ftx

Sam Bankman-Fried to reportedly plead not guilty to criminal charges

Former FTX CEO Sam Bankman-Fried (SBF), currently free on a $250 million bail bond, will reportedly plead not guilty to the alleged FTX and Alameda-related financial frauds in court on Jan. 3. SBF was arrested in the Bahamas at the request of the U.S. government under suspicion of defrauding investors and misappropriation of funds held on the FTX crypto exchange. Following a court hearing on Dec. 22, SBF was released on bail and is slated to appear on court on Jan.3 before U.S. District Judge Lewis Kaplan in Manhattan. During the hearing, SBF is expected to enter a plea of not guilty to the criminal charges, according to a Reuters report. On Dec. 13, the SEC charged the former FTX CEO with violating the anti-fraud provisions of the Securities Act of 1933 and the Securities Exchange Act of ...

Winners and losers of 2022: A disastrous year that saw few winners among a sea of losers

2022 was supposed to be the year crypto went mainstream, with a significant chunk of traditional venture capital firms betting heavily on the ecosystem in 2021. However, with one disaster after another, 2022 turned out to be a catastrophic year for the nascent crypto ecosystem. Some of the biggest names touted as pivotal to taking the crypto ecosystem forward turned out to be the orchestrators of its worst year in recent memory. That said, quite a few protagonists rose to the occasion. These winners proved that crypto is not just about a few select individuals and companies but a vibrant ecosystem that can survive significant setbacks. Let’s start with some of the biggest winners of the crypto ecosystem in 2022. The list includes individuals, companies and anonymous groups working for the ...

Sam Bankman-Fried denies moving funds from Alameda wallets

Sam Bankman-Fried, the former CEO of the now-defunct FTX exchange, has denied moving funds tied to Alameda wallets, days after he was released on a $250 million bond. On Dec. 30, Fried tweeted to his 1.1 million followers, denying any involvement in the movement of funds from Alameda wallets. In response to the allegations that he may have been responsible for moving funds out of Alameda wallets, he shared: “None of these are me. I’m not and couldn’t be moving any of those funds; I don’t have access to them anymore.” None of these are me. I’m not and couldn’t be moving any of those funds; I don’t have access to them anymore.https://t.co/5Gkin30Ny5 — SBF (@SBF_FTX) December 30, 2022 SBF’s tweet was in response to a news story published by Coint...

Solana joins ranks of FTT, LUNA with SOL price down 97% from peak — Is a rebound possible?

Solana (SOL), the cryptocurrency once supported by Sam Bankman-Fried, pared some losses on Dec. 30, a day after falling to its lowest level since February 2021. Solana price down 97% from November 2021 peak On the daily chart, SOL’s price rebounded to around $10.25, up over 20% from its previous day’s low of approximately $8. SOL/USD weekly price chart. Source: TradingView Nevertheless, the intraday recovery did little to offset the overall bear trend — down 97% from its record peak of $267.50 in November 2021, and down over 20% in the past week. But while the year has been brutal for markets, Solana now joins the ranks of the worst-performing tokens of 2022, namely FTX Token and LUNA, which are down around 98%. FTT (red) vs. LUNA (green) vs. SOL (blue) ...

