ftx

SBF’s lawyers terminate FTX representation due to conflicts of interest

Paul, Weiss, the law firm backing FTX CEO Sam Bankman-Fried (SBF) amid bankruptcy, renounced representing the entrepreneur, citing a conflict of interest. The decision to withdraw from representation after SBF’s tweets were found to disrupt the law firm’s reorganization efforts. Starting Nov. 14, SBF published a series of tweets that amassed extensive attention across Crypto Twitter. The move, however, sparked speculations that the cryptic tweets were used to distract bots from noticing concurrently deleted tweets. While no ill-intent could be concluded, Paul, Weiss attorney Martin Flumenbaum believed that SBF’s “incessant and disruptive tweeting” was negatively impacting the reorganization efforts: “We informed Mr. Bankman-Fried several days ago, after the filing of the FTX bankruptcy, th...

FTX funds on the move as thief converts thousands of ETH into Bitcoin

According to blockchain analysis company Chainalysis, funds stolen from the FTX crypto exchange are now being converted from ETH into Bitcoin. On Nov. 20, Chainalysis took to Twitter to encourage exchanges to freeze these coins, should the thief attempt to convert them into fiat or further obfuscate the assets through other means. 1/ Funds stolen from FTX are on the move and exchanges should be on high alert to freeze them if the hacker attempts to cash out — Chainalysis (@chainalysis) November 20, 2022 Amid the controversial collapse and bankruptcy of FTX, news broke that an unknown actor had stolen 228,523 ETH from the exchange. The ownership of these coins, worth a whopping $268,057,479 USD at time of publication, currently rank the thief as one of the largest owners of ETH in the world...

