ftx

Sam Bankman-Fried deepfake attempts to scam investors impacted by FTX

A faked video of Sam Bankman-Fried, the former CEO of cryptocurrency exchange FTX, has circulated on Twitter attempting to scam investors affected by the exchange’s bankruptcy. Created using programs to emulate Bankman-Fried’s likeness and voice, the poorly made “deepfake” video attempts to direct users to a malicious site under the promise of a “giveaway” that will “double your cryptocurrency.” Over the weekend, a verified account posing as FTX founder SBF posted dozens of copies of this deepfake video offering FTX users “compensation for the loss” in a phishing scam designed to drain their crypto wallets pic.twitter.com/3KoAPRJsya — Jason Koebler (@jason_koebler) November 21, 2022 The video uses appears to be old interview footage of Bankman-Fried and used a voice emulator to...

Why is Bitcoin price down today?

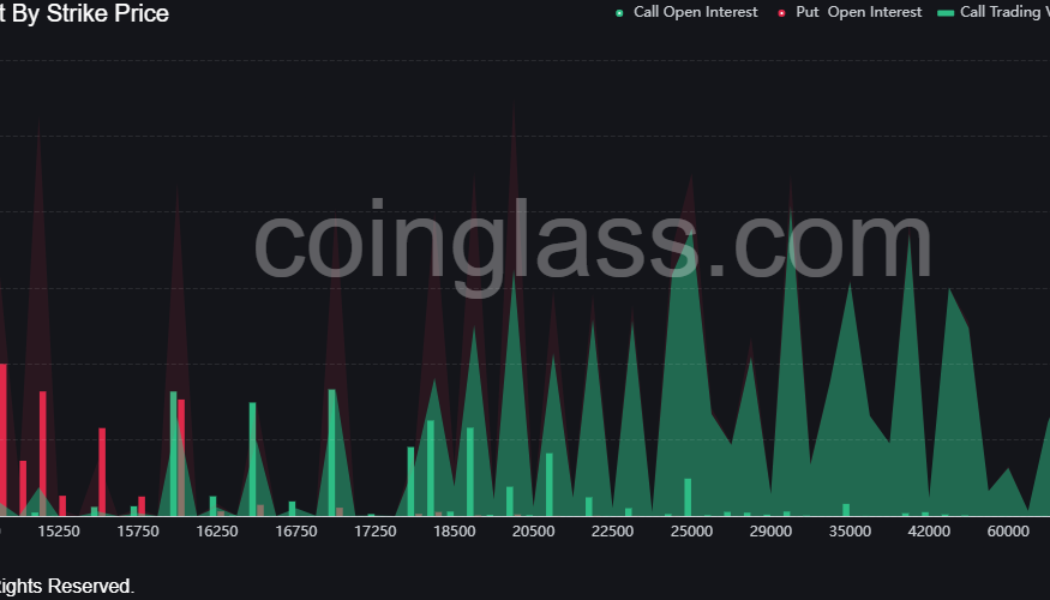

Bitcoin (BTC) price accelerated its sell-off on Nov. 21 to hit a new yearly low at $15,654. The move follows a market-wide decline that was catalyzed by investors running for the hills in fear that the FTX-induced contagion would infect every corner of the crypto sector. Stocks also closed the day in the red, with the tech-heavy Nasdaq down 1% and the S&P 500 losing 0.42% on the back of investors’ concerns about rising interest rates. Data from Coinglass shows over $100 million in leverage longs were liquidated on Nov. 20 and Nov. 21 as investors fear an accelerated sell-off if Digital Currency Group (DCG) and BlockFi fail to secure funding and are forced to declare bankruptcy. BTC open interest by strike price. Coinglass Some analysts are betting on Bitcoin price declining below...

