Futures

FTX partners with Paradigm for ‘one-click’ futures spread trading

Paradigm has announced the launch of spreads trading in partnership with crypto exchange FTX. In a Friday blog post, Paradigm said under the FTX partnership users would be able to utilize “one-click” trading with “no leg risk” for the spread between spot, perpetuals and fixed maturity futures on Bitcoin (BTC), Ether (ETH), Solana (SOL), Avalanche (AVAX), ApeCoin (APE), Dogecoin (DOGE), Chainlink (LINK) and Litecoin (LTC). FTX will provide “guaranteed atomic execution and clearing of both legs” for the trades. According to Paradigm CEO Anand Gomes, the arrangement was aimed at drawing in new crypto investors interested in cash and carry trades — leveraging crypto spot purchases and futures instruments on FTX. Gomes added that the rollout could lead to new product offerings “further down the...

Ethereum futures backwardation hints at 30% ‘airdrop rally’ ahead of the Merge

Ether (ETH) bulls like a positive spread between its spot and ETH futures prices because the so-called contango reflects optimism about a higher rate in the future. But as of Aug. 1, the Ethereum futures curve slid in the opposite direction. Ethereum quarterly futures in backwardation On the daily chart, Ethereum futures quarterly contracts, scheduled to expire in December 2022, have slipped into backwardation, a condition opposite to contango, wherein the futures price becomes lower than the spot price. The spread between Ethereum’s spot and futures price grew to -$8 on Aug. 1. ETH230-ETHUSD daily price chart. Source: TradingView One one hand, the current ETH spot price being higher than its year-end outlook appears like a bearish sign. However, the conditions surrou...

Fed policy and crumbling market sentiment could send the total crypto market cap back under $1T

The total crypto market capitalization broke above $1 trillion on July 18 after an agonizing thirty-five-day stint below the key psychological level. Over the next seven days, Bitcoin (BTC) traded flat near $22,400 and Ether (ETH) faced a 0.5% correction to $1,560. Total crypto market cap, USD billion. Source: TradingView The total crypto capitalization closed July 24 at $1.03 trillion, a modest 0.5% negative seven-day movement. The apparent stability is biased toward the flat performance of BTC and Ether and the $150 billion value of stablecoins. The broader data hides the fact that seven out of the top-80 coins dropped 9% or more in the period. Even though the chart shows support at the $1 trillion level, it will take some time until investors regain confidence to invest in cryptocurrenc...

How Bitcoin’s strong correlation to stocks could trigger a drop to $8,000

The Bitcoin (BTC) price chart from the past couple of months reflects nothing more than a bearish outlook and it’s no secret that the cryptocurrency has consistently made lower lows since breaching $48,000 in late March. Bitcoin price in USD. Source: TradingView Curiously, the difference in support levels has been getting wider as the correction continues to drain investor confidence and risk appetite. For example, the latest $19,000 baseline is almost $10,000 away from the previous support. So if the same movement is bound to happen, the next logical price level would be $8,000. Traders are afraid of regulation and contagion On July 11, the Financial Stability Board (FSB), a global financial regulator including all G20 countries, announced that a framework of recommendations for the crypt...

Voyager Digital cuts withdrawal amount as 3AC contagion ripples through DeFi and CeFi

The Singapore-based crypto venture firm Three Arrows Capital (3AC) failed to meet its financial obligations on June 15 and this caused severe impairments among centralized lending providers like Babel Finance and staking providers like Celsius. On June 22, Voyager Digital, a New York-based digital assets lending and yield company listed on the Toronto Stock exchange, saw its shares drop nearly 60% after revealing a $655 million exposure to Three Arrows Capital. Voyager offers crypto trading and staking and had about $5.8 billion of assets on its platform in March, according to Bloomberg. Voyager’s website mentions that the firm offers a Mastercard debit card with cashback and allegedly pays up to 12% annualized rewards on crypto deposits with no lockups. More recently, on June 2...