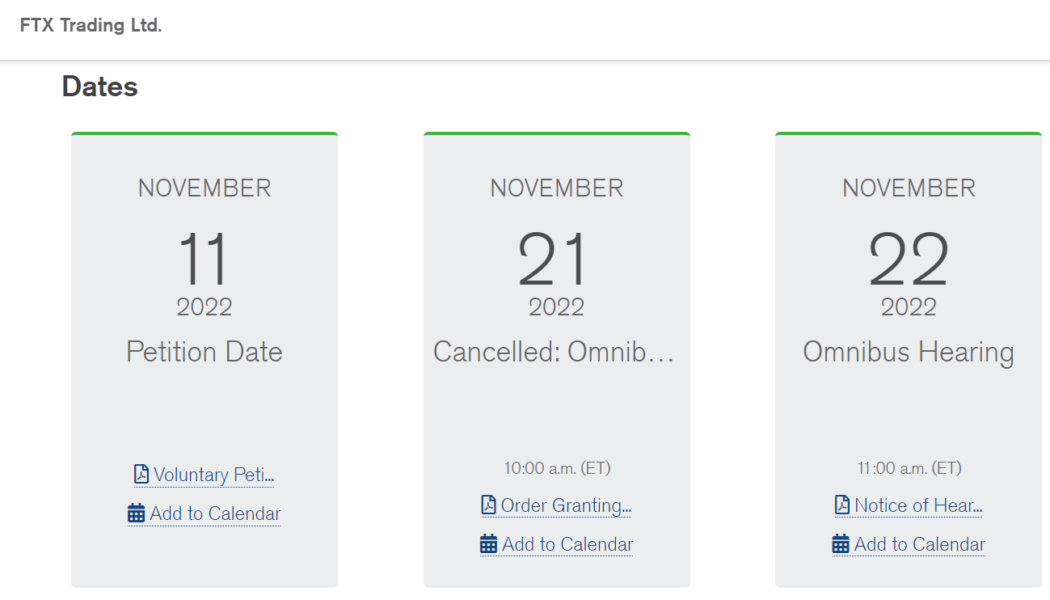

Bankrupt crypto exchange FTX begins strategic review of global assets

As part of the recent bankruptcy filing, the defunct crypto exchange FTX, along with 101 of the 130 affiliated companies, announced the launch of a strategic review of their global assets. The review is an attempt to maximize recoverable value for stakeholders. FTX, at the time led by CEO Sam Bankman-Fried (SBF), filed for Chapter 11 bankruptcy on Nov. 11 after being caught misappropriating user funds. The bankruptcy filing sought to cushion the losses of stakeholders connected to FTX and affiliated companies, a.k.a FTX debtors. 1/ Sharing a Press Release issued early today – FTX launches strategic review of its global assets. Text below (and link). https://t.co/wxz9MYnXrn — FTX (@FTX_Official) November 19, 2022 FTX debtors are in talks with financial services firm Perella Wein...

I predicted FTX’s collapse a month before it happened

The collapse of FTX has shown that where there’s smoke, there’s fire. In a year filled with jaw-dropping unveilings, none compare to the bewildering fall of Sam Bankman-Fried’s FTX exchange. While many were stunned, there were a few tell-tale signs that may have indicated not everything was peachy-perfect over at FTX headquarters. These issues began to compound and, on Oct. 5, I published a detailed commentary about my decision to begin pulling funds out of FTX and short FTT. Im taking all of my capital out of @FTX_Official and going short $FTT FTX has been swinging and missing all year long on so many activations AND Something shady is going on at FTX. Here’s 12 reasons why I’m completely out on the FTX mafia and @SBF_FTX: [1/20] pic.twitter.com/ECrhQn5Rjx — Ishan B (@Ishanb22...

FTX collapse won’t impact everyday use of crypto in Brazil: Transfero CEO

The crumbling of the FTX crypto empire may have damaged Brazilian retail and institutional sentiment toward crypto. However, its impact won’t affect everyday citizens — who will still use crypto for cross-border transactions. Reflecting on the recent fall of FTX, Thiago César, the CEO of fiat on-ramp provider Transfero Group said that the exchange’s fall, like in many countries around the world, has hurt confidence around centralized crypto exchanges and crypto in general. Transfero Group is tied in closely with the Brazilian crypto ecosystem and FTX as it was the fiat on-and-off-ramp provider for the exchange and is also the issuer of Brazilian Stablecoin BRZ, which was listed on the now-defunct exchange. César told Cointelegraph that the collapse of the exchange had removed a...

Singapore police warn investors against FTX phishing scams: Report

The Singapore Police Force has warned investors to be weary of fake websites claiming they can help them recover funds from the now-bankrupt cryptocurrency exchange FTX. On Nov. 19, the police issued a warning about a website claiming to be hosted by the United States Department of Justice that prompts FTX users to log in with their account credentials, local news agency Channel News Asia reported. The website, which was not identified, targets local investors affected by the FTX collapse, claiming that customers “would be able to withdraw their funds after paying legal fees.” The police said the website was a phishing scam designed to fool unsuspecting users into giving away their private information. Local authorities have also warned against fake online articles that promote crypt...

FTX illustrated why banks need to take over cryptocurrency

FTX — the three letters on everyone’s lips in recent days. For those active in the crypto space, it has been a shattering blow as a tumultuous year for crypto nears an end. The repercussions are severe, with over a million people and businesses owed money following the collapse of the crypto exchange, according to bankruptcy filings. With investigations into the collapse ongoing, it will certainly push forward regulatory changes, either via lawmakers or through federal agencies. While regulators may feel relieved that the scandal didn’t occur under their supervision, it highlights that there simply hasn’t been enough action taken yet by regulators across the globe toward crypto exchanges, many of whom would welcome clear frameworks by those in power. Related: Bankman-Fried misguided ...