Alameda wallets funnel over $1.7M via crypto mixers overnight

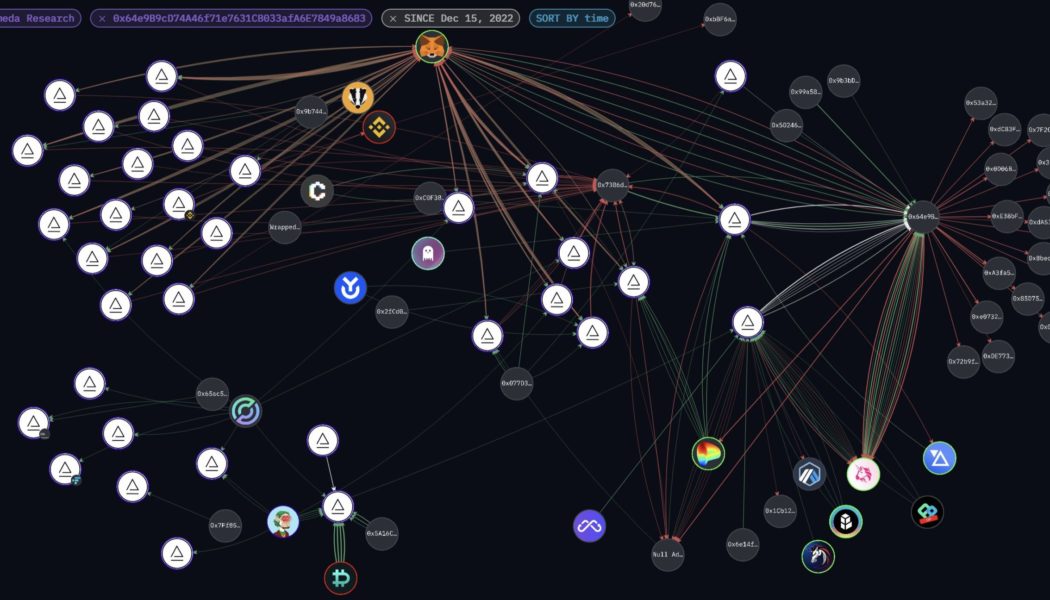

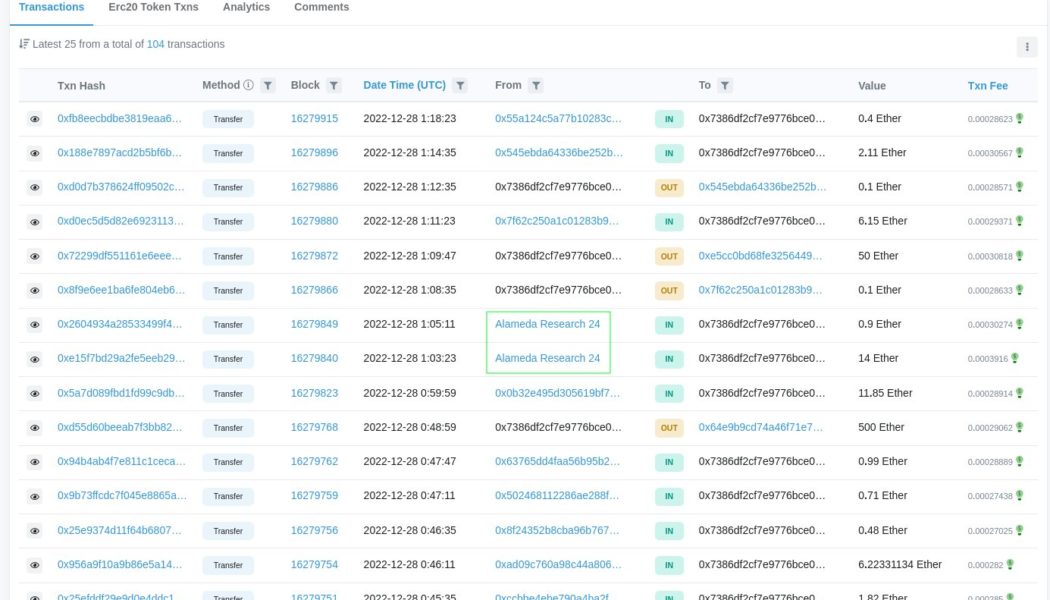

30 cryptocurrency wallets linked to Alameda Research, the bankrupt sister company of crypto exchange FTX, became active on Dec. 28 following four weeks of inactivity. These wallets swapped and mixed over $1.7 million worth of crypto assets through various crypto-mixing services. Crypto mixers are often used by market exploiters and criminals to obscure the transaction path so that the funds cannot be traced to the original source. As Cointelegraph reported on Dec. 28, the sudden movement of funds from Alameda wallets just days after Sam Bankman Fried was released on bail raised suspicions across the crypto community. Nearly 24 hours later, it seems the culprit behind these fund transfers used extensive planning to hide transaction routes. According to data shared by the crypto forensic gro...