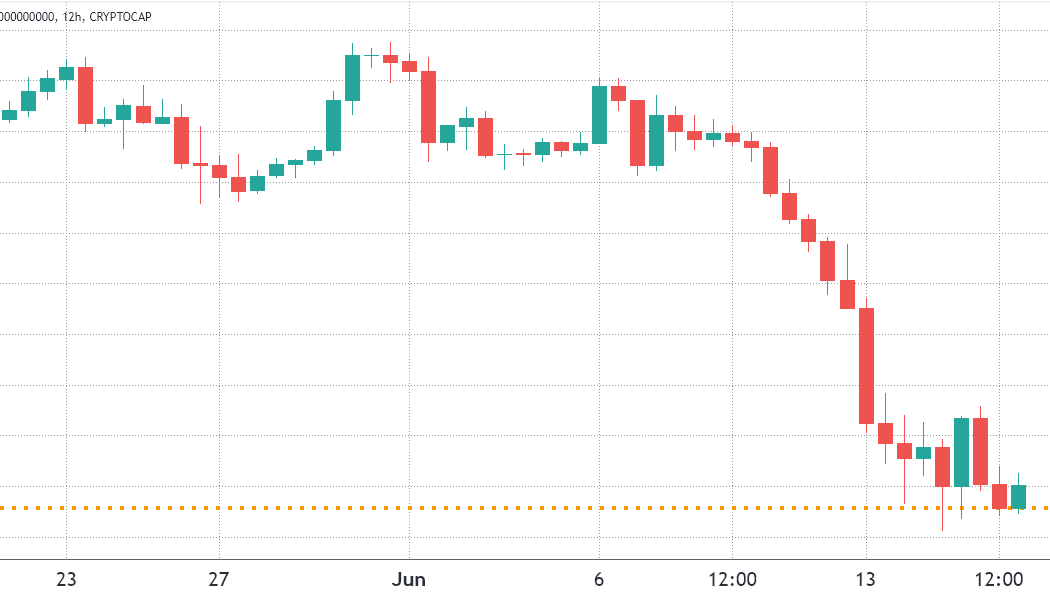

Market selling might ease, but traders are on the sidelines until BTC confirms $20K as support

The total crypto market capitalization fell off a cliff between June 10 and 13 as it broke below $1 trillion for the first time since January 2021. Bitcoin (BTC) fell by 28% within a week and Ether (ETH) faced an agonizing 34.5% correction. Total crypto market cap, USD billion. Source: TradingView Presently, the total crypto capitalization is at $890 million, a 24.5% negative performance since June 10. That certainly raises the question of how the two leading crypto assets managed to underperform the remaining coins. The answer lies in the $154 billion worth of stablecoins distorting the broader market performance. Even though the chart shows support at the $878 billion level, it will take some time until traders take in every recent event that has impacted the market. For example, the U.S...

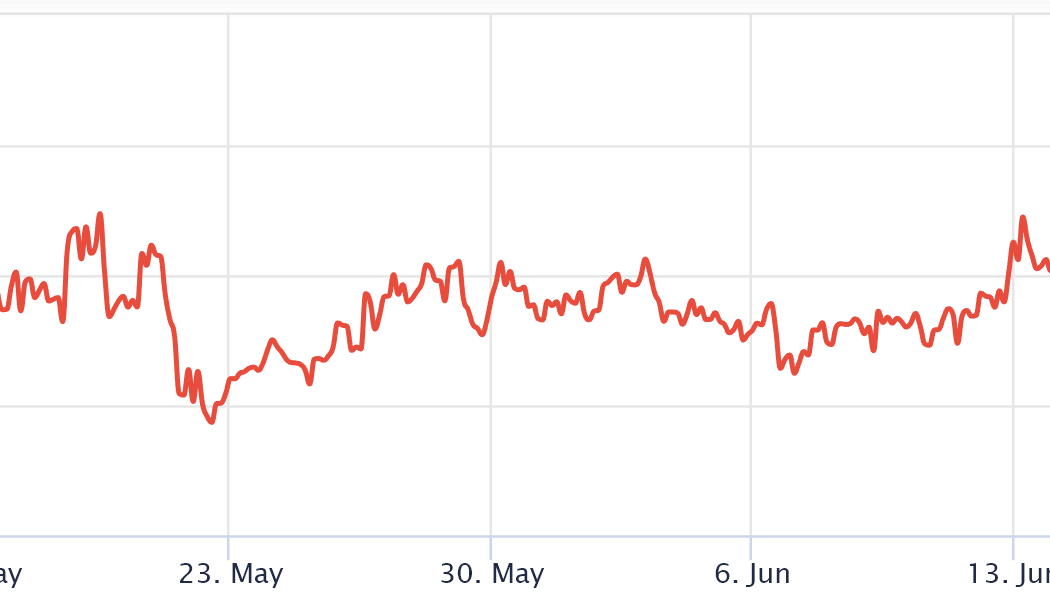

The total crypto market cap drops under $1.2T, but data show traders are less inclined to sell

An improving Tether discount in Asian markets and positive futures premiums for BTC and ETH suggest a slight recovery is in the making. The total crypto market capitalization has been trading in a descending channel for the past 29 days and currently displays support at the $1.17 trillion level. In the past 7 days, Bitcoin (BTC) presented a modest 2% drop and Ether (ETH) faced a 5% correction. Total crypto market cap, USD billion. Source: TradingView The June 10 consumer price index (CPI) report showed an 8.6% year-on-year increase and crypto and stock markets immediately felt the impact, but it’s not certain whether the figure will convince the U.S. Federal Reserve to hesitate in future interest rate hikes. Mid-cap altcoins dropped further, sentiment is still bearish The generalized beari...