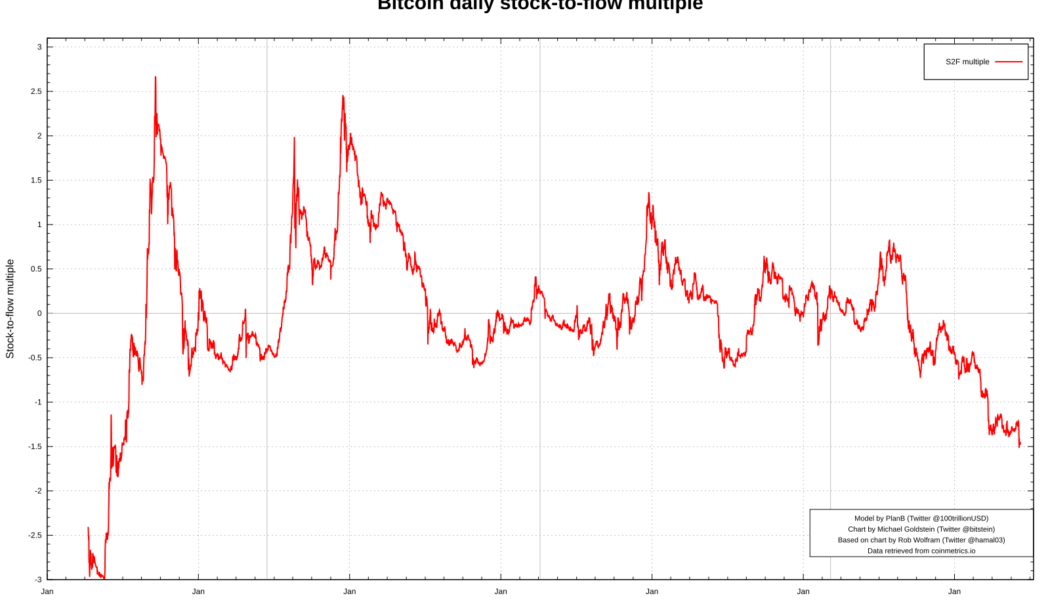

Bitcoin sees record Stock-to-Flow miss — BTC price model creator brushes off FTX ‘blip’

Bitcoin (BTC) is now further than ever from its target price according to the Stock-to-Flow (S2F) model. The latest data shows that BTC/USD has deviated from planned price growth to an extent never seen before. Stock-to-Flow sets grim new record With BTC price suppression ongoing in light of the FTX scandal, an already bearish trend has only strengthened. This has implications for many core aspects of the Bitcoin network, notably miners, but some of its best-known metrics are also feeling the heat. Among them is S2F, which is seeing its price forecasts come under increasing strain — and criticism. Enjoying great popularity until Bitcoin’s last all-time high in November 2021, the model uses block subsidy halving events as the central element in plotting exponential price growth through the ...

Grayscale cites security concerns for withholding on-chain proof of reserves

Cryptocurrency investment product provider Grayscale Investments has refused to provide on-chain proof of reserves or wallet addresses to show the underlying assets of its digital currency products citing “security concerns.” In a Nov. 18 Twitter thread addressing investor concerns, Grayscale laid out information regarding the security and storage of its crypto holdings and said all crypto underlying its investment products are stored with Coinbase’s custody service, stopping short of revealing the wallet addresses. 6) Coinbase frequently performs on-chain validation. Due to security concerns, we do not make such on-chain wallet information and confirmation information publicly available through a cryptographic Proof-of-Reserve, or other advanced cryptographic accounting procedure. — Grays...

FTX leadership pressed for information by US subcommittee chairman

The former and current CEOs of the bankrupt FTX cryptocurrency exchange have been pressed by the chair of a United States House subcommittee calling for documents relating to the exchange’s finances. “FTX’s customers, former employees, and the public deserve answers,” Raja Krishnamoorthi, Chairman of the Subcommittee on Economic and Consumer Policy wrote in a Nov. 18 letter addressed to both former FTX CEO Sam Bankman-Fried and the exchange’s current CEO John J. Ray III, who took over in the wake of FTX’s bankruptcy filings. Krishnamoorthi added the subcommittee was “seeking detailed information on the significant liquidity issues faced by FTX, the company’s abrupt decision to declare bankruptcy, and the potential impact of these actions on customers who used your exchange.” He...

