA), and 9.7% drop in Polkadot (DOT) price. Analyzing a broader range of altcoins provides a more balanced picture, that includes 25% gains from some gaming and Metaverse projects in the same time period. Weekly winners and losers among the top 80 coins. Source: Nomics Apecoin (APE) rallied 44% due to the upcoming Otherside metave...

Ethereum on-chain data hints at further downside for ETH price

Analyzing Ether’s (ETH) current price chart paints a bearish picture, which is largely justified by the 11% drop over the past month, but other traditional finance assets faced more extreme price corrections in the same period. The Invesco China Technology ETF (CQQ) is down 31% and the Russell 2000 declined by 8%. Ether price at FTX, in USD. Source: TradingView Currently, traders fear that losing the descending channel support at $2,850 could lead to a stronger price downturn, but this largely depends on how derivatives traders are positioned along with the Ethereum network’s on-chain metrics. According to Defi Llama, the Ethereum network’s total value locked (TVL) flattened in the last 30 days at 27 million Ether. TVL measures the number of coins deposited on smart contr...

Bitcoin spot vs. futures ETFs: Key differences explained

The Bitcoin spot ETF does not yet exist, with crypto companies proposing various concepts to the Securities and Exchange Commission (SEC) over the years. However, a few companies have legitimized the Bitcoin futures ETF. Crypto companies have fought to legitimize a Bitcoin spot ETF in the United States for years, but the SEC has yet to give in despite its recent two allegedly “crypto-positive” chairmen. For instance, Jay Clayton, who was head of the SEC from May 4, 2017, to December 23, 2020, is a fan of Bitcoin as a store of value. However, no proposal convinced Clayton that a Bitcoin ETF of any kind was ready. Clayton’s successor, Gary Gensler, approved ProShares’ BITO. Other ETF proposals, including those from Valkyrie and Van ...

Traders predict $3,800 Ethereum, but multiple data points suggest otherwise

Investors tend not to complain about a price rally, except when the chart presents steep downside risks. For example, analyzing Ether’s (ETH) current price chart could lead one to conclude that the ascending channel since March 15 is too aggressive. Ether price at FTX, in USD. Source: TradingView Thus, it is only natural for traders to fear that losing the $3,340 support could lead to a retest of the $3,100 level or a 12% correction down to $3,000. Of course, this largely depends on how traders are positioned along with the Ethereum network’s on-chain metrics. For starters, the Ethereum network’s total value locked (TVL) peaked at ETH 32.8 million on Jan. 23 and has since gone down by 20%. TVL measures the number of coins deposited on smart contracts, including decentralized fi...

Bitcoin rally hopes diminish as pro traders flip bearish, retail interest at 12-month lows

Bitcoin (BTC) has been trapped in a symmetrical triangle for 56 days and the trend change could last until early May, according to price technicals. Currently, the support level stands at $38,000, while the triangle resistance for daily close stands at $43,600. Bitcoin mining up, retail interest down Bitcoin/USD price at FTX. Source: TradingView The week started with a positive achievement for the Bitcoin network as the Lightning Network capacity reached a record-high 3,500 BTC. This solution allows extremely cheap and instant transactions on a secondary layer, known as off-chain processing. After cryptocurrency mining activities were banned in China in 2021, publicly-listed companies in the United States and Canada attracted most of this processing power. As a result, Bitcoin’s hash...

Bitcoin’s got 3 strikes, but investors remain calm despite price drop

After Bitcoin (BTC) faced its third consecutive rejection, investors became more confident in adding altcoin positions. For the leading cryptocurrency, the path to $50,000 appears more challenging than previously expected. According to Euronews Next, on March 14, the European Union rejected a proposed rule that could have banned the energy-intensive proof-of-work (PoW) mining algorithm used by Bitcoin and other cryptocurrencies. Several EU parliamentarians have been pushing to ban PoW mining over energy concerns. BTC/USD price at FTX. Source: TradingView In terms of performance, the aggregate market capitalization of all cryptos was relatively flat over the past seven days, registering a modest 0.4% gain to $1.77 trillion. However, the apparent lack of performance in the overall market doe...

Bitcoin derivatives metrics reflect traders’ neutral sentiment, but anything can happen