Bankman-Fried may enter plea in NY federal court next week before Judge Lewis Kaplan

Former FTX CEO Sam Bankman-Fried is scheduled to appear in court on the afternoon of Jan. 3 to enter a plea on two counts of wire fraud and six counts of conspiracy against him in relation to the collapse of the FTX cryptocurrency exchange, Reuters reported on Dec. 28, citing court records. Bankman-Fried will appear before District Judge Lewis Kaplan in Manhattan. Judge Kaplan was assigned to the case on Dec. 27 after the original judge on the case, Ronnie Abrams, recused herself due to connections between FTX and the Davis Polk & Wardwell law firm, where her husband is a partner. The firm provided advisory services to FTX in 2021. Kaplan was nominated by U.S. President Bill Clinton in 1994 and is known for his straightforward manner and efficient handling of courtroom proce...

Alameda wallets become active days after SBF bail, community mulls foul play

The crypto wallets associated with now-bankrupt trading firm Alameda Research, the sister company of FTX, were seen transferring out funds just days after the former CEO Sam Bankman Fried was released on a $250 million bond. The transfer of funds from Alameda wallets raised community curiosity, but more than that, the way in which these funds were transferred grabbed the community’s attention. The Alameda wallet was found to be swapping bits of ERC20s for ETH/USDT, and then the Ether (ETH) and USDT (USDT) were funneled through instant exchangers and mixers. For example, a wallet address that starts with 0x64e9 received over 600 ETH from wallets that belong to Alameda, part of it was swapped to USDT while the other part of the transaction was sent to ChangeNow. On-chain analyst ZachXBT note...

FTX customers file class-action lawsuit to get priority reparations

While the government agencies are queuing to sue the FTX and its founder Sam Bankman-Fried, the group of former customers made an effort to get their money back first. A class lawsuit initiated by four individuals demands priority access to frozen funds of the company for its customers, not investors. The lawsuit was filed on Dec. 27 in the United States Bankruptcy Court for the District of Delaware. Four plaintiffs claim to be representing the whole class of former FTX customers, which might amass up to 1 million individuals. What the lawsuit seeks to obtain are the priority rights to return digital assets held by FTX US or FTX.com to its customers. The plaintiffs emphasize that the FTX User Agreement did not permit the platform to use customer funds for its own purposes, including ...

Community slams NYT for its latest ‘sympathy piece’ on FTX’s Bankman-Fried

The online community including some cryptocurrency figures has condemned the latest so-called “sympathy” article from The New York Times written about FTX founder Sam Bankman-Fried. In the Dec. 26 article published titled “In the Bahamas, a Lingering Sympathy for Sam Bankman-Fried,” New York Times journalist Rob Copeland quotes local Bahamians who appeared to have mostly positive things to say about the cryptocurrency exchange founder. One resident opined he had a “good heart,” with another local saying they “feel bad for him.” A resident interviewed for the article even said it “doesn’t make any sense” that Bankman-Fried’s alleged crimes landed him in prison. The article suggests that the glowing reviews of Bankman-Fried by locals stem from his millions of dollars i...

Top five crypto winners (and losers) of 2022

Cointelegraph looks back on the best and worst-performing cryptocurrencies of 2022 among the top 100 assets by market capitalization. We used the highest and the lowest year-to-date (YTD) returns through the close of Dec. 25, 2022. Overall, Cryptoindex.com 100 (CIX100), an index that tracks the 100 best-performing cryptocurrencies, fell nearly 68% YTD, suggesting most top coins underperformed in 2022. CIX100 weekly price chart. Source: TradingView Stablecoins are naturally omitted from the list below. Similarly, coins tracking the value of gold and similar mainstream assets have also been ignored. Instead, the coins mentioned below include decentralized currencies, smart contract tokens, exchange tokens and others. Top five crypto of 2022 1. GMX (GMX) YTD return: 111% Sector: Decentralized...

7 biggest crypto collapses of 2022 the industry would like to forget

2022 has been a bumpy year for the cryptocurrency market, with one of the worst bear markets on record and the downfall of some major platforms within the space. The global economy is beginning to feel the consequences of the pandemic, and clearly, this has had an influence on the crypto industry. Below is a breakdown of some of the biggest disappointments in the crypto space this year. Axie Infinity’s Ronin Bridge hacked In March of this year, Ronin, the blockchain network that runs the popular nonfungible token (NFT) crypto game Axie Infinity, was hacked for $625 million. The hacker took 173,600 Ether (ETH) and 25.5 million USD Coin (USDC) from the Ronin bridge in two transactions. When the Lazarus Group started its attack, five of the nine private keys for the Ronin Network’s cross-chai...