On the move: FTX hacker splits nearly $200M in ETH across 12 wallets

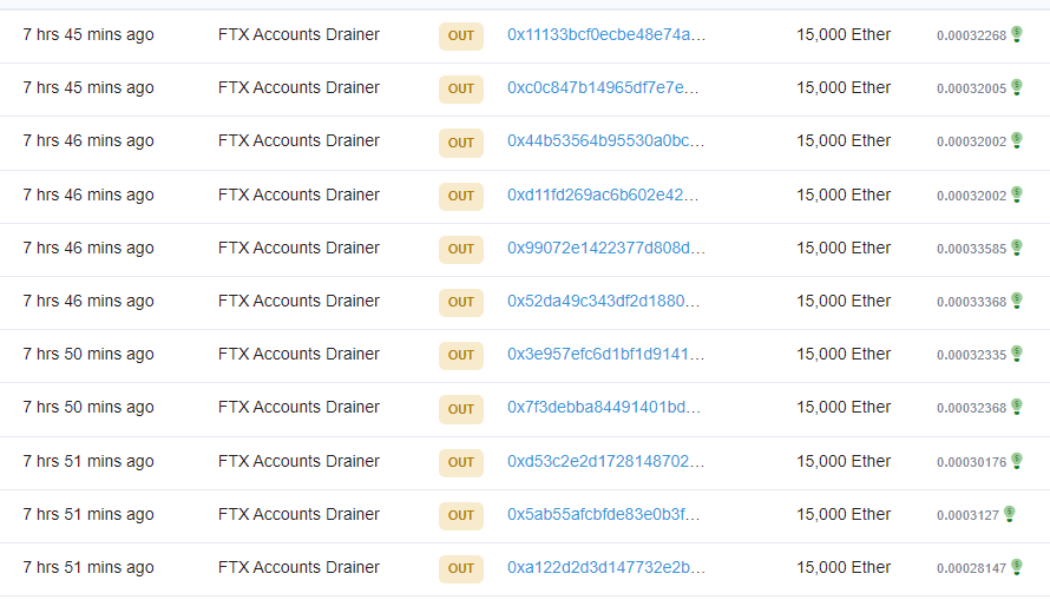

The hacker behind the theft of more than $447 million of crypto from the crypto exchange FTX has been again spotted moving their ill-gotten funds. According to Etherscan data, between 4:11 to 4:17 pm UTC on November 21, the attacker moved a total of 180,000 Ether (ETH) across 12 newly created wallets — each receiving 15,000 ETH. The total amount moved totaled $199.3 million at current prices. Recent transactions from wallet labeled “FTX Accounts Drainer” — Source: Etherscan At the time of publication, the ETH has not moved from any of the 12 wallets. Some in the crypto community suggest the attacker may be planning to subdivide it into smaller and smaller amounts in order to confuse investigators, a process known as “peel chaining,” or they may be planning to use a mixing...

FTX showed the value of using DeFi platforms instead of gatekeepers

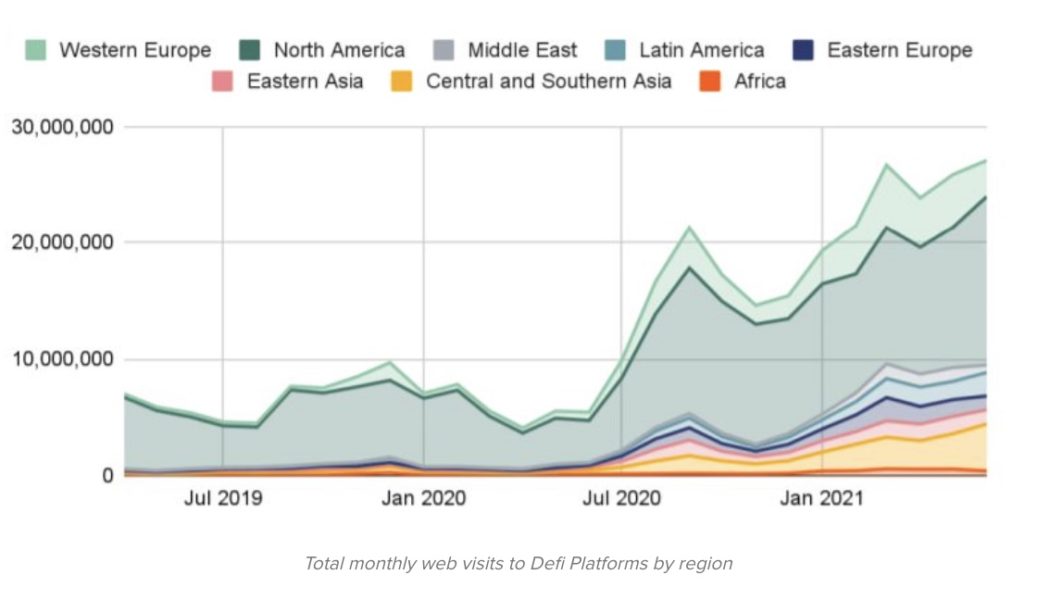

The rapid implosion of FTX has led general investors and crypto believers alike to question the validity of crypto and, indeed, predict its end. But, an understanding of history points not to crypto’s demise but rather a move toward new technology and growth. Financial markets move, as Willie Nelson once said, in phases and stages, circles and cycles. Companies develop ideas, grow quickly, ignite unwarranted investor euphoria and then implode — only to seed the ground for the next company, the next idea and the next growth phase. Crypto is no different. In 2010, an unknown person famously used Bitcoin (BTC) to buy pizza. After its initial launch, market capitalization grew to more than $12 billion when Mt. Gox’s 2014 hack and bankruptcy precipitated crypto’s first bear market. The ma...

