ftx

Crypto hotspots continue to thrive despite FTX collapse

The sudden failure of FTX has left many people questioning the impact this will have on the cryptocurrency ecosystem. For instance, it remains questionable whether or not crypto hotspots will continue to flourish or if there will be a decline in innovation. While it may be too soon to fully understand the impact of the FTX collapse, industry leaders within crypto-friendly geographies believe that the FTX failure will not hamper innovation. For example, Dubai — which has been dubbed as one of the most innovative regions for crypto and blockchain development — continues to see ecosystem activity. Most recently, The Algorand Foundation, the organization driving the growth of the Alogrand blockchain, hosted its second annual Decipher conference in Dubai. The event took place Nov. 29–30, ...

Sam Bankman-Fried says he will testify before the US House Financial Services Committee remotely

Continuing his so-called apology tour, Sam Bankman-Fried appeared on a Twitter Spaces chat with Unusual Whales and told nearly 60,000 listeners that he intends to testify at the United States House of Representatives Financial Services Committee remotely on Dec. 13. He was previously confirmed to appear in person. Bankman-Fried, who is allegedly currently located in the Bahamas, missed the deadline to confirm his appearance before the Senate Banking Committee the following day, despite the threat of a subpoena. Despite his frequent public speaking, Bankman-Fried has gone silent on Twitter himself, not posting since Dec. 9, when he indicated his agreement to appear at the House committee hearing. 1) I still do not have access to much of my data — professional or personal. So the...

Arthur Hayes: Bitcoin bottomed as ‘everyone who could go bankrupt has gone bankrupt’

Arthur Hayes, the former CEO of crypto derivatives platform BitMEX, thinks the worst might be over for Bitcoin (BTC) this cycle as the “largest most irresponsible entities” have run out of BTC to sell. “Looking forward, pretty much everyone who could go bankrupt has gone bankrupt,” he said in the Dec. 11 interview with crypto advocate and podcaster Scott Melker. Hayes elaborates on his stance by explaining that when centralized lending firms (CELs) have financial troubles, they will often call in loans first, then sell BTC first because it operates as the “reserve asset of crypto” and “the most pristine asset and the most liquid.” “When you look at the balance sheet of any of these of the heroes, there’s no Bitcoin on it because what do they do, they sold...

Former top SEC crypto regulator hired by Caroline Ellison

A former top crypto regulator with the United States Securities and Exchange Commission (SEC) will represent Caroline Ellison, the ex-Alameda Research CEO, in an ongoing federal probe, according to a Dec. 10 report from Bloomberg. Ellison will be represented by Stephanie Avakian and a team of attorneys from WilmerHale. Avakain is currently chair of the Securities and Financial Services department at the law firm. At the SEC, she was a director at the Enforcement Division, where she expanded cryptocurrency oversight, bringing cases against Robinhood and Ripple Lab. According to the law firm’s website, “Ms. Avakian oversaw the Division’s approximately 1,400 professionals and staff. During her four years leading the Division, the SEC brought more than 3,000 enforcement actio...

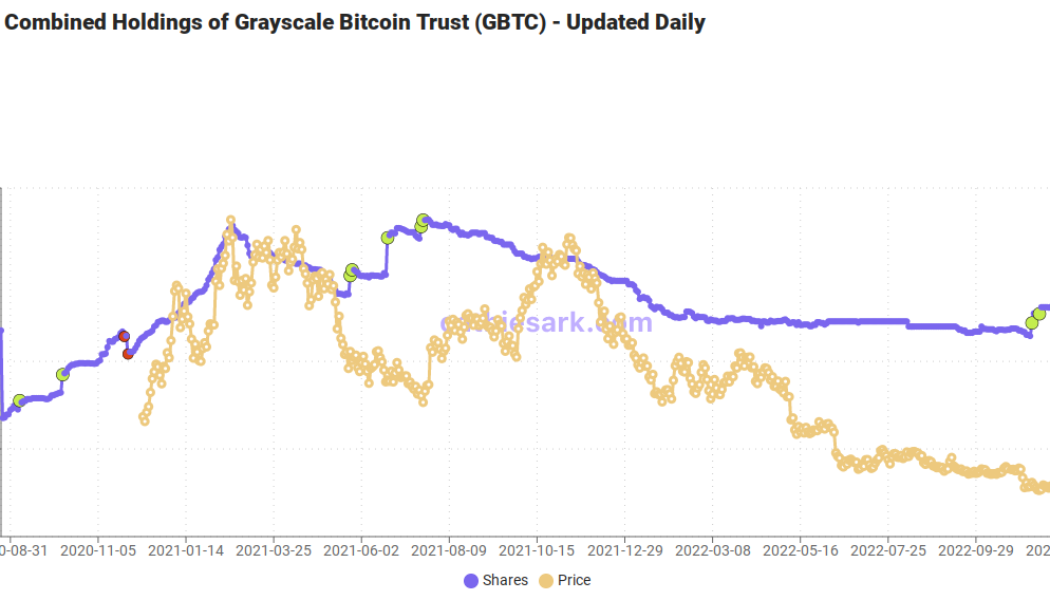

SBF ‘didn’t like’ decentralized Bitcoin — ARK Invest CEO Cathie Wood

Bitcoin (BTC) is too “decentralized and transparent” for former FTX CEO Sam Bankman-Fried, says Cathie Wood. In a tweet on Dec. 10, Wood, who is CEO of investment giant ARK Invest, delivered a fresh damning appraisal of the FTX saga. Wood: SBF “couldn’t control” Bitcoin As the legal ramifications of FTX and Bankman-Fried, also known as SBF, continue, Bitcoin loyalists are giving him little sympathy. ARK’s Wood is now firmly among them, not mincing her words as BTC price action continues to trade around 20% down over the month. “The Bitcoin blockchain didn’t skip a beat during the crisis caused by opaque centralized players,” she wrote. “No wonder Sam Bankman Fried didn’t like Bitcoin: it’s transparent and decentralized. He couldn’t control it.” Wood linked to ARK Invest’s...

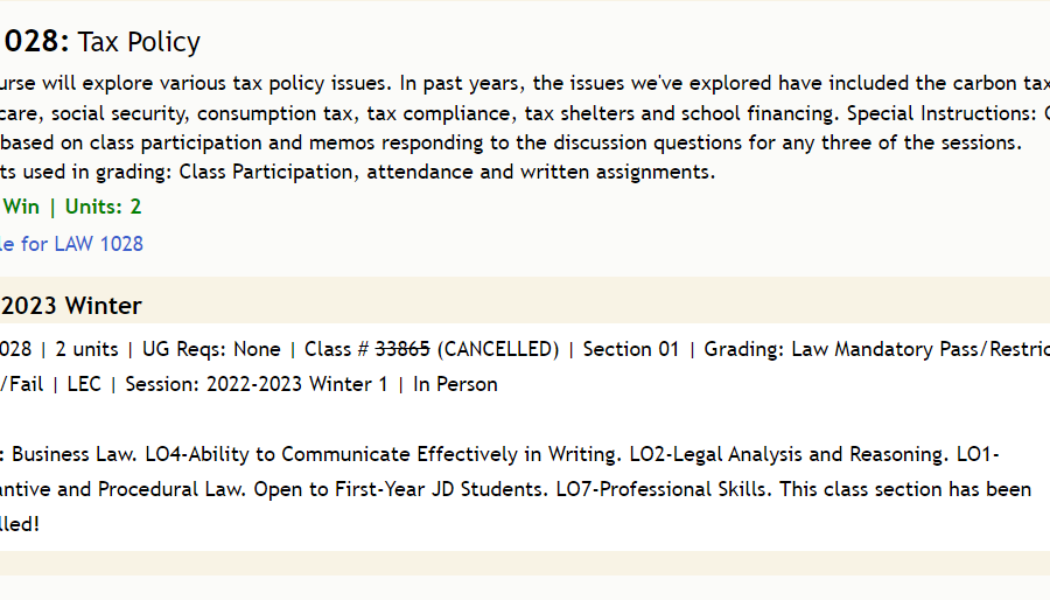

Sam Bankman-Fried’s parents no longer on the Stanford Law School roster

The domino effect of FTX CEO Sam Bankman-Fried’s actions came full circle as his reputation began impacting the professional lives of his parents — Stanford Law professors Joseph Bankman and Barbara Fried. SBF’s father, Bankman, had to cancel his winter session course on tax policy, which according to The Standford Daily, was at a time when the family was accused of acquiring an FTX-owned $16.4 million vacation home before the crypto exchange’s collapse. Stanford Law professor Joseph Bankman’s tax policy course was canceled. Source: explorecourses.stanford.edu On the other hand, SBF’s mother, Fried, was surprisingly not even listed as an instructor for any of the courses. While this event coincides with FTX’s fallout, where Fried became a focal point of discussion owing to her ...

FTT investors’ claims to be investigated for securities laws violations

To help out the recently duped investors of FTX Tokens (FTT), shareholder rights litigation firm — Schall Law Firm — has taken up the task of investigating the investors’ claims against FTX for violations of the securities laws. It is estimated that over one million people have lost their life savings owing to the financial fraud committed by FTX CEO Sam Bankman-Fried. To help the investors legally recoup losses, the law firm plans to investigate FTX for issuing misleading statements or failing to disclose crucial information. In an official statement, Schall Law Firm highlighted how various media publications uncovered the cracks within FTX-Alameda operations, eventually leading to the crash of FTX’s in-house FTT tokens. The law firm advised all FTT investors to participate in the drive b...

SBF tried to destabilize crypto market to save FTX: Report

Tether executives and Binance CEO Changpeng “CZ” Zhao worried that Sam Bankman-Fried (SBF), former FTX CEO, was attempting to destabilize the crypto market aiming to save the now-bankrupt exchange, according to reports on Dec. 9. Messages seen by The Wall Street Journal of a Signal group chat named “Exchange coordination” reveals an argument between CZ and SBF on Nov. 10 about Tether’s stablecoin USDT. According to the report, CZ and others in the group worried that trades made by Alameda Research were focusing on depeg the stablecoin, which would have a ripple effect in crypto prices. Binance CEO reportedly confronted SBF: “Stop trying to depeg stablecoins. And stop doing anything. Stop now, don’t cause more damage.” SBF denied the claims in a statement to the WSJ....

Bahamian attorneys pursue access to FTX data of international customers

Authorities across the globe are fighting against time to bring justice to the millions of people impacted by the financial frauds committed by FTX CEO Sam Bankman-Fried. As part of the ongoing investigations, attorneys representing the Securities Commission of the Bahamas seek access to FTX’s database with international customer information. The Bahamian attorneys filed an emergency motion with a Delaware bankruptcy judge requesting access to FTX’s customer database to aid their ongoing investigations. The motion highlighted previous failed attempts to access the defunct crypto exchange’s database. As a result, the lawyers claimed that FTX employees and counsel prevented authorities from getting critical financial information. The database in question is reportedly stored on Amazon Web Se...

US DOJ reportedly investigating FTX CEO for siphoning funds out of the US

While many crypto fraudsters were able to slip through the cracks in the past, the same does not hold for FTX CEO Sam Bankman-Fried (SBF). Running parallel to the ongoing scrutiny related to FTX frauds, the United States Department of Justice (DOJ) is reportedly investigating a potential fraud that involves SBF siphoning funds offshore just days before FTX filed for bankruptcy. According to a Bloomberg report, the federal investigation aims to examine SBF’s involvement in improperly transferring FTX funds to the Bahamas as the defunct crypto exchange filed for bankruptcy on Nov. 11. The anonymous informant further revealed that DOJ officials met with FTX’s court-appointed overseers to discuss the scope of the information they need for further investigation. DOJ also plans to investigate wh...

Who’s expected to testify before Congressional hearings on FTX?

United States lawmakers have been pushing for certain witnesses — including Sam Bankman-Fried — to appear before committee hearings scheduled in December. Who should the crypto space expect to see testifying on the events leading to the downfall of FTX? On Dec. 9, Bankman-Fried, or SBF, said — under threat of a potential subpoena — that he was willing to speak at a U.S. House hearing aimed at exploring FTX’s collapse. Leadership with both the House Financial Services Committee and Senate Banking Committee had suggested that they might subpoena the former FTX CEO, prompting SBF to say on Twitter he was “willing to testify” on Dec. 13. At the time of publication, SBF’s name did not appear as a witness in the House committee’s ‘Investigating the Collapse of FTX, Part I’ hearing — suggesting m...