ftx

Former Alameda CEO confirms firm borrowed billions from FTX customer deposits as part of plea deal

Caroline Ellison, the former CEO of Alameda Research, said as part of her plea deal that she was aware FTX funds had been made available for the venture capital firm’s investments. In a transcript of proceedings for her plea deal in the Southern District of New York released on Dec. 23, Ellison acknowledged the financial ties between FTX and Alameda at the center of prosecutors’ case against former FTX CEO Sam Bankman-Fried. According to the former Alameda CEO, Alameda had access to a “borrowing facility” through FTX from 2019 to 2022. “I understood that FTX executives had implemented special settings on Alameda’s FTX.com account that permitted Alameda to maintain negative balances in various fiat currencies and crypto currencies,” said Ellison. “In practical terms, this arrangement permit...

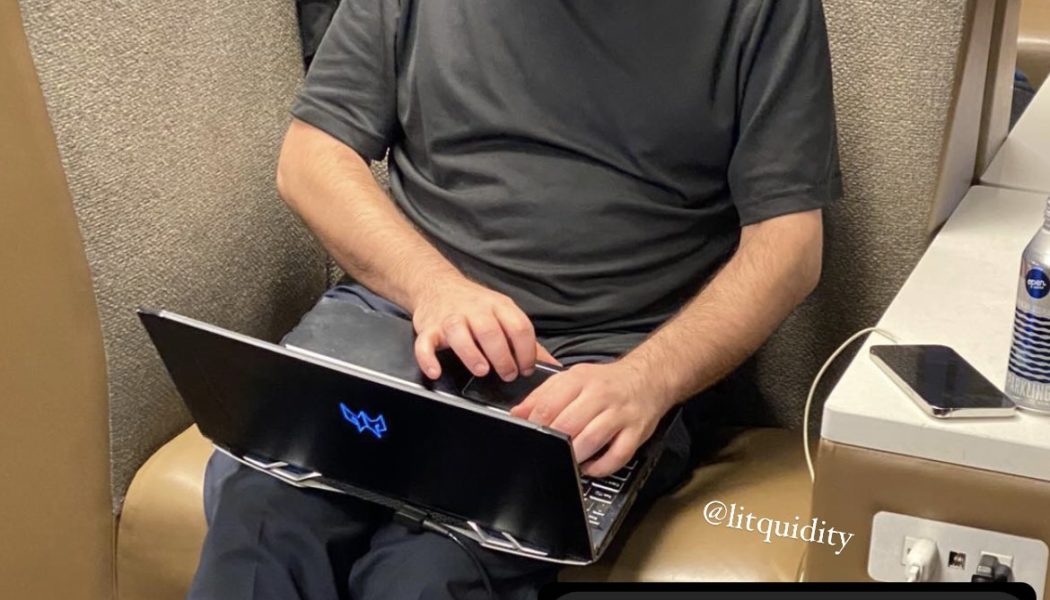

Sam Bankman-Fried found ‘chilling’ in JFK airport lounge on $250M bail bond

The momentary arrest of former FTX CEO Sam Bankman-Fried (SBF) can be attributed to the efforts taken by the crypto community to aid investigations and track down the whereabouts of the infamous entrepreneur. While SBF eventually escaped prison time via a $250 million bail bond, the community continues to monitor his every move publicly. Just three days after being released on a personal recognizance bond, a crypto community member allegedly spotted SBF “chilling” in a John F. Kennedy International Airport lounge. The supporting images were shared on Twitter by @litcapital, which shows SBF sitting on a lounge chair with access to a laptop and mobile phone. Sam Bankman-Fried found at the JFK airport lounge. Source: Twitter Based on the pictures, other community members confirmed that SBF’s ...