FTX Japan plans to resume withdrawals by 2023: Report

Crypto exchange FTX’s subsidiary in Japan, FTX Japan, reportedly plans to resume withdrawals by the end of 2022. According to a Nov. 21 report from Japan-based news outlet NHK, FTX Japan has been making preparations to resume withdrawals. Japan’s Financial Services Agency, or FSA, requested the exchange suspend business orders on Nov. 10 prior to FTX Group declaring bankruptcy in the United States for more than 130 associated companies, including FTX Japan Holdings, FTX Japan, and FTX Japan Services. On Nov. 11, the FSA announced that it had taken administrative actions against FTX Japan amid reports its parent company was “facing credit uncertainties.” The orders required FTX Japan to suspend over-the-counter derivatives transactions and related margins as well as new deposits from users ...

My story of telling the SEC ‘I told you so’ on FTX

“I hate to say I told you so” is a phrase oft-repeated but rarely sincere. It’s a delightful feeling to claim credit for warning about a problem in advance. That’s a liberty I’m taking with federal financial regulators at the United States Securities and Exchange Commission. In January of this year, while serving as a member of the SEC Investor Advisory Committee that advises SEC Chairman Gary Gensler on crypto and other matters, I filed a petition with the SEC. I asked them to open a formal public comment about unique issues presented by crypto and other digital assets. I pointed to crypto custody and intermediary conflicts of interest as key issues the SEC should address. I called this fresh start a “Digital Asset Regulation Genesis Block” that would help the SEC improve crypto regulatio...

FTX hacker dumps 50,000 ETH, still among top 40 Ether holders

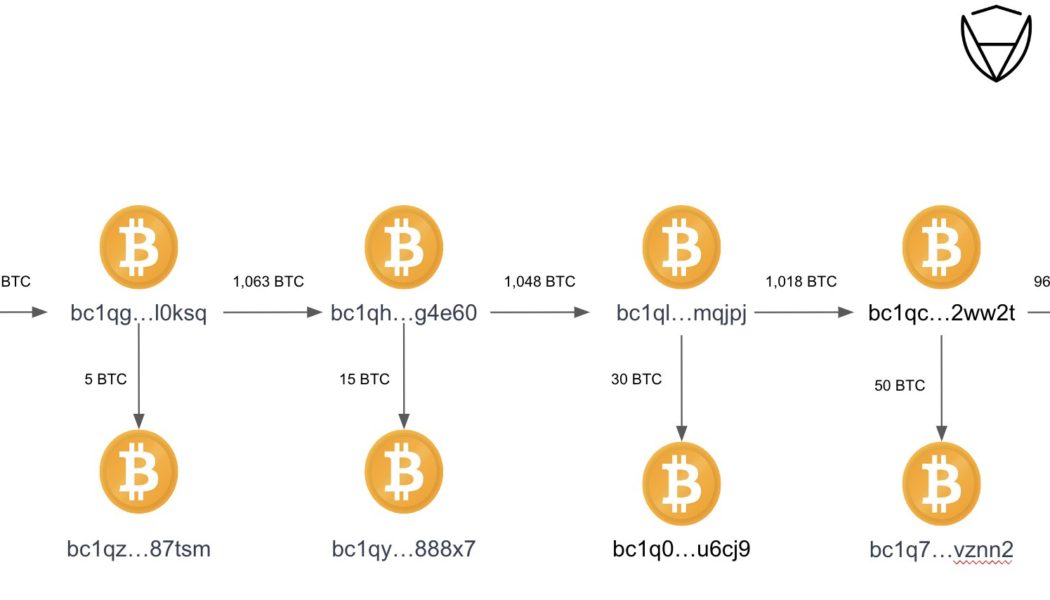

The hacker behind the bankrupt cryptocurrency exchange FTX started transferring their Ether (ETH) holding to a new wallet address on Nov. 20. The FTX wallet drainer was the 27th largest ETH holder after the hack but dropped by 10 positions after the weekend ETH dump. The FTX hacker drained nearly $447 million out of multiple FTX global and FTX US exchange wallets just hours after the crypto exchange filed for Chapter 11 bankruptcy on Nov. 11. Majority of the stolen funds were in ETH, making the exploiter the 27th largest ETH whale. On Nov. 20, the FTX wallet drainer 1 transferred 50,000 ETH to a new address, 0x866E. The new wallet address then swapped the ETH for renBTC (ERC-20 version of BTC) and bridged to two wallets on the Bitcoin blockchain. One of the wallets bc1qvd…gpedg held 1,070 ...