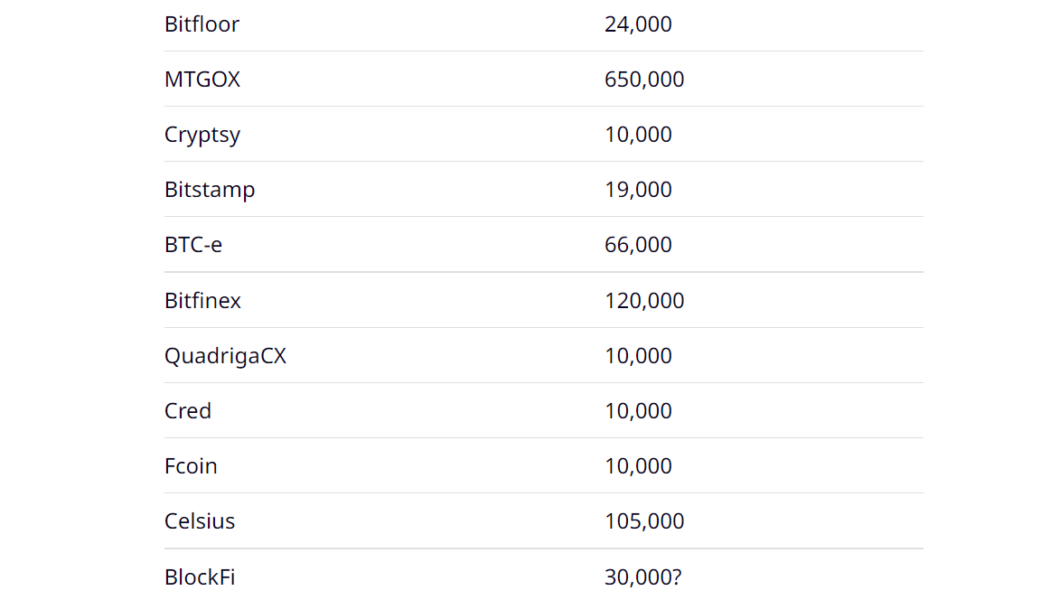

Bitcoin scarcity rises as bad exchanges take 1.2M BTC out of circulation

One of the biggest factors differentiating Bitcoin (BTC) from fiat currency and most cryptocurrencies is the hard limit of 21 million on its total circulating supply. However, the demise of numerous crypto exchanges over the last decade has permanently taken out at least 5.7% (1.2 million BTC) of the total issuable Bitcoin from circulation. The lack of clarity around a crypto exchange’s proof-of-reserves came out as the primary reason for their sudden collapses, as seen recently with FTX. Historical data around crypto crashes revealed that 14 crypto exchanges, together, were responsible for the loss of 1,195,000 BTC, which represents 6.3% of the 19.2 Bitcoin currently in circulation. Bitcoin lost due to defunct crypto exchanges. Source: Casa Blog An investigation conducted by Jameson ...

FTX collapse could trigger ‘appetite’ for harsher regulation, says Andrew Yang

Calls for harsher regulations around cryptocurrencies and digital assets will likely grow louder in the aftermath of FTX’s collapse — something former United States presidential candidate Andrew Yang said isn’t conducive to making America a hotbed for blockchain innovation. Speaking at the Texas Blockchain Summit in Austin on Nov. 18, Yang acknowledged that the bankruptcy of FTX and sister company Alameda Research would make common sense crypto regulation harder to pass in the short term. “I’ve always been in the camp that some intelligent regulation is a good thing. I think it would help the industry mature and make it more mainstream. But, unfortunately, we missed a beat — like a major beat,” he said, referring to the collective failures of FTX, FTX US and Alameda Research. “...