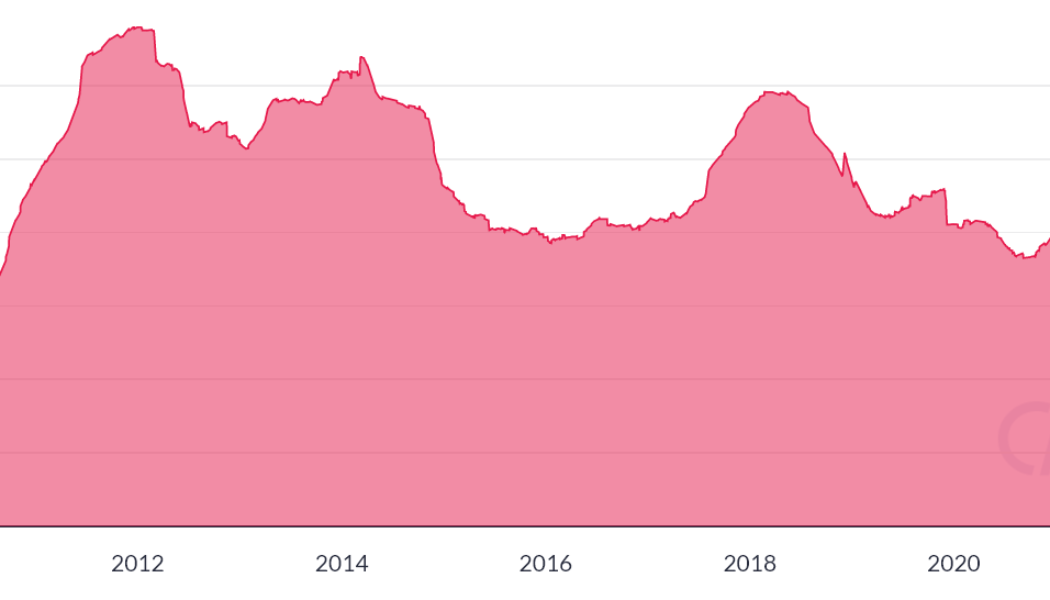

Bitcoin’s (BTC) last daily close above $45,000 was 66 days ago, but more importantly, the current $39,300 level was first seen on Jan. 7, 2021. The 13 months of boom and bust cycles culminated with BTC price hitting $69,000 on Nov. 10, 2021. It all started with the VanEck spot Bitcoin exchange-traded fund being rejected by the United States Securities and Exchange Commission (SEC) on Nov. 12, 2020. Even though the decision was largely expected, the regulator was harsh and direct on the rationale backing the denial. Curiously, nearly one year later, on Nov. 10, 2021, cryptocurrency markets rallied to an all-time high market capitalization at $3.11 trillion right as U.S. inflation as measured by the CPI index hit 6.2%, a 30-year high. Inflation also had negative consequences on risk ma...

Bitcoin traders say $34K was the bottom, but data says it’s too early to tell

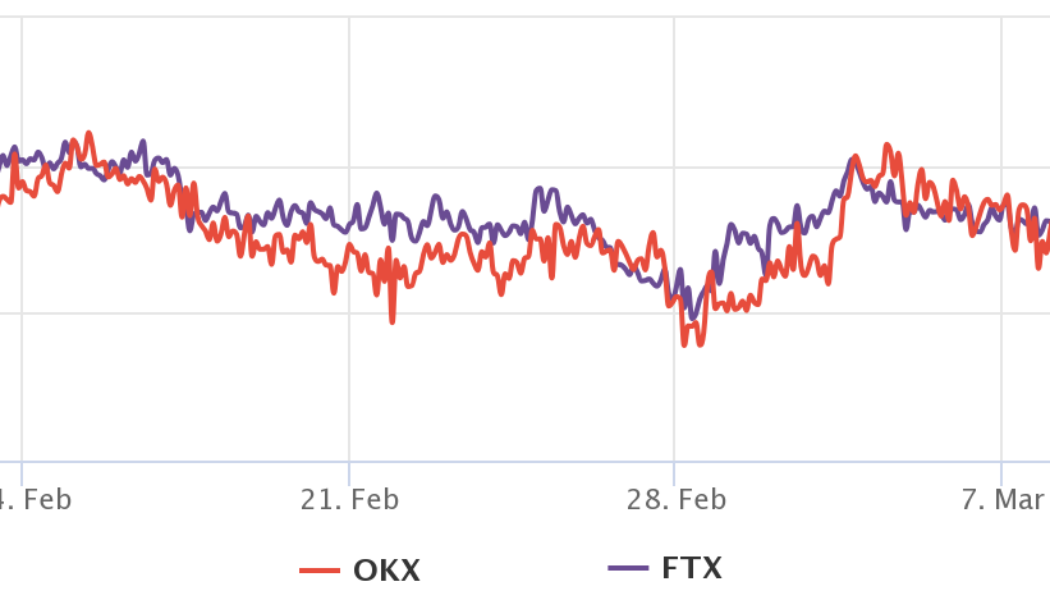

Bitcoin (BTC) price traded down 23% in the eight days following its failure to break the $45,000 resistance on Feb. 16. The $34,300 bottom on Feb. 24 happened right after the Russian-Ukraine conflict escalated, triggering a sharp sell-off in risk assets. While Bitcoin reached its lowest level in 30 days, Asian stocks were also adjusting to the worsening conditions, a fact evidenced by Hong Kong’s Hang Seng index dropping 3.5% and the Nikkei also reached a 15-month low. Bitcoin/USD at FTX. Source: TradingView The first question one needs to answer is whether cryptocurrencies are overreacting compared to other risk assets. Sure enough, Bitcoin’s volatility is much higher than traditional markets, running at 62% per year. As a comparison, the United States small and mid-cap stock ...

Overwhelming support for Grayscale BTC Trust ETF conversion proposal

The U.S. Securities and Exchange Commission has allowed comments and feedback on a proposed rule change that would convert Grayscale’s Bitcoin Trust to a spot-based exchange-traded fund (ETF). A notice of filing a proposed rule change to list and trade shares of Grayscale Bitcoin Trust as a spot-based ETF has generated a long list of comments with a large majority in approval. Bloomberg’s senior ETF analyst Eric Balchunas had a look through some of the more recent comments on Feb. 15 observing that 95% are in favor of the proposed conversion. Just glancing through the many comments from ppl to the SEC re converting $GBTC to an ETF and 95% are in favor of it and most using real names and pointing to the stupefying fact that futures ETF ok but spot not. eg: pic.twitter.com/j15iNYnh8R — Eric ...