GBTC next BTC price black swan? — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week still replaying November 2020 after its lowest weekly close in two years. The largest cryptocurrency, just like the rest of the crypto industry, remains highly susceptible to downside risk as it continues to deal with the fallout from the implosion of exchange FTX. Contagion is the world on everyone’s lips as November grinds on — just like the Terra LUNA collapse earlier this year, fears are that new victims of FTX’s giant liquidity vortex will continue to surface. The stakes are decidedly high — the initial shock may be over, but the consequences are only just beginning to surface. These include issues beyond just financial losses, as lawmakers attempt to grapple with FTX and place renewed emphasis on urgent Bitcoin and crypto regulation. With that, it is n...

FTX-owned Liquid exchange pauses all trading after withdrawal halt

Liquid has suspended all trading operations on its platform in line with instructions from FTX Trading, the firm announced on Twitter on Nov. 20. The statement indicates that Liquid exchange paused “all forms of trading” because of the operation of the Chapter 11 process in the Delaware courts. “We have since done so while we assess the situation. We are working through these issues and will endeavor to give a fuller update in due course,” Liquid added. Liquid’s operational halt comes five days after the exchange suspended all withdrawals on its platform, citing compliance with the requirements of voluntary Chapter 11 proceedings. Japan’s Financial Services Agency previously also requested another FTX’s local subsidiary, FTX Japan, to suspend business orders on Nov. 10. As previously repor...

FTX fiasco means coming consequences for crypto in Washington DC

On Nov. 11, while the rest of the country was celebrating Veteran’s Day, Sam Bankman-Fried announced that FTX — one of the world’s largest cryptocurrency exchanges by volume — had filed for bankruptcy. Lawmakers and pundits quickly latched onto the rapid disintegration of FTX to call for more regulation of the crypto industry. “The most recent news further underscores these concerns [about consumer harm] and highlights why prudent regulation of cryptocurrencies is indeed needed,” said White House Press Secretary Karine Jean-Pierre. It remains unclear what exactly transpired at FTX. Reports indicating that between $1 billion and $2 billion of customer funds are unaccounted for are deeply troubling. Widespread consumer harm and indications of corporate impropriety only increase the likelihoo...

FTX owes over $3 billion to its 50 biggest creditors: Bankruptcy filing

According to a court filing on Nov. 20, FTX Trading LTD owes its top 50 creditors over $3 billion USD. The document, which was submitted through the United States bankruptcy court for the district of Delaware, was filed as part of the company’s Chapter 11 bankruptcy proceedings. FTX discloses its top 50 creditors are owed $3.1 billion. The largest creditor is owed $226 million. All names were redacted. pic.twitter.com/JGeddvMB7w — Tom Dunleavy (@dunleavy89) November 20, 2022 The filing indicated that FTX owes the top individual alone in excess of $226 million USD, with all others owed sums approximately ranging between $21 million and $203 million. The creditors’ identities are unknown, and their locations undisclosed. The document explained: “The Top 50 List is based on the Debtors’...

Crypto sleuth debunks 3 biggest misconceptions about the FTX hack

On-chain sleuth ZachXBT has shared his findings on what he sees as the three most common misconceptions about the FTX hack — taking to Twitter to correct a “ton of misinformation” about the event and the possible culprits. In a lengthy Nov. 20 post on Twitter, the self-proclaimed “on-chain sleuth” debunked speculation that Bahamian officials were behind the FTX hack, that exchanges knew the hacker’s true identity, and that the culprit is trading memecoins. 1/ I have seen a ton of misinformation being spread on Twitter and in the news about the FTX event so let me debunk the three most common things I’ve seen “Bahamian officials are behind the FTX hack”“Exchanges know who the hacker is”“FTX hacker is trading meme coins” pic.twitter.com/IAtHnpJI44 — ZachXBT (@zachxbt)...