ftx

Lessons we learned from the Terraform-FTX implosions

In May 2022, Terraform Labs’ LUNA cryptocurrency and TerraUSD (UST) stablecoin collapsed, triggering a massive shock in the crypto industry. Six months later, the bruised industry took another hammering as one of the largest cryptocurrency exchanges, FTX, filed for bankruptcy protection and billions of dollars of user assets went missing. The FTX empire, once valued at more than $30 billion, fell to zero in fewer than 10 days. FTX reportedly has more than 1 million creditors, most of whom are retail investors who were convinced that FTX would not collapse and had been keeping their assets on the exchange. Taking a look at Mt. Gox in 2014 — whose creditors still failed to reclaim compensation — FTX may be a repeat of that mistake. It can be said that FTX succeeded because of Alameda Researc...

Amber Group ditches expansion plans after denying insolvency: Report

Cryptocurrency trading firm Amber Group is putting its expansion plans on hold despite the FTX contagion having “no disruption” to its daily operations, according to a senior executive. Amber has scrapped plans to expand in Europe and the United States as a consequence of exposure to the now-defunct exchange FTX and will focus on institutional clients in Asia, according to managing partner Annabelle Huang. Huang also said that Amber has been forced to deprioritize its new metaverse project due the FTX contagion, the Financial Times reported on Dec. 9. Apart from ditching its expansion plans, the firm has reportedly been cutting its headcount recently. After reportedly laying off up to 40% of staff in September, the firm continued to lay off employees again in December. According to Huang, ...

CZ and SBF duke it out on Twitter over failed FTX/Binance deal

Binance CEO Changpeng Zhao, or CZ, and former FTX CEO Sam Bankman-Fried, or SBF, have revealed new details about the failed agreement between the exchanges during FTX’s liquidity crisis in November. In a Dec. 9 Twitter thread, CZ referred to Bankman-Fried as a “fraudster,” saying Binance exited its position in FTX in July 2021 after becoming “increasingly uncomfortable with Alameda/SBF.” According to the Binance CEO, SBF was “unhinged” at the exchange pulling out — a claim that prompted an online response from the former FTX CEO. Bankman-Fried criticized CZ for his public admonition of FTX, adding details about the negotiations between the exchanges amid FTX’s reported “liquidity crunch” in November prior to the firm filing for bankruptcy. SBF said at the time that FTX had reached a ...

FTX reportedly gets 3 more months to stop all operations in Japan

The Japanese subsidiary of the now-defunct cryptocurrency exchange FTX has received approval from local regulators to continue sorting out issues with withdrawals until next year. The Kanto Local Finance Bureau, a local financial regulator running under the Ministry of Finance of Japan, has issued a statement regarding FTX Japan operations, Reuters reported. The Japanese authority has postponed FTX’s business suspension deadline until March 9, 2023, extending the original time limit by three months. In mid-November, Japan’s Financial Services Agency (FSA) initially requested FTX Japan to suspend business orders by Dec. 9. According to the announcement, the Kanto Local Finance Bureau has ordered the extension of the deadline because FTX Japan has so far failed to return assets from custody ...

The all-in-one approach at the foundation of next gen crypto investment platforms

The ongoing FTX saga has injected more uncertainty into an already shaken market. If it was not clear already, even the biggest centralized exchanges can fail. The problem is multi-faceted. On the one hand, just like in traditional finance, centralized institutions are only as good as the people who run them. When investors use services like FTX, they are putting their trust in the people that run the service. Unfortunately, history is rife with examples of powerful people taking advantage of that trust. On the other hand, cryptocurrency is still very new. The vast majority of crypto users are not well-versed in all of the technical underpinnings of how things work. For most, digital assets are simply an alternative means of investing and therefore the most convenient solutions are often t...

FTX hires forensics team to find customers’ missing billions: Report

The new management for bankrupt crypto exchange FTX has reportedly hired a team of financial forensic investigators to track down the billions of dollars worth of missing customer crypto. Financial advisory company AlixPartners was chosen for the task and is led by former Securities and Exchange Commission (SEC) chief accountant, Matt Jacques, according to a Dec. 7 report from the Wall Street Journal. It is understood that the forensics firm will be tasked with conducting “asset-tracing” to identify and recover the missing digital assets and will complement the restructing work being undertaken by FTX. On Nov. 11 hackers drained wallets owned by FTX and FTX.US of over $450 million worth of assets. Former CEO Sam Bankman-Fried claimed in an interview recorded on Nov. 16 with crypto blogger ...

Cryptocurrency has become a playground for fraudsters

News involving crypto and fraud is ubiquitous in the white-collar crime sphere and, perhaps more worryingly, these fraudulent activities in the crypto sector are not limited to a single type of crime. Diverse and distinct yet with one common thread, these crimes involve real money and crypto investors are the victims. Many people have placed their life savings into crypto and, on a larger scale, private equities, pension schemes and even nation-states are principal investors and losers. There are con artists who will try and entice their targets to invest in a get-rich scheme that turns out to be a Ponzi. On Nov. 21, officials announced that two Estonian citizens were arrested in a $575 million cryptocurrency fraud and money laundering scheme. Additionally, in September, United States...