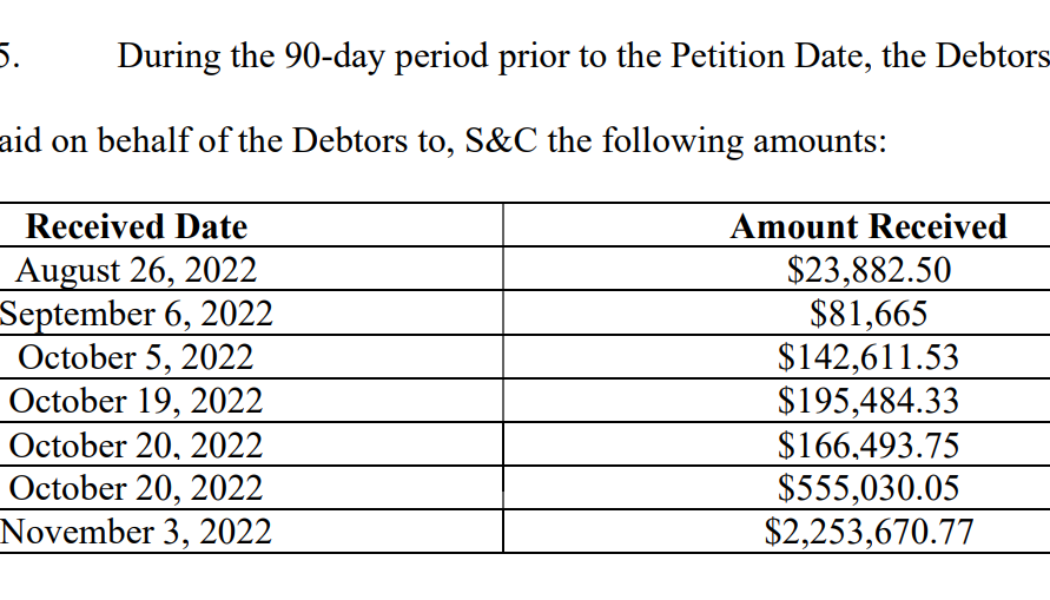

FTX paid $12M retainer to a New York law firm before bankruptcy filing

Defunct crypto exchange FTX paid a retainer of $12 million to bankruptcy lawyers as security for payment of its fees and expenses amid Chapter 11 bankruptcy proceedings, shows a court filing dated Dec. 21. Sullivan & Cromwell LLP (S&C), a law firm headquartered in New York City, received $12 million from West Realm Shires Services Inc. on behalf of FTX for legal services. In addition, the filing confirmed that over the past 90 days, i.e., since Aug. 26, 2022, FTX paid nearly $3.5 million to S&C. Snippet of the court filing revealing FTX’s historical payments to S&C law firm. Source: aboutblaw.com Based on the information provided, FTX paid at least $15.5 million to avail and retain the legal services of S&C. The filing further revealed that S&C currently ...

Crypto billionaires lost $116B since March: Report

The bear market and the wave of bankruptcies in the crypto industry drained $116 billion from the pockets of founders and investors in the past nine months, according to recent estimates by Forbes. The loss represents the combined personal equity of 17 people in the space, with over 15 losing more than half of their fortunes since March. As a result, 10 names were removed from the crypto billionaires list. One of the major losses was attributed to Binance CEO Changpeng “CZ” Zhao. In March, his 70% stake in the crypto exchange was valued at $65 billion, but it is now worth $4.5 billion. Coinbase CEO Brian Armstrong has a net worth estimated at $1.5 billion, down from $6 billion in March. The fortune of Ripple’s co-founder Chris Larsen was reduced from $4.3 billion to...

Xmas dinner table: What to tell your family about what happened in crypto this year

After a lackluster rise of crypto in 2021, which saw many new crypto millionaires and several crypto startups attain unicorn status, came the dramatic fall in 2022. The industry was plagued by macroeconomic pressures, scandals and meltdowns that wiped out fortunes virtually overnight. As 2022 comes to a close, many crypto proponents are perplexed about the state of the industry, especially in light of the recent FTX collapse and the contagion it has caused, taking down several firms associated with it. Many who couldn’t stop talking about crypto and recommending their family to invest in it last year at Christmas dinner could see the tables turn this year, with them having a lot of explaining to do about the state of crypto today. While as awkward as that conversation is going to be,...

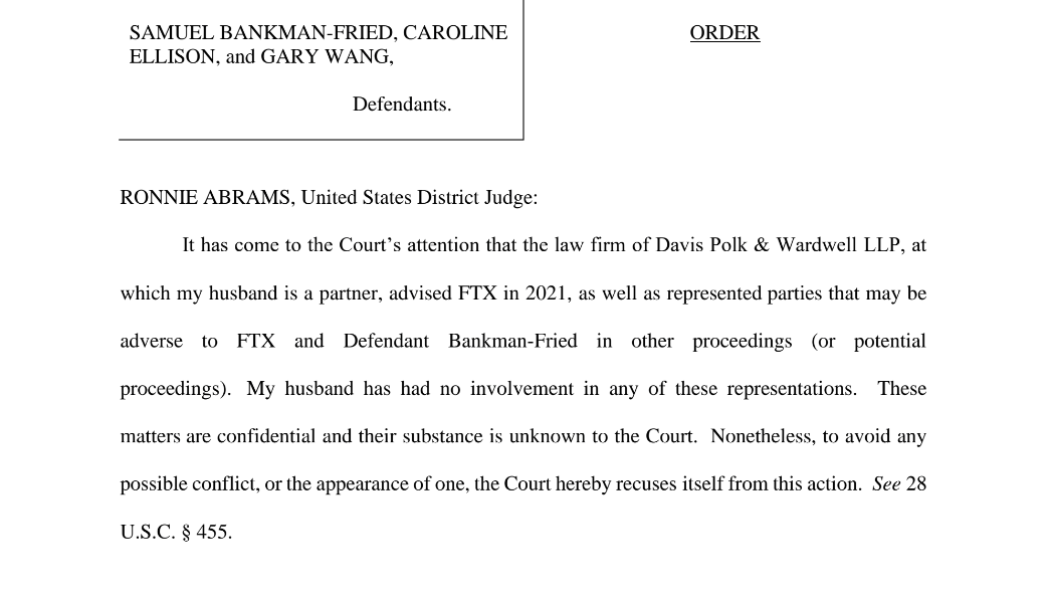

Judge pulls out of SBF-FTX case citing husband’s law firm’s advisory link

The ongoing legal proceedings around former FTX CEO Sam Bankman-Fried (SBF) took a new turn as District Judge Ronnie Abrams withdrew her participation from the case. The United States District Court for the Southern District of New York rescued itself from the FTX case after revealing that a law firm — which employs Abrams’ husband as a partner — had advised the crypto exchange in 2021. In a Dec. 23 filing, Judge Abrams revealed that her husband, Greg Andres, is a partner at Davis Polk & Wardwell, a law firm where he has been employed since June 2019. Additionally, it was highlighted that the law firm had advised FTX in 2021. Abrams also stated that the law firm represented parties that may be adverse to FTX and SBF in other legal proceedings. “My husband has had no involvement i...

