Funding

Former FTX US president raises $5M for new crypto software firm

Brett Harrison departed FTX US roughly two months before FTX Group filed for bankruptcy, citing “cracks” in his relationship with SBF. News Own this piece of history Collect this article as an NFT The former head of FTX US is launching a new cryptocurrency software company and has raised $5 million from several investors, according to Bloomberg. Brett Harrison, who served as president of FTX US between May 2021 and September 2022, has received backing from Coinbase Ventures and Circle Ventures to launch a new software startup. SALT Fund, Motivate VC, P2P Validator, Third Kind Venture Capital, Shari Glazer of Kalos Labs and Anthony Scaramucci also participated in the seed round. His new startup, dubbed Architect, will develop trading software for large institutions looking...

FTX VCs liable to ‘serious questions’ around due diligence — CFTC Commissioner

Amid ongoing investigations around the defunct crypto exchange FTX, the Commodity Futures Trading Commission (CFTC) questions the due diligence conducted by institutional investors and their accountability regarding the loss of users’ funds. CFTC Commissioner Christy Goldsmith Romero stated that VCs that had to write down their investments in millions of dollars to nearly zero raises “serious questions” about the due diligence conducted over the last year, speaking to Bloomberg. CFTC Commissioner Christy Goldsmith Romero questioning the VCs that once backed FTX. Source: Bloomberg She raised concerns about FTX CEO John Ray’s revelations in court about not having any records and controls over the exchange’s financials. I’m glad Mr. Ray is finally paying lip service to turning the excha...

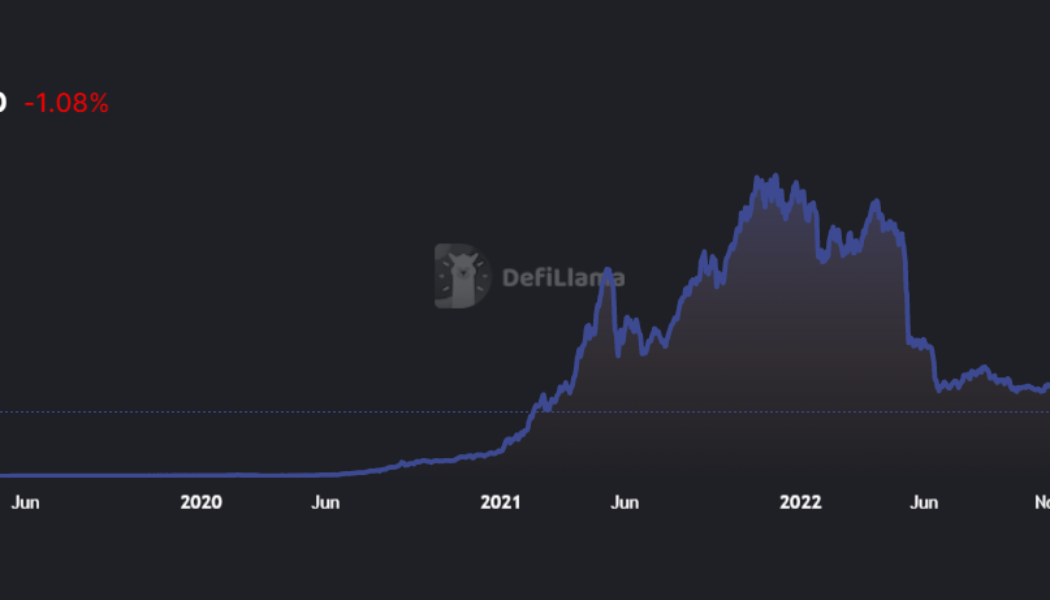

Top crypto funding stories of 2022

2022 was a watershed year for crypto venture capital, as investors poured tens of billions of dollars into blockchain-focused startups despite the overwhelmingly bearish trend in asset prices. Is the VC-dominated crypto funding model good for the industry? Only time will tell. Cointelegraph Research is still in the process of tallying all the funding figures for the year, but 2022 easily outpaced all other years in terms of total capital raised and deals completed. VC inflows were above $14 billion in each of the first two quarters before receding to just under $5 billion in the third quarter — still an impressive tally given the industry-wide contagion sparked by the sudden collapses of Celsius, Three Arrows Capital, Genesis, BlockFi and FTX, among others. Against this backdrop, we’...

Bitvavo to prefund locked DCG assets worth $296.7M amid liquidity crisis

The Digital Currency Group and its affiliates (DCG), which manages $296.7 million (280 million euros) in deposits and digital assets of crypto exchange Bitvavo for off-chain staking services, suspended repayments citing liquidity problems amid the bear market. However, Bitvavo announced to prefund the locked assets, preventing DCG-induced service disruption for users. With users proactively exploring self-custody options as a means to safeguard their funds, an acute liquidity crisis is expected to loom over exchanges. DCG cited liquidity problems as it suspended repayments, temporarily halting users from withdrawing their funds. Bitvavo, on the other hand, decided to prefund the locked assets to ensure that none of its users are exposed to DCG liquidity issues. “The current situation at DC...

Blockstream raising funds for mining at 70% lower company valuation

The depths of a bear market may not be the best time to raise funds but that is exactly what Blockstream is doing. The crypto infrastructure firm is seeking fresh funding, but at a much lower valuation than previous rounds, according to a Dec. 7 Bloomberg report. Blockstream was valued at $3.2 billion when it held its last Series B funding round raising $210 million in August 2021. Today that valuation may have fallen almost 70% to below $1 billion according to the report. The company, founded in 2014, has raised a total of $299 million in funding over four rounds, according to CrunchBase. Blockstream CEO and cryptographer Adam Back did not share details of the latest funding round but did reveal that the capital will be invested into expanding the firm’s mining capacity. “We rapidly sold ...

FTX US ex-president reportedly seeks $6M funding to launch crypto startup

Just a month after the controversial fall of Sam Bankman-Fried’s FTX exchange and 130 affiliated companies, a former high-ranking executive is reportedly seeking out investors to launch a crypto startup. The ex-president of FTX US, Brett Harrison, is on the lookout for $6 million in funding to launch a start-up that would build crypto trading software for big investors, according to The Information. Harrison’s funding round would be against a $60 million valuation. On Sept. 27, Harrison announced his plans to step down as the president of FTX US as he moved into an advisory role — over a month before the infamous fall of FTX. As a result, the entrepreneur was not immediately accused of having direct involvement in misappropriating users’ funds. Like most here, I was surprised and saddened ...

Crypto lender Matrixport seeks $100M funding despite lending crisis

Matrixport, the cryptocurrency firm founded by Bitmain co-founder Wu Jihan, is in the process of raising $100 million in funding despite the ongoing crypto market crisis. Lead investors have already committed $50 million for Matrixport’s new funding round at a $1.5 billion valuation, Bloomberg reported on Nov. 25. The deal has yet to be finalized as Matrixport is still looking for investors for the other half of the round. We’re excited and look forward to engaging with participants, on similar terms, in the other half of the #funding round. Appreciate the trust and confidence our investors continue have in Team #Matrixport.@business https://t.co/DqQhsYucUy — Matrixport (@realMatrixport) November 25, 2022 According to the company, the new round is part of Matrixport’s usual funding a...

Crypto lender Matrixport seeks $100M funding despite lending crisis

Matrixport, the cryptocurrency firm founded by Bitmain co-founder Wu Jihan, is in the process of raising $100 million in funding despite the ongoing crypto market crisis. Lead investors have already committed $50 million for Matrixport’s new funding round at a $1.5 billion valuation, Bloomberg reported on Nov. 25. The deal has yet to be finalized as Matrixport is still looking for investors for the other half of the round. We’re excited and look forward to engaging with participants, on similar terms, in the other half of the #funding round. Appreciate the trust and confidence our investors continue have in Team #Matrixport.@business https://t.co/DqQhsYucUy — Matrixport (@realMatrixport) November 25, 2022 According to the company, the new round is part of Matrixport’s usual funding a...

Genesis denies ‘imminent’ plans to file for bankruptcy

Cryptocurrency lending company Genesis has refuted speculation that it is planning an “imminent” bankruptcy filing should it fail to cover a $1 billion shortfall caused by the fall of crypto exchange FTX. The firm has reportedly faced difficulties raising money for its lending unit and told investors it would have to file for bankruptcy, according to a Nov. 21 Bloomberg report citing people familiar with the matter. A spokesperson for Genesis told Cointelegraph that there were no plans to file for bankruptcy “imminently” and that it continued to have “constructive” discussions with creditors. “We have no plans to file bankruptcy imminently. Our goal is to resolve the current situation consensually without the need for any bankruptcy filing. G...

What the Russia-Ukraine conflict has revealed about crypto

The Russia-Ukraine conflict has tested the capabilities of crypto in a real-world conflict where sanctions and inventive blockchain crowdfunding models abound. The war, which is drawing into its ninth month, has uncovered a raft of blockchain benefits, such as the capacity to support humanitarian endeavors. It has also revealed how much control national authorities can exert over crypto networks. Vadym Synegin, co-founder at IT and crypto solutions provider Tecor, told Cointelegraph that cryptocurrencies have a unique advantage in situations where there is an increased risk of money transfer interruptions due to the centralization of conventional systems. “With most markets controlled by centralized authority figures that can easily buckle under the political tensions, the crypto markets r...