Sam Bankman-Fried hires defense attorney as US authorities probe FTX: Report

Former FTX chief executive officer Sam Bankman-Fried has reportedly hired Mark Cohen, a former federal prosecutor, to act as his defense attorney. According to a Dec. 6 report from Reuters, Bankman-Fried’s spokesperson Mark Botnick said the former FTX CEO has retained Cohen amid a flurry of civil litigation from investors in the crypto exchange and investigations by lawmakers and regulators in the United States. Cohen, a co-founder of law firm Cohen & Gresser, was a former assistant U.S. attorney for the Eastern District of New York who also on the defense team for the high-profile case involving Ghislaine Maxwell — sentenced to 20 years in prison for child sex trafficking and related charges. Lawmakers with the U.S. Senate and House of Representatives have announced separate hea...

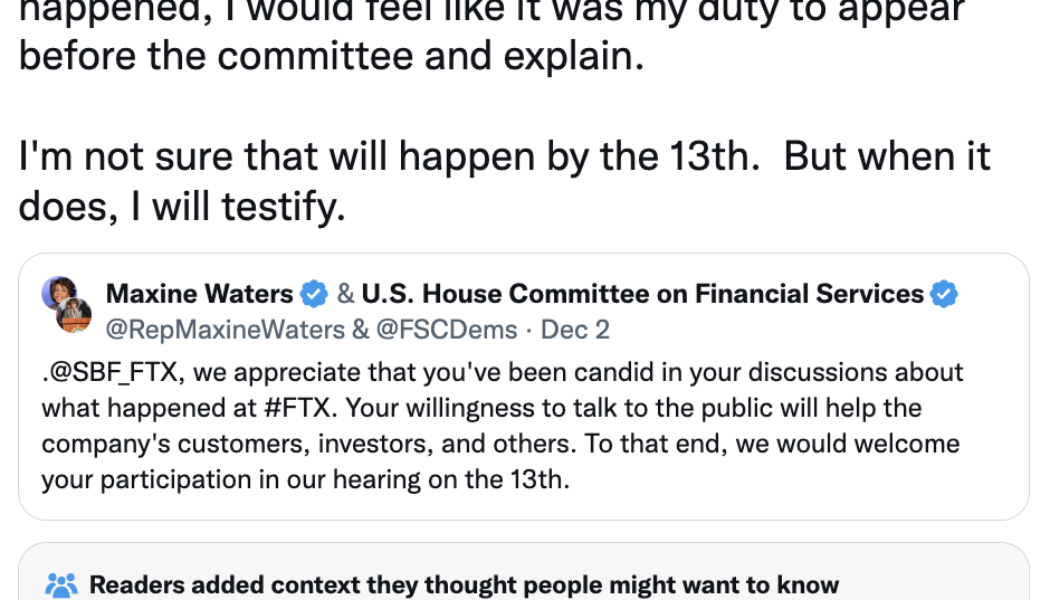

US House committee chair pushes back against SBF’s excuse to potentially delay testimony

Maxine Waters, chair of the United States House Financial Services Committee, has called out former FTX CEO Sam Bankman-Fried for announcing on social media he intended to testify after “learning and reviewing what happened” at the exchange. In a Dec. 5 Twitter thread, Waters cited Bankman-Fried’s numerous media interviews in the wake of FTX’s bankruptcy as evidence that his information was “sufficient for testimony” before the committee. Waters will preside over a hearing investigating the collapse of FTX on Dec. 13, in which committee leadership said they expected Bankman-Fried and other individuals associated with the events around the exchange’s downfall to appear. “The collapse of FTX has harmed over one million people,” said Waters, in a statement directed to Bankman-Fried. “Your tes...

Alameda Research invested $1.15B in crypto miner Genesis Digital: Report

Crypto mining company Genesis Digital Assets was the biggest venture investment made by Alameda Research, FTX’s sister company and in the center of the exchange’s bankruptcy. Documents disclosed by Bloomberg on Dec. 3 show that Genesis Digital raised $1.15 billion from Alameda in less than nine months. The capital infusion was made before the crypto prices downturn, between August 2021 and April of this year. Genesis Digital is the major United States-based Bitcoin mining company, and it’s not related to Genesis Capital, the trading company with $175 million worth of funds locked away in an FTX trading account. Former FTX CEO Sam Bankman-Fried recently recognized participating in Alameda’s venture decisions, including the investment in Genesis Digital, despite...

Crypto lender Genesis allegedly owes $900M to Gemini’s clients: Report

Crypto lender Genesis and its parent company Digital Currency Group (DCG) allegedly owe $900 million to Gemini’s clients, according to a Financial Times report disclosed on Dec. 3, citing people familiar with the matter. The issue derives from the FTX dramatic collapse in November. Crypto exchange Gemini operates a product called Gemini Earn in partnership with Genesis, offering investors the opportunity to earn 8% in interest by lending out their crypto, including Bitcoin and stablecoins pegged to fiat currencies. On Nov. 16, Genesis announced it had temporarily suspended withdrawals citing “unprecedented market turmoil,” days after disclosing around $175 million worth of funds stuck in an FTX trading account. Genesis is reportedly facing difficulties raising money for its...