Santas and Grinches: The heroes and villains of 2022

From an outside perspective, 2022 has been a rollercoaster ride for crypto. The market reached a total valuation of $3 trillion during the bull market of 2021, only to scale back to its current level of around $810 billion. While this poor performance can be partly attributed to the pervading macroeconomic environment — compounded by rising inflation rates and the ongoing Ukraine-Russia conflict, among other factors — one cannot deny the role that the recent slew of insolvencies has had on the sector. That said, below is a list of arguably the most notable heroes and villains who have undeniably impacted this rapidly evolving industry over the past year. The heroes Changpeng Zhao At a time when some of the biggest players in crypto crumbled, Changpeng Zhao, also known as “CZ,” ensure...

Rating agencies, not regulators, can rebuild trust in crypto after FTX

The last year has been an eventful one for the crypto space. The collapse of the Terra ecosystem and its TerraUSD (UST) algorithmic stablecoin saw $50 billion wiped off the market in a flash. And more recently, FTX, an exchange many thought was “too big to fail,” came crashing down. There’s been no shortage of drama in the space, which has seen name-stay businesses and projects disappear along with investors’ funds. Given the events of this year, it’s inevitable that serious government attention is coming for the space, in every major jurisdiction — and on the time scale of a few months to at most a few years, not decades. This was fairly clear to most industry observers even before the recent FTX debacle, and now it has become glaringly obvious. There is much debate in the space abo...

Third parties could return FTX funds directly to customers: Law firm

More than one million creditors of failed crypto exchange FTX have been waiting to be made whole since before the firm’s bankruptcy filing on Nov. 11, but according to one expert, recipients of donations and contributions may have a legal means of returning the funds directly to investors and customers. Louise Abbott, a partner at United Kingdom-based firm Keystone Law, told Cointelegraph it was “extremely unlikely” FTX would have a legal leg to stand on in its demands for the voluntary return of political campaign donations, grants, and other contributions the firm made prior to its bankruptcy. However, many individuals and organizations — likely the result of public scrutiny — have already returned or pledged to return an estimated $6.6 million to FTX, a fraction of the millions th...

SBF received special treatment inside Bahamian jail: Report

Former FTX CEO Sam Bankman-Fried, who was remanded to the notorious Fox Hill Prison in Nassau, Bahamas, pending an investigation into the collapse of his exchange, had a different experience than many other prisoners. According to the Financial Times, Bankman-Fried was held in the sickbay where he had access to a toilet, running water, a TV, local newspapers, crossword puzzles, and many other perks, including vegan food. Anonymous prison officials disclosed that the former CEO spent his days watching the news and reading articles about himself. SBF’s prison experience appears to have been very different from what many other prisoners endure in their overcrowded, poorly ventilated, rat-infested prison cells, where they are forced to sleep on the floor using makeshift cards. Unlike oth...

Sam Bankman-Fried is one step closer to US extradition: Report

Former FTX CEO Sam Bankman-Fried, who has been in the custody of Bahamian authorities, faces extradition to the United States following a hearing. According to reports, Bankman-Fried appeared in a hearing of The Bahamas Magistrate Court on Dec. 21 — the third since his arrest — where he waived his right to a formal extradition process that could have taken weeks. Officials from the U.S. Embassy, Federal Bureau of Investigation, and U.S. Marshals Service were reportedly in attendance to facilitate Bankman-Fried’s handover, to which he had first signed papers on Dec. 20. Reuters reported that SBF’s legal team said the former CEO was “anxious to leave” The Bahamas. Jerome Roberts, on Bankman-Fried’s legal team, reportedly heard SBF say on Dec. 19 his decision...

Who has returned donations or contributions from FTX amid the firm’s reputational risks?

Before its downfall, crypto exchange FTX and its then-CEO Sam Bankman-Fried had been some of the most prolific spenders in the space, bailing out crypto firms and donating to political campaigns and media outlets. With more than 1 million FTX creditors looking to be made whole, what’s happening with these funds? Bankman-Fried said in May he had been willing to donate between $100 million and $1 billion to lawmakers as part of elections in 2024. Bloomberg reported on Dec. 12 — hours before SBF’s arrest in the Bahamas — that his total donations could be at least $73 million, given directly to candidates or through political action committees (PACs). Though many of Bankman-Fried’s and FTX’s donations to Democrats were noted with the Federal Election Commission as part